Shein's Stalled London IPO: US Tariffs Cast A Shadow

Table of Contents

The Looming Threat of US Tariffs

US authorities are investigating potential anti-dumping and countervailing duties on Shein's imports. These Shein Tariffs, if implemented, could significantly increase the cost of Shein's products in the US market, its largest and most lucrative market. This uncertainty surrounding the outcome of these investigations creates a significant risk for potential investors considering participation in the Shein Stock Market. The potential tariff amounts are substantial and could severely impact Shein's profit margins, potentially crippling its already razor-thin margins inherent in the fast fashion business model.

- Significant Financial Impact: While precise figures are yet to be released, industry analysts predict tariffs could range from 25% to 50% on various Shein clothing items. This would represent a substantial increase in the cost of goods sold, directly affecting Shein's profitability and competitiveness.

- Anti-Dumping and Countervailing Duties: The investigations focus on whether Shein is engaging in unfair trade practices, such as dumping (selling goods below market value) and receiving unfair government subsidies. These Shein Trade Disputes could result in significant US Import Tariffs specifically targeting Shein products.

- Uncertainty for Investors: This ongoing investigation creates considerable uncertainty for potential investors. The risk of substantial Clothing Tariffs impacting Shein's profitability makes it difficult to accurately assess the company's long-term value, causing a chill effect on the Shein London IPO.

Impact on Shein's Valuation and Investor Confidence

The tariff uncertainty has undeniably negatively impacted investor sentiment towards Shein. Potential investors are hesitant to commit capital until the tariff issue is resolved. This uncertainty has likely contributed significantly to the delay in the London IPO. The Shein Valuation is directly tied to its ability to operate profitably in its key market, and the threat of substantial tariffs undermines this core assumption.

- Negative Investor Sentiment: The Shein IPO delay demonstrates a clear lack of confidence from investors who are unwilling to risk investment in a company facing such significant regulatory hurdles. This has implications extending beyond the immediate Shein Stock Price and into long-term growth projections.

- Impact on Brand Image: The delay could also negatively affect Shein's brand image and reputation. Constant media coverage of the tariff issues could damage consumer trust and impact sales.

- Comparison to Competitors: Other fast-fashion brands have faced similar regulatory challenges, but Shein's scale and reliance on the US market make its situation particularly precarious. Analyzing how these competitors handled similar issues could offer insights into possible strategies for Shein.

Shein's Response and Future Strategies

Shein has released public statements expressing its commitment to cooperating fully with the US investigation and working to resolve the issues. However, specifics regarding their strategy are scarce. To mitigate the impact of potential tariffs, Shein might explore several avenues.

- Supply Chain Diversification: Shifting production away from China, potentially to Southeast Asia or other regions, could help reduce reliance on a single manufacturing base and potentially lower costs. However, this will require significant time and investment.

- Price Adjustments: Shein might absorb some of the increased cost of goods, impacting profit margins, or pass them onto consumers, risking a loss of market share.

- Legal Challenges: Shein's Shein Legal Team might challenge the tariffs in court, aiming to overturn or reduce them. This is a costly and time-consuming strategy with uncertain success.

- Sustainability Focus: Investing in more sustainable and ethical sourcing practices could improve Shein’s Shein Sustainability profile, potentially enhancing investor relations in the long term, however, this is a long-term strategy unlikely to impact the immediate Shein IPO concerns. Shein's ability to navigate these legal and regulatory hurdles will significantly determine its future trajectory.

Wider Implications for the Fast Fashion Industry

The Shein situation highlights the growing regulatory scrutiny facing the fast-fashion industry as a whole. The increasing pressure on fast-fashion companies to improve their ethical and environmental practices is forcing a re-evaluation of business models.

- Increased Regulatory Scrutiny: Shein's experience serves as a warning to other fast-fashion companies, highlighting the need for robust regulatory compliance and ethical sourcing. This heightened scrutiny represents a broader shift in Fast Fashion Regulations.

- Impact on Future IPOs: The Shein case could influence the valuations and attractiveness of future fast-fashion IPOs, potentially leading to more stringent due diligence processes by investors.

- Global Trade and Industry Trends: This situation underscores the interconnectedness of global trade and the significant impact of international relations on individual companies. The case highlights changing Industry Trends and the growing importance of ethical and sustainable practices.

Conclusion

Shein's stalled London IPO underscores the significant challenges faced by fast-fashion giants operating in a complex global regulatory environment. The threat of substantial US tariffs casts a long shadow over the company's future growth prospects, impacting investor confidence and delaying its entry into the public markets. The outcome of the US tariff investigations will be crucial in determining Shein's future trajectory and setting a precedent for other companies in the fast fashion industry.

Call to Action: Stay informed about the latest developments concerning the Shein IPO and the ongoing US tariff investigation. Understanding the complexities of the Shein situation will provide valuable insights into the future of the fast fashion industry and the challenges of navigating global trade and regulatory compliance. Keep up-to-date on the Shein London IPO situation to see how this fast-fashion giant will ultimately overcome these hurdles.

Featured Posts

-

Nhl Playoffs Crucial Showdown Saturday Games And Standings Update

May 04, 2025

Nhl Playoffs Crucial Showdown Saturday Games And Standings Update

May 04, 2025 -

Ufc 314 Volkanovski Lopes Headliner And Full Fight Card Preview

May 04, 2025

Ufc 314 Volkanovski Lopes Headliner And Full Fight Card Preview

May 04, 2025 -

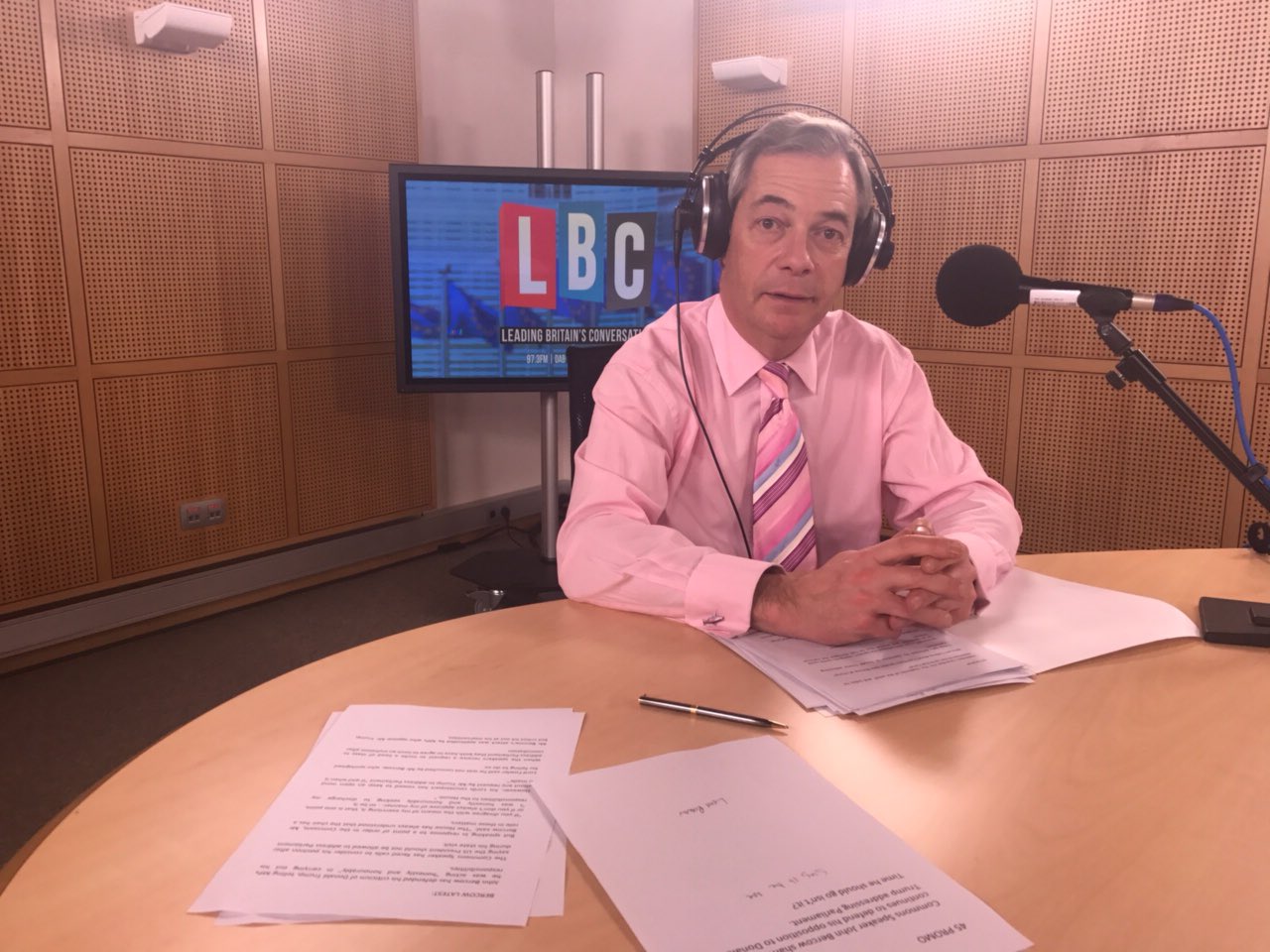

My Experience At A Nigel Farage Press Conference

May 04, 2025

My Experience At A Nigel Farage Press Conference

May 04, 2025 -

Justice Department To Sue Google Over Dominance In Online Advertising

May 04, 2025

Justice Department To Sue Google Over Dominance In Online Advertising

May 04, 2025 -

What Irritated Canelo Alvarez About David Benavidez A Boxers Perspective

May 04, 2025

What Irritated Canelo Alvarez About David Benavidez A Boxers Perspective

May 04, 2025