Should You Invest In XRP (Ripple) Below $3? Risks And Rewards

Table of Contents

The Potential Rewards of Investing in XRP Below $3

While the regulatory landscape presents challenges, several compelling factors could justify investing in XRP below $3.

XRP's Technological Advantages

XRP boasts several technological advantages over other cryptocurrencies, making it an attractive option for various applications.

- Speed and Scalability: XRP transactions are significantly faster and cheaper than those on Bitcoin or Ethereum, processing thousands of transactions per second. This high throughput makes it ideal for large-scale payments.

- Low Transaction Fees: The minimal transaction fees associated with XRP make it a cost-effective solution for cross-border payments and remittances.

- Energy Efficiency: Unlike proof-of-work cryptocurrencies, XRP utilizes a consensus mechanism that requires significantly less energy, making it a more environmentally friendly option.

- Programmability: While not as extensive as some competitors, XRP is increasingly programmable, opening up possibilities for decentralized applications (dApps) and smart contracts.

Ripple's Growing Partnerships and Adoption

Ripple, the company behind XRP, has forged numerous partnerships with major financial institutions globally. This increasing adoption fuels XRP's potential for growth.

- Global Reach: RippleNet, Ripple's payment network, facilitates cross-border transactions for banks and financial institutions worldwide, driving demand for XRP.

- Strategic Partnerships: Ripple has partnered with several large banks and payment providers, integrating XRP into their systems for faster and cheaper international transfers. These partnerships signal a growing acceptance of XRP within the traditional financial sector.

- Recent Developments: Stay updated on Ripple's news and announcements regarding new partnerships and integrations. These developments often positively impact XRP's price.

The Potential for Price Appreciation

While predicting cryptocurrency prices is inherently speculative, several factors could contribute to XRP's price appreciation.

- Positive Legal Outcome: A favorable resolution to the SEC lawsuit could trigger a significant price surge.

- Increased Adoption: Widespread adoption by financial institutions and increased use in cross-border payments would boost demand and price.

- Market Sentiment: Positive market sentiment towards cryptocurrencies, coupled with XRP's technological advantages, could lead to price appreciation.

- Market Analysis: Analyzing historical price trends, trading volume, and other market indicators can provide insights into potential future price movements. However, remember past performance is not indicative of future results.

The Risks Associated with Investing in XRP Below $3

Investing in XRP, even at a seemingly low price, carries inherent risks.

The Ongoing SEC Lawsuit

The ongoing SEC lawsuit against Ripple Labs is a major risk factor for XRP investors.

- Uncertainty: The outcome of the lawsuit remains uncertain, potentially impacting XRP's price significantly.

- Delisting Risk: Depending on the court's decision, some exchanges might delist XRP, reducing its accessibility and liquidity.

- Legal Costs: The legal battle involves substantial costs for Ripple, potentially affecting its future development and growth.

Regulatory Uncertainty in the Crypto Market

The cryptocurrency market faces significant regulatory uncertainty globally.

- Changing Regulations: Governments worldwide are developing regulations for cryptocurrencies, and these changes could negatively impact XRP's value.

- Varying Regulations: Regulations vary significantly across jurisdictions, potentially creating challenges for XRP's global adoption.

- Increased Scrutiny: The increased scrutiny of the cryptocurrency market by regulatory bodies adds another layer of risk for investors.

Volatility of the Cryptocurrency Market

Cryptocurrency markets are notoriously volatile, and XRP is no exception.

- Price Fluctuations: XRP's price can experience significant fluctuations in short periods, leading to potential losses.

- Market Sentiment: Market sentiment plays a crucial role in XRP's price, and negative news or events can trigger sharp declines.

- Risk Management: It is crucial to practice effective risk management techniques, such as diversifying your investment portfolio and only investing what you can afford to lose.

Conclusion

Investing in XRP below $3 presents a potential opportunity for significant returns, driven by its technological advantages, growing adoption, and the possibility of a positive legal outcome. However, the SEC lawsuit, regulatory uncertainty, and inherent market volatility pose considerable risks. Before considering investing in XRP, carefully weigh these factors against your risk tolerance and investment goals. Thoroughly research XRP and the broader cryptocurrency market to make informed decisions. Carefully consider investing in XRP only after conducting comprehensive due diligence. Learn more about XRP investment strategies and understand the potential downsides before committing your capital. Research XRP before investing to mitigate potential losses.

Featured Posts

-

Shock Result Tonga Ends Samoas Hopes

May 01, 2025

Shock Result Tonga Ends Samoas Hopes

May 01, 2025 -

England Vs France Six Nations Dalys Crucial Late Contribution

May 01, 2025

England Vs France Six Nations Dalys Crucial Late Contribution

May 01, 2025 -

Should You Buy Xrp Ripple Now Price Under 3 Analysis

May 01, 2025

Should You Buy Xrp Ripple Now Price Under 3 Analysis

May 01, 2025 -

Obituary Priscilla Pointer Celebrated Dalla Star Dead At 100

May 01, 2025

Obituary Priscilla Pointer Celebrated Dalla Star Dead At 100

May 01, 2025 -

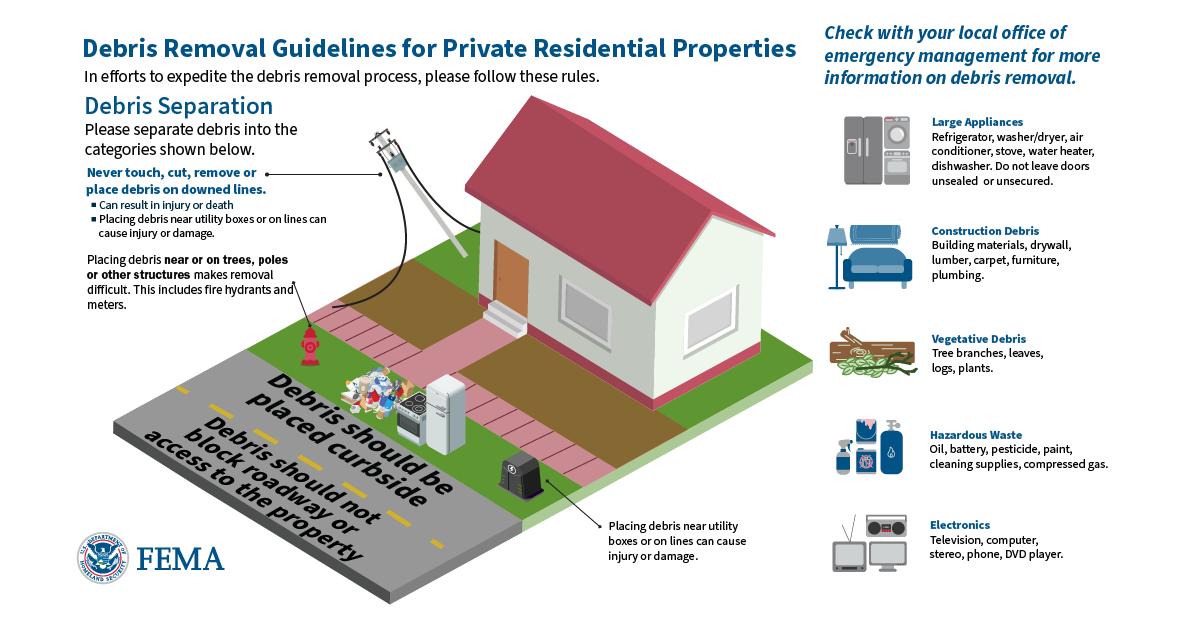

Louisvilles Post Storm Debris Removal Request Your Pickup Today

May 01, 2025

Louisvilles Post Storm Debris Removal Request Your Pickup Today

May 01, 2025