Secure Personal Loans With Bad Credit: Direct Lender Options Explained

Table of Contents

Understanding Direct Lenders for Bad Credit Loans

When you need a personal loan for bad credit, understanding the benefits of using a direct lender is crucial. Direct lenders are financial institutions that provide loans directly to borrowers, unlike brokers who act as intermediaries. This direct approach offers several advantages:

- Avoids paying broker fees: Brokers charge fees for their services, which can significantly increase the overall cost of your loan. Direct lenders eliminate this extra expense.

- Streamlined application process: Dealing directly with the lender simplifies the application process, often making it faster and easier.

- Potentially more transparent terms and conditions: Direct lenders generally offer more transparent terms and conditions compared to brokers, allowing you to fully understand the loan agreement.

- May offer personalized loan options: Direct lenders can often tailor loan options to suit your individual financial situation and needs, offering flexibility that brokers may not provide.

Factors Affecting Approval for Bad Credit Personal Loans

Several factors influence your chances of approval for a bad credit personal loan. Direct lenders assess applications based on various criteria, including:

- Credit score: While a low credit score can make it harder to secure a loan, many direct lenders specialize in working with individuals with less-than-perfect credit histories. They consider your credit report but also other factors.

- Debt-to-income ratio (DTI): Your DTI, which represents the proportion of your income dedicated to debt repayment, is a critical factor. A lower DTI demonstrates your ability to manage existing debts and handle additional loan payments.

- Income verification: Lenders require proof of stable income to ensure you can afford the monthly loan repayments. Consistent income significantly strengthens your application.

- Loan amount: The amount you borrow impacts approval chances. Smaller loan amounts generally have higher approval rates than larger ones. Start by considering a smaller loan amount to increase your odds of success.

- Loan repayment history: Even with a bad credit score, demonstrating a history of responsible repayment on other loans (like student loans or credit cards) can work in your favor.

Finding Reputable Direct Lenders for Bad Credit Personal Loans

Finding a reputable direct lender is vital to avoid predatory lending practices. Here's how to research and choose a reliable lender:

- Check online reviews and ratings: Look for lenders with positive feedback from previous borrowers. Websites like the Better Business Bureau can provide valuable insights.

- Look for lenders licensed and regulated in your state/country: Ensure the lender operates legally and adheres to regulatory guidelines protecting consumers.

- Be wary of lenders promising guaranteed approval: Legitimate lenders don't guarantee approval; they assess your application based on your financial situation.

- Compare interest rates and fees from multiple lenders: Shop around and compare offers to secure the best terms for your personal loan. Don't just focus on the interest rate; look at all associated fees.

- Understand the loan's terms and conditions carefully: Read the fine print before signing any loan agreement. Ensure you fully understand the repayment schedule, interest rates, and any penalties for late payments.

Utilizing Online Tools to Compare Bad Credit Loan Options

Using online loan comparison tools can streamline your search. These tools allow you to compare interest rates, fees, and loan terms from different direct lenders. Many websites offer loan calculators to estimate your monthly payments based on different loan amounts and interest rates. This helps you make informed decisions and choose the loan that best suits your budget.

Improving Your Chances of Securing a Secure Personal Loan

While securing a personal loan with bad credit is possible, taking steps to improve your creditworthiness before applying can significantly increase your chances of approval:

- Dispute errors on your credit report: Check your credit report for any inaccuracies and dispute them with the relevant credit bureaus.

- Pay bills on time: Consistent on-time payments demonstrate responsible financial behavior and positively impact your credit score.

- Reduce your debt-to-income ratio: Paying down existing debts can improve your DTI, making you a more attractive borrower.

- Consider credit counseling: A credit counselor can help you develop a budget, manage your debt, and improve your financial habits.

Conclusion:

Securing a secure personal loan with bad credit through a direct lender is achievable with careful planning and research. Understanding the factors influencing approval, identifying reputable lenders, and potentially improving your credit score can significantly increase your chances of success. Remember, responsible borrowing involves carefully reviewing loan terms and ensuring you can comfortably afford the monthly repayments.

Call to Action: Start your search for secure personal loans for bad credit today! Compare offers from various direct lenders to find the best option that meets your financial needs and helps you achieve your financial goals. Remember to carefully review all terms and conditions before signing any loan agreement.

Featured Posts

-

Hemp Legality In Georgia A Comprehensive Overview Of Current Laws

May 28, 2025

Hemp Legality In Georgia A Comprehensive Overview Of Current Laws

May 28, 2025 -

Surya Paloh Sorot Krisis Infrastruktur Jalan Di Bali

May 28, 2025

Surya Paloh Sorot Krisis Infrastruktur Jalan Di Bali

May 28, 2025 -

Green Home Loan Expansion E750 Million Investment From The Cabinet

May 28, 2025

Green Home Loan Expansion E750 Million Investment From The Cabinet

May 28, 2025 -

Marlins And Torpedo Bats A Growing Trend

May 28, 2025

Marlins And Torpedo Bats A Growing Trend

May 28, 2025 -

Prakiraan Cuaca Terbaru Kalimantan Timur Ikn Balikpapan Samarinda And Sekitarnya

May 28, 2025

Prakiraan Cuaca Terbaru Kalimantan Timur Ikn Balikpapan Samarinda And Sekitarnya

May 28, 2025

Latest Posts

-

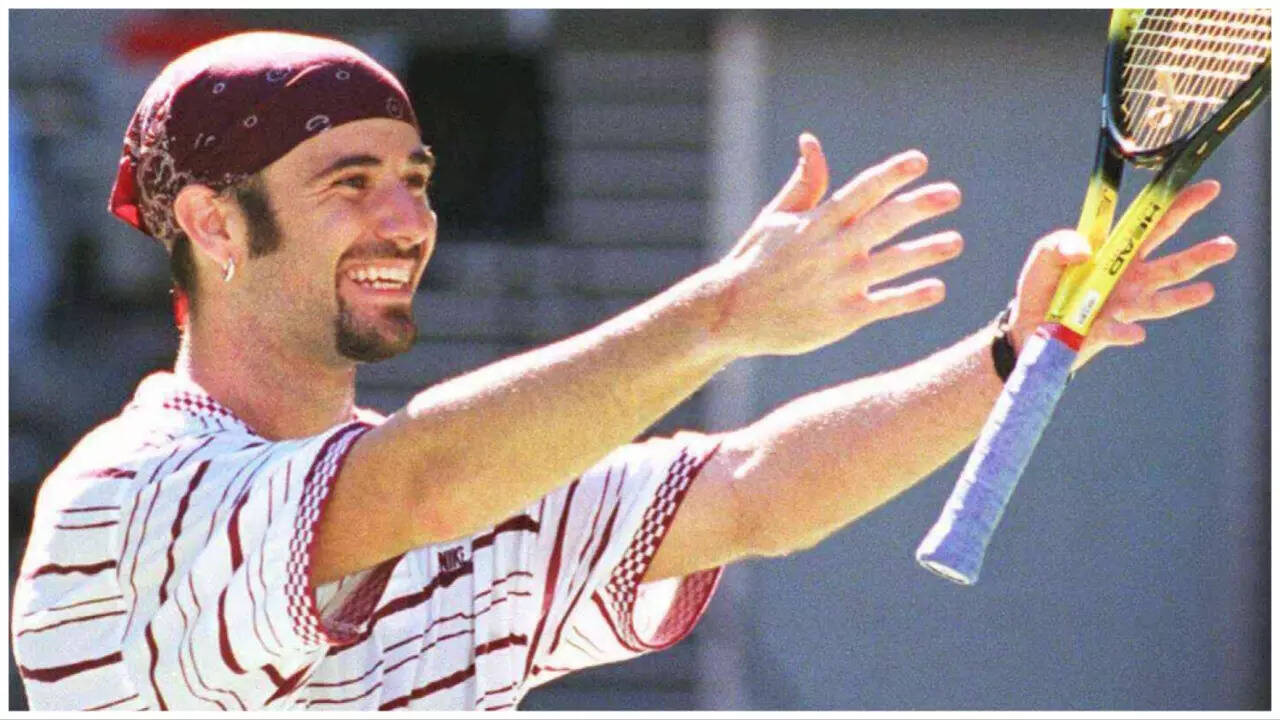

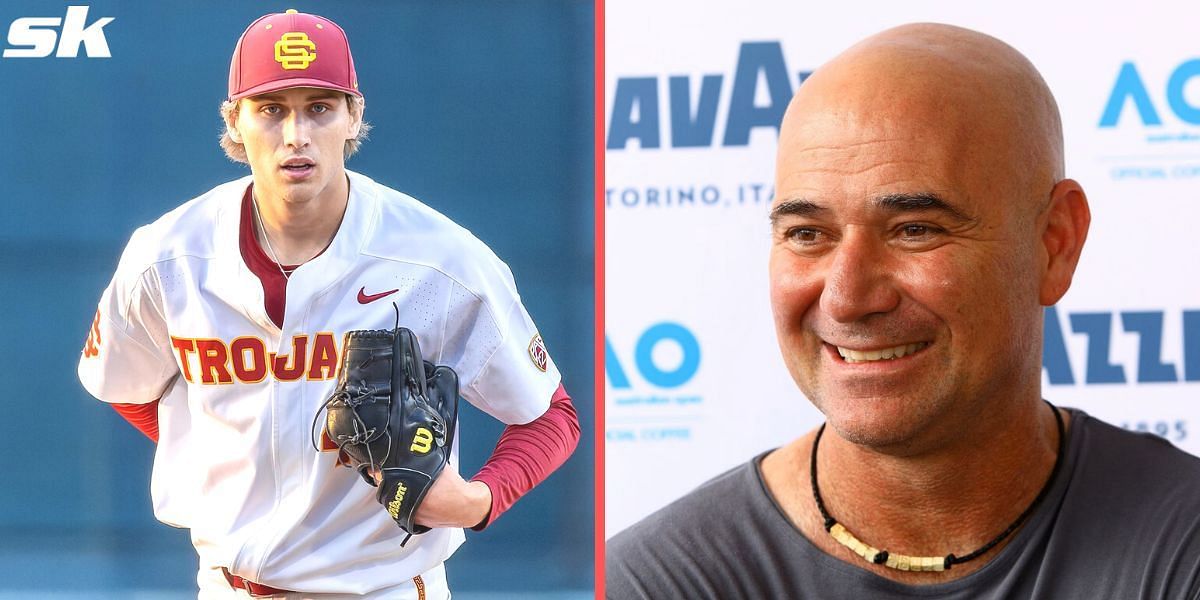

Nervi De Otel Andre Agassi Vorbeste Despre Anxietatea Sa

May 30, 2025

Nervi De Otel Andre Agassi Vorbeste Despre Anxietatea Sa

May 30, 2025 -

Tennis Legend Andre Agassi Enters The World Of Professional Pickleball

May 30, 2025

Tennis Legend Andre Agassi Enters The World Of Professional Pickleball

May 30, 2025 -

Agassi Mai Nervos Decat Un Tigan Cu Ipoteca Marturie Sincera

May 30, 2025

Agassi Mai Nervos Decat Un Tigan Cu Ipoteca Marturie Sincera

May 30, 2025 -

Andre Agassi And Ira Khan An Unexpected Encounter And Revelation

May 30, 2025

Andre Agassi And Ira Khan An Unexpected Encounter And Revelation

May 30, 2025 -

Andre Agassi Dezvaluie Tensiunea Inainte De Meciuri

May 30, 2025

Andre Agassi Dezvaluie Tensiunea Inainte De Meciuri

May 30, 2025