Should You Invest In Uber Technologies (UBER)?

Uber's Business Model and Market Position

Uber's business model centers on connecting riders and drivers through its platform, initially disrupting the traditional taxi industry. This ride-sharing service remains its flagship offering, but Uber has significantly diversified. Uber Eats, its food delivery service, competes directly with DoorDash and Grubhub, while Uber Freight targets the logistics sector. This diversification reduces reliance on any single segment and opens up several avenues for growth.

Analyzing Uber's market share is crucial for any potential investor. While it holds significant market dominance in ride-sharing in many regions, the competitive landscape is fiercely contested. Lyft is a major competitor in the ride-sharing space, while DoorDash and Grubhub present challenges in the food delivery market. The success of Uber's expansion into new markets and services, including autonomous vehicles and micromobility, will heavily influence its future market position and growth prospects.

- Market dominance in ride-sharing services: Uber remains a leader, particularly in many international markets.

- Growth potential in food delivery and freight: These segments represent substantial growth opportunities, potentially offsetting challenges in the mature ride-sharing market.

- Competitive pressures and market saturation: Intense competition requires continuous innovation and adaptation to maintain market share and profitability.

- Expansion into new markets and services: Uber's strategic moves into new areas are essential for sustained long-term growth.

Financial Performance and Growth Prospects

Assessing Uber's financial health requires a thorough review of its revenue, profitability, and debt levels. While Uber has shown significant revenue growth, achieving consistent profitability remains a challenge. Analyzing its financial statements, including income statements and balance sheets, reveals trends in operating expenses, which can impact profit margins. Factors like driver compensation, marketing costs, and regulatory compliance all contribute to these expenses. Future growth projections need to consider the macroeconomic climate, fuel prices, and evolving consumer preferences. The impact of inflation and potential economic downturns on consumer spending can influence demand for ride-sharing and food delivery services.

- Revenue growth trends and projections: Analyzing historical revenue data and industry forecasts helps predict future growth.

- Profitability margins and potential for future profitability: Evaluating profitability is crucial for assessing long-term investor returns.

- Debt levels and financial health of the company: High debt levels can pose risks, impacting the company's financial flexibility.

- Impact of macroeconomic factors on UBER's financial performance: Economic conditions significantly influence consumer spending patterns and, in turn, Uber's revenue.

Risks and Challenges Facing Uber

Despite its success, Uber faces considerable risks and challenges. Regulatory hurdles vary across different geographical regions, impacting its operational costs and profitability. Stringent regulations regarding driver classification, insurance, and safety standards can significantly impact Uber's business model. The intense competition mentioned previously presents ongoing pressure. Furthermore, driver-related lawsuits, safety concerns, and potential for increased labor costs represent ongoing operational challenges. Economic downturns can drastically reduce demand for ride-sharing and food delivery services, potentially leading to reduced revenue and profitability.

- Regulatory changes affecting ride-sharing and food delivery: Navigating evolving regulations is a constant challenge for Uber.

- Competition from established and emerging players: The competitive landscape requires ongoing innovation and strategic adaptations.

- Potential for increased driver costs and labor disputes: Managing driver compensation and ensuring fair labor practices is paramount.

- Safety concerns and their impact on public perception: Addressing safety concerns is crucial for maintaining public trust and brand reputation.

- Economic sensitivity of the business model: Economic downturns can significantly impact demand for Uber's services.

Valuation and Investment Strategy

Evaluating Uber's stock valuation involves analyzing metrics like its Price-to-Earnings (P/E) ratio, comparing it to industry peers and considering its future growth prospects. Different investment strategies exist for UBER stock. A buy-and-hold strategy involves purchasing shares and holding them for the long term, benefiting from potential long-term growth. Short-term trading focuses on capitalizing on short-term price fluctuations. Dollar-cost averaging involves investing a fixed amount at regular intervals, reducing the impact of market volatility. The chosen strategy depends on your risk tolerance, investment goals, and understanding of the market.

- Current market capitalization and stock price: Monitoring the stock's performance is essential for informed investment decisions.

- Key valuation metrics and comparisons to competitors: Comparative analysis helps assess whether the stock is undervalued or overvalued.

- Different investment strategies and their suitability: Choosing the right strategy aligns with your investment horizon and risk appetite.

- Potential risks and rewards associated with each strategy: Every investment strategy carries inherent risks and potential rewards.

Conclusion

Investing in Uber Technologies (UBER) requires careful consideration of its strengths and weaknesses. While its dominant market position in ride-sharing and expansion into promising sectors like food delivery and freight offer significant potential, it faces substantial challenges related to competition, regulation, and profitability. A thorough understanding of its financial performance, growth prospects, and inherent risks is paramount.

Call to Action: Before investing in Uber Technologies (UBER) or any other stock, conduct thorough due diligence, analyze financial statements, and consider seeking advice from a qualified financial advisor. Remember that all investments involve risk, and past performance is not indicative of future results. Do your research and only invest in UBER if it aligns with your individual financial goals and risk tolerance.

Jalen Brunson Out Knicks Lose To Lakers After Ot Injury

Jalen Brunson Out Knicks Lose To Lakers After Ot Injury

Eminems Potential Wnba Ownership A Surprising Development

Eminems Potential Wnba Ownership A Surprising Development

Uber One Arrives In Kenya Everything You Need To Know

Uber One Arrives In Kenya Everything You Need To Know

Jalen Brunsons Absence The Cm Punk Vs Seth Rollins Raw Match In Jeopardy

Jalen Brunsons Absence The Cm Punk Vs Seth Rollins Raw Match In Jeopardy

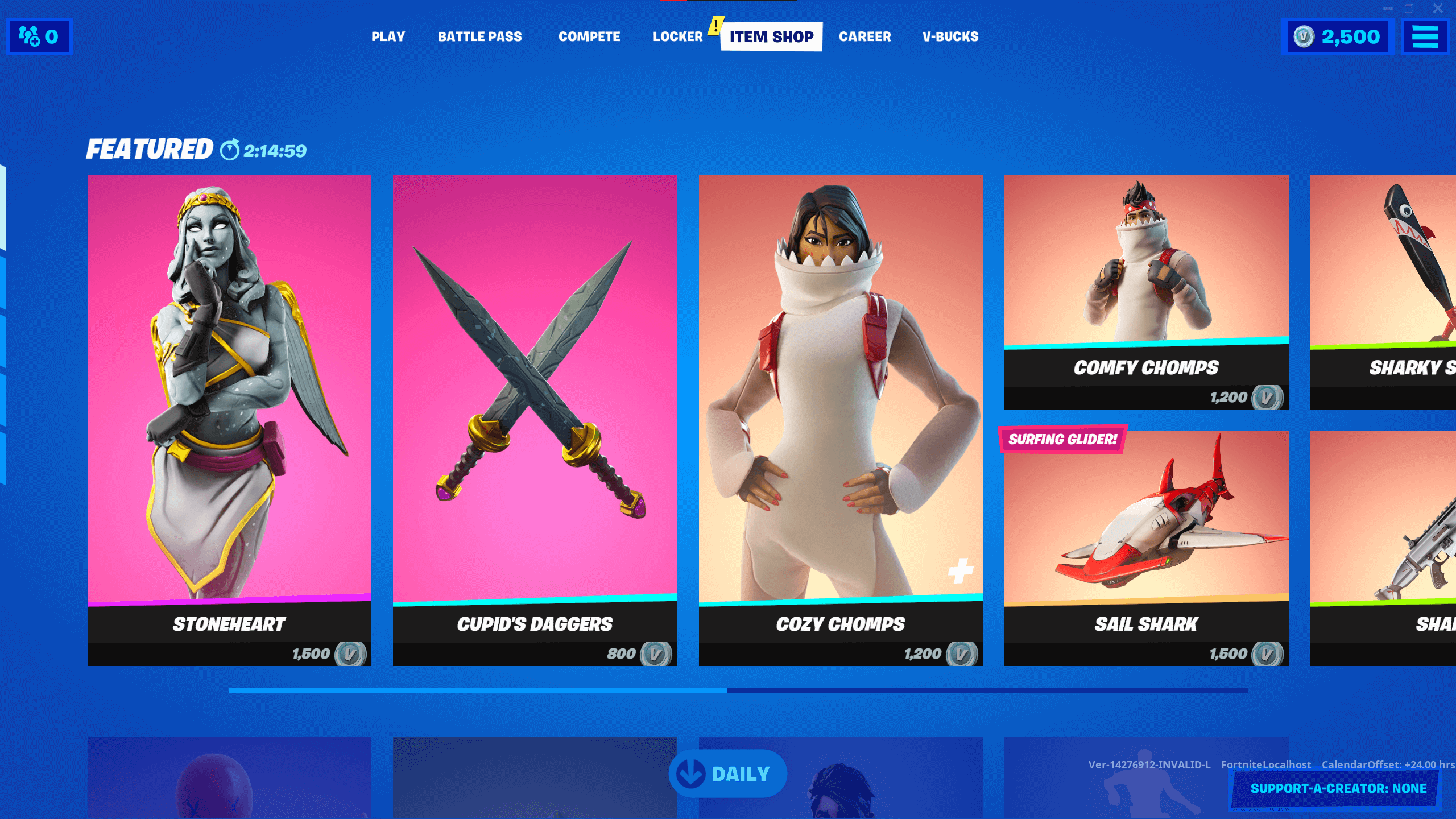

Fortnites Item Shop Gets A Much Needed Upgrade

Fortnites Item Shop Gets A Much Needed Upgrade