Should You Buy Palantir Stock? A Pre-May 5th Analysis

Table of Contents

Palantir's Recent Performance and Financial Health

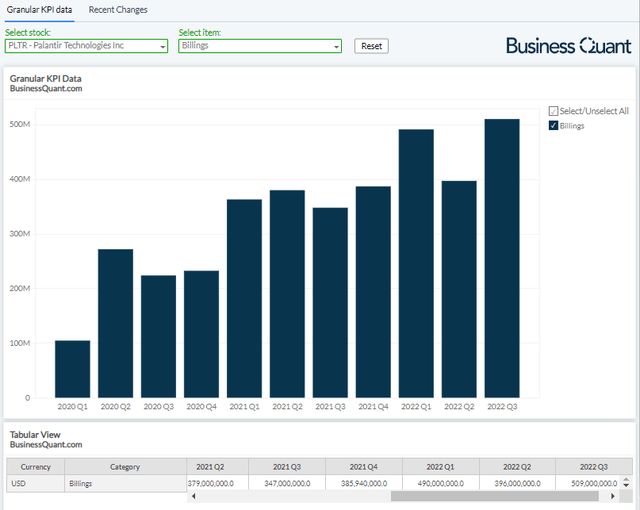

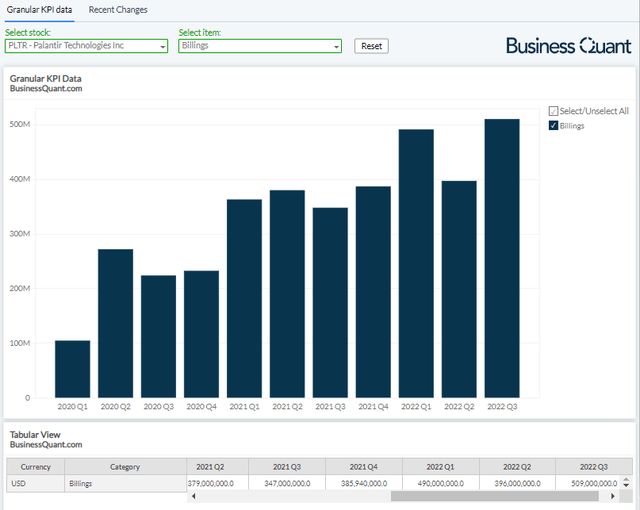

Before deciding whether to buy Palantir stock, examining its recent financial health is essential. Leading up to May 5th, Palantir demonstrated [insert specific data on stock performance – e.g., percentage change, volatility]. Analyzing key financial indicators reveals a more complete picture.

- Revenue Growth: Palantir reported [insert specific revenue figures and growth percentages for recent quarters]. This showcases [positive or negative interpretation of growth trend – e.g., consistent growth, slowing growth, etc.].

- Profitability: Key profitability metrics, such as net income and operating margin, paint a picture of Palantir's efficiency. [Insert specific data on net income and operating margin, analyzing the trends].

- Cash Flow: Analyzing cash flow from operations is crucial for assessing a company's financial stability. Palantir's cash flow from operations shows [insert data and interpretation – e.g., strong positive cash flow, indicating healthy operations, or explain any negative trends].

- Debt Levels: [Insert data on Palantir's debt levels and assess its impact on the company's financial health. Discuss debt-to-equity ratio if available].

Government Contracts vs. Commercial Growth

Palantir's revenue stream is significantly influenced by its government contracts and its growing commercial sector. Understanding this balance is critical when considering whether to buy Palantir stock.

- Government Contracts: A large portion of Palantir's revenue is derived from government contracts. [Insert data on percentage of revenue from government contracts]. The stability of these contracts and the potential for future contracts are essential considerations. [Mention any specific contract renewals or potential new contracts].

- Commercial Growth: Palantir's commercial growth is a key indicator of its long-term potential. [Insert data on the growth of Palantir's commercial sector and its contribution to overall revenue]. Their strategies for penetrating the commercial market and their success in various sectors should be analyzed.

- Risk Assessment: Over-reliance on government contracts presents risks. Changes in government budgets, policy shifts, or geopolitical events could significantly impact Palantir's revenue. Careful assessment of these potential risks is necessary.

Competitive Landscape and Future Outlook

The big data analytics market is competitive, with major players like AWS, Microsoft Azure, and Google Cloud. Understanding Palantir's position within this landscape is key to answering, "Should you buy Palantir stock?"

- Key Competitors: Palantir faces intense competition from established tech giants with extensive resources. [Compare Palantir's offerings with those of its main competitors – highlight strengths and weaknesses].

- Competitive Advantages: Palantir's competitive advantages lie in [mention specific technologies, unique capabilities, partnerships, or other advantages]. These differentiators must be weighed against the competition's strengths.

- Future Outlook: The big data analytics market is expected to [insert market forecasts and predictions for growth]. Palantir's potential for growth depends on its ability to [discuss factors like innovation, market penetration, successful partnerships, etc.]. Consider potential for new product development or market expansion.

Risk Factors to Consider Before Investing in Palantir Stock

Before investing in Palantir stock, it's crucial to acknowledge the inherent risks. Technology stocks, in general, are volatile, and Palantir presents specific challenges.

- Valuation: Palantir's valuation compared to industry peers should be carefully analyzed. [Discuss the Price-to-Earnings ratio, or other relevant valuation metrics]. A high valuation could indicate overpricing and increased risk.

- Client Concentration: Palantir's reliance on a few key government and commercial clients presents a concentration risk. The loss of a major client could significantly impact revenue.

- Technological Disruption: The technology landscape is constantly evolving, and Palantir must continuously innovate to stay ahead of the competition. Technological disruption could negatively impact its market share.

- Macroeconomic Factors: Geopolitical events, economic downturns, and other macroeconomic factors can significantly affect Palantir's performance.

Conclusion: Should You Invest in Palantir Stock? A Post-Analysis Summary

This pre-May 5th analysis has explored various aspects of Palantir, highlighting both its potential and the associated risks. While Palantir showcases impressive growth in certain areas, the dependence on government contracts and competition from established players present significant considerations. Remember, the information provided here is for informational purposes only and should not be considered financial advice. The question, "Should you buy Palantir stock?", ultimately depends on your individual risk tolerance, investment timeline, and due diligence. Conduct thorough research and consult with a financial advisor before making any investment decisions. Ultimately, the question of "Should you buy Palantir stock?" remains a personal decision based on your individual risk tolerance and investment goals.

Featured Posts

-

August Deadline Approaches Us Treasury Flags Debt Limit Concerns

May 10, 2025

August Deadline Approaches Us Treasury Flags Debt Limit Concerns

May 10, 2025 -

Divine Mercy Extended Religious Life And Faith In 1889

May 10, 2025

Divine Mercy Extended Religious Life And Faith In 1889

May 10, 2025 -

Analysis Of Us Government Grants For Transgender Animal Research

May 10, 2025

Analysis Of Us Government Grants For Transgender Animal Research

May 10, 2025 -

What Is A Real Safe Bet And How To Find It

May 10, 2025

What Is A Real Safe Bet And How To Find It

May 10, 2025 -

Attorney General Uses Prop Fentanyl To Illustrate Drug Crisis

May 10, 2025

Attorney General Uses Prop Fentanyl To Illustrate Drug Crisis

May 10, 2025