Should You Buy XRP After Its 400% 3-Month Rally? Risks And Rewards

Table of Contents

XRP's Recent Price Surge: Analyzing the Factors Behind the 400% Rally

Several factors have contributed to XRP's impressive 400% price rally. Understanding these is crucial to evaluating the current market situation.

The Ripple Case and its Impact

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) has profoundly influenced XRP's price. Positive developments in the case often trigger price increases, while negative news can lead to sharp drops.

- Positive Developments: Recent court rulings seemingly favorable to Ripple have fueled optimism among XRP investors. [Link to relevant news article 1] [Link to relevant news article 2]

- Negative Developments: The SEC's arguments and potential counter-moves continue to pose a significant risk. [Link to relevant SEC filing]

- Expert Opinions: Analysts remain divided, with some predicting a significant price increase upon a favorable outcome, while others caution against overestimating the impact. [Link to analyst report]

- Market Sentiment Shifts: The overall market sentiment surrounding the Ripple case directly impacts XRP's price volatility. Positive news leads to buying pressure, while negative news creates selling pressure.

Increased Institutional Interest?

While anecdotal evidence suggests some increased institutional interest in XRP, concrete proof remains limited. Further investigation is needed to determine the extent of institutional involvement.

- Evidence of Institutional Adoption: There have been reports of certain institutional investors accumulating XRP, but verifying this information independently is crucial.

- Potential Partnerships: Ripple continues to forge partnerships, which could potentially boost XRP adoption and its price. However, the impact of these partnerships on the price remains speculative.

- Trading Volume Analysis: Increased trading volume can signal growing interest, but it can also be influenced by other factors, including speculation.

Broader Cryptocurrency Market Trends

XRP's price is inextricably linked to the broader cryptocurrency market. Positive trends in Bitcoin and a general "altcoin season" can boost XRP's price, while negative market sentiment can trigger widespread sell-offs.

- Bitcoin's Price Movement: Bitcoin often acts as a bellwether for the entire crypto market. A bullish Bitcoin market often translates to positive sentiment towards altcoins like XRP.

- Altcoin Season: Periods where altcoins outperform Bitcoin are known as "altcoin seasons," often leading to significant price rallies across a range of cryptocurrencies, including XRP.

- General Market Sentiment: Overall investor confidence in the cryptocurrency market significantly influences XRP's price.

Understanding the Risks of Investing in XRP After a Significant Rally

While the 400% rally is tempting, understanding the associated risks is paramount before investing.

High Volatility and Price Correction Potential

Cryptocurrencies are inherently volatile, and XRP is no exception. Sharp price increases are often followed by corrections.

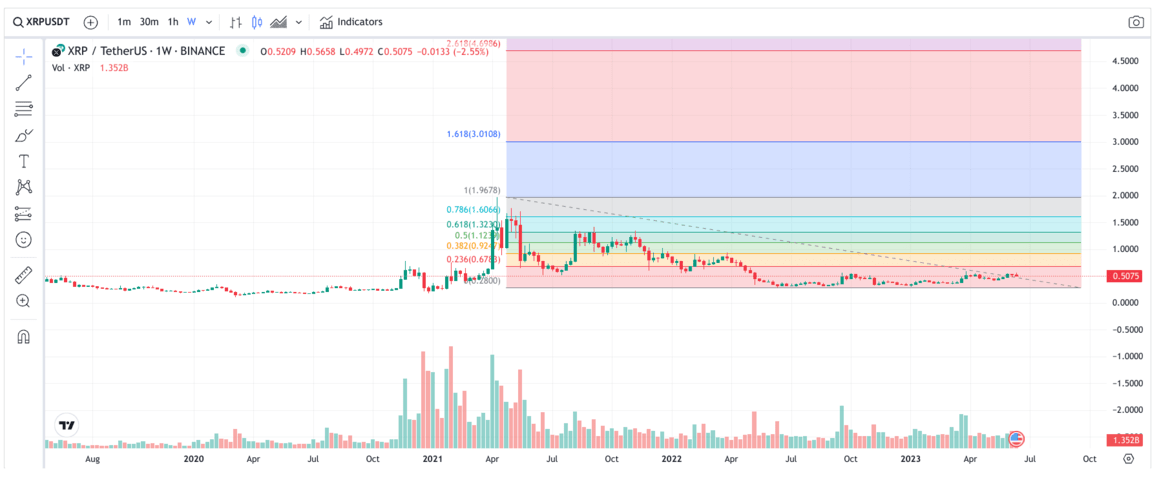

- Historical Price Charts: Analyzing XRP's historical price charts reveals a pattern of significant rallies followed by substantial price corrections. [Link to XRP price chart]

- Technical Analysis: Technical indicators can offer insights into potential price movements, but should not be solely relied upon for investment decisions.

- Risk Assessment Strategies: Employing risk management techniques, like setting stop-loss orders, is crucial to mitigate potential losses.

Regulatory Uncertainty

Regulatory uncertainty remains a major risk for XRP and the broader crypto market.

- Potential Future Regulations: Governments worldwide are actively considering regulations for cryptocurrencies, and the outcome could significantly impact XRP's price.

- Impact on Liquidity: Increased regulatory scrutiny could limit XRP's liquidity, making it difficult to buy or sell quickly.

- Potential for Further Legal Action: The ongoing Ripple case highlights the potential for further legal challenges that could negatively affect XRP's price.

Market Manipulation Concerns

The possibility of market manipulation influencing XRP's price should not be disregarded.

- Evidence (or lack thereof) of manipulation: While there is no definitive proof of large-scale manipulation, the potential remains a concern.

- Analysis of trading volume and price action: Analyzing trading patterns can provide clues, but definitive conclusions are difficult to draw.

Evaluating the Potential Rewards of Investing in XRP

Despite the risks, XRP presents potential rewards for investors with a long-term perspective and a high-risk tolerance.

Long-Term Growth Potential

XRP's potential for long-term growth hinges on its adoption as a cross-border payment solution.

- Use case scenarios for XRP: RippleNet, Ripple's payment network, aims to facilitate faster and cheaper cross-border transactions using XRP.

- Adoption rate projections: The success of RippleNet and the overall adoption of XRP will determine its long-term price potential.

- Technological advancements: Continued development and improvement of Ripple's technology could enhance XRP's functionality and appeal.

Potential for Further Price Appreciation

While predicting future price movements is impossible, certain factors could contribute to further price appreciation.

- Technical analysis: Some technical indicators may suggest further upward potential, but these are not guarantees.

- Market sentiment: Sustained positive market sentiment could fuel further price increases.

- Future catalysts: Positive developments in the Ripple case or significant partnerships could act as catalysts for further price appreciation.

Diversification Benefits

Including XRP in a diversified investment portfolio can help mitigate overall risk.

- Risk mitigation strategies: Diversification reduces reliance on any single asset, thereby minimizing potential losses.

- Asset allocation: Determining the appropriate allocation of XRP within a broader portfolio depends on individual risk tolerance and investment goals.

Conclusion: Should You Buy XRP Now? Weighing the Risks and Rewards

The decision of whether to buy XRP after its recent rally is a complex one. While the price surge is compelling, the inherent volatility and regulatory uncertainty present significant risks. Conversely, the potential for long-term growth and diversification benefits offer attractive rewards. Remember, conducting thorough research and understanding your own risk tolerance is paramount before investing in any cryptocurrency, including XRP. This analysis provides a balanced perspective; it does not constitute financial advice. Before investing in XRP or any other cryptocurrency, carefully weigh the risks and rewards, conduct your own due diligence, and consider consulting with a qualified financial advisor.

Featured Posts

-

Kycklingnuggets Med Majsflingor Krispigt Gott And Enkel Asiatisk Kalsallad

May 02, 2025

Kycklingnuggets Med Majsflingor Krispigt Gott And Enkel Asiatisk Kalsallad

May 02, 2025 -

Riot Fest 2025 Full Lineup Announcement With Green Day And Weezer

May 02, 2025

Riot Fest 2025 Full Lineup Announcement With Green Day And Weezer

May 02, 2025 -

No 10 Texas Tech Edges Kansas 78 73 In Away Game

May 02, 2025

No 10 Texas Tech Edges Kansas 78 73 In Away Game

May 02, 2025 -

Xrp Price Prediction 2024 Analyzing The Potential For A 10 Surge

May 02, 2025

Xrp Price Prediction 2024 Analyzing The Potential For A 10 Surge

May 02, 2025 -

Find The Latest Lotto Lotto Plus 1 And Lotto Plus 2 Results Here

May 02, 2025

Find The Latest Lotto Lotto Plus 1 And Lotto Plus 2 Results Here

May 02, 2025