Should I Buy Palantir Stock Before 2025? A Realistic Assessment

Table of Contents

Palantir's Financial Performance and Growth Trajectory

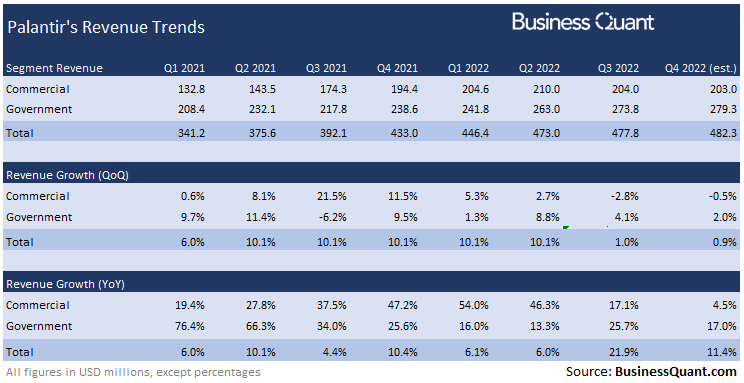

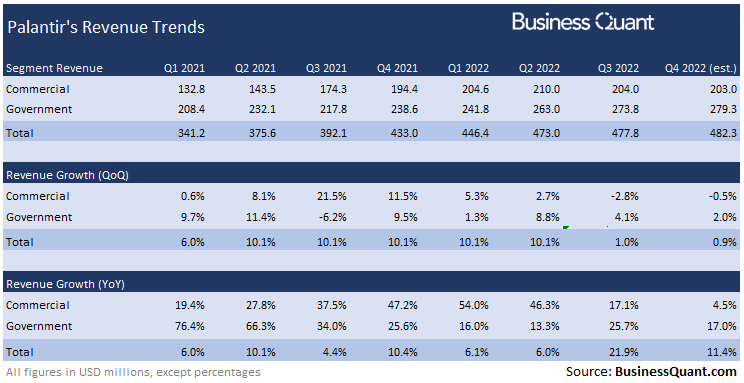

Palantir's financial story is complex. While the company boasts impressive revenue growth, sustained profitability remains elusive. Analyzing Palantir's financials requires a nuanced perspective. Let's delve into the key metrics:

-

Revenue Growth: Palantir has consistently shown strong revenue growth, particularly in its government sector. However, the rate of growth has fluctuated, and understanding the drivers behind this fluctuation is crucial. Analyzing year-over-year growth rates, alongside the contribution from government versus commercial clients, paints a clearer picture.

-

Profitability (EBITDA & Net Income): While Palantir has shown positive EBITDA in recent quarters, achieving consistent net profitability has been a challenge. Factors contributing to this include significant research and development investments, and the nature of its long-term government contracts. Understanding the path towards sustained profitability is key to evaluating Palantir's long-term value.

-

Cash Flow: Monitoring Palantir's operating cash flow is essential. This metric indicates the company’s ability to generate cash from its core business operations, independent of accounting adjustments. A healthy cash flow suggests financial strength and the ability to fund future growth initiatives.

Significant Financial Events:

- 2020 IPO: Palantir's successful initial public offering marked a significant milestone.

- Large Government Contracts: Securing substantial contracts with government agencies has been a major driver of revenue growth.

- Expansion into Commercial Markets: Palantir is actively pursuing growth in the commercial sector, a critical area for long-term sustainability.

Analyzing charts depicting Palantir's revenue growth, EBITDA, and cash flow over time is crucial for understanding its financial trajectory and predicting future performance. The sustainability of its current growth rate and its path to profitability are key factors to consider before investing in Palantir stock. Keywords: Palantir financials, Palantir revenue growth, Palantir profitability, Palantir stock performance.

Competitive Landscape and Market Share

Palantir operates in a fiercely competitive data analytics market, facing giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. While Palantir boasts proprietary technology and deep expertise, particularly in the government sector, understanding its competitive advantages and disadvantages is crucial.

Competitive Advantages:

- Proprietary Technology: Palantir's Gotham and Foundry platforms offer unique capabilities, particularly in data integration and analysis for complex problems.

- Strong Government Relationships: Palantir has cultivated strong relationships with government agencies, providing a significant revenue stream and a barrier to entry for competitors.

- Specialized Expertise: Palantir possesses deep expertise in data analytics and cybersecurity, making it a valuable partner for government and commercial clients.

Competitive Challenges:

- Pricing Pressure: Competition from established players like AWS and Microsoft can lead to pricing pressure, potentially impacting profitability.

- Market Share: While Palantir holds a strong position in certain niche markets, expanding market share against established competitors will be a continuous challenge.

- Technological Advancements: The rapid pace of technological advancements necessitates continuous investment in research and development to maintain a competitive edge.

Comparing Palantir’s strengths and weaknesses against its main competitors is key. Keywords: Palantir competitors, data analytics market, market share, competitive advantage, Palantir market position.

Future Growth Potential and Key Catalysts

Palantir's future growth hinges on several key factors. Expansion into new markets, successful product development, and strategic partnerships are crucial for driving future revenue and profitability.

Potential Growth Opportunities:

- Expanding Commercial Sales: Further penetration into the commercial market is vital for diversification and long-term growth.

- Developing New AI Capabilities: Investing in and integrating advanced AI and machine learning capabilities into its platforms will be crucial for maintaining a competitive edge.

- Strategic Partnerships: Collaborating with other technology companies and industry leaders can unlock new markets and accelerate growth.

Risks and Uncertainties:

- Economic Downturns: Economic instability could impact government spending and commercial demand for data analytics solutions.

- Geopolitical Instability: Geopolitical events can significantly affect government contracts and overall market stability.

- Increased Competition: The competitive landscape is dynamic, and the emergence of new competitors could pose a threat to Palantir's market position.

Keywords: Palantir future growth, Palantir AI, Palantir technology, growth catalysts, market expansion.

Valuation and Investment Risks

Evaluating Palantir's current stock valuation relative to its peers and considering the inherent risks is crucial before investing. The stock's volatility and uncertainty about future performance are key concerns.

Key Risks and Uncertainties:

- High Valuation: Palantir's current valuation might be considered high by some investors, given its relatively low profitability.

- Dependence on Government Contracts: A significant portion of Palantir's revenue comes from government contracts, making it susceptible to changes in government spending.

- Competition: Intense competition from established players in the data analytics market could impact revenue growth and profitability.

Analyzing Palantir's risk-reward profile is crucial. Keywords: Palantir stock valuation, Palantir stock price, investment risks, Palantir stock analysis.

Conclusion: Should You Invest in Palantir Stock Before 2025? A Final Verdict

Palantir presents a compelling investment opportunity, driven by its innovative technology and strong presence in the government sector. However, the company faces challenges related to profitability, competition, and valuation. The path to sustained profitability and market share expansion remains uncertain.

Therefore, a cautious approach is warranted. While Palantir's long-term prospects are promising, the high valuation and inherent risks associated with the stock necessitate thorough due diligence. Whether to buy, hold, sell, or wait-and-see depends entirely on your individual risk tolerance and investment strategy.

Conduct your own thorough due diligence before making any decisions about buying Palantir stock. Remember, this article is for informational purposes only and does not constitute financial advice. Keywords: Palantir stock investment, Palantir stock outlook, buy Palantir stock, Palantir stock prediction, investing in Palantir.

Featured Posts

-

The 10 Best Film Noir Movies For A Perfect Watch

May 10, 2025

The 10 Best Film Noir Movies For A Perfect Watch

May 10, 2025 -

Bundesliga 2 Matchday 27 Results And Colognes Rise To The Top

May 10, 2025

Bundesliga 2 Matchday 27 Results And Colognes Rise To The Top

May 10, 2025 -

Dakota Johnson El Exito Del Bolso Hereu Entre Las Celebrities

May 10, 2025

Dakota Johnson El Exito Del Bolso Hereu Entre Las Celebrities

May 10, 2025 -

Uk Tightens Visa Rules For Nigerians Amidst Overstay Concerns

May 10, 2025

Uk Tightens Visa Rules For Nigerians Amidst Overstay Concerns

May 10, 2025 -

Pakistans Stock Market Volatility Causes Psx Portal Outage

May 10, 2025

Pakistans Stock Market Volatility Causes Psx Portal Outage

May 10, 2025