Securing A Loan With Bad Credit: Understanding Tribal Loan Options

Table of Contents

What are Tribal Loans?

Understanding Tribal Lending

Tribal loans are offered by lending institutions that are owned or operated by Native American tribes. These lenders often operate outside of traditional state banking regulations, which can sometimes lead to different lending practices and terms compared to banks or credit unions. The relationship between tribal lenders and Native American tribes is complex and often involves agreements and partnerships that govern lending operations. It's crucial to understand that not all tribal lenders are the same, and some may adhere to stricter ethical and lending standards than others.

- Regulatory Environment: The regulatory landscape surrounding tribal lending is complex and often debated. Some argue that tribal sovereignty protects these lenders from state regulations, while others advocate for stricter oversight to protect consumers. Understanding these complexities is crucial when considering a tribal loan.

- Tribal Loans vs. Payday Loans: While both might seem similar at first glance, tribal loans are distinct from payday loans. Payday loans usually involve smaller amounts and very short repayment terms, often leading to a cycle of debt. Tribal loans can have higher loan amounts and longer repayment periods.

- Potential Advantages & Disadvantages: Tribal loans may offer advantages like higher approval rates and faster processing times for those with bad credit. However, they may also carry higher interest rates than traditional loans.

Eligibility Requirements for Tribal Loans

Credit Score Considerations

Credit scores play a significant role in loan applications, but tribal lenders often have less stringent requirements than traditional banks. This doesn't mean they don't check credit; rather, they may be more willing to approve applications from individuals with lower credit scores. However, a poor credit history will likely impact the interest rate and loan amount offered.

- Common Eligibility Criteria: Besides credit score, eligibility typically involves factors such as age (usually 18 or older), verifiable income to demonstrate repayment ability, and residency within a specific state or region.

- Impact of Bad Credit: A bad credit history will often result in higher interest rates on a tribal loan compared to someone with excellent credit. The loan amount approved may also be smaller.

- Accurate Information: Providing accurate information during the application process is vital. Inaccuracies can lead to application rejection or even legal consequences.

The Pros and Cons of Tribal Loans

Potential Benefits

For individuals with bad credit, tribal loans can offer several benefits:

- Higher Approval Rates: The less stringent credit requirements often translate to higher approval rates compared to traditional lenders.

- Faster Processing Times: Some tribal lenders boast faster loan processing and disbursement compared to traditional banks.

- Potential for Flexible Repayment Options: While not always guaranteed, some tribal lenders may offer flexible repayment plans.

Potential Drawbacks

Despite the potential benefits, it's important to be aware of the potential drawbacks:

- Higher Interest Rates: Expect to pay higher interest rates than you would with a loan from a traditional lender with better credit.

- Predatory Lending Practices: Be cautious, as some unscrupulous lenders engage in predatory lending practices. Thorough research is essential to avoid such lenders.

- Thorough Research is Crucial: Never rush into a tribal loan. Take your time to thoroughly investigate any lender before you apply.

Finding Reputable Tribal Lenders

Due Diligence is Key

Finding a reputable tribal lender is crucial to avoid potential scams or predatory lending practices. Never rush into a decision. Always perform thorough due diligence before applying for a loan.

- Check Online Reviews and Ratings: Look for independent reviews and ratings from other borrowers to get an idea of the lender's reputation.

- Verify Tribal Affiliation and Legitimacy: Confirm the lender's genuine affiliation with a Native American tribe and verify their legitimacy through official channels.

- Compare Interest Rates and Loan Terms: Compare offers from multiple lenders to ensure you're getting the best possible terms.

- Understand All Fees and Charges: Carefully review all fees and charges associated with the loan to avoid unexpected costs.

Responsible Borrowing Practices

Managing Debt Effectively

Even with a tribal loan, responsible borrowing practices are crucial. Don't let the ease of access to funds lead to overspending or accumulating more debt.

- Create a Budget and Stick to It: Develop a realistic budget that allows you to comfortably repay the loan without impacting other essential expenses.

- Explore Debt Consolidation Options: If you have multiple debts, consider debt consolidation to simplify repayments and potentially lower interest rates.

- Seek Credit Counseling if Needed: Don't hesitate to seek professional credit counseling if you're struggling to manage your debt effectively.

Conclusion

Tribal loans can offer a viable option for individuals with bad credit who need financial assistance. However, it's vital to approach them cautiously. Higher approval rates and faster processing times can be tempting, but the potential for higher interest rates and predatory lending practices necessitate thorough research and a responsible approach. Carefully weigh the pros and cons and choose a reputable lender before applying for a tribal loan. Remember to explore all available options and seek professional credit counseling if needed. Remember to always prioritize responsible borrowing practices to avoid further financial difficulties.

Featured Posts

-

Tyrese Haliburtons Girlfriends Savage Comment After Game 1

May 28, 2025

Tyrese Haliburtons Girlfriends Savage Comment After Game 1

May 28, 2025 -

American Music Awards 2025 Lopez Confirmed As Host

May 28, 2025

American Music Awards 2025 Lopez Confirmed As Host

May 28, 2025 -

White House Cocaine Found Secret Service Concludes Investigation

May 28, 2025

White House Cocaine Found Secret Service Concludes Investigation

May 28, 2025 -

Hailee Steinfelds Pregnancy Fact Or Fiction The Josh Allen Connection

May 28, 2025

Hailee Steinfelds Pregnancy Fact Or Fiction The Josh Allen Connection

May 28, 2025 -

Kyle Stowers Walk Off Grand Slam Marlins Win Stays Hot

May 28, 2025

Kyle Stowers Walk Off Grand Slam Marlins Win Stays Hot

May 28, 2025

Latest Posts

-

El Odio Y La Admiracion Un Tenista Argentino Y La Leyenda De Rios

May 30, 2025

El Odio Y La Admiracion Un Tenista Argentino Y La Leyenda De Rios

May 30, 2025 -

Marcelo Rios El Dios Del Tenis Segun Un Rival Argentino

May 30, 2025

Marcelo Rios El Dios Del Tenis Segun Un Rival Argentino

May 30, 2025 -

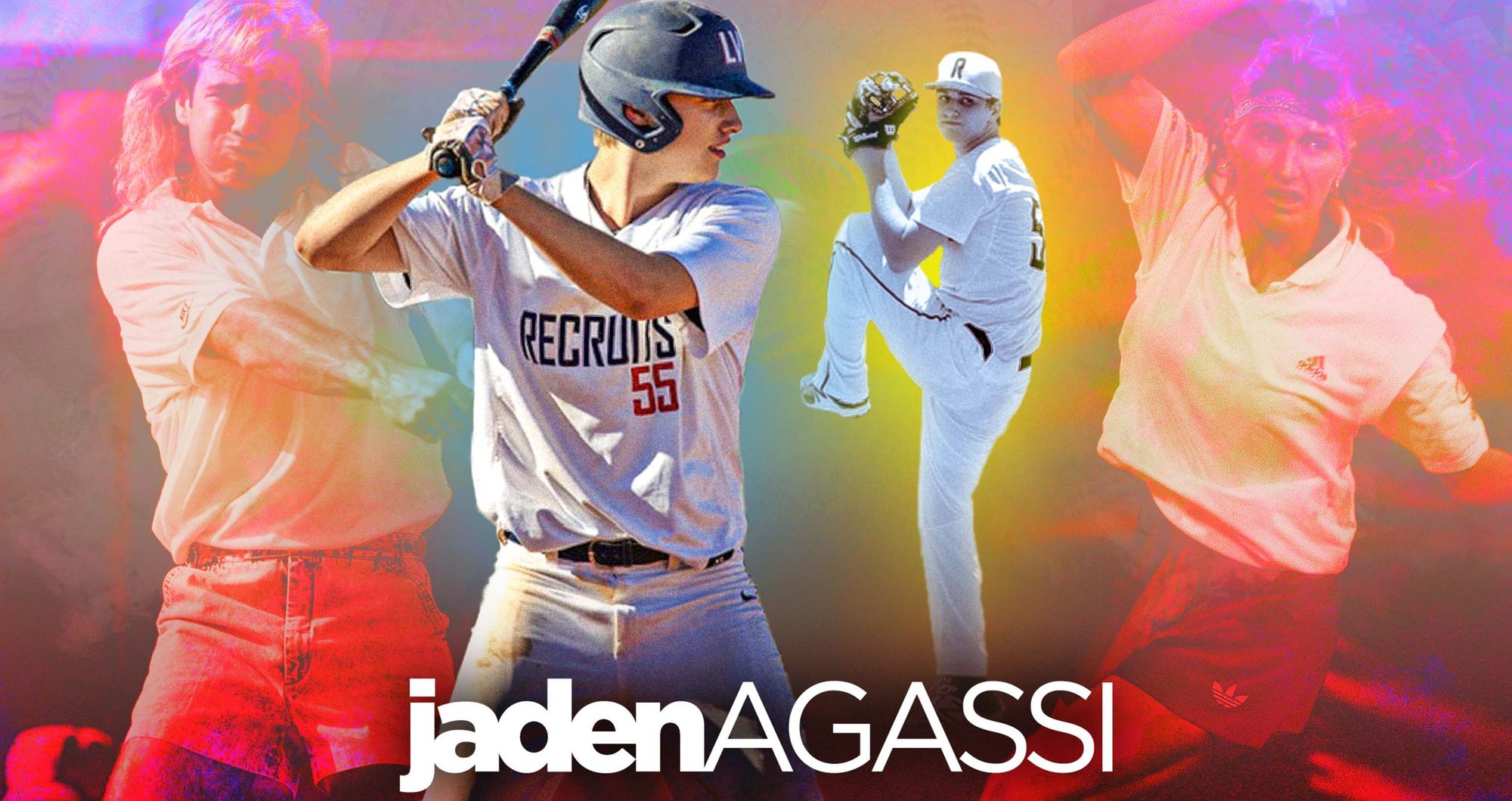

De La Raqueta A La El Sorprendente Regreso De Andre Agassi Al Deporte

May 30, 2025

De La Raqueta A La El Sorprendente Regreso De Andre Agassi Al Deporte

May 30, 2025 -

So Spielen Steffi Graf Und Andre Agassi Erfolgreich Pickleball

May 30, 2025

So Spielen Steffi Graf Und Andre Agassi Erfolgreich Pickleball

May 30, 2025 -

Un Tenista Argentino Reconoce La Grandeza De Rios A Pesar De Su Odio

May 30, 2025

Un Tenista Argentino Reconoce La Grandeza De Rios A Pesar De Su Odio

May 30, 2025