Should You Buy Palantir Stock After Its 30% Fall?

Table of Contents

Understanding Palantir's Recent Stock Price Decline

Market Sentiment and Tech Stock Corrections

The recent decline in Palantir's stock price isn't isolated. The broader tech market has experienced a significant correction, impacting numerous tech companies, including Palantir. Several factors contribute to this downturn:

- Rising Interest Rates: The Federal Reserve's aggressive interest rate hikes to combat inflation have increased borrowing costs, making growth stocks like Palantir less attractive to investors.

- Inflation Concerns: Persistent inflation erodes purchasing power and makes investors more cautious, leading to a flight to safety and away from riskier assets.

- General Investor Risk Aversion: Uncertainty surrounding the global economy and geopolitical events has increased investor risk aversion, causing a sell-off in many sectors, including technology.

These factors are reflected in major market indices. For example, the Nasdaq Composite, a tech-heavy index, has experienced a significant decline in recent months, correlating with Palantir's own price drop. Analyzing the performance of these indices provides crucial context for understanding PLTR's recent performance.

Palantir's Financial Performance and Earnings Reports

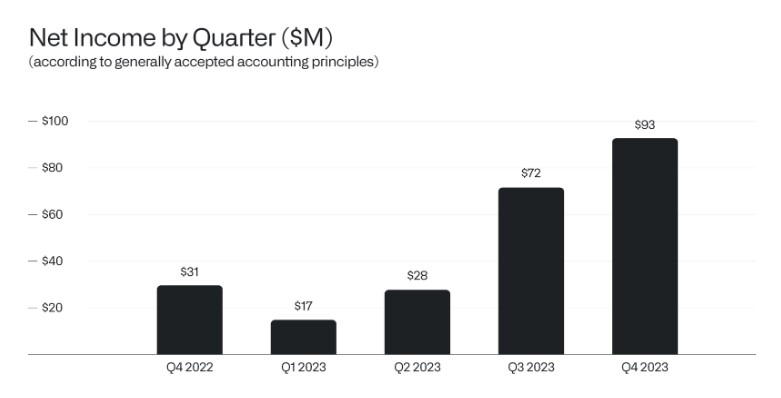

Palantir's recent earnings reports offer further insight into its stock price decline. While revenue growth has been reported, analysts have scrutinized profitability and key metrics.

- Positive Aspects: Consistent revenue growth in both government and commercial sectors demonstrates the ongoing demand for Palantir's data analytics platforms.

- Negative Aspects: Profitability margins might not meet certain investor expectations, potentially contributing to the stock price decline. A closer look at operating expenses and their growth is necessary.

Comparing these figures to previous quarters and industry benchmarks is crucial for assessing the company’s performance and its trajectory. Analyzing specific numbers from these reports, such as year-over-year revenue growth and changes in net income, gives a more comprehensive picture.

Geopolitical Factors and Their Influence

Geopolitical events, particularly the ongoing war in Ukraine, have also impacted investor sentiment toward Palantir.

- Government Contracts: Palantir's substantial reliance on government contracts, especially in defense and intelligence, makes it sensitive to geopolitical shifts and potential changes in government spending priorities. Increased defense spending in response to global instability could benefit Palantir.

- International Operations: The complexity of operating in a global landscape and navigating international relations adds an additional layer of risk and uncertainty, influencing investor confidence.

News articles and reports analyzing the impact of these geopolitical factors on Palantir's business should be carefully considered when assessing the company's outlook.

Evaluating Palantir's Long-Term Growth Potential

Government Contracts and Future Revenue Streams

Palantir's substantial portfolio of government contracts forms a significant portion of its revenue.

- Stability and Long-Term Prospects: Government contracts often offer greater stability than commercial contracts, providing a predictable revenue stream.

- Future Growth: The long-term prospects for government contracts depend on factors such as continued government funding and the evolving needs of national security agencies. Analyzing the pipeline of potential future contracts is critical.

Specific data points like the total value of current contracts and projections for future contract awards are crucial for evaluating this aspect of Palantir's growth potential.

Expansion into the Commercial Sector

Palantir is actively expanding its presence in the commercial market.

- Strategy and Challenges: The company's strategy focuses on providing data analytics solutions to large enterprises across various sectors. However, penetrating the commercial market is challenging and requires significant investment in sales and marketing.

- Key Clients: Identifying key commercial clients and their contributions to revenue offers a measure of the success of this expansion strategy.

Analyzing the growth rate of commercial revenue and comparing it to the government sector provides valuable insight.

Innovation and Technological Advancements

Palantir's ongoing R&D efforts are key to its long-term growth potential.

- New Product Launches: The introduction of new products and features enhances its offerings and attracts new clients.

- Technological Breakthroughs: Innovation in data analytics and artificial intelligence is vital for maintaining a competitive edge. Patents and technological advancements act as key indicators of innovative capacity.

Monitoring new product launches, patent filings, and investments in R&D gives a clear picture of Palantir's innovation capacity.

Assessing the Risks Associated with Investing in Palantir

Valuation and Stock Price Volatility

Palantir's valuation and stock price volatility present significant risks.

- High Valuation: The company's valuation might be considered high compared to its current earnings, creating the risk of a further price correction.

- Price Volatility: Its stock price has historically shown significant volatility, making it a risky investment for risk-averse investors.

Comparing Palantir's valuation metrics (like P/E ratio) to industry competitors helps assess the level of risk involved.

Competition and Market Share

Palantir faces stiff competition in the data analytics market.

- Key Competitors: Companies like AWS, Google Cloud, and Microsoft Azure offer competing data analytics solutions.

- Market Share: Maintaining and growing market share requires continuous innovation and effective competition.

Analyzing market share data and the competitive landscape gives a better understanding of Palantir's position.

Dependence on Government Contracts

Palantir's significant reliance on government contracts exposes it to specific risks.

- Government Policy Changes: Changes in government policy or budget cuts could significantly impact its revenue.

- Political Risk: Geopolitical instability or changes in government priorities could also affect the company's prospects.

Understanding the level of diversification between government and commercial contracts is critical in assessing this risk.

Conclusion

Investing in Palantir stock after its recent decline presents a complex scenario with both potential benefits and significant risks. While the company demonstrates growth in revenue and boasts a strong government contract portfolio, its reliance on this sector, high valuation, and competitive landscape create uncertainty. The broader tech market downturn and geopolitical factors further add to the complexity.

Ultimately, the decision of whether to buy Palantir stock is a personal one. Carefully consider the information provided in this article, conduct your own thorough research, and consult with a financial advisor before making any investment decisions. Remember to always assess your own risk tolerance before investing in volatile stocks like Palantir. Understanding the potential for both significant gains and losses is crucial before investing in Palantir stock.

Featured Posts

-

Understanding The Epstein Client List Controversy Pam Bondis Perspective

May 09, 2025

Understanding The Epstein Client List Controversy Pam Bondis Perspective

May 09, 2025 -

Two Pedestrians Dead After Being Struck By Driver In Elizabeth City

May 09, 2025

Two Pedestrians Dead After Being Struck By Driver In Elizabeth City

May 09, 2025 -

Sex Slur Scandal Wynne Evans Removed From Go Compare Advertising Campaign

May 09, 2025

Sex Slur Scandal Wynne Evans Removed From Go Compare Advertising Campaign

May 09, 2025 -

Young Thugs Uy Scuti When Can We Expect The New Album

May 09, 2025

Young Thugs Uy Scuti When Can We Expect The New Album

May 09, 2025 -

Nyt Strands Hints And Answers Tuesday March 4 Game 366

May 09, 2025

Nyt Strands Hints And Answers Tuesday March 4 Game 366

May 09, 2025