Shopping Mall Giant's Ambitions: B.C. Billionaire Seeks Hudson's Bay Space

Table of Contents

The Billionaire's Business Strategy and Real Estate Portfolio

This B.C. billionaire, known for their shrewd investments and keen eye for lucrative real estate opportunities, has amassed a significant portfolio over the years. Their expertise lies in retail property development and management, focusing on high-traffic, prime locations. Their existing portfolio showcases a preference for large-scale properties, often situated in bustling urban centers. This experience is highly relevant to the potential HBC acquisition, given the extensive network of iconic Hudson's Bay stores across Canada.

- Examples of previous successful acquisitions: The billionaire's track record includes the successful acquisition and revitalization of several major shopping malls across Western Canada, boosting their value significantly.

- Specific types of retail properties in their portfolio: Their portfolio comprises a diverse mix of properties, including flagship department stores, enclosed shopping malls, and stand-alone retail outlets.

- Their investment strategy focusing on prime retail locations: The core of their strategy revolves around acquiring and redeveloping premium retail locations with strong potential for growth and high rental yields.

Hudson's Bay Company (HBC) and its Current Market Position

Hudson's Bay Company, a cornerstone of Canadian retail history, is currently navigating the complexities of a rapidly changing market. While HBC remains a recognizable brand with a rich history, it faces numerous challenges in today's competitive landscape. Speculation suggests that the company might be considering selling off its extensive real estate holdings to focus on its core retail operations.

- Key financial indicators relevant to the sale: HBC's recent financial reports show a focus on streamlining operations and improving profitability. The sale of its real estate could provide a significant injection of capital.

- HBC's recent strategic moves: The company has undertaken various strategic initiatives in recent years, including the sale of certain assets and a focus on enhancing the customer experience.

- Market analysis of the Canadian retail sector: The Canadian retail landscape is experiencing significant transformations, with the rise of e-commerce and changing consumer preferences impacting traditional brick-and-mortar stores.

Potential Impacts of the Acquisition on the Retail Landscape

The potential acquisition of HBC's real estate has far-reaching implications for the Canadian retail landscape. The billionaire's vision for these properties could lead to significant changes in how Canadians shop and experience retail spaces.

- Possible changes to shopping mall experiences: The acquisition could lead to the modernization and revitalization of existing HBC properties, incorporating new retail concepts, entertainment options, and improved customer amenities. This could transform outdated malls into vibrant community hubs.

- Job creation or loss implications: While some job losses might occur during transitions, the redevelopment and revitalization of properties could also lead to new job creation in construction, retail, and management sectors.

- Impact on local businesses: The redevelopment could benefit local businesses by attracting more foot traffic and enhancing the overall vibrancy of surrounding areas. However, it could also increase competition for some existing businesses.

Challenges and Obstacles to the Acquisition

Despite the potential benefits, several obstacles could hinder the acquisition. Navigating regulatory approvals and securing adequate financing are significant challenges.

- Regulatory bodies involved in the approval process: The acquisition would likely require approvals from various regulatory bodies, including competition bureaus and municipal planning authorities.

- Potential financing options for the acquisition: The scale of the acquisition requires significant financing, potentially involving a combination of debt and equity financing.

- Factors that could influence the acquisition’s success: Competing bidders, market conditions, and the overall financial health of HBC could all impact the success of the acquisition.

Conclusion

The B.C. billionaire's ambitions to acquire a significant portion of Hudson's Bay Company's real estate portfolio represent a potentially transformative moment for the Canadian retail sector. While the acquisition faces challenges, the potential benefits—revitalized shopping malls, job creation, and enhanced consumer experiences—are substantial. The outcome will depend on a complex interplay of factors, including regulatory approvals, financing, and competition. Stay tuned for further updates on this significant shopping mall giant's ambitions as the B.C. billionaire's pursuit of Hudson's Bay space unfolds. Learn more about the potential impacts of this retail real estate acquisition and the future of Canadian shopping malls.

Featured Posts

-

Southern Tourist Destination Rebuts Claims Of Poor Safety Following Recent Shooting

May 25, 2025

Southern Tourist Destination Rebuts Claims Of Poor Safety Following Recent Shooting

May 25, 2025 -

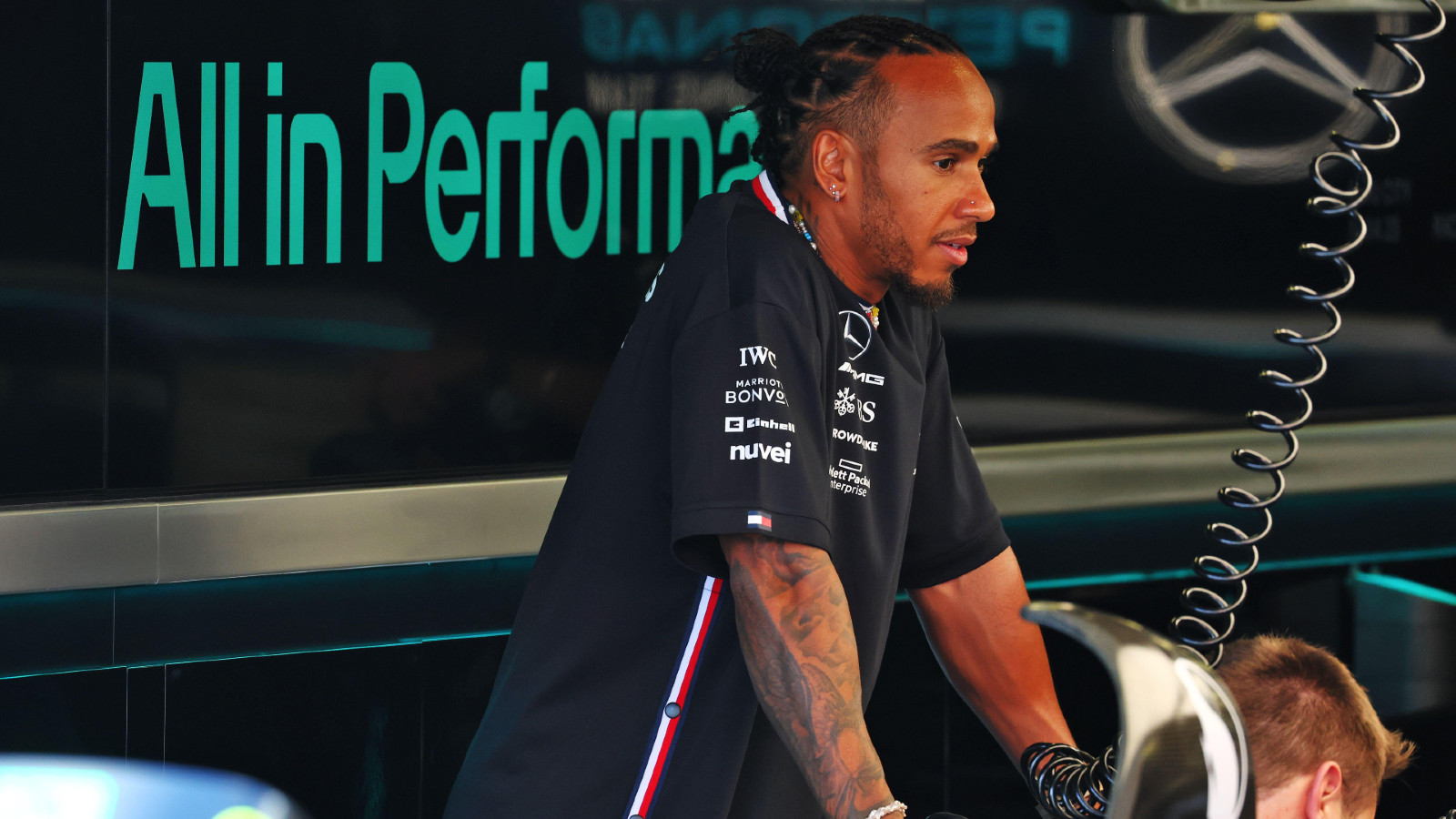

George Russell 1 5m Debt Repaid Fueling Mercedes Contract Speculation

May 25, 2025

George Russell 1 5m Debt Repaid Fueling Mercedes Contract Speculation

May 25, 2025 -

The Shifting Landscape Of Delivery Services Canada Post And The Competition

May 25, 2025

The Shifting Landscape Of Delivery Services Canada Post And The Competition

May 25, 2025 -

The Woody Allen Dylan Farrow Case Sean Penn Offers A Different Perspective

May 25, 2025

The Woody Allen Dylan Farrow Case Sean Penn Offers A Different Perspective

May 25, 2025 -

Police Arrest Made In Fatal Myrtle Beach Hit And Run

May 25, 2025

Police Arrest Made In Fatal Myrtle Beach Hit And Run

May 25, 2025

Latest Posts

-

Ealas Grand Slam Opportunity Paris 2024

May 25, 2025

Ealas Grand Slam Opportunity Paris 2024

May 25, 2025 -

Paris Beckons Ealas Grand Slam Journey Begins

May 25, 2025

Paris Beckons Ealas Grand Slam Journey Begins

May 25, 2025 -

Grand Slam Debut Filipina Tennis Star Eala Set For Paris

May 25, 2025

Grand Slam Debut Filipina Tennis Star Eala Set For Paris

May 25, 2025 -

Ealas Paris Grand Slam Debut A Look Ahead

May 25, 2025

Ealas Paris Grand Slam Debut A Look Ahead

May 25, 2025 -

Eala Ready For Grand Slam Debut In Paris

May 25, 2025

Eala Ready For Grand Slam Debut In Paris

May 25, 2025