Securing Funding For Sustainability Initiatives In Small And Medium Enterprises

Table of Contents

Identifying Funding Sources for Sustainability Projects

Finding the right funding source is crucial for the success of your sustainability projects. Several avenues offer support specifically designed for SMEs aiming to adopt sustainable business practices.

Grants and Subsidies

Government agencies, regional development funds, and various foundations offer grants and subsidies specifically aimed at supporting sustainable business practices in SMEs. These funds often target specific areas like energy efficiency, waste reduction, and renewable energy adoption.

- Examples of relevant grant programs: While specific programs vary by location, research national and regional government websites for initiatives like the [insert example of a national or regional grant program, e.g., European Union's LIFE Programme, or a similar program relevant to your target audience]. Many countries also offer tax credits or incentives for investing in green technologies.

- Eligibility criteria: Requirements differ depending on the grant, but typically include factors like business size, sector, project feasibility, and environmental impact.

- Application processes: Applications usually involve detailed project proposals, financial projections, and evidence of environmental benefits. Thoroughly review the application guidelines to maximize your chances of success. Keywords: "government grants for sustainability," "sustainable business grants," "subsidies for green initiatives."

Green Loans and Green Bonds

Green financing options are increasingly accessible to SMEs. These loans and bonds are specifically designed to fund environmentally friendly projects.

- Types of green loans: These can cover various initiatives, including energy-efficient upgrades (e.g., installing LED lighting, improving insulation), renewable energy installations (e.g., solar panels, wind turbines), and sustainable waste management systems.

- Advantages over traditional loans: Green loans often come with lower interest rates or more favorable terms due to the positive environmental impact. Some lenders prioritize ESG factors, making it easier to secure financing.

- Criteria for eligibility: Lenders assess factors similar to traditional loans but also focus on the environmental benefits and long-term sustainability of the project. Keywords: "green loans for SMEs," "green bonds for sustainable businesses," "sustainable financing options."

Impact Investing and Venture Capital

Impact investors and venture capitalists are increasingly interested in sustainable and environmentally conscious SMEs. They seek not only financial returns but also positive social and environmental impact.

- What impact investors look for: These investors look for businesses with a clear social or environmental mission, strong management teams, measurable impact, and a viable business model.

- How to pitch to impact investors: Develop a strong investment pitch that clearly articulates your sustainability goals, metrics, and projected financial returns. Highlight the positive impact your business has on the environment and society.

- Finding suitable VC firms: Research firms specializing in sustainable businesses or ESG investing. Keywords: "impact investing in SMEs," "sustainable venture capital," "ESG investing in small businesses."

Crowdfunding and Corporate Social Responsibility (CSR) Initiatives

Alternative funding avenues such as crowdfunding and corporate partnerships offer further opportunities.

- Types of crowdfunding platforms: Platforms like Kickstarter and Indiegogo allow businesses to raise funds directly from the public through rewards-based or equity-based crowdfunding.

- Building a compelling crowdfunding campaign: Create a compelling narrative that clearly communicates your sustainability goals and the benefits to backers. High-quality visuals and videos are essential.

- Identifying potential CSR partners: Approach larger corporations with established CSR programs that align with your sustainability initiatives. Keywords: "crowdfunding for sustainability projects," "CSR partnerships for SMEs," "sustainable business crowdfunding."

Developing a Compelling Sustainability Funding Proposal

Securing funding requires a well-structured and persuasive proposal that clearly outlines your sustainability goals and their financial benefits.

Defining Clear Sustainability Goals and Metrics

Establish SMART (Specific, Measurable, Achievable, Relevant, and Time-bound) goals.

- Examples of SMART goals: Reduce carbon emissions by 20% in two years, increase recycling rate to 75% within one year, achieve zero waste to landfill by 2025.

- Methods for measuring progress: Implement a robust monitoring system to track your progress against your goals and demonstrate your commitment to sustainability.

- Establishing baseline data: Gather baseline data to accurately measure the impact of your initiatives. Keywords: "sustainable business plan," "measuring sustainability performance," "SMART sustainability goals."

Showcasing the Financial Benefits of Sustainability Initiatives

Highlight the financial advantages of your sustainability projects.

- Examples of cost savings: Energy efficiency improvements can lead to significant reductions in energy bills. Waste reduction programs minimize disposal costs.

- Quantifiable benefits: Present clear data showing projected cost savings, increased efficiency, and improved operational performance.

- Long-term financial projections: Demonstrate the long-term financial viability of your sustainability initiatives, including potential revenue growth and enhanced brand value. Keywords: "ROI of sustainability initiatives," "cost savings through sustainability," "financial benefits of green technologies."

Crafting a Strong Narrative and Communication Strategy

Effectively communicate your sustainability story.

- Tips for writing a compelling proposal: Use clear and concise language, highlight the problem your project addresses, clearly articulate your solution, and demonstrate your expertise.

- Incorporating visuals and data: Use charts, graphs, and images to illustrate your points and make your proposal more engaging.

- Tailoring the proposal to the specific funder: Customize your proposal to align with the funder's priorities and interests. Keywords: "sustainability funding proposal," "effective communication for grant applications," "pitching sustainability initiatives."

Conclusion

Securing funding for sustainability initiatives in SMEs requires a well-defined plan, a compelling narrative, and a clear demonstration of financial benefits. By exploring the various funding sources outlined above – from government grants and green loans to impact investing and crowdfunding – and by crafting a strong funding proposal that highlights the ROI of your sustainability projects, you can significantly increase your chances of securing the necessary resources. Start securing funding for your sustainability initiatives today! Explore funding options for your SME's sustainability projects. Learn how to successfully secure funding for your sustainable business.

Featured Posts

-

India News Today Top 5 Headlines Bjp Vs Congress You Tuber Spy Case And Breaking News

May 19, 2025

India News Today Top 5 Headlines Bjp Vs Congress You Tuber Spy Case And Breaking News

May 19, 2025 -

Proedria Ee Syzitiseis Kompos Sigiarto Gia Kypriako Kai Dimereis Sxeseis Kyproy Oyggarias

May 19, 2025

Proedria Ee Syzitiseis Kompos Sigiarto Gia Kypriako Kai Dimereis Sxeseis Kyproy Oyggarias

May 19, 2025 -

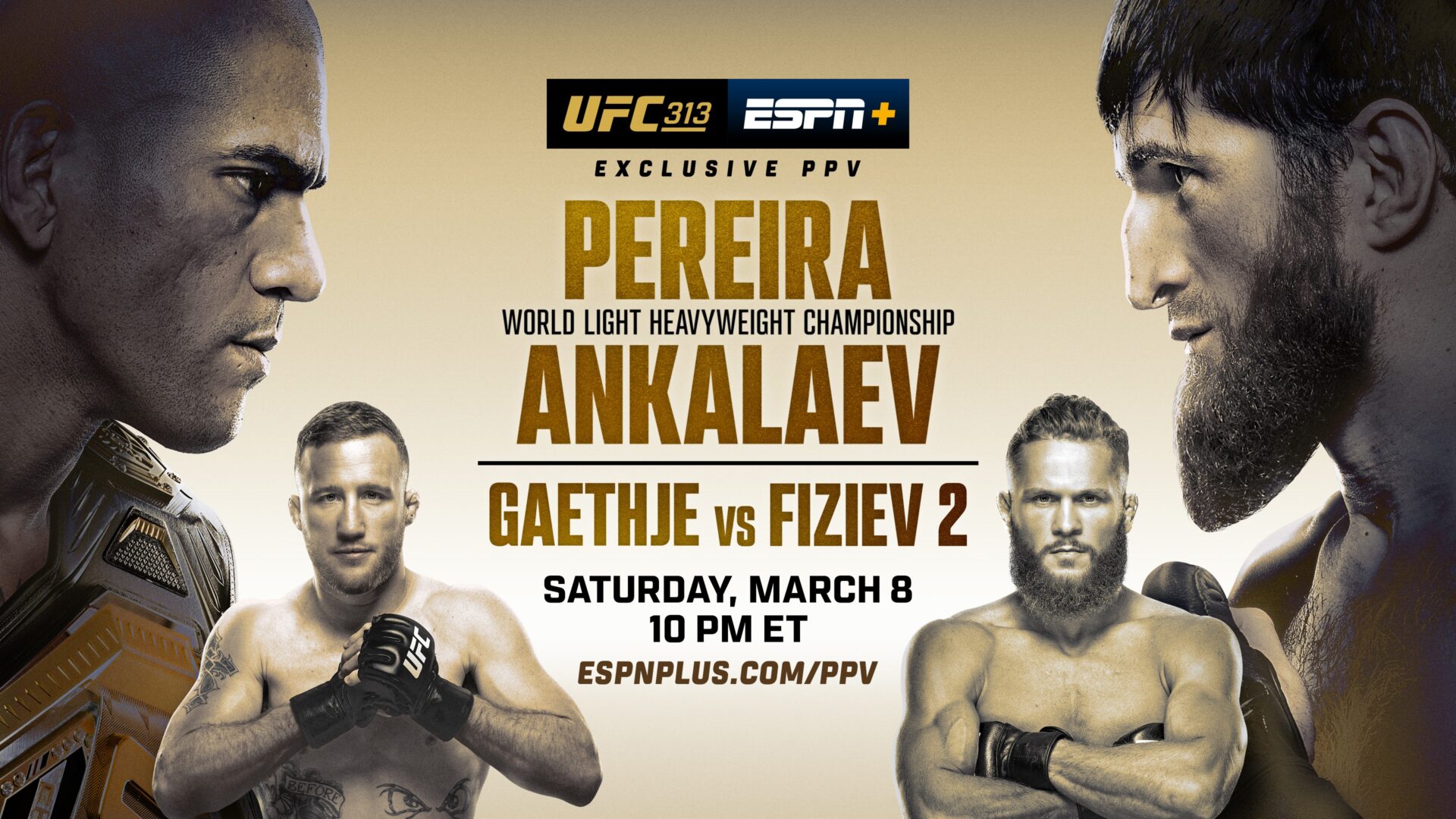

How To Watch Ufc 313 Tickets Full Fight Card And Top Bout Predictions

May 19, 2025

How To Watch Ufc 313 Tickets Full Fight Card And Top Bout Predictions

May 19, 2025 -

India Espionage Case You Tuber Jyoti Malhotras Arrest And The Pakistani Connection

May 19, 2025

India Espionage Case You Tuber Jyoti Malhotras Arrest And The Pakistani Connection

May 19, 2025 -

Is Cooke Maroney The Hot Art Dad Everyones Talking About Jennifer Lawrences Husband

May 19, 2025

Is Cooke Maroney The Hot Art Dad Everyones Talking About Jennifer Lawrences Husband

May 19, 2025