Should You Buy Palantir Stock Today? A Detailed Investor's Guide

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir's revenue streams are multifaceted, creating both opportunities and challenges for potential investors. Understanding these streams is crucial for assessing the long-term viability of a Palantir stock investment.

Government Contracts

Palantir's initial success was heavily reliant on substantial government contracts, particularly within the US defense sector. This reliance presents a double-edged sword.

- Recent contract wins: Palantir continues to secure significant contracts with various government agencies, demonstrating its continued relevance in national security and intelligence. However, the specifics of these contracts are often shrouded in secrecy.

- Potential for future contracts: The ongoing need for advanced data analytics within government agencies ensures a consistent stream of potential contract opportunities for Palantir. However, government budgeting cycles and political changes introduce uncertainty.

- Risks associated with government dependence: Over-reliance on government contracts makes Palantir vulnerable to shifts in government priorities, budget cuts, and changes in administration. This is a key risk factor to consider when evaluating Palantir stock. Diversification into commercial markets is crucial to mitigate this risk. Keywords: Palantir government contracts, Palantir defense contracts, government spending on technology.

Commercial Partnerships

Palantir has actively pursued expansion into the commercial sector, leveraging its powerful data analytics platforms, Gotham and Foundry, to attract private sector clients.

- Key commercial clients: Palantir boasts a growing list of prominent commercial clients across various industries, including finance, healthcare, and manufacturing. These partnerships showcase the adaptability and value proposition of Palantir's technology.

- Success stories: Several case studies highlight how Palantir's solutions have enabled commercial clients to achieve significant operational efficiencies and gain valuable insights from their data. These success stories bolster investor confidence.

- Challenges in expanding commercial partnerships: Penetrating the competitive commercial data analytics market requires significant effort and investment. Palantir faces stiff competition from established players and newer entrants in this space. Keywords: Palantir commercial clients, Palantir Foundry, Palantir Gotham, commercial data analytics.

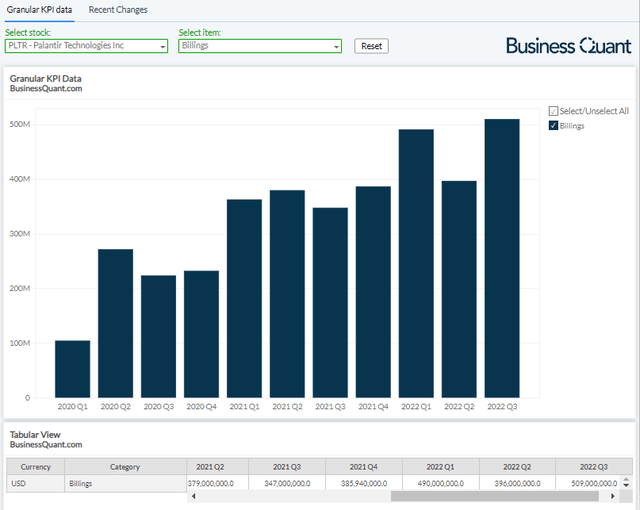

Revenue Growth and Financial Performance

Analyzing Palantir's financial performance is crucial for any potential investor. Examining revenue growth, profitability, and cash flow provides insights into the company's financial health and sustainability.

- Revenue growth trends: Palantir has demonstrated consistent revenue growth, though profitability has remained elusive. Tracking these trends is key to understanding the trajectory of the company's financial performance.

- Profitability margins: Palantir's operating margins have fluctuated, reflecting the investment needed for growth and expansion. Investors should carefully monitor these margins to assess the long-term profitability potential.

- Cash flow and debt levels: A strong cash flow position is vital for a company's long-term health. Analyzing Palantir's cash flow and debt levels helps determine its financial stability and its ability to fund future growth initiatives. Keywords: Palantir financials, Palantir revenue, Palantir earnings, Palantir financial analysis.

Market Analysis and Competition

Understanding Palantir's position within the broader data analytics market and the competitive landscape is vital for assessing its future prospects.

Competitive Landscape

The data analytics market is fiercely competitive, with both established players and innovative startups vying for market share.

- Major competitors: Palantir faces competition from companies like Databricks, Snowflake, and other established players in the big data analytics space. Each competitor offers unique strengths and challenges Palantir's market position.

- Competitive advantages of Palantir: Palantir's proprietary technology, particularly its expertise in complex data integration and analysis, provides a significant competitive advantage. Its focus on high-value, mission-critical projects further differentiates it from competitors.

- Market share: Palantir's market share is still relatively small compared to some larger competitors, indicating significant room for growth but also highlighting the challenges of capturing a larger portion of this expansive market. Keywords: Palantir competitors, data analytics market, big data analytics, competition in data analytics.

Market Trends and Growth Potential

The data analytics market is experiencing explosive growth, driven by the increasing volume and complexity of data generated across all sectors.

- Growth projections for data analytics: Industry reports project significant growth for the data analytics market in the coming years, presenting a substantial opportunity for companies like Palantir.

- Emerging trends in data analytics: The integration of artificial intelligence (AI) and machine learning (ML) into data analytics is transforming the field, creating new opportunities and challenges. Palantir is actively investing in AI and ML capabilities to maintain its competitive edge.

- Palantir's innovation potential: Palantir's continued investment in research and development, combined with its focus on innovation, positions it to capitalize on emerging trends within the data analytics market. Keywords: Data analytics market growth, AI in data analytics, future of data analytics.

Risks and Challenges Associated with Investing in Palantir Stock

Investing in Palantir stock involves considerable risk. Understanding these risks is crucial for making an informed investment decision.

Volatility and Stock Price Fluctuations

Palantir's stock price has historically exhibited significant volatility. This volatility presents both opportunities and risks for investors.

- Historical price volatility: Analyzing Palantir's historical stock price fluctuations helps investors understand the potential for significant price swings in the future.

- Factors influencing price changes: Various factors, including market sentiment, financial performance, news events, and overall market conditions, can significantly impact Palantir's stock price.

- Risk tolerance: Investing in Palantir stock requires a high degree of risk tolerance, as significant price fluctuations are expected. Keywords: Palantir stock volatility, PLTR stock price prediction, investment risk.

Dependence on a Few Large Clients

Palantir's revenue is concentrated among a relatively small number of large clients, creating significant client concentration risk.

- Client concentration risk: The loss of a major client could severely impact Palantir's financial performance, highlighting the importance of diversification.

- Potential loss of contracts: Government contracts, in particular, are subject to renewal cycles and potential cancellation, creating uncertainty.

- Diversification strategy: Palantir is actively working to diversify its client base to mitigate this risk. The success of this strategy will be crucial for its long-term stability. Keywords: Palantir client concentration, risk management, diversification of revenue streams.

Long-Term Growth Uncertainty

While Palantir's technology is promising, uncertainties surrounding its long-term growth prospects remain.

- Future market conditions: The overall economic climate and the specific conditions within the data analytics market will significantly impact Palantir's growth trajectory.

- Technological disruptions: Rapid technological advancements could render Palantir's technology obsolete, necessitating continuous innovation and adaptation.

- Competition: Intense competition from established and emerging players poses a significant challenge to Palantir's long-term growth potential. Keywords: Palantir long-term growth, future of Palantir, investment outlook.

Conclusion

Deciding whether to buy Palantir stock requires careful assessment of its business model, market position, financial performance, and inherent risks. While Palantir presents exciting opportunities within the rapidly expanding data analytics sector, its reliance on government contracts and volatile stock price introduce significant challenges. This comprehensive analysis of Palantir stock equips you with the necessary information to make an informed investment decision. Remember that whether you should buy Palantir stock today hinges on your individual risk tolerance and investment objectives. Always conduct thorough due diligence and consult with a financial advisor before making any investment decisions regarding Palantir stock.

Featured Posts

-

Uk To Restrict Student Visas Impact On Asylum Seekers

May 10, 2025

Uk To Restrict Student Visas Impact On Asylum Seekers

May 10, 2025 -

Oilers Favored To Finish Kings In Playoff Series Betting Odds Analysis

May 10, 2025

Oilers Favored To Finish Kings In Playoff Series Betting Odds Analysis

May 10, 2025 -

Farcical Misconduct Nottingham Families Urge For Proceedings Delay

May 10, 2025

Farcical Misconduct Nottingham Families Urge For Proceedings Delay

May 10, 2025 -

Taiwans Lai Sounds Alarm On Totalitarianism In Ve Day Speech

May 10, 2025

Taiwans Lai Sounds Alarm On Totalitarianism In Ve Day Speech

May 10, 2025 -

New Uk Visa Rules Targeting Misuse Of Work And Student Permits

May 10, 2025

New Uk Visa Rules Targeting Misuse Of Work And Student Permits

May 10, 2025