Sensex And Nifty 50 End Flat: Bajaj Twins Losses And Geopolitical Tensions Weigh

Table of Contents

Bajaj Twins' Impact on Market Sentiment

The substantial decline in Bajaj Finance and Bajaj Finserv shares exerted a significant downward pressure on the overall market sentiment. Their considerable weight in the indices makes their performance a key indicator of the daily movement of the Sensex and Nifty 50.

- Sharp Price Drops: Bajaj Finance and Bajaj Finserv witnessed sharp price drops, contributing to a negative drag on both indices. This volatility highlighted the inherent risks associated with investing in even large-cap, seemingly stable stocks. Investors saw significant losses in their portfolio value, impacting confidence.

- Reasons for the Decline: While specific reasons require further investigation, potential factors contributing to the decline could include profit booking by investors after a period of growth, concerns about the broader NBFC sector's performance in light of rising interest rates, or potential shifts in investor sentiment towards the company's future prospects. Analyst downgrades or any negative news reports surrounding the Bajaj twins could also have played a significant role.

- Ripple Effect: The losses in these heavyweight stocks triggered a ripple effect, impacting investor confidence across various sectors. This interconnectedness underscores the systemic nature of the Indian stock market, where the performance of key players significantly influences the broader market trajectory. This cautionary tale emphasizes the importance of diversification in an investment portfolio.

Geopolitical Tensions and Global Uncertainty

Rising geopolitical tensions, particularly the ongoing conflict in Ukraine and its ripple effects on global energy markets and supply chains, created a climate of uncertainty in global markets. This uncertainty inevitably spills over into the Indian markets, impacting investor confidence and leading to risk-averse behavior.

- Global Market Volatility: Global uncertainties directly impact Indian markets due to their increasing integration with the global economy. Foreign Institutional Investor (FII) flows, a significant factor in the Indian stock market's performance, are particularly sensitive to global instability. A risk-off sentiment globally typically translates into capital outflows from emerging markets like India.

- Crude Oil Prices: Fluctuating crude oil prices, heavily influenced by geopolitical events, exert considerable pressure on the Indian economy and, consequently, the stock market. High crude oil prices increase inflationary pressures, impacting businesses and consumers alike, leading to a slowdown in economic growth and dampening investor sentiment.

- Inflationary Concerns: Geopolitical instability often exacerbates inflationary concerns, as supply chain disruptions and increased energy costs fuel price increases. High inflation erodes purchasing power and prompts central banks, including the RBI, to increase interest rates, potentially slowing economic growth further and impacting stock market valuations.

Sectoral Performance and Key Movers

Beyond the Bajaj twins and geopolitical factors, analyzing the performance of individual sectors provides a more granular understanding of the market's nuanced behavior.

- Winning Sectors: While the overall market ended flat, certain sectors, such as [insert example of a well-performing sector, e.g., IT or Pharma], demonstrated resilience and posted gains. This highlights the diverse nature of the market and the importance of identifying sectors less sensitive to macroeconomic headwinds.

- Losing Sectors: Conversely, sectors like [insert example of an underperforming sector, e.g., real estate or auto] experienced losses, reflecting specific challenges within those industries. Analyzing these underperformers offers valuable insights into sector-specific risks and potential future trends.

- Impact of RBI Policy: The recent policy decisions by the Reserve Bank of India (RBI) concerning interest rates and monetary policy significantly influence market stability and investor behavior. Any changes in interest rates or liquidity measures can have immediate and long-term effects on the Sensex and Nifty 50.

Conclusion

The Sensex and Nifty 50's flat performance reflects a complex interplay of factors. The significant losses in Bajaj Finance and Bajaj Finserv, coupled with persistent geopolitical uncertainties and global economic anxieties, contributed substantially to the subdued market activity. Understanding these interwoven elements is critical for investors seeking to make well-informed decisions in the dynamic Indian stock market. By staying informed about major market movers, geopolitical events, RBI policies, and global economic trends, investors can better navigate the complexities of the Sensex and Nifty 50. Regularly monitor the Sensex and Nifty 50 performance and consider diversifying your investment portfolio to mitigate risks associated with individual stock volatility and global uncertainty. Remember to consult with a financial advisor before making any significant investment decisions.

Featured Posts

-

Elizabeth Arden Skincare Walmart Vs Other Retailers

May 10, 2025

Elizabeth Arden Skincare Walmart Vs Other Retailers

May 10, 2025 -

Elon Musks Influence Tesla Stock Drop And The Impact On Dogecoin

May 10, 2025

Elon Musks Influence Tesla Stock Drop And The Impact On Dogecoin

May 10, 2025 -

Frantsiya Polsha Podpisanie Vazhnogo Dogovora Zayavlenie Unian

May 10, 2025

Frantsiya Polsha Podpisanie Vazhnogo Dogovora Zayavlenie Unian

May 10, 2025 -

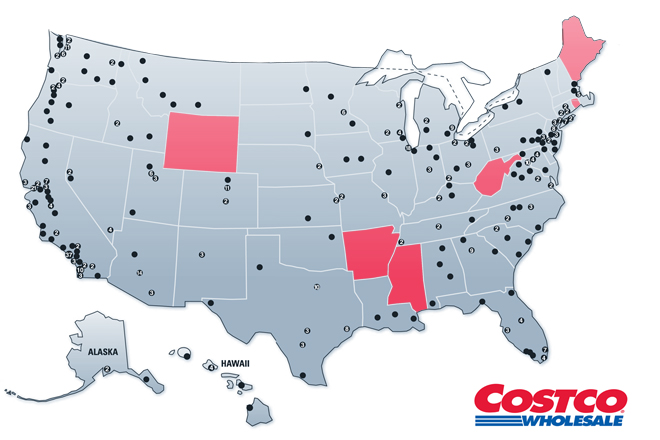

Identifying Promising Business Locations A Nationwide Map

May 10, 2025

Identifying Promising Business Locations A Nationwide Map

May 10, 2025 -

Gambling On Natural Disasters The Rise Of Wildfire Betting

May 10, 2025

Gambling On Natural Disasters The Rise Of Wildfire Betting

May 10, 2025