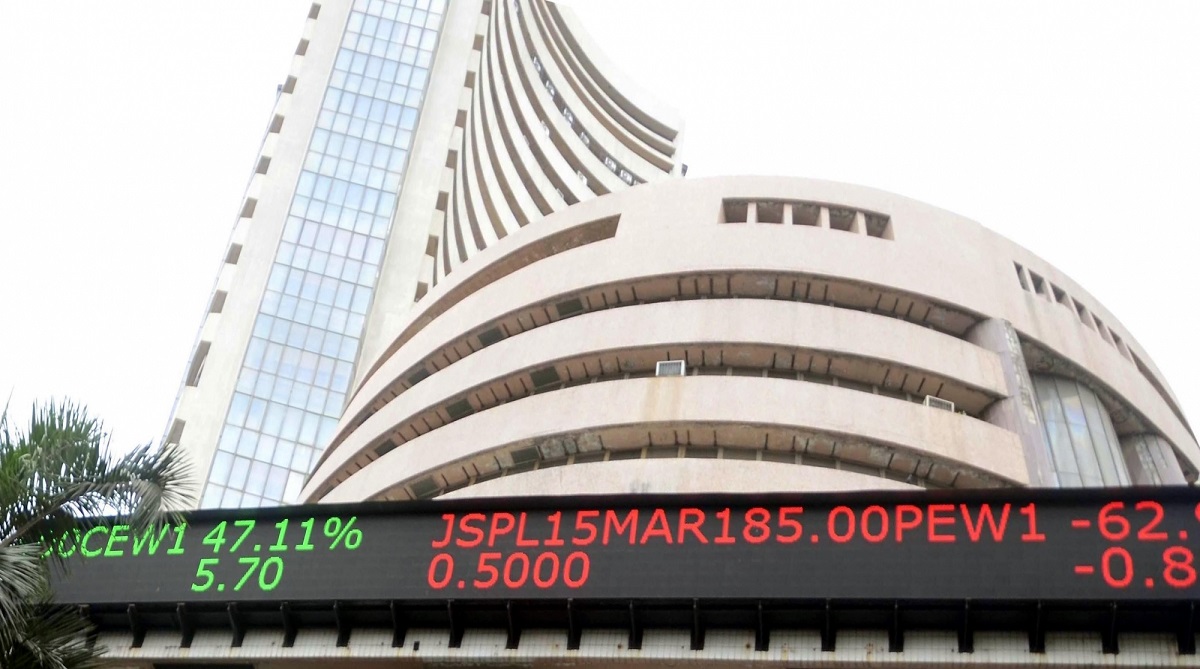

Sensex Gains Momentum: BSE Stocks With Double-Digit Growth

Table of Contents

Top Performing BSE Stocks with Double-Digit Growth

Several BSE stocks have showcased exceptional performance, achieving double-digit growth in recent times. Identifying these top performers is crucial for investors seeking significant returns. This section highlights some of the leading players, providing a brief overview and analysis of their growth drivers. Remember that past performance is not indicative of future results, and thorough due diligence is always recommended.

Note: The following data is hypothetical for illustrative purposes only and does not represent actual stock performance. Always consult up-to-date financial information before making any investment decisions.

- Company A:

- Sector: Technology

- Percentage Growth: 25%

- Key Growth Drivers: Successful product launch, expansion into new markets, strategic partnerships.

- Company B:

- Sector: Pharmaceuticals

- Percentage Growth: 18%

- Key Growth Drivers: Strong R&D pipeline, increased market share, successful clinical trials.

- Company C:

- Sector: Consumer Goods

- Percentage Growth: 15%

- Key Growth Drivers: Brand revitalization, efficient marketing campaigns, expansion into e-commerce.

- Company D:

- Sector: Infrastructure

- Percentage Growth: 12%

- Key Growth Drivers: Government contracts, successful project execution, strong order book.

- Company E:

- Sector: Finance

- Percentage Growth: 10%

- Key Growth Drivers: Increased lending activity, robust asset management performance, strategic acquisitions.

These top BSE stocks represent a diverse range of sectors, highlighting the breadth of opportunities within the Indian stock market. Analyzing each company's business model, financial performance, and growth trajectory is vital for informed investment decisions.

Analyzing the Factors Driving Double-Digit Growth

The recent surge in the Sensex and the double-digit growth witnessed by several BSE stocks are driven by a confluence of factors. Understanding these underlying forces is essential for navigating the market effectively.

- Economic Growth and its Impact: Positive economic indicators, such as rising GDP and increased consumer spending, significantly influence stock market performance.

- Industry-Specific Trends: Certain sectors, like technology and pharmaceuticals, are experiencing robust growth, creating lucrative investment opportunities within those sectors.

- Company-Specific Strategies: Effective management, innovative product development, and efficient operational strategies contribute significantly to individual company growth.

- Impact of Global Events: Global economic trends and geopolitical events also play a role, impacting investor sentiment and market dynamics. The influence of foreign investment on BSE stocks should also be considered.

The interplay of macroeconomic factors and company-specific performance creates a dynamic environment where some BSE stocks outperform others. Analyzing these factors carefully is critical for identifying potential winners.

Risk Assessment and Investment Strategies for BSE Stocks

Investing in the stock market, particularly high-growth stocks, involves inherent risks. Understanding and mitigating these risks is crucial for successful investing.

- Understanding Market Volatility: The stock market is inherently volatile; prices can fluctuate significantly in short periods.

- Importance of Diversification: Diversifying your investment portfolio across different sectors and asset classes reduces overall risk.

- Analyzing Financial Statements: Thorough due diligence, including analyzing a company's financial statements, is essential before investing.

- Setting Realistic Investment Goals: Defining clear investment objectives and a suitable timeframe is crucial for long-term success.

A well-defined investment strategy that incorporates risk management techniques is essential for navigating the complexities of the stock market.

Long-Term Growth Potential of High-Yield BSE Stocks

While short-term gains are attractive, evaluating the long-term growth potential of high-yield BSE stocks is crucial for sustainable investment returns. Industry trends, technological advancements, and regulatory changes will influence the future prospects of these companies.

The companies highlighted above, given their current trajectories, may offer compelling long-term investment prospects. However, potential challenges such as increased competition, economic downturns, and changing consumer preferences must be considered. A thorough analysis of each company’s long-term strategy is critical before making any long-term investment decisions.

Conclusion: Capitalizing on Sensex Momentum: Your Guide to High-Growth BSE Stocks

The Sensex's upward momentum presents a compelling opportunity to identify and invest in high-growth BSE stocks. This article has highlighted several top performers and analyzed the key factors driving their success. Remember, successful investing involves a combination of identifying promising stocks, conducting thorough due diligence, and employing effective risk management strategies. While this article offers valuable insights, further research into the specific companies and thorough market analysis are crucial before making any investment decisions. Start your journey toward capitalizing on Sensex gains by conducting in-depth research on these high-growth BSE stocks and developing a well-informed investment strategy. Don't miss out on the potential for double-digit growth!

Featured Posts

-

Dozhive Te Go Detskiot Festival Potochinja

May 15, 2025

Dozhive Te Go Detskiot Festival Potochinja

May 15, 2025 -

Ontarios Gas Tax Cut Permanent Relief And Highway 407 East Toll Removal

May 15, 2025

Ontarios Gas Tax Cut Permanent Relief And Highway 407 East Toll Removal

May 15, 2025 -

Who To Watch Carneys Cabinet And Its Impact On Business

May 15, 2025

Who To Watch Carneys Cabinet And Its Impact On Business

May 15, 2025 -

The Warriors Need Jimmy Butler Not Another Kevin Durant

May 15, 2025

The Warriors Need Jimmy Butler Not Another Kevin Durant

May 15, 2025 -

Devendra Fadnavis

May 15, 2025

Devendra Fadnavis

May 15, 2025

Latest Posts

-

Paddy Pimblett Responds To Critics After Ufc 314 Victory Over Michael Chandler

May 15, 2025

Paddy Pimblett Responds To Critics After Ufc 314 Victory Over Michael Chandler

May 15, 2025 -

The Awkward Truth Of Pimblett Vs Chandler A Ufc Veterans Take

May 15, 2025

The Awkward Truth Of Pimblett Vs Chandler A Ufc Veterans Take

May 15, 2025 -

Analyzing Chandlers Ufc Loss Gordon Ramsays Expert Opinion

May 15, 2025

Analyzing Chandlers Ufc Loss Gordon Ramsays Expert Opinion

May 15, 2025 -

Paddy Pimblett Ufc 314 Travel Plans Shaped By Liverpool Fc Commitment

May 15, 2025

Paddy Pimblett Ufc 314 Travel Plans Shaped By Liverpool Fc Commitment

May 15, 2025 -

Gordon Ramsay Reacts Michael Chandlers Training And Ufc Performance

May 15, 2025

Gordon Ramsay Reacts Michael Chandlers Training And Ufc Performance

May 15, 2025