Scandal Spurs PwC Withdrawal From Over A Dozen Nations

Table of Contents

The Nature of the PwC Scandal

The core of the PwC scandal revolves around a significant breach of confidential client data and potential ethical violations. This PwC data breach involved the unauthorized access and dissemination of sensitive information, impacting numerous clients and raising serious concerns about PwC's internal security protocols. The leaked information included details about tax strategies, financial performance, and other commercially sensitive material. This PwC confidential information leak resulted in a loss of trust and triggered regulatory investigations across multiple jurisdictions.

-

Specific examples of leaked information and their impact: Reports suggest that confidential tax planning strategies for numerous multinational corporations were leaked, potentially leading to reputational damage for both PwC and its clients. The information leak also raised concerns about potential tax evasion and other illegal activities.

-

Regulatory bodies involved in the investigation: Several international regulatory bodies, including those in the UK, US, and possibly others, are currently investigating the PwC scandal and the extent of the data breach. These investigations will determine the full extent of the ethical violations and potential legal repercussions.

-

Potential legal ramifications for PwC and its employees: The potential legal ramifications are substantial, including significant fines, reputational damage, and potential criminal charges against involved individuals. The scale of the data breach and the potential for misuse of the leaked information significantly increases the severity of the legal consequences.

-

Public reaction and media coverage of the scandal: Public reaction has been largely negative, with widespread criticism of PwC's lack of security and ethical lapses. The media coverage has been extensive, intensifying pressure on the firm and raising concerns about the wider auditing profession.

Nations Affected by PwC Withdrawal

The PwC withdrawal is not confined to a single region; its impact is global. The geographic impact of the scandal is far-reaching, with PwC significantly reducing its presence or completely withdrawing from numerous countries. This PwC global presence, so widely established, is now severely curtailed in many regions. This demonstrates the widespread nature of the issue and its implications for international accounting.

-

A list of the countries impacted, organized geographically: While a definitive list is still emerging, reports indicate withdrawals or significant scaling back in several European countries, a number of Asian nations, and at least one country in South America. The precise number of affected countries continues to fluctuate as investigations and responses evolve.

-

The size and significance of PwC's operations in each affected country: PwC's market share varies from country to country. In some, its withdrawal represents a substantial loss to the local professional services sector and could significantly impact local businesses who relied on their services.

-

Potential economic consequences of the withdrawals in each nation: The economic consequences are multifaceted and still being assessed. They range from disruption to ongoing audits and advisory services, to potential implications for investment decisions and business confidence. Smaller markets are particularly vulnerable to this disruption in the global audit sector.

-

Impact on clients in each affected region: Clients now face uncertainty and must find new auditors, which could be costly and time-consuming, potentially disrupting their business operations. This places an enormous burden on affected companies, particularly those in regions where PwC had a dominant market share.

Impact on the Global Auditing Industry

The PwC scandal has far-reaching implications for the global auditing industry, potentially leading to significant reforms and increased scrutiny of auditing practices. This audit industry crisis has placed immense pressure on regulators to implement stronger oversight mechanisms and tighten ethical guidelines for all major audit firms.

-

Increased pressure for regulatory reform in the auditing sector: The scandal has ignited calls for stricter regulation, greater transparency, and enhanced oversight of audit firms globally. This could result in increased financial penalties for non-compliance and stricter enforcement of existing regulations.

-

Potential impact on the competitive landscape among other major audit firms (Deloitte, EY, KPMG): The fallout benefits competitors like Deloitte, EY, and KPMG, who may gain clients and market share as PwC restructures. However, the scandal also puts pressure on them to demonstrate their own ethical standards and robust internal controls.

-

Changes in client confidence and potential shifts in the market: The scandal has eroded client confidence in the auditing profession as a whole. Clients are likely to demand greater transparency and stricter compliance measures from their auditors.

-

The long-term effects of the scandal on public trust in audit firms: The long-term damage to public trust in auditing firms could be significant. Restoring that trust will require substantial reforms and demonstrable commitment to ethical conduct and rigorous regulatory compliance within the global audit sector.

PwC's Response and Future Outlook

PwC's response to the scandal has included public apologies, internal investigations, and promises of reform. The focus is now on damage control, reputation management, and preventing future incidents. PwC's recovery strategy hinges on regaining client trust and demonstrating a commitment to ethical conduct.

-

PwC's public statements and apologies: PwC has issued numerous public statements apologizing for the data breach and pledging to take corrective action. This is a crucial first step in attempting to mitigate the damage to their reputation and address stakeholder concerns.

-

Internal investigations and disciplinary actions taken: PwC has initiated internal investigations to determine the extent of the data breach and identify those responsible. Disciplinary actions, including dismissals, are anticipated.

-

Plans for rebuilding trust with clients and stakeholders: PwC's plan for rebuilding trust includes enhanced cybersecurity measures, stricter ethical guidelines, and increased transparency. It also involves significant investment in improving its internal controls and compliance programs.

-

Long-term strategies for preventing similar incidents: PwC will likely implement new technologies and processes to enhance data security, strengthen internal controls, and improve whistleblower protection. This is a crucial element to ensure the long-term stability of the firm and prevent the recurrence of such a damaging event.

Conclusion

The PwC scandal is a significant event with far-reaching consequences. The scale of PwC's withdrawal from over a dozen nations underscores the severity of the crisis and its impact on the global auditing industry. The scandal highlights the importance of ethical conduct, robust internal controls, and strong regulatory oversight. The long-term implications for the global financial system and the future of PwC itself remain to be seen. The PwC scandal serves as a stark reminder of the importance of ethical conduct and robust regulatory oversight in the auditing profession. Stay informed about future developments in the PwC scandal and its ongoing impact on the global business landscape by following reputable news sources and industry publications. Understanding the intricacies of the PwC scandal and its implications is crucial for all stakeholders in the global financial system.

Featured Posts

-

The King Of The Roadies Willie Nelson Pays Tribute In New Documentary

Apr 29, 2025

The King Of The Roadies Willie Nelson Pays Tribute In New Documentary

Apr 29, 2025 -

New York Times Pilots Deviation From Protocol Preceded Deadly Black Hawk Helicopter Crash In D C

Apr 29, 2025

New York Times Pilots Deviation From Protocol Preceded Deadly Black Hawk Helicopter Crash In D C

Apr 29, 2025 -

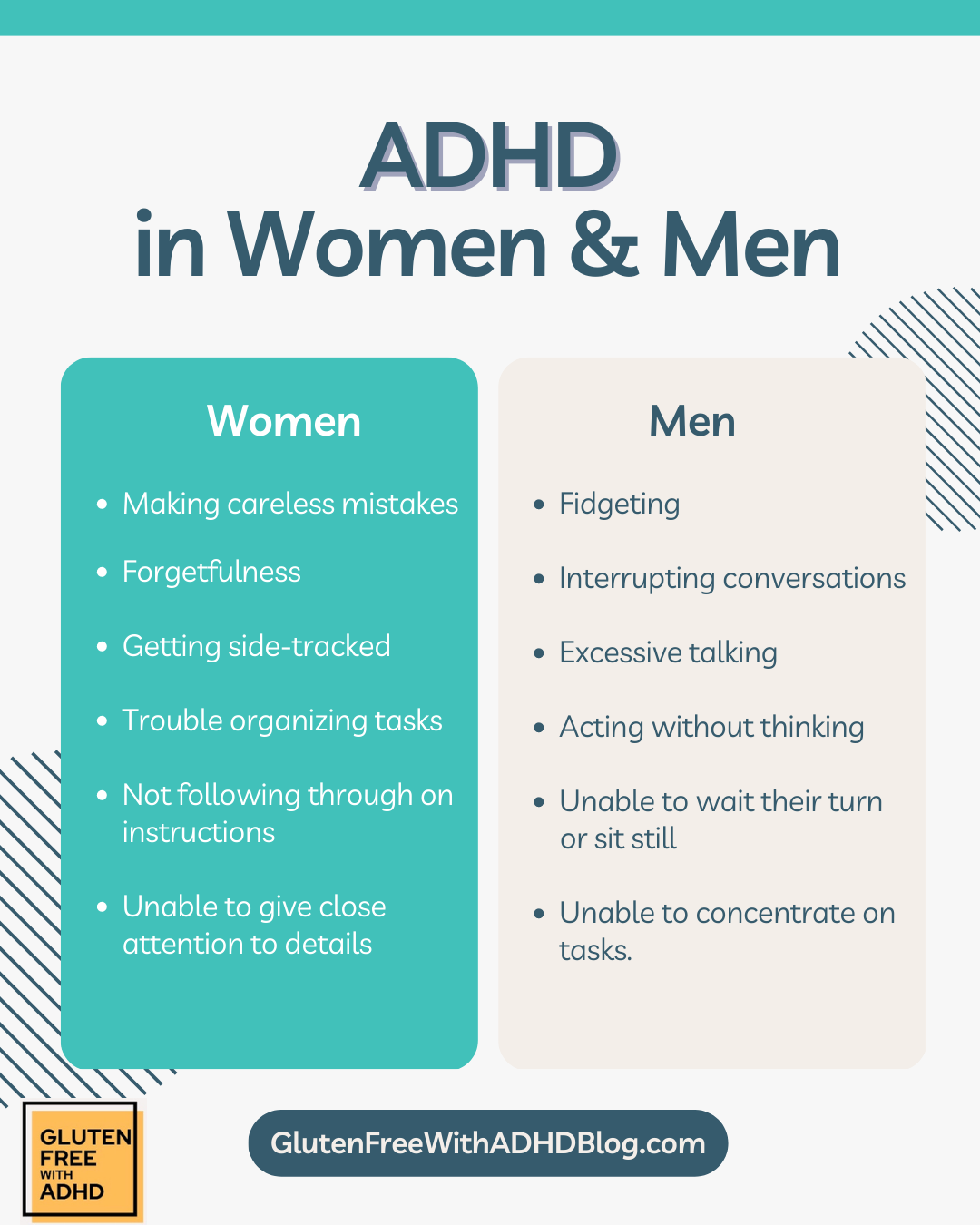

What To Do If You Think You Have Adult Adhd

Apr 29, 2025

What To Do If You Think You Have Adult Adhd

Apr 29, 2025 -

Convicted Cardinal Claims Entitlement To Vote For Next Pope

Apr 29, 2025

Convicted Cardinal Claims Entitlement To Vote For Next Pope

Apr 29, 2025 -

Rose Pardon A Comprehensive Look At Trumps Decision

Apr 29, 2025

Rose Pardon A Comprehensive Look At Trumps Decision

Apr 29, 2025

50 Godini Praznuva Lyubimetst Na Milioni

50 Godini Praznuva Lyubimetst Na Milioni