Should You Invest In D-Wave Quantum Inc. (QBTS) Stock Now?

Table of Contents

D-Wave's Technology and Market Position

Understanding D-Wave's Quantum Annealing Approach

D-Wave Quantum Inc. distinguishes itself by focusing on quantum annealing, a specific type of quantum computation. Unlike gate-based quantum computing pursued by companies like IBM and Google, quantum annealing is best suited for solving specific types of optimization problems.

- Advantages of Quantum Annealing: Faster solutions for certain optimization problems compared to classical algorithms. Potentially cost-effective for specific applications.

- Limitations: Not as versatile as gate-based quantum computing; not suitable for all types of quantum algorithms. Limited qubit connectivity compared to some competitors.

- Suitability: Ideal for applications requiring the optimization of complex systems, such as logistics, materials science, and financial modeling. The pursuit of "quantum supremacy" – exceeding the capabilities of classical computers – remains a key goal, albeit with differing definitions and benchmarks across different approaches.

D-Wave's Competitive Landscape

D-Wave faces stiff competition from giants like IBM, Google, IonQ, and Rigetti. While these competitors pursue gate-based quantum computing, offering a potentially broader range of applications, D-Wave maintains a unique position with its specialized quantum annealing technology.

- Strengths: Established track record, early market entry, focus on a niche but important area of quantum computing. Growing ecosystem of users and developers.

- Weaknesses: Limited scalability compared to some competitors' roadmaps, a narrower range of solvable problems compared to gate-based approaches. Market share in the overall quantum computing market remains relatively small.

- Market Growth Potential: The overall quantum computing market is projected to experience significant growth in the coming years, offering potential for substantial returns for early investors. However, the specific market share captured by D-Wave remains uncertain.

Financial Performance and Future Projections

Analyzing QBTS Stock Performance

Analyzing QBTS stock performance requires a careful review of historical data, including price fluctuations, revenue streams, and earnings. While past performance doesn't guarantee future results, understanding historical trends can inform future expectations. (Insert relevant chart/graph showing QBTS stock performance here).

- Key Financial Metrics: Track revenue growth, profitability (or lack thereof), earnings per share (EPS), and other relevant financial indicators to assess D-Wave’s financial health and sustainability.

- Significant Trends: Observe patterns and identify any significant upward or downward trends that may suggest underlying factors impacting the company’s financial performance.

Assessing Future Growth Potential

D-Wave's future growth hinges on several factors, including the expansion of its technology, securing strategic partnerships, and the overall growth of the quantum computing market.

- Future Applications: Identifying new applications and industries where quantum annealing can provide a significant advantage is crucial for D-Wave’s future. Success in this area could drive significant revenue growth.

- Partnerships and Collaborations: Strategic collaborations with industry leaders and research institutions can accelerate D-Wave's development and broaden its market reach. Government funding and grants also play a vital role.

- Quantum Computing Market Size: Market research reports project substantial growth in the quantum computing market. D-Wave's success is tied to its ability to secure a meaningful share of this expanding market.

Risks and Considerations for Investors

The Volatility of Quantum Computing Stocks

Investing in quantum computing stocks like QBTS carries significant risk. This is a nascent technology with an uncertain future, meaning high volatility is expected.

- Price Fluctuations: Expect substantial price swings in response to technological breakthroughs, market sentiment, and competitive developments.

- Technological Setbacks: The development of quantum computing is inherently complex. Unforeseen technical challenges could delay progress and impact stock prices.

- Competition: Competition from well-funded established tech giants could hinder D-Wave's growth and market share.

Due Diligence Before Investing in QBTS

Before investing in QBTS stock or any other quantum computing investment, thorough due diligence is essential. Understand the company's financial position, its technological strengths and weaknesses, and the competitive landscape.

- Research Resources: Utilize reputable financial news sources, company filings (10-K, 10-Q), and independent analyst reports to gather information.

- Seek Professional Advice: Consulting a financial advisor experienced in high-risk investments can help you make informed decisions aligned with your risk tolerance and financial goals.

Conclusion: Should You Invest in D-Wave Quantum Inc. (QBTS) Stock Now?

Investing in D-Wave Quantum Inc. (QBTS) presents a high-risk, high-reward opportunity. D-Wave holds a unique position in the quantum computing market with its quantum annealing technology, but faces significant competition and inherent technological risks. While its future prospects are promising due to the growth potential of the overall quantum computing market, financial performance remains a key factor to consider. Its historical stock price performance, coupled with its current financial metrics, is not conclusive evidence of future success or failure. Further research is crucial in determining its potential trajectory.

Based on the analysis, a decision to invest in QBTS should be made with caution. Before making any decisions regarding D-Wave Quantum Inc. (QBTS) stock or other quantum computing investments, carefully assess your own risk tolerance and conduct thorough due diligence. Consider consulting a qualified financial advisor before investing in this high-risk, high-reward sector.

Featured Posts

-

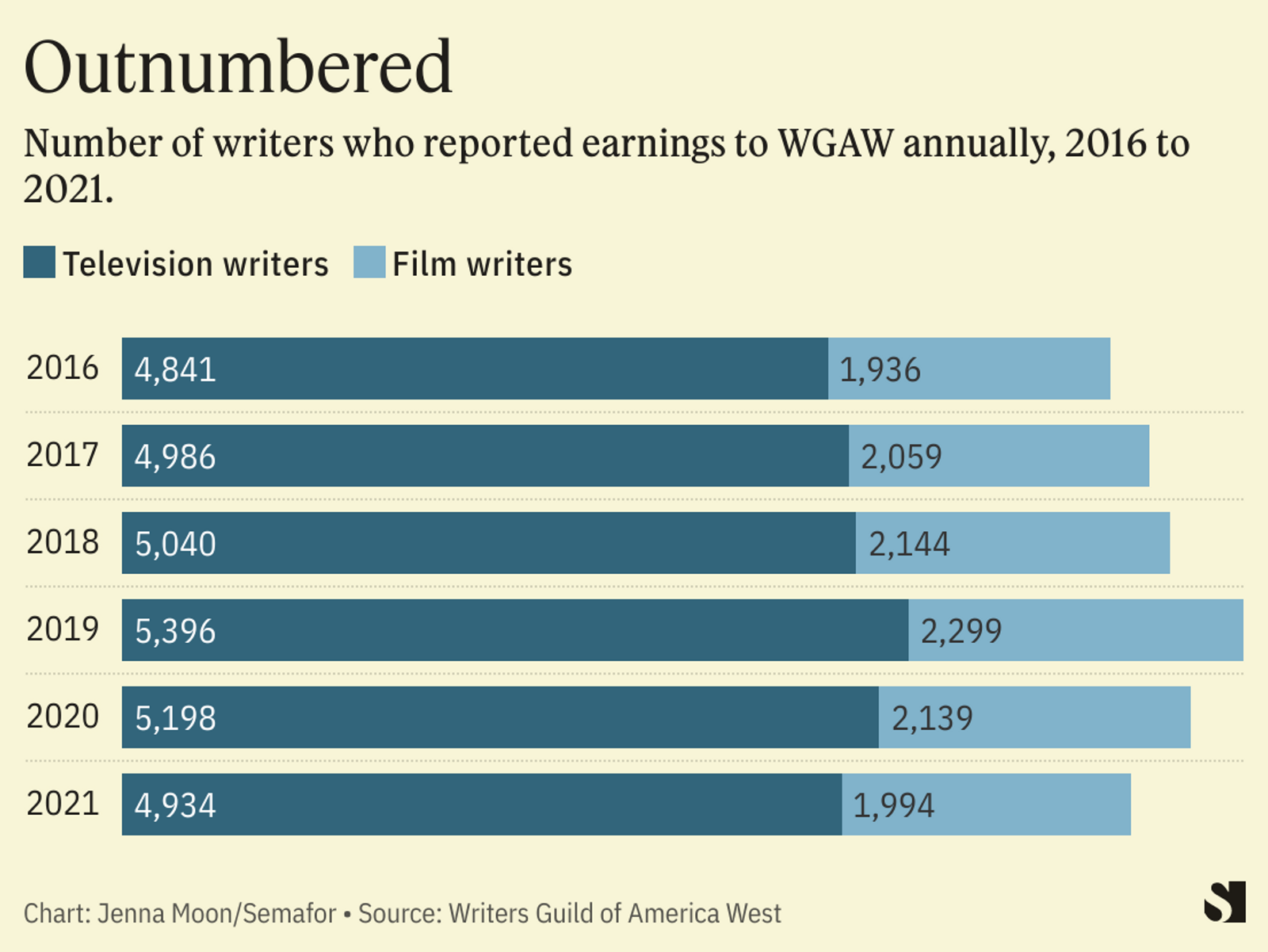

Hollywood At A Standstill Joint Writers And Actors Strike Impacts The Industry

May 21, 2025

Hollywood At A Standstill Joint Writers And Actors Strike Impacts The Industry

May 21, 2025 -

Manchester Uniteds Rashford Bags Brace Against Aston Villa In Fa Cup Victory

May 21, 2025

Manchester Uniteds Rashford Bags Brace Against Aston Villa In Fa Cup Victory

May 21, 2025 -

The Goldbergs A Look At The Shows Humor And Nostalgic Appeal

May 21, 2025

The Goldbergs A Look At The Shows Humor And Nostalgic Appeal

May 21, 2025 -

The Goldbergs Behind The Scenes And Production Insights

May 21, 2025

The Goldbergs Behind The Scenes And Production Insights

May 21, 2025 -

Uk News Tory Politicians Wifes Jail Term Confirmed For Migrant Remarks

May 21, 2025

Uk News Tory Politicians Wifes Jail Term Confirmed For Migrant Remarks

May 21, 2025

Latest Posts

-

United Kingdom News Tory Wifes Imprisonment For Southport Incident

May 22, 2025

United Kingdom News Tory Wifes Imprisonment For Southport Incident

May 22, 2025 -

Jail Term Stands Update On Tory Politicians Wifes Migrant Remarks Case

May 22, 2025

Jail Term Stands Update On Tory Politicians Wifes Migrant Remarks Case

May 22, 2025 -

Update Ex Tory Councillors Wifes Appeal For Racial Hatred Tweet

May 22, 2025

Update Ex Tory Councillors Wifes Appeal For Racial Hatred Tweet

May 22, 2025 -

Connollys Racial Hatred Conviction Upheld Appeal Rejected

May 22, 2025

Connollys Racial Hatred Conviction Upheld Appeal Rejected

May 22, 2025 -

Southport Stabbing Mothers Tweet Imprisonment And Housing Struggle

May 22, 2025

Southport Stabbing Mothers Tweet Imprisonment And Housing Struggle

May 22, 2025