SSE Announces £3 Billion Reduction In Spending Amidst Market Slowdown

Table of Contents

Details of the £3 Billion Spending Reduction

SSE's decision to slash £3 billion from its planned spending represents a dramatic shift in its investment strategy. This reduction directly affects several key areas of the company's operations. Specifically, the cuts impact:

- Renewable Energy Projects: Several renewable energy projects, including wind farms and solar power initiatives, have experienced delays or cancellations. This includes the postponement of the planned expansion of the Viking wind farm and a reevaluation of several smaller-scale solar projects.

- Network Infrastructure Upgrades: Investment in upgrading and modernizing the electricity network infrastructure has been scaled back. This may lead to delays in improving grid resilience and capacity.

- Energy Storage Solutions: Projects focused on developing energy storage capabilities, crucial for integrating renewable energy sources, have also been affected.

These cuts represent a significant recalibration of SSE's capital expenditure plans for the foreseeable future. The company cited the need for financial prudence in the face of challenging market conditions as the primary reason for this drastic measure.

Reasons Behind SSE's Decision to Cut Spending

SSE's decision to reduce spending by £3 billion is a direct response to a confluence of macroeconomic factors that have created a challenging investment climate. These factors include:

- High Inflation: Soaring inflation has increased the cost of materials, labor, and other inputs, making projects significantly more expensive.

- Increased Interest Rates: Higher interest rates make borrowing more expensive, increasing the cost of financing large-scale infrastructure projects.

- Energy Price Volatility: The fluctuating price of energy makes it difficult to accurately forecast future revenues and assess the viability of long-term investments.

These factors have combined to create a situation where the profitability of many energy projects is significantly reduced, making it difficult for SSE to secure the necessary funding and justify the high initial investment required. Securing funding for large-scale projects has become considerably harder given investor concerns about returns in this volatile climate.

Potential Impacts of the Spending Reduction on SSE and the Wider Energy Sector

The £3 billion spending reduction will undoubtedly have significant consequences for SSE and the broader energy sector.

- SSE Growth and Profitability: The cutbacks could impact SSE's future growth trajectory and short-term profitability. Reduced investment in renewable energy could hinder its long-term sustainability goals.

- Renewable Energy Deployment: Delays in renewable energy projects could slow the transition to a cleaner energy system, potentially delaying the UK’s commitment to net-zero targets.

- Infrastructure Development: Reduced investment in infrastructure upgrades could affect grid stability and capacity, potentially leading to power outages and hindering the integration of renewable energy sources.

- Job Security: The spending cuts could lead to job losses within SSE and related industries, impacting employment in the energy sector.

These impacts highlight the ripple effect of SSE's decision, affecting not just the company itself but also the broader economic and environmental landscape.

Investor and Public Reaction to SSE's Announcement

The announcement of the £3 billion spending reduction has resulted in mixed reactions from investors and the public.

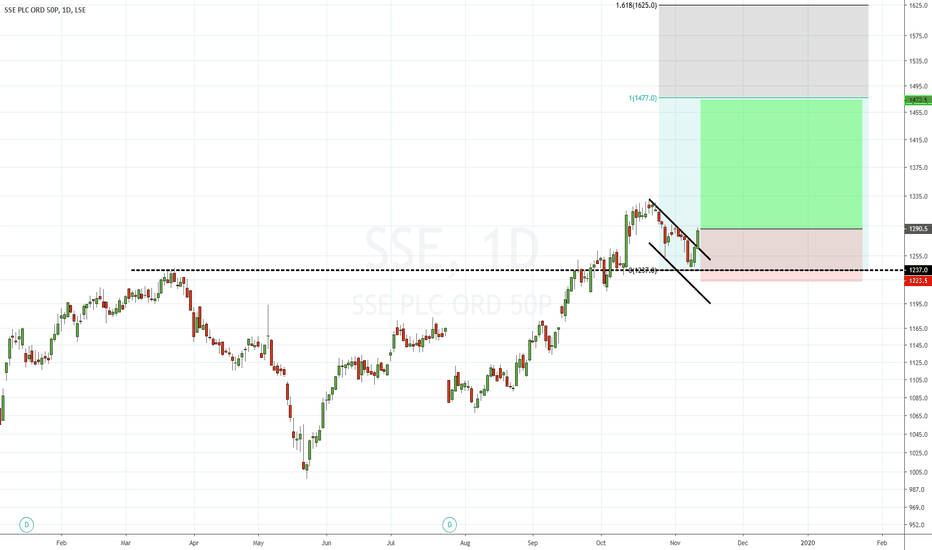

- Stock Price: The immediate market reaction saw a slight dip in SSE's share price, reflecting investor uncertainty. However, some analysts view the move as prudent given the challenging market conditions.

- Public Opinion: Public response has been varied, with some expressing concern about potential delays in renewable energy projects and infrastructure upgrades, while others understand the need for financial prudence in the face of economic uncertainty.

- Government Response: The government has yet to issue a formal statement, but the implications for the UK's energy transition goals are likely to be a key area of focus going forward.

The ongoing situation requires close monitoring, given the potential long-term effects on both SSE and the national energy strategy.

Conclusion: Navigating the Market Slowdown: The Future of SSE's Investment Strategy

SSE's £3 billion spending cut is a significant development reflecting the challenging energy market conditions characterized by high inflation, increased interest rates, and energy price volatility. The decision to delay or cancel projects across renewable energy, network infrastructure, and energy storage highlights the difficulties facing large-scale energy investments. While the immediate impact might be a reduction in growth, the move could prove prudent in the long run, ensuring the company's financial stability amidst uncertainty. The long-term effects on SSE's growth, renewable energy deployment, and the overall energy landscape remain to be seen, requiring careful observation and analysis. Stay updated on SSE’s progress and the evolving energy market landscape by following our future reports on SSE's spending cuts and their impact on the UK energy sector. Learn more about SSE’s response to market slowdowns and future investment plans.

Featured Posts

-

Netflixs New Dark Comedy Kevin Bacon And Julianne Moore Lead The Cast

May 23, 2025

Netflixs New Dark Comedy Kevin Bacon And Julianne Moore Lead The Cast

May 23, 2025 -

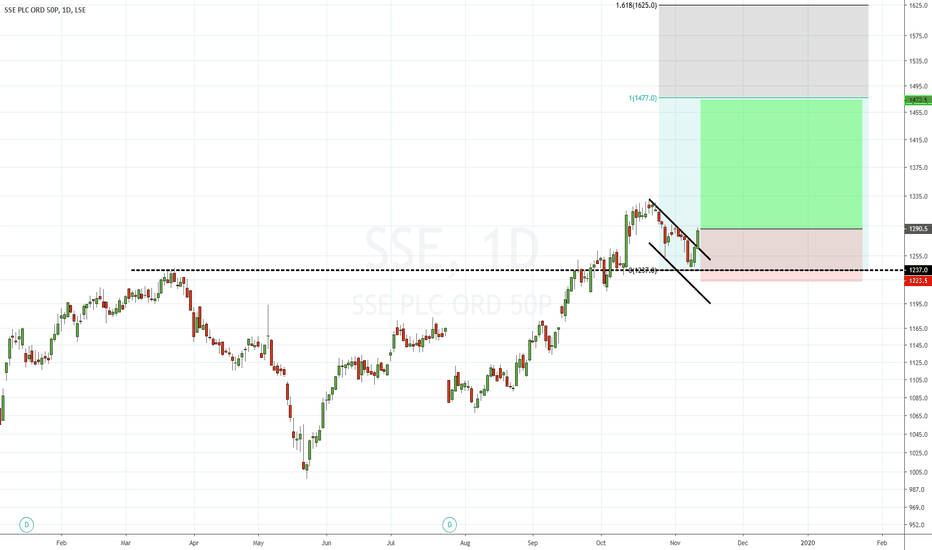

Stocks Tumble Amid Growing Us Fiscal Anxiety

May 23, 2025

Stocks Tumble Amid Growing Us Fiscal Anxiety

May 23, 2025 -

Trumps Memecoin Dinner Anonymity For Paying Guests

May 23, 2025

Trumps Memecoin Dinner Anonymity For Paying Guests

May 23, 2025 -

Grand Ole Oprys Century Of Music A Special London Performance

May 23, 2025

Grand Ole Oprys Century Of Music A Special London Performance

May 23, 2025 -

Thqyq Mqtl Mwzfy Alsfart Alisrayylyt Mn Hw Ilyas Rwdryjyz

May 23, 2025

Thqyq Mqtl Mwzfy Alsfart Alisrayylyt Mn Hw Ilyas Rwdryjyz

May 23, 2025

Latest Posts

-

Joe Jonas The Unexpected Response To A Marital Dispute

May 23, 2025

Joe Jonas The Unexpected Response To A Marital Dispute

May 23, 2025 -

Broadways Just In Time Jonathan Groffs Performance And Tony Award Chances

May 23, 2025

Broadways Just In Time Jonathan Groffs Performance And Tony Award Chances

May 23, 2025 -

Joe Jonas Responds To Couple Fighting Over Him The Best Reaction

May 23, 2025

Joe Jonas Responds To Couple Fighting Over Him The Best Reaction

May 23, 2025 -

Couple Fights Over Joe Jonas His Hilarious Response

May 23, 2025

Couple Fights Over Joe Jonas His Hilarious Response

May 23, 2025 -

Couple Fights Over Joe Jonas His Response Is Hilarious

May 23, 2025

Couple Fights Over Joe Jonas His Response Is Hilarious

May 23, 2025