Significant Asset Reduction At Schroders: Q1 Market Analysis

Table of Contents

Macroeconomic Impact on Schroders Q1 Performance

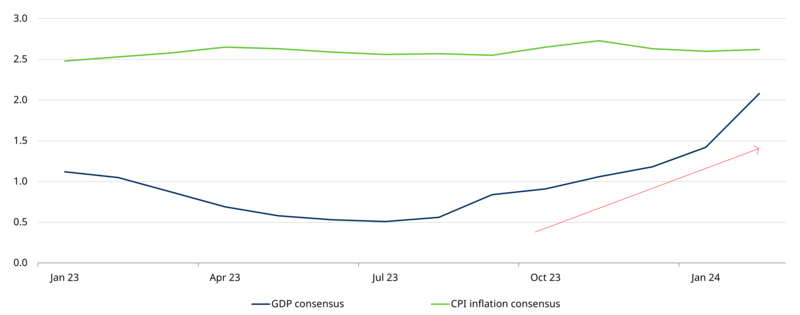

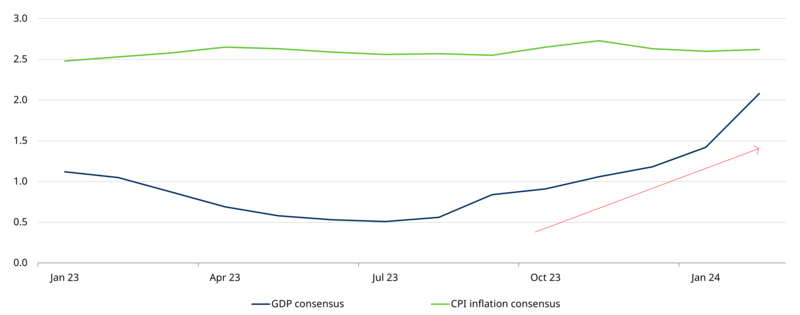

The global economic environment during Q1 2024 presented significant headwinds for asset managers like Schroders. Several macroeconomic factors contributed to the reduction in AUM, impacting investor confidence and investment decisions.

-

Rising Interest Rates: The persistent inflationary pressures globally led central banks to implement aggressive interest rate hikes. This directly affected bond markets, resulting in lower valuations for fixed-income instruments held within Schroders' portfolios. This impacted the performance of Schroders' fixed-income funds, leading to decreased AUM.

-

Geopolitical Uncertainty: Ongoing geopolitical instability, including [mention specific events, e.g., the war in Ukraine, tensions in the Taiwan Strait], created significant market volatility. This uncertainty deterred investors, leading to reduced risk appetite and outflows from equity markets, negatively affecting Schroders' equity holdings.

-

Inflationary Pressures and Investor Sentiment: High inflation eroded investor purchasing power and fueled concerns about future economic growth. This negative sentiment translated into decreased investor confidence and increased risk aversion, resulting in substantial outflows from various investment vehicles, including those managed by Schroders.

Schroders Investment Performance Q1 Analysis

Schroders' Q1 2024 performance varied across different asset classes. While some strategies performed relatively well, others underperformed benchmarks, contributing to the overall AUM reduction.

-

Equity Performance: Schroders' equity holdings experienced [mention specific performance data with source, e.g., a 5% decline, citing the Schroders Q1 report]. Specific sectors like [mention underperforming sectors, e.g., technology] were particularly hard hit due to [explain reason, e.g., rising interest rates impacting growth stocks]. A comparison to benchmark indices like the S&P 500 shows [mention the comparison, e.g., underperformance relative to the market].

-

Fixed-Income Performance: The rise in interest rates significantly impacted the performance of Schroders' fixed-income funds. [Insert specific data and comparison to benchmarks]. The duration of bonds held within the portfolio played a crucial role in the performance.

-

Alternative Investments: Performance in alternative asset classes [mention specific performance and relevant details]. This segment often shows less correlation with traditional markets, but was still affected by the overall market sentiment.

[Insert chart or graph visually representing Schroders' performance across asset classes in Q1 2024. Clearly label the axes and source the data.]

Schroders Fund Flows and Investor Sentiment Q1

Analyzing fund flows provides crucial insight into investor behavior and sentiment towards Schroders during Q1 2024.

-

Net Outflows: Schroders experienced significant net outflows across several key funds, [mention specific fund examples and quantitative data]. This indicates a decrease in investor confidence and a shift in investment preferences.

-

Investor Redemptions: A large portion of the AUM reduction stemmed from investor redemptions, reflecting concerns about market volatility and Schroders' investment performance.

-

Qualitative Assessment: News reports and analyst comments suggest that investor sentiment toward Schroders was [mention overall sentiment, e.g., cautious] during Q1 2024, primarily driven by macroeconomic uncertainty and the underperformance of certain investment strategies.

Schroders Future Outlook and Strategic Response

In response to the asset reduction, Schroders has [mention specific actions taken by Schroders, e.g., implemented cost-cutting measures, adjusted investment strategies]. The company's future outlook remains [mention company's outlook, e.g., cautiously optimistic], contingent on market conditions and global economic recovery.

-

Strategic Realignment: Schroders is likely to adjust its investment strategies to adapt to the changing market landscape. [Mention any announced changes in strategy].

-

Cost-Cutting Measures: The company may implement cost-cutting measures to improve efficiency and profitability during this period of market volatility.

-

Future Predictions: Based on current market trends and Schroders' response, the outlook for the remainder of 2024 remains uncertain. Further analysis is needed to predict performance accurately.

Conclusion: Implications of Schroders' Q1 Asset Reduction and Future Prospects

Schroders' significant Q1 2024 asset reduction highlights the impact of macroeconomic factors and investment performance on AUM. The combination of rising interest rates, geopolitical uncertainty, and negative investor sentiment led to substantial outflows. While Schroders has responded with strategic adjustments and cost-cutting measures, its future performance remains dependent on market recovery and the success of its revised strategies. It's crucial for investors to continue monitoring Schroders' performance and market conditions closely. Stay updated on Schroders' Q2 performance and learn more about Schroders' asset management strategies for informed investment decisions. Deep dive into Q1 market trends impacting Schroders' AUM to gain a comprehensive understanding of the current investment landscape.

Featured Posts

-

The Walking Deads Negan In Fortnite Jeffrey Dean Morgan Speaks Out

May 02, 2025

The Walking Deads Negan In Fortnite Jeffrey Dean Morgan Speaks Out

May 02, 2025 -

Juridische Strijd Kampen Dagvaardt Enexis Voor Stroomaansluiting

May 02, 2025

Juridische Strijd Kampen Dagvaardt Enexis Voor Stroomaansluiting

May 02, 2025 -

Actress Daisy May Cooper Addresses Past Workplace Theft And Dismissal

May 02, 2025

Actress Daisy May Cooper Addresses Past Workplace Theft And Dismissal

May 02, 2025 -

The Truth About Daisy May Coopers Dismissal A Theft Confession

May 02, 2025

The Truth About Daisy May Coopers Dismissal A Theft Confession

May 02, 2025 -

Fortnites Cowboy Bebop Freebies Limited Time Offer

May 02, 2025

Fortnites Cowboy Bebop Freebies Limited Time Offer

May 02, 2025