Simple Dividend Investing: A Proven Strategy For High Returns

Table of Contents

Understanding Dividend Investing Basics

What are Dividends?

Dividends are payments made by publicly traded companies to their shareholders, typically from a portion of their profits. These payments represent a share of the company's success and are distributed on a regular basis, often quarterly or annually. Think of it as receiving a paycheck from your investments, supplementing your income and contributing to long-term growth. Understanding how dividends work is the cornerstone of successful simple dividend investing.

Types of Dividend Stocks

Different types of dividend stocks cater to varying investor risk tolerances and financial goals. Let's explore some key categories:

- High-Yield Dividend Stocks: These stocks offer high dividend payouts relative to their share price. While tempting, they often come with higher risk, as companies with exceptionally high yields might be facing financial challenges. Example: Real estate investment trusts (REITs) frequently offer high yields.

- Growth Dividend Stocks: These companies prioritize reinvesting profits into growth, leading to potentially higher share price appreciation over time, alongside a consistent but not necessarily high dividend payout. Example: Many technology companies fall into this category.

- Blue-Chip Dividend Stocks: These are typically large, established companies with a long history of paying consistent dividends. They're generally considered less risky than high-yield stocks, offering a balance of stability and income. Example: Many well-known companies in the consumer staples or healthcare sectors.

Characteristics:

- High-Yield: High dividend yield, potentially higher risk, lower price appreciation.

- Growth: Lower dividend yield, higher potential for price appreciation, lower risk.

- Blue-Chip: Moderate dividend yield, moderate risk, steady price appreciation.

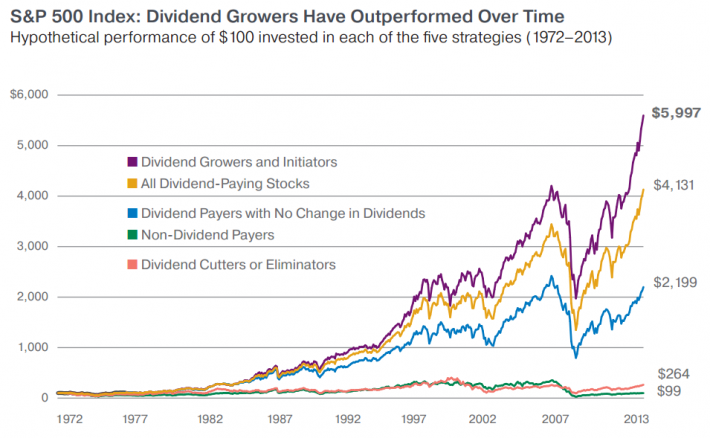

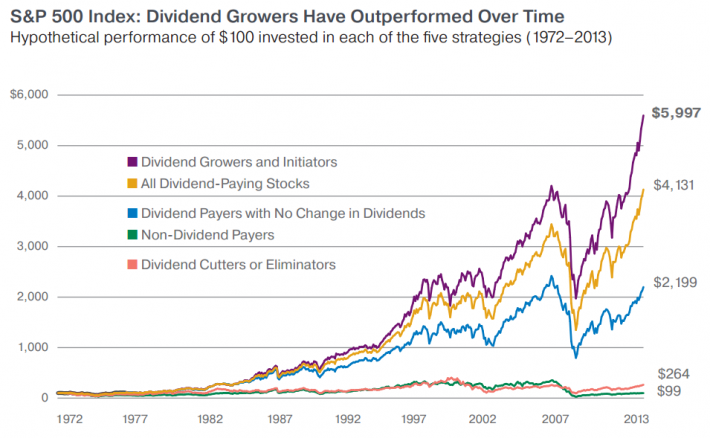

The Power of Reinvestment

One of the most effective strategies in simple dividend investing is reinvesting your dividends. This involves automatically buying more shares of the same stock with your dividend payments. This creates a powerful compounding effect, accelerating your investment growth over time.

Advantages of DRIPs (Dividend Reinvestment Plans):

- Compounding Growth: Dividends earn more dividends, significantly boosting your returns over the long term.

- Minimized Transaction Fees: Automatic reinvestment eliminates brokerage fees associated with frequent buying.

- Increased Returns: The snowball effect of compounding accelerates wealth accumulation, making simple dividend investing highly effective.

Building a Simple Dividend Portfolio

Selecting Dividend-Paying Stocks

Choosing dividend stocks for your portfolio requires careful consideration, but it doesn't need to be overly complex. Focus on simplicity and a long-term perspective.

Criteria for Selecting Stocks:

- Consistent Dividend History: Look for companies with a proven track record of paying regular dividends for several years.

- Sustainable Payout Ratio: The payout ratio (dividends paid relative to earnings) should be sustainable, indicating the company can afford its dividend payments.

- Strong Financial Health: Analyze a company's financial statements to ensure its financial stability and growth potential.

- Use Screening Tools: Online brokerage platforms offer screening tools to identify stocks that meet your criteria.

Diversification for Risk Management

Diversification is crucial for mitigating risk in simple dividend investing. Don't put all your eggs in one basket!

Examples of Diversification:

- Across Sectors: Invest in companies from various sectors (e.g., technology, healthcare, consumer staples) to reduce the impact of any single sector's downturn.

- Across Market Caps: Include a mix of large-cap, mid-cap, and small-cap stocks for broader exposure.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging is a simple, effective strategy for building your dividend portfolio, particularly beneficial in volatile markets. This involves investing a fixed amount of money at regular intervals, regardless of price fluctuations.

Advantages of DCA:

- Reduces Risk: It prevents investing a large sum at a market peak.

- Consistency: Regular investments build your portfolio steadily over time.

- Emotional Discipline: It encourages disciplined investing, avoiding emotional reactions to market swings.

Example: Investing $100 per month regardless of market conditions.

Managing Your Dividend Portfolio

Monitoring Your Investments

Regular monitoring is essential, but it doesn't require constant attention. Simple checks can suffice.

Simple Monitoring Techniques:

- Check Dividend Payments: Verify you're receiving your dividend payments regularly.

- Review Portfolio Performance: Periodically review your portfolio's overall performance, focusing on long-term growth.

- Stay Informed: Keep up-to-date on company news and market trends, but avoid excessive trading.

Tax Implications

Dividend income is generally taxable. Consult a tax professional for guidance on how dividend income is taxed in your specific jurisdiction. Proper tax planning is vital to maximize your returns.

Rebalancing Your Portfolio

Rebalancing your portfolio involves adjusting your asset allocation back to your target percentages. This helps maintain your desired level of risk and ensures you don't become overly concentrated in any one area.

Simple Rebalancing Strategies:

- Annual Rebalancing: Rebalance your portfolio once a year.

- Threshold Rebalancing: Rebalance when the allocation deviates by a certain percentage from your target.

Conclusion

Simple dividend investing offers a powerful strategy for building wealth and generating passive income. By understanding dividend basics, building a diversified portfolio using dollar-cost averaging, and implementing simple monitoring and rebalancing strategies, you can create a long-term investment plan that aligns with your financial goals. Remember the potential benefits: consistent passive income, long-term growth, and increased financial security. Begin your simple dividend investing strategy today and take control of your financial future. Learn more about building a simple, high-return dividend portfolio by [link to relevant resource].

Featured Posts

-

Political Fallout Schoof Avoids Debate On Fabers Honours Decision

May 11, 2025

Political Fallout Schoof Avoids Debate On Fabers Honours Decision

May 11, 2025 -

Rochelle Humes Fashion Week Hairstyle A Closer Look

May 11, 2025

Rochelle Humes Fashion Week Hairstyle A Closer Look

May 11, 2025 -

Parliamentary Pressure On Migration Minister Over Illegal Immigration

May 11, 2025

Parliamentary Pressure On Migration Minister Over Illegal Immigration

May 11, 2025 -

The Future Of John Wick Keanu Reeves Plans For Chapter 5

May 11, 2025

The Future Of John Wick Keanu Reeves Plans For Chapter 5

May 11, 2025 -

Whoop User Anger Mounts Over Broken Free Upgrade Promises

May 11, 2025

Whoop User Anger Mounts Over Broken Free Upgrade Promises

May 11, 2025