Securing Your Place In The Sun: A Step-by-Step Guide To International Property Investment

Table of Contents

Researching Your Ideal International Property Market

Before diving into the exciting world of overseas property, thorough research is paramount. Successful international property investment hinges on understanding the nuances of different markets. Effective market research for international property involves more than just browsing appealing online listings. It requires a systematic approach considering various factors.

-

Identify Your Investment Goals: Are you seeking long-term rental income, capital appreciation, or a personal vacation home? Your goals will heavily influence your market selection. For example, a high-yield rental property requires different market analysis than an investment focused purely on capital growth.

-

Researching Potential Markets: Consider factors such as economic stability, political climate, and property market trends. Countries with robust economies, stable political systems, and growing property markets generally offer lower risks. Look at reports on the best countries to invest in property and analyze data on property market trends and real estate market analysis.

-

Analyze Specific Locations: Once you’ve identified promising countries, narrow your focus to specific cities or regions. Consider factors like infrastructure (transportation, utilities), amenities (schools, healthcare), and potential rental demand. A location with strong infrastructure and high rental demand can significantly enhance your investment’s return.

-

Utilize Available Resources: Leverage online resources, real estate agents specializing in international property, and local market reports to gather comprehensive data. Don't rely solely on online portals; engage with local experts for on-the-ground insights.

-

Consider Tax Implications: Research tax implications in your target country. Factors like property taxes, capital gains taxes, and potential tax treaties with your home country will significantly impact your overall returns. Understanding these tax implications early in the process is crucial for successful global real estate investment.

Securing Financing for Your International Property Purchase

Securing financing for an international property purchase presents unique challenges. Understanding the options and navigating the process effectively is vital.

-

Explore Financing Options: Consider international mortgages, foreign currency loans, or cash purchases. The best option depends on your financial situation and risk tolerance. International mortgages often require a larger down payment and may have higher interest rates than domestic loans.

-

Compare Lenders: Compare interest rates, fees, and terms from various lenders specializing in international property financing. Shop around to secure the most favorable terms. Look specifically for lenders experienced in global real estate financing and overseas property financing.

-

Required Documentation: Gather the necessary documentation, including credit reports, proof of income, and property appraisals. Lenders will have specific requirements, so be prepared to provide extensive documentation.

-

Currency Fluctuations: Be aware of the potential impact of currency fluctuations on your mortgage payments. A shifting exchange rate can significantly affect the cost of your mortgage over time. Consult with a financial advisor to mitigate this risk.

-

Financial Advisor Consultation: Consulting with a financial advisor experienced in international investments is crucial. They can help you develop a financing strategy that aligns with your overall investment goals and risk tolerance.

Navigating the Legal and Regulatory Landscape

The legal and regulatory landscape for international property transactions can be complex. Seeking expert legal advice is essential to avoid costly mistakes.

-

Legal Counsel is Crucial: Engage a lawyer specializing in international property law in your chosen country. Their expertise in local regulations is invaluable.

-

Understand Local Laws: Thoroughly understand local laws and regulations regarding property ownership, taxation, inheritance, and conveyancing. These laws can differ significantly from your home country.

-

Review Legal Documents: Carefully review all legal documents, including contracts, deeds, and titles, before signing. Don't hesitate to seek clarification from your lawyer on any unclear aspects.

-

Ensure Compliance: Ensure all transactions comply with local regulations and international best practices. Non-compliance can lead to significant legal and financial consequences.

-

Assess Legal Risks: Be aware of the potential legal risks associated with buying property abroad. Due diligence is key to minimizing these risks.

Managing Your International Property Investment

Effective management is crucial for maximizing returns and preserving your investment’s value.

-

Self-Management vs. Professional Management: Decide whether to self-manage your property or hire a professional property management company. Professional management simplifies the process but incurs additional fees. Consider the time commitment and expertise required for self-management.

-

Property Management Services: Research property management services in your chosen location and compare their fees and services. Choose a reputable company with experience in overseas property rental management.

-

Property Maintenance: Establish a clear plan for property maintenance and upkeep. Regular maintenance protects your investment and preserves its value.

-

Tax Implications of Rental Income: Understand the tax implications of rental income generated from your international property. Tax laws vary across countries, and proper accounting is crucial.

-

Long-Term Strategy: Develop a long-term strategy for managing your international property investment, including potential renovations, upgrades, or resale. Regular review and adaptation of your strategy are important for maximizing returns.

Conclusion

Investing in international property can offer substantial rewards, but it necessitates careful planning, thorough research, and expert guidance. By following this step-by-step guide, you can increase your chances of securing your place in the sun and building a successful international property portfolio. Remember to conduct thorough due diligence, secure appropriate financing, and navigate the legal landscape with professional assistance. Don't delay—start your journey towards successful international property investment today!

Featured Posts

-

Indonesia Turkiye Perkuat Kerja Sama 13 Poin Penting Hasil Kunjungan Presiden Erdogan

May 03, 2025

Indonesia Turkiye Perkuat Kerja Sama 13 Poin Penting Hasil Kunjungan Presiden Erdogan

May 03, 2025 -

Arsenals Rice Souness Points To Final Third Weakness In World Class Assessment

May 03, 2025

Arsenals Rice Souness Points To Final Third Weakness In World Class Assessment

May 03, 2025 -

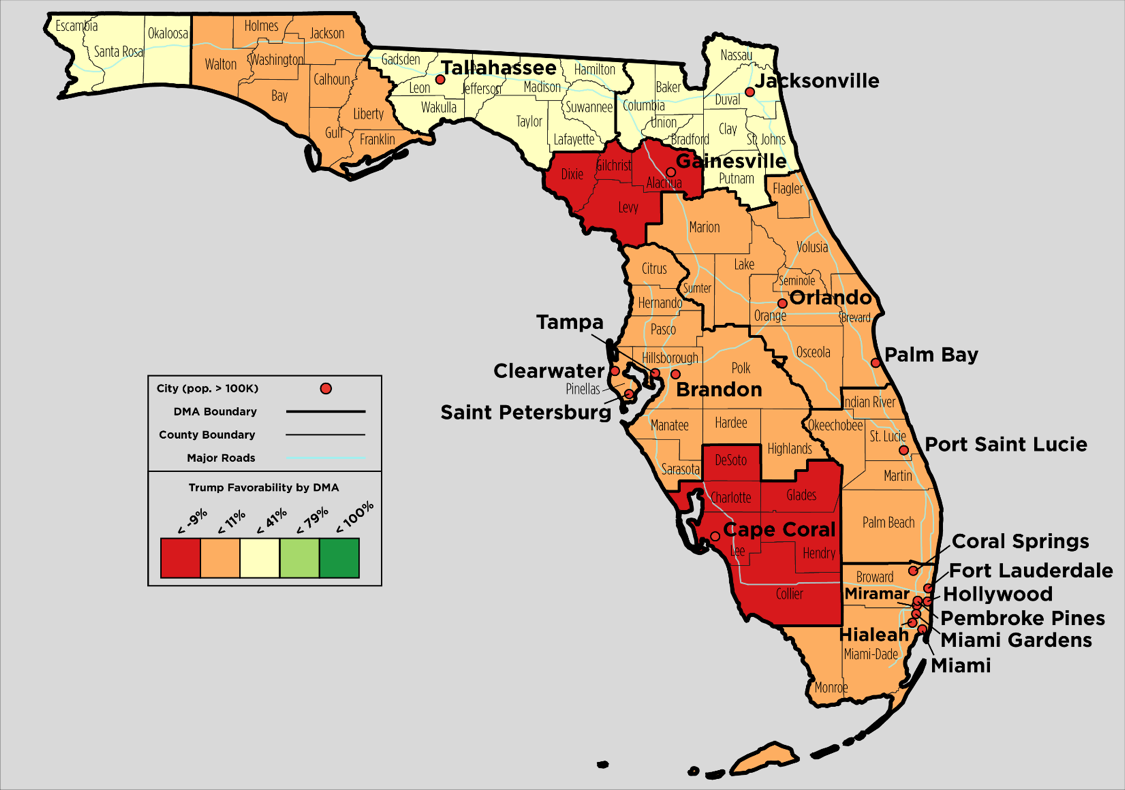

Florida And Wisconsin Turnout A Deep Dive Into The Current Political Landscape

May 03, 2025

Florida And Wisconsin Turnout A Deep Dive Into The Current Political Landscape

May 03, 2025 -

Serie Joseph Tf 1 Vaut Elle Le Detour Critique Et Analyse

May 03, 2025

Serie Joseph Tf 1 Vaut Elle Le Detour Critique Et Analyse

May 03, 2025 -

Police Investigate Mp Rupert Lowe Latest Updates

May 03, 2025

Police Investigate Mp Rupert Lowe Latest Updates

May 03, 2025