SEC Overhauls Crypto Broker Rules: What To Expect

Table of Contents

Increased Scrutiny for Crypto Broker-Dealers

The SEC is cracking down on unregistered broker-dealers offering crypto services. This means stricter enforcement and potential penalties for those operating outside the regulatory framework. The agency is actively pursuing firms that have not properly registered as broker-dealers and are offering services related to digital assets without appropriate licensing. This increased scrutiny aims to protect investors from fraud and manipulation within the burgeoning cryptocurrency market.

- Increased registration requirements for broker-dealers handling digital assets: The SEC is clarifying the definition of "broker-dealer" in the context of cryptocurrencies, demanding more comprehensive registration processes and demonstrating a clear understanding of the digital asset landscape.

- Heightened scrutiny of custody practices for crypto assets: Brokers are facing stricter rules on how they handle and secure client assets. This includes rigorous security protocols, insurance against loss, and transparent reporting mechanisms.

- Stringent anti-money laundering (AML) and know-your-customer (KYC) compliance measures: The SEC is emphasizing the need for robust AML and KYC procedures to combat illicit activities and prevent money laundering within the crypto ecosystem. This includes thorough due diligence on clients and transactions.

- Potential for increased audits and inspections: Expect a significant increase in the frequency and intensity of SEC audits and inspections for crypto broker-dealers, ensuring compliance with the evolving regulatory framework.

The SEC's definition of what constitutes a "broker-dealer" in the crypto space is becoming more precise, leaving less room for ambiguity and demanding full compliance. Failure to comply can lead to substantial fines and legal repercussions.

Implications for Security Tokens and Digital Asset Offerings

The SEC's new rules significantly impact how security tokens and other digital assets are offered and traded. This creates a need for greater clarity and compliance for issuers and platforms. The focus is on ensuring that investors are adequately protected and have access to complete and accurate information.

- Stricter registration requirements for security token offerings (STOs): Issuers of security tokens must now comply with stricter registration requirements, providing more comprehensive disclosures and meeting stringent regulatory standards.

- Enhanced disclosures for investors regarding the risks associated with digital assets: The SEC is demanding greater transparency around the inherent risks associated with investing in digital assets, requiring clear and concise disclosure statements to protect investors from potential losses.

- Greater oversight of trading platforms dealing in security tokens: Platforms facilitating the trading of security tokens are subject to increased scrutiny, requiring them to adhere to stricter operational and compliance standards.

- Potential for reclassification of certain cryptocurrencies as securities: The SEC is rigorously evaluating various cryptocurrencies to determine if they meet the definition of a security under the Howey Test. This could lead to significant regulatory changes for some digital assets.

The SEC is focusing on whether a digital asset meets the definition of a security, requiring issuers to carefully navigate the regulatory landscape to avoid potential legal challenges. This requires a deep understanding of securities law and careful legal counsel.

The Role of Investment Advisors and Regulatory Compliance

Investment advisors offering advice on cryptocurrencies are also coming under increased SEC scrutiny, facing tougher requirements for registration and disclosures. Advisors must now demonstrate a comprehensive understanding of the crypto market and its inherent risks.

- Increased fiduciary duties for advisors recommending crypto investments: Advisors have an elevated responsibility to act in the best interest of their clients when recommending crypto investments, requiring greater due diligence and careful consideration of client suitability.

- Stricter requirements for disclosure of conflicts of interest: Advisors must transparently disclose any potential conflicts of interest related to their crypto recommendations, ensuring full transparency with their clients.

- More robust client suitability assessments for crypto investments: Before recommending crypto investments, advisors must conduct thorough suitability assessments to ensure that the investment aligns with the client's risk profile and financial goals.

- Potential for heightened penalties for non-compliance: Non-compliance with these heightened regulations will result in stricter penalties for investment advisors, highlighting the importance of adherence to the new guidelines.

Advisors must ensure their recommendations are suitable for clients, and fully disclose any conflicts of interest related to their crypto recommendations. This necessitates ongoing professional development and a thorough understanding of the evolving regulatory landscape.

Navigating the Changing Regulatory Landscape for Crypto Brokers

Crypto brokers need a proactive strategy to navigate the evolving landscape of SEC regulations for cryptocurrencies. Failure to adapt could have severe financial and legal consequences.

- Seek expert legal and compliance advice to ensure regulatory compliance: Engaging experienced legal and compliance professionals is crucial to understand and navigate the complexities of the new regulations.

- Implement robust KYC/AML procedures to mitigate risk: Implementing stringent KYC/AML procedures is paramount to mitigating the risks associated with money laundering and other illicit activities.

- Invest in advanced technology solutions for compliance management: Investing in technology solutions designed to automate compliance processes can help streamline operations and improve efficiency.

- Stay updated on evolving SEC guidance and regulatory changes: The regulatory landscape is constantly evolving, demanding continuous monitoring and adaptation to stay compliant.

Proactive compliance is crucial for crypto brokers to avoid substantial penalties and maintain operational viability. Ignoring these changes could lead to significant legal and financial consequences.

Conclusion

The SEC's overhaul of crypto broker rules marks a pivotal moment for the digital asset industry. These changes, while creating challenges, ultimately aim to protect investors and bring greater transparency to the market. Understanding these new regulations is crucial for all stakeholders, from crypto brokers and issuers to investors. To stay informed and ensure compliance, actively monitor SEC updates and seek professional advice on navigating the complexities of crypto broker regulations. Ignoring these changes could result in significant legal and financial consequences. Understanding the SEC's evolving stance on crypto rules and investing in robust regulatory compliance strategies is essential for continued success in the crypto space.

Featured Posts

-

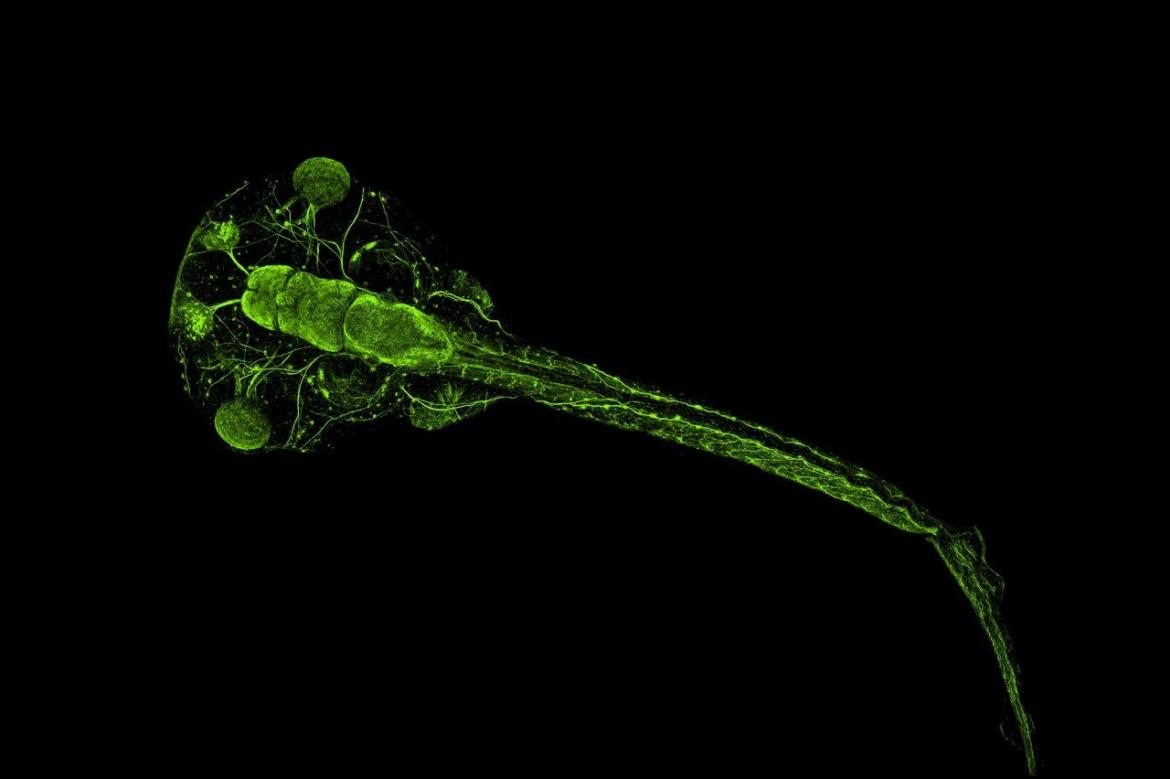

Untangling Autism And Adhd In Adults Are You One Of The Millions

May 13, 2025

Untangling Autism And Adhd In Adults Are You One Of The Millions

May 13, 2025 -

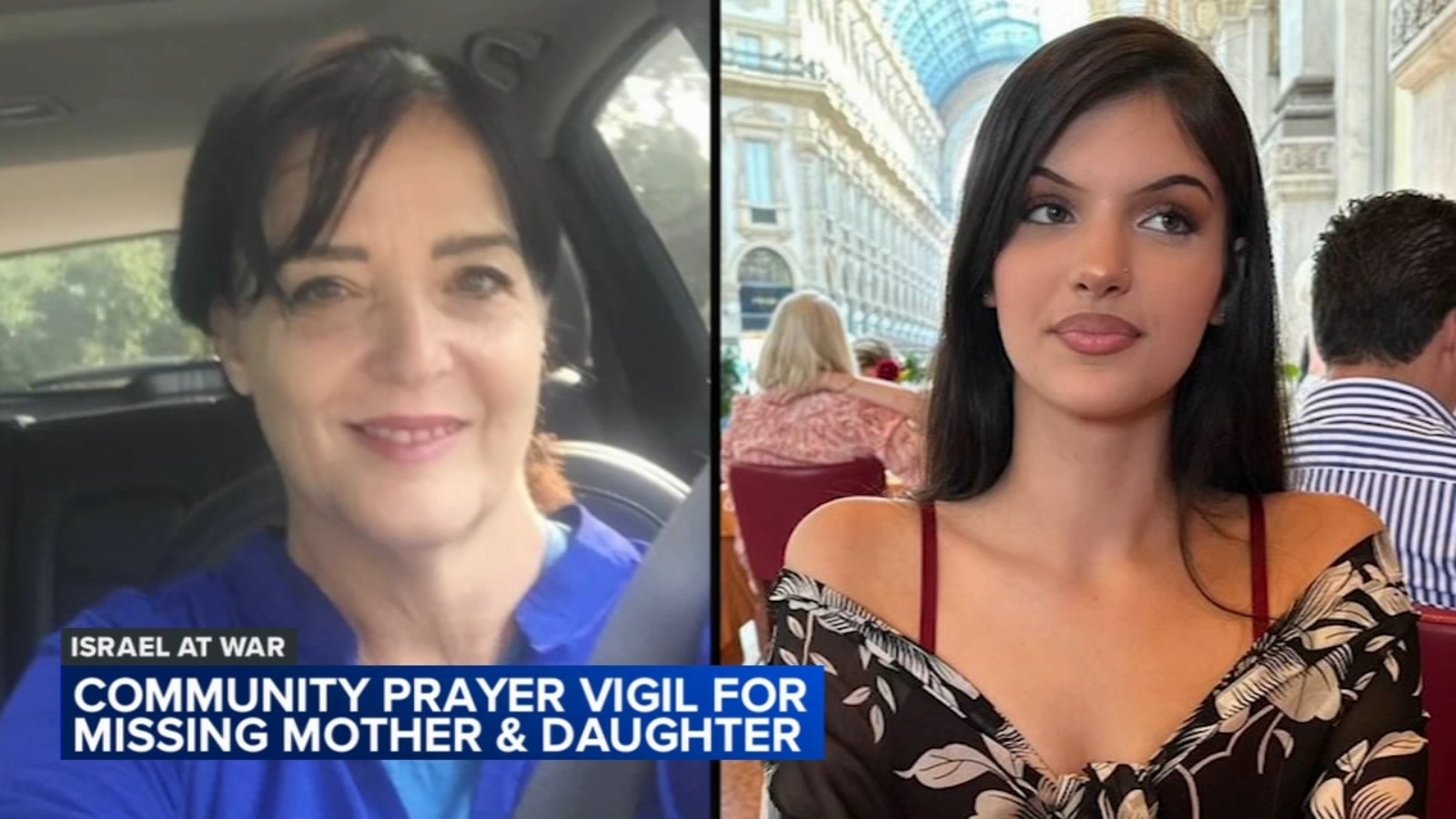

Us Urged To Engage Hamas In Talks Father Of Captured Son Edan Alexander Remains Hopeful

May 13, 2025

Us Urged To Engage Hamas In Talks Father Of Captured Son Edan Alexander Remains Hopeful

May 13, 2025 -

Prvo Izdanie Romski Narodni Ba Ki

May 13, 2025

Prvo Izdanie Romski Narodni Ba Ki

May 13, 2025 -

The Nightmare In Gaza The Plight Of Hostage Families

May 13, 2025

The Nightmare In Gaza The Plight Of Hostage Families

May 13, 2025 -

Could You Have Autism Or Adhd Common Symptoms And Diagnosis In Britain

May 13, 2025

Could You Have Autism Or Adhd Common Symptoms And Diagnosis In Britain

May 13, 2025