Sharp Decline On Amsterdam Stock Exchange: 11% Drop Since Wednesday

Table of Contents

Causes of the Amsterdam Stock Exchange Decline

Several interconnected factors contributed to the sharp Amsterdam Stock Exchange decline. Analyzing these contributing elements provides a clearer picture of the current market instability.

Global Market Volatility

The current downturn on the Amsterdam Stock Exchange is intrinsically linked to broader global market volatility. Rising interest rates implemented by central banks worldwide to combat persistent inflation are creating a challenging environment for equities. Geopolitical instability, particularly the ongoing conflict in Ukraine and its ripple effects on energy prices and supply chains, further exacerbates the situation.

- Examples of global events impacting the market: The recent increase in US interest rates by the Federal Reserve, ongoing tensions in Eastern Europe, and persistent supply chain disruptions all contribute to a climate of uncertainty.

- Impact on global indices: The Dow Jones Industrial Average and the FTSE 100 have also experienced significant declines, reflecting the global nature of this market correction. This interconnectedness underscores the ripple effect of global economic events on regional markets like the Amsterdam Stock Exchange.

Specific Sectoral Weakness

While the entire Amsterdam Stock Exchange has suffered, certain sectors have been hit harder than others. This sectoral weakness reflects specific vulnerabilities within these industries.

- Top 3 most affected sectors:

- Technology: Down 15%, reflecting concerns about slowing growth and increased competition.

- Energy: Down 12%, influenced by fluctuating oil prices and geopolitical uncertainties.

- Financials: Down 10%, impacted by rising interest rates and fears of a potential recession.

- Reasons behind sectoral weakness: Company-specific news, such as disappointing earnings reports or regulatory changes, further contributed to the decline in specific sectors. Industry-wide trends, like the shift away from fossil fuels in the energy sector, also played a role.

Investor Sentiment and Market Psychology

Negative news cycles and a general sense of uncertainty have significantly impacted investor sentiment, driving the Amsterdam Stock Exchange decline. Fear and a lack of confidence are prompting investors to sell off assets, accelerating the downward trend.

- Significant sell-offs: A noticeable increase in sell-off activity has been observed, particularly among foreign investors.

- Impact of social media and news coverage: Negative news coverage and social media discussions about the market's downturn further fuel investor anxieties, creating a self-fulfilling prophecy. This underscores the crucial role of market psychology in driving market movements.

Impact of the Decline on the Dutch Economy

The Amsterdam Stock Exchange decline has significant implications for the broader Dutch economy, potentially impacting various aspects of the nation's financial health.

Economic Implications

The sharp drop in the Amsterdam Stock Exchange could negatively affect several key economic indicators.

- Potential effects on GDP growth: A decline in stock market values can reduce overall wealth and consumer spending, potentially slowing down GDP growth.

- Impact on employment: Companies facing financial difficulties due to the stock market downturn may be forced to implement cost-cutting measures, including potential layoffs.

- Government responses: The Dutch government may need to consider implementing fiscal stimulus measures to mitigate the economic consequences of this market decline.

Impact on Dutch Companies

Listed Dutch companies are directly impacted by the decreased value of their shares.

- Examples of affected companies: Several large Dutch corporations, particularly those in the energy and technology sectors, have seen their share prices significantly reduced.

- Company reactions: Companies are responding with cost-cutting measures, restructuring plans, and potentially delaying investments to navigate the challenging market conditions.

Potential Recovery Scenarios and Future Outlook

Predicting the future of the Amsterdam Stock Exchange is challenging, but analyzing potential recovery scenarios and long-term prospects is crucial.

Short-Term Predictions

The short-term outlook remains uncertain, with the potential for further declines.

- Catalysts for a rebound: Positive economic news, such as improved inflation data or easing geopolitical tensions, could trigger a rebound. Government intervention, such as monetary policy adjustments, could also play a role.

- Possibility of further declines: However, until underlying global economic uncertainties resolve, further declines remain a distinct possibility.

Long-Term Prospects

The long-term prospects depend on several factors, including global economic stability and the resilience of the Dutch economy.

- Strengths of the Dutch economy: The Netherlands boasts a strong export sector and a skilled workforce. These strengths could contribute to a recovery in the long term.

- Factors driving future growth: Continued innovation, investments in sustainable technologies, and a focus on attracting foreign investments are crucial for long-term growth.

Conclusion

The sharp 11% decline on the Amsterdam Stock Exchange since Wednesday represents a significant event with potentially far-reaching consequences. Global market volatility, specific sectoral weakness, and deteriorating investor sentiment are the primary contributing factors. The impact on the Dutch economy, including potential effects on GDP growth, employment, and corporate performance, necessitates close monitoring. While short-term predictions remain uncertain, the long-term prospects for the Amsterdam Stock Exchange depend heavily on global economic stability and the continued strength of the Dutch economy. To stay informed about the Amsterdam Stock Exchange performance and trends, regularly check reputable financial news sources and consult with financial advisors before making investment decisions. Understanding the Amsterdam Stock Exchange decline is essential for navigating the current market climate and making informed decisions about your investments.

Featured Posts

-

Is This Us Band Playing Glastonbury Unofficial Announcement Creates Frenzy

May 24, 2025

Is This Us Band Playing Glastonbury Unofficial Announcement Creates Frenzy

May 24, 2025 -

Kynning A Fyrstu 100 Rafmagnsutgafu Porsche Macan

May 24, 2025

Kynning A Fyrstu 100 Rafmagnsutgafu Porsche Macan

May 24, 2025 -

En France La Chine Utilise Tous Les Moyens Pour Reduire Au Silence Les Dissidents

May 24, 2025

En France La Chine Utilise Tous Les Moyens Pour Reduire Au Silence Les Dissidents

May 24, 2025 -

Best Of Bangladesh In Europe 2nd Edition Collaboration And Growth

May 24, 2025

Best Of Bangladesh In Europe 2nd Edition Collaboration And Growth

May 24, 2025 -

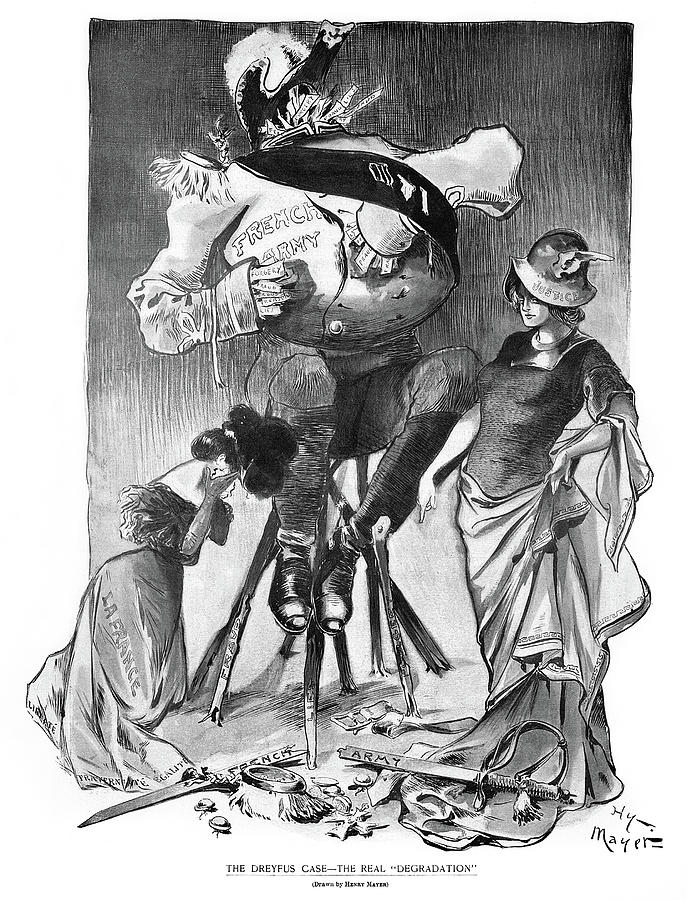

France Revisits The Dreyfus Affair Lawmakers Seek Promotion

May 24, 2025

France Revisits The Dreyfus Affair Lawmakers Seek Promotion

May 24, 2025

Latest Posts

-

Public Figure Questions The Accusations Sean Penn And The Dylan Farrow Case

May 24, 2025

Public Figure Questions The Accusations Sean Penn And The Dylan Farrow Case

May 24, 2025 -

Mia Farrow On Trumps Venezuelan Deportation Lock Him Up

May 24, 2025

Mia Farrow On Trumps Venezuelan Deportation Lock Him Up

May 24, 2025 -

Woody Allen And Dylan Farrow Sean Penns Perspective On The Allegations

May 24, 2025

Woody Allen And Dylan Farrow Sean Penns Perspective On The Allegations

May 24, 2025 -

Actress Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Actress Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Sean Penns View On The Dylan Farrow Woody Allen Sexual Assault Case

May 24, 2025

Sean Penns View On The Dylan Farrow Woody Allen Sexual Assault Case

May 24, 2025