Sell America Returns As 30-Year Treasury Yields Hit 5%

Table of Contents

The Impact of Rising 30-Year Treasury Yields

The 5% yield on 30-year Treasury bonds has significant implications for the broader economy and investor behavior.

Increased Borrowing Costs: This rise translates to substantially higher borrowing costs for businesses and the government.

- Higher interest payments: Companies face increased expenses servicing existing and new debt, potentially hindering expansion plans and impacting profitability.

- Reduced investment: Businesses may postpone or cancel investment projects due to the higher cost of capital.

- Potential economic slowdown: Elevated borrowing costs can dampen economic activity, leading to slower growth or even recessionary pressures. This slowdown directly impacts corporate profitability and stock market valuations. The keyword "interest rates" is key to understanding this section.

Attractiveness of US Treasuries: Despite the increase, US Treasuries remain attractive to many investors. Their safe-haven status continues to be a major draw, though the appeal is complicated by inflation concerns.

- Risk-averse investors: In times of uncertainty, many investors flock to the perceived safety and stability of US government debt. The keyword "safe-haven assets" is important here.

- Inflation hedge (debatable): While traditionally considered a safe haven, the effectiveness of Treasuries as an inflation hedge depends heavily on the prevailing inflation rate and market expectations. It’s a complex relationship best investigated with more research into "inflation" and "fixed income" securities.

- Diversification benefits: US Treasuries offer diversification benefits within a well-balanced portfolio, helping to mitigate risks associated with other asset classes. "Diversification" is another key term for investors.

Geopolitical Factors Fueling "Sell America"

Geopolitical tensions significantly influence investor sentiment, fueling the "Sell America" trend.

Global Economic Uncertainty: The current geopolitical climate is fraught with uncertainty, impacting investor confidence in US assets.

- Examples of geopolitical events: The ongoing war in Ukraine, tensions with China, and global supply chain disruptions all contribute to a sense of unease.

- Investor flight to safety (potentially outside the US): Investors may seek safer havens outside the US, potentially impacting the US dollar's value. Keywords like "geopolitical risk" and "global economy" are crucial here.

- Implications for the dollar: A weakening dollar can make US assets less attractive to international investors, further reinforcing the "Sell America" sentiment. The "US dollar" and "currency exchange rates" are relevant considerations.

Competition from Emerging Markets: Emerging markets are increasingly seen as attractive alternatives to US investments.

- Higher growth potential: Many emerging markets offer higher growth potential compared to developed economies.

- Potential for higher returns: This potential for higher returns, while associated with higher risk, is a strong draw for some investors.

- Increased risk: Investing in emerging markets carries significant risks, including political instability, currency fluctuations, and regulatory uncertainty. Terms like "emerging markets," "investment opportunities," and "risk tolerance" help clarify this section. "Portfolio allocation" strategy is also critical here.

Domestic Factors Contributing to "Sell America"

Domestic economic conditions also play a role in the resurgence of the "Sell America" trend.

Inflation and Monetary Policy: The Federal Reserve's response to inflation significantly impacts investor decisions.

- Inflationary pressures: Persistent inflation erodes the purchasing power of assets, influencing investment strategies. The "inflation rate" and "consumer price index (CPI)" are important metrics.

- Interest rate hikes: The Fed's interest rate hikes, aimed at curbing inflation, increase borrowing costs and can slow economic growth. "Monetary policy" and "Federal Reserve" are keywords to focus on.

- Impact on consumer spending and business investment: Higher interest rates can reduce consumer spending and business investment, impacting overall economic growth.

Political and Regulatory Uncertainty: Political instability and regulatory changes affect investor confidence.

- Examples of political risks: Political gridlock and partisan divisions can create uncertainty about future policy decisions.

- Regulatory changes affecting businesses: Changes in regulations can impact business operations and profitability, affecting investor sentiment.

- Impact on market volatility: Political and regulatory uncertainty often leads to increased market volatility, making investors hesitant to commit capital. Keywords like "political risk," "regulatory uncertainty," "market volatility," and "investor confidence" are critical in this context.

Conclusion: Navigating the "Sell America" Trend

The resurgence of the "Sell America" sentiment is driven by a confluence of factors: rising 30-year Treasury yields, intensifying geopolitical uncertainty, and domestic economic challenges, including inflation and political risk. This necessitates a reassessment of investment strategies. Investors need to prioritize diversification and careful portfolio management to mitigate potential risks associated with the "Sell America" trend. Don't get caught off guard by the "Sell America" trend – take control of your investments today! Conduct thorough research into alternative investment options and consider consulting with a financial advisor to develop a robust and adaptable investment strategy tailored to your risk tolerance and financial goals. Understanding "Sell America" and its implications is crucial for long-term investment success.

Featured Posts

-

D Wave Quantum Qbts Revolutionizes Drug Discovery With Ai Powered Quantum Computing

May 21, 2025

D Wave Quantum Qbts Revolutionizes Drug Discovery With Ai Powered Quantum Computing

May 21, 2025 -

Apples Efforts To Improve Llm Siris Performance

May 21, 2025

Apples Efforts To Improve Llm Siris Performance

May 21, 2025 -

Pivdenniy Mist Aktualna Informatsiya Pro Remontni Roboti

May 21, 2025

Pivdenniy Mist Aktualna Informatsiya Pro Remontni Roboti

May 21, 2025 -

Klopps Coaching Influence Hout Bay Fcs Rise

May 21, 2025

Klopps Coaching Influence Hout Bay Fcs Rise

May 21, 2025 -

Karin Polman Leidt Hypotheekactiviteiten Abn Amro Florius En Moneyou

May 21, 2025

Karin Polman Leidt Hypotheekactiviteiten Abn Amro Florius En Moneyou

May 21, 2025

Latest Posts

-

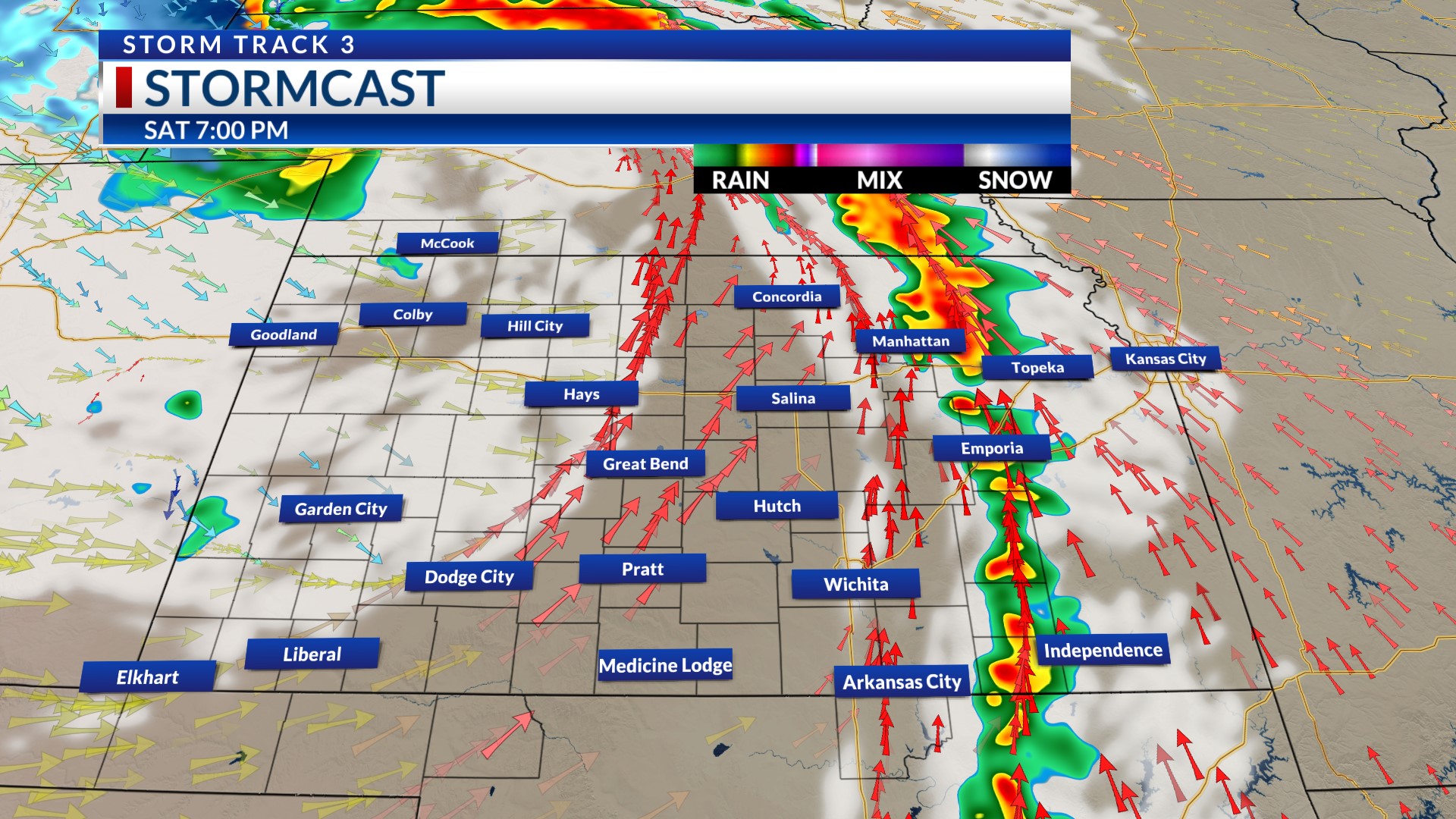

Staying Safe During Fast Moving Storms With High Winds

May 21, 2025

Staying Safe During Fast Moving Storms With High Winds

May 21, 2025 -

Ftv Lives Hell Of A Run A Critical Analysis Of Its Success And Failures

May 21, 2025

Ftv Lives Hell Of A Run A Critical Analysis Of Its Success And Failures

May 21, 2025 -

Nations League Goretzka Features In Nagelsmanns Germany Squad

May 21, 2025

Nations League Goretzka Features In Nagelsmanns Germany Squad

May 21, 2025 -

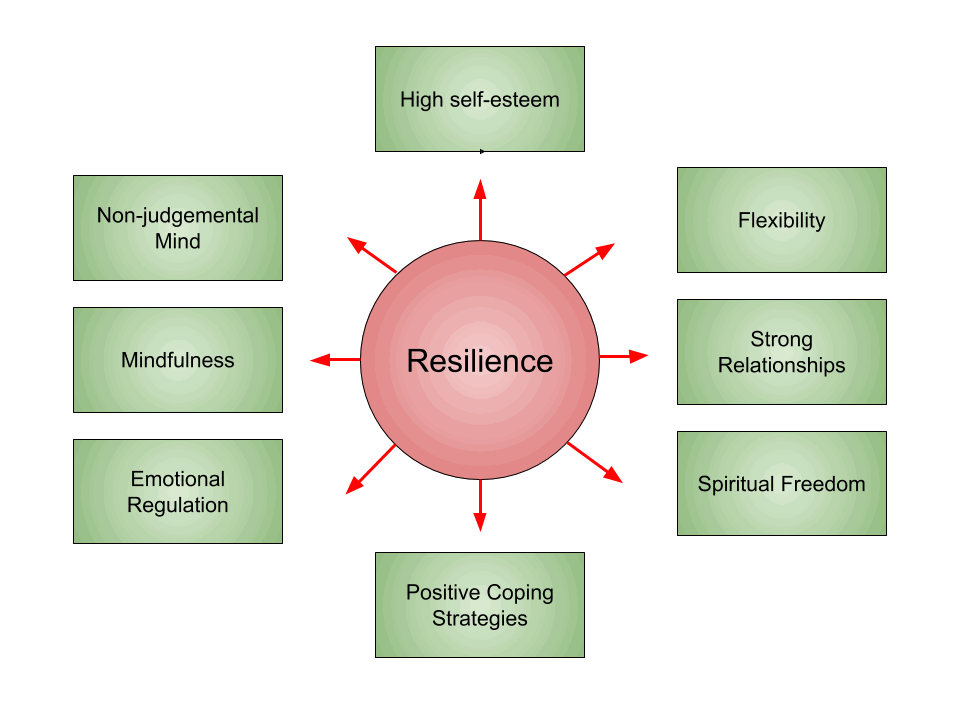

Developing Resilience Coping With Lifes Challenges

May 21, 2025

Developing Resilience Coping With Lifes Challenges

May 21, 2025 -

Severe Weather The Dangers Of Fast Moving Storms And Strong Winds

May 21, 2025

Severe Weather The Dangers Of Fast Moving Storms And Strong Winds

May 21, 2025