Schroders Q1 Performance: Falling Assets And Stock Market Trends

Table of Contents

Schroders Q1 2024 Performance Overview

Schroders' Q1 2024 performance reflected the challenging global economic environment. While precise figures require referencing Schroders' official financial reports (source: [Insert Link to Schroders Q1 2024 Report]), preliminary data suggests a decline in AUM and potentially lower profitability compared to the previous quarter and the same period last year.

- AUM Decrease: Reports indicate a percentage decrease in AUM of [Insert Percentage, e.g., 5%] compared to Q4 2023.

- Key Performance Indicators (KPIs): This decrease impacted key performance indicators such as revenue and operating margin, leading to a [Insert description of profit/loss, e.g., reduced profit or net loss].

- Quarter-over-Quarter and Year-over-Year Comparison: Compared to Q1 2023, the performance shows a [Insert description of performance change, e.g., significant downturn], highlighting the impact of the changing market conditions.

- Inflows and Outflows: Preliminary data may suggest a net outflow of assets, potentially indicating shifting investor sentiment and strategies.

Factors Contributing to Falling Assets Under Management (AUM)

Several interconnected factors contributed to the decline in Schroders' AUM during Q1 2024.

Impact of Market Volatility

Global market uncertainty significantly influenced investor sentiment and investment decisions.

- Market Events: Rising interest rates implemented by central banks globally to combat inflation, coupled with ongoing geopolitical tensions (e.g., the war in Ukraine), created a volatile market environment. This uncertainty led to increased risk aversion among investors.

- Investor Behavior: The correlation between market volatility and investor behavior is clear: heightened uncertainty generally leads to investors shifting away from riskier assets and into safer havens.

- Asset Class Declines: Equities, particularly in technology and growth sectors, experienced significant declines, impacting portfolios heavily invested in these areas. Bond yields also fluctuated significantly, further dampening investor confidence.

Changes in Investor Behavior

Shifting investor strategies played a significant role in the decline of AUM.

- Inflation and Interest Rates: High inflation and rising interest rates forced investors to re-evaluate their risk tolerance and investment strategies. Many sought safer, higher-yielding alternatives.

- Demand for Investment Products: Demand for defensive asset classes like government bonds increased, while demand for riskier assets like equities decreased.

- Allocation Strategies: Investors adjusted their asset allocation strategies, moving away from growth stocks and towards more conservative investments to protect against potential losses.

Competition within the Asset Management Industry

The competitive landscape within the asset management industry also played a role.

- Key Competitors: Schroders faces stiff competition from major players such as [mention key competitors, e.g., BlackRock, Vanguard]. The relative performance of these competitors needs to be considered in evaluating Schroders' results.

- Market Share: The competitive pressure may have resulted in a shift in market share, although definitive figures require further analysis of industry data.

- Strategic Responses: Schroders might have implemented strategic changes in response to competitive pressures, such as adjusting fees or launching new products, but the impact of these initiatives on Q1 performance is yet to be fully assessed.

Stock Market Trends and their Impact on Schroders' Investment Strategies

Understanding the broader stock market trends during Q1 2024 is crucial for analyzing Schroders’ performance.

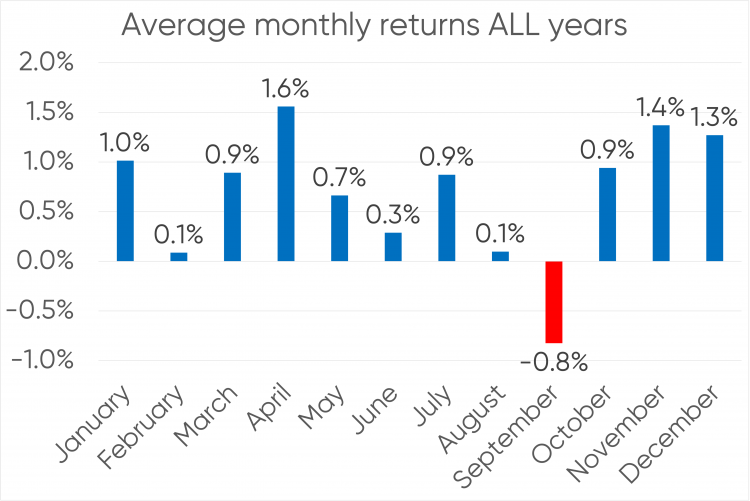

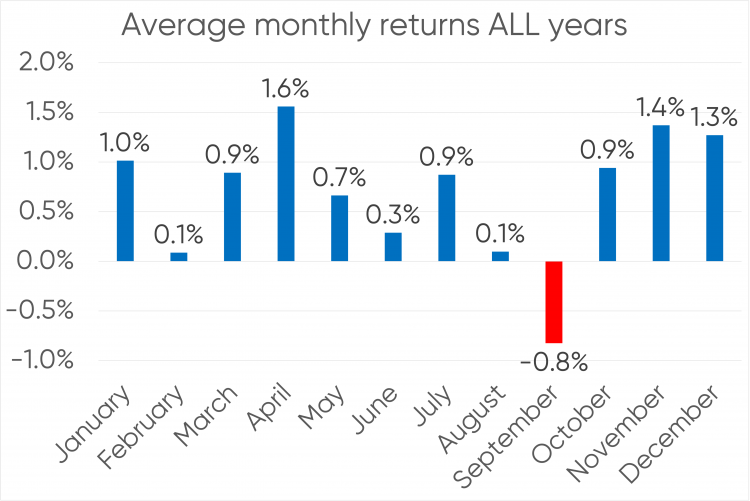

Analysis of Key Market Indices

Major global indices experienced mixed performance in Q1 2024.

- Index Performance: The S&P 500 [insert performance data, e.g., experienced a slight decline], while the FTSE 100 [insert performance data, e.g., showed more resilience].

- Sector-Specific Performance: Technology stocks underperformed, while more defensive sectors such as utilities and consumer staples showed relatively better results, reflecting a shift in investor preferences.

- Portfolio Impact: These trends directly affected Schroders' portfolio performance, depending on its specific asset allocation strategy and sector exposure.

Schroders' Investment Strategy and Portfolio Adjustments

Schroders' investment approach and any adjustments made in response to market conditions are crucial to understanding their Q1 results.

- Asset Allocation Changes: It is likely Schroders adjusted its asset allocation strategy during Q1, reducing exposure to riskier assets and shifting towards more defensive positions.

- Sector Bets: Any significant sector bets made by Schroders in Q1 (and their success or failure) will have influenced the overall performance. Information on specific underperforming sectors would be useful for a complete picture.

- Rationale for Changes: Understanding the rationale behind any strategic changes implemented by Schroders is key to interpreting their Q1 performance and anticipating future strategies.

Conclusion

Schroders' Q1 2024 performance reflected the challenging global economic environment characterized by market volatility, changes in investor behavior, and intense competition. Falling AUM was primarily influenced by factors such as rising interest rates, geopolitical uncertainty, and shifts in investor preferences toward safer assets. Schroders' investment strategy and portfolio adjustments in response to these market dynamics played a significant role in determining the overall outcome. To gain a comprehensive understanding of Schroders' Q1 performance, further analysis of their official financial reports is necessary.

Call to Action: Stay informed about Schroders' performance and the evolving dynamics of the investment landscape by regularly reviewing their financial reports and market analysis. Understanding Schroders Q1 performance and the broader stock market trends is crucial for investors looking to navigate the complexities of the asset management industry and make informed investment decisions. Learn more about Schroders' performance and investment strategies by visiting their website: [Insert Link to Schroders' Website].

Featured Posts

-

Riot Platforms Inc Announces Waiver And Irrevocable Proxy In Press Release

May 02, 2025

Riot Platforms Inc Announces Waiver And Irrevocable Proxy In Press Release

May 02, 2025 -

April 17 2025 Daily Lotto Results

May 02, 2025

April 17 2025 Daily Lotto Results

May 02, 2025 -

Loss In The World Of 80s Television A Dallas Star Dies

May 02, 2025

Loss In The World Of 80s Television A Dallas Star Dies

May 02, 2025 -

Nea Ethniki Stratigiki P Syxikis Ygeias 2025 2028 Stoxoi Kai Draseis

May 02, 2025

Nea Ethniki Stratigiki P Syxikis Ygeias 2025 2028 Stoxoi Kai Draseis

May 02, 2025 -

Tulsas Winter Weather Key Statistics And Trends

May 02, 2025

Tulsas Winter Weather Key Statistics And Trends

May 02, 2025