Significant Saudi Rule Change Reshapes The ABS Landscape

Table of Contents

Key Changes Introduced by the New Saudi Regulations

The new Saudi ABS regulations introduce several significant changes designed to enhance market transparency, protect investors, and promote sustainable growth. These "Saudi Arabia ABS regulations" encompass a range of modifications impacting various aspects of the ABS market. Key changes include:

-

Increased Capital Requirements: Issuers now face higher capital requirements, potentially reducing the number of new ABS offerings in the short term. This change aims to strengthen the financial resilience of ABS issuers and mitigate systemic risk. The rationale behind this stems from a desire to prevent future financial crises stemming from insufficient capitalization. This impacts issuers, who may need to restructure their offerings.

-

Stricter Due Diligence Procedures: The new rules enforce more rigorous due diligence procedures for both issuers and originators. This involves more comprehensive assessments of underlying assets, enhanced verification processes, and increased scrutiny of credit quality. This aims to reduce the risk of default and protect investor interests. This impacts all stakeholders, particularly rating agencies who must now be more thorough.

-

Revised Credit Rating Requirements: The regulations have introduced stricter criteria for credit ratings, requiring greater transparency and accountability from rating agencies. This ensures that credit ratings accurately reflect the true risk profile of the underlying assets and enhance investor confidence. This impacts investors who must rely less on credit ratings and more on their own due diligence.

-

Enhanced Disclosure Requirements: The regulations also mandate greater transparency through more comprehensive and detailed disclosure requirements for ABS issuers. This change enhances market transparency, allowing investors to make better-informed decisions. This directly impacts investors by providing them with more data to work with.

Impact on ABS Issuance in Saudi Arabia

The impact of these new "Saudi ABS regulations" on ABS issuance in Saudi Arabia is complex and multifaceted. While stricter regulations may initially lead to a decrease in the volume of ABS issuances, the long-term effects are expected to be more nuanced.

-

Reduced Issuance (Short-Term): Increased capital requirements and stricter due diligence procedures will likely deter some smaller issuers, leading to a temporary reduction in ABS issuance.

-

Shift in Issuance Type: The focus may shift towards higher-quality, less risky ABS deals, attracting more conservative investors.

-

Sectoral Implications: Sectors heavily reliant on ABS financing, such as real estate and consumer finance, may experience a temporary tightening of credit conditions. However, the improved transparency and investor confidence resulting from the new regulations could lead to more sustainable growth in the long run. For example, the real estate sector may see fewer high-risk projects moving forward.

Implications for Investors in Saudi ABS

The new Saudi ABS regulations significantly impact investors in several ways. The changes influence both the risk profile and potential returns associated with Saudi ABS.

-

Increased Due Diligence: Investors must now conduct even more thorough due diligence, reviewing detailed disclosures and independently assessing the risk profile of ABS offerings. This means a higher level of effort is required from investors.

-

Potential for Lower Returns (Short-Term): The reduced volume of ABS issuance and a potential shift to lower-risk deals could mean lower returns in the short term. However, this is offset by a more stable long-term outlook.

-

Improved Market Liquidity (Long-Term): Enhanced transparency and increased investor confidence could lead to improved liquidity in the secondary market for Saudi ABS, though this is a longer-term prospect.

-

Advantages & Disadvantages: While the increased due diligence represents a higher investment of effort, the ultimate benefit of this change should result in more informed, confident investing.

Opportunities Created by the New Regulatory Framework

Despite the challenges, the new regulatory framework presents several opportunities for the Saudi ABS market:

-

Enhanced Market Transparency: The emphasis on improved disclosures fosters greater market transparency, encouraging greater participation from international investors.

-

Increased Investor Confidence: Stricter regulations and enhanced transparency boost investor confidence, attracting more domestic and international capital.

-

Opportunities for Market Innovation: The new rules also encourage the development of innovative ABS structures that better address the specific needs of the Saudi market.

-

Foreign Investment Attraction: The improved regulatory environment is likely to attract foreign investment into the Saudi ABS market, promoting growth and diversification.

Conclusion: Navigating the Reshaped Saudi ABS Landscape

The significant Saudi rule change has fundamentally reshaped the Saudi ABS landscape. While the short-term implications may include reduced issuance and stricter due diligence processes, the long-term prospects point towards greater transparency, investor confidence, and sustainable growth. Understanding this Significant Saudi Rule Change is crucial for anyone involved in the Saudi ABS market. Stay informed and seek expert guidance to navigate this evolving landscape. The changes, while initially challenging, pave the way for a more robust and resilient Saudi ABS market that attracts both domestic and international investment. Thorough research of the new regulations and consultation with financial professionals are paramount to making sound investment decisions in this dynamic market.

Featured Posts

-

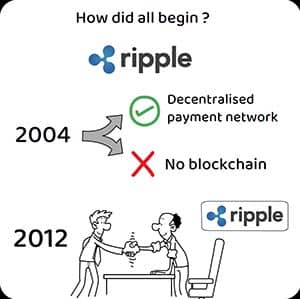

What Is Xrp A Beginners Guide To Ripple

May 02, 2025

What Is Xrp A Beginners Guide To Ripple

May 02, 2025 -

New Legal Trouble For Epic Games Over Fortnites In Game Store Sales

May 02, 2025

New Legal Trouble For Epic Games Over Fortnites In Game Store Sales

May 02, 2025 -

Unlawful Harassment Allegations Against Rupert Lowe In Reform Shares Report

May 02, 2025

Unlawful Harassment Allegations Against Rupert Lowe In Reform Shares Report

May 02, 2025 -

Miss Samoa Crowned Miss Pacific Islands 2025

May 02, 2025

Miss Samoa Crowned Miss Pacific Islands 2025

May 02, 2025 -

Enexis En Kampen In Juridisch Conflict Kort Geding Over Stroomaansluiting

May 02, 2025

Enexis En Kampen In Juridisch Conflict Kort Geding Over Stroomaansluiting

May 02, 2025