Saudi Arabia's ABS Market Opens: A Rule Change Bigger Than Spain's

Table of Contents

The Significance of the Saudi Arabia ABS Market Opening

Unprecedented Growth Potential

The Saudi Arabian economy presents a vast, largely untapped potential for securitization. Numerous sectors are ripe for utilizing ABS to unlock capital and fuel expansion.

- Significant growth in various sectors: Real estate, consumer finance, and infrastructure projects all offer substantial pools of eligible assets for securitization.

- Large pool of eligible assets: The Kingdom's robust economy and burgeoning population create a significant volume of assets suitable for ABS transactions.

- Potential for attracting foreign investment: The opening of the ABS market signals to international investors a commitment to transparency and regulatory modernization, attracting crucial foreign capital.

The ABS market offers a crucial mechanism for channeling capital into these high-growth sectors. By facilitating the efficient transfer of risk and providing access to diverse funding sources, ABS can significantly accelerate economic diversification and growth, directly supporting the objectives outlined in Saudi Vision 2030.

Comparison to Spain's ABS Market Liberalization

While Spain's ABS market liberalization spurred considerable growth, Saudi Arabia's potential is arguably even greater. This stems from several key factors:

- Size of the potential market: Saudi Arabia boasts a significantly larger economy and a more extensive range of securitizable assets than Spain did at the time of its liberalization.

- Speed of adoption: The Kingdom's proactive regulatory approach suggests a potentially faster adoption rate compared to Spain's experience.

- Impact on economic growth: The potential contribution of ABS to Saudi Arabia's GDP growth could be substantial, considering the size and diversification of its economy.

- Regulatory framework differences: While both countries aim for efficient markets, Saudi Arabia's framework might benefit from lessons learned in Spain, resulting in a more refined and robust regulatory environment.

Data comparisons, while still nascent for the Saudi market, suggest a considerably larger scale and faster potential growth trajectory for the Saudi Arabian ABS market than its Spanish counterpart.

Key Regulatory Changes Driving the Market

New Regulations and Frameworks

The Capital Markets Authority (CMA) in Saudi Arabia has implemented crucial regulatory changes to facilitate the ABS market's launch:

- Changes to the Capital Markets Authority (CMA) regulations: These changes introduced clearer guidelines for ABS issuance, listing, and trading.

- New licensing requirements: Specific licenses and approvals are now in place for entities involved in the issuance and management of ABS.

- Framework for issuance and listing of ABS: A robust and transparent framework has been established, promoting market integrity and investor protection.

These regulations aim to establish a transparent, efficient, and internationally competitive market for ABS, attracting both domestic and international participation. This increased transparency is vital for building confidence and attracting crucial foreign investment.

Implications for Islamic Finance

The adaptation of ABS structures to comply with Sharia principles is a critical aspect of the Saudi Arabian ABS market's success:

- Development of Sharia-compliant ABS structures: Significant effort has been devoted to structuring ABS that adhere to Islamic finance principles.

- Opportunities for Islamic banks and financial institutions: The market opens vast opportunities for Islamic banks to expand their product offerings and tap into new sources of funding.

- Potential for attracting further Islamic investment: This compliance attracts significant investment from Islamic financial institutions globally, further bolstering the market's growth.

The integration of Sharia-compliant ABS represents a significant milestone in promoting ethical and sustainable finance within the Kingdom, attracting a substantial global pool of investors committed to responsible investing.

Opportunities and Challenges for Investors and Businesses

Opportunities for Investors

The Saudi Arabia ABS market presents significant opportunities for investors, both domestic and international:

- Higher potential returns compared to traditional investment options: ABS offer the potential for attractive returns, diversifying investment portfolios.

- Diversification opportunities: The range of underlying assets creates opportunities to diversify investment portfolios beyond traditional asset classes.

- Access to a previously untapped market: The Saudi Arabian ABS market offers exposure to a dynamic and rapidly developing economy.

Investors can employ various strategies, from direct investment in ABS to investing in funds that focus on the Saudi Arabian market, leveraging the opportunities presented by this new asset class.

Challenges and Mitigation Strategies

While the potential is immense, certain challenges need to be addressed:

- Developing a robust secondary market: Establishing a liquid secondary market is crucial for enhancing investor confidence and facilitating efficient trading.

- Building investor confidence: Sustained efforts are needed to educate investors and build trust in the market's transparency and efficiency.

- Managing credit risk: Robust credit assessment and risk management frameworks are crucial to mitigate potential losses.

- Dealing with potential regulatory uncertainties: Continuous monitoring and adaptation to evolving regulatory landscapes are necessary.

Mitigation strategies include government initiatives supporting market development, investor education programs, and the establishment of robust credit rating agencies. Addressing these challenges proactively will be instrumental in fostering a sustainable and thriving ABS market.

Conclusion

The opening of Saudi Arabia's ABS market represents a transformative shift in the Kingdom's financial landscape, potentially surpassing the impact of Spain's ABS market liberalization. Key regulatory changes, alongside the integration of Sharia-compliant structures, have paved the way for unprecedented growth. While challenges remain, the potential for investors and businesses is immense, offering significant opportunities for diversification and higher returns. Explore the opportunities in the burgeoning Saudi Arabia ABS market and learn more about Saudi Arabia's revolutionary Asset-Backed Securities market. Invest in Saudi Arabia's rapidly growing ABS sector and be a part of this exciting economic transformation.

Featured Posts

-

France Russie Macron Promet Une Pression Renforcee Sur Moscou

May 03, 2025

France Russie Macron Promet Une Pression Renforcee Sur Moscou

May 03, 2025 -

Police Investigate Mp Rupert Lowe Latest Updates

May 03, 2025

Police Investigate Mp Rupert Lowe Latest Updates

May 03, 2025 -

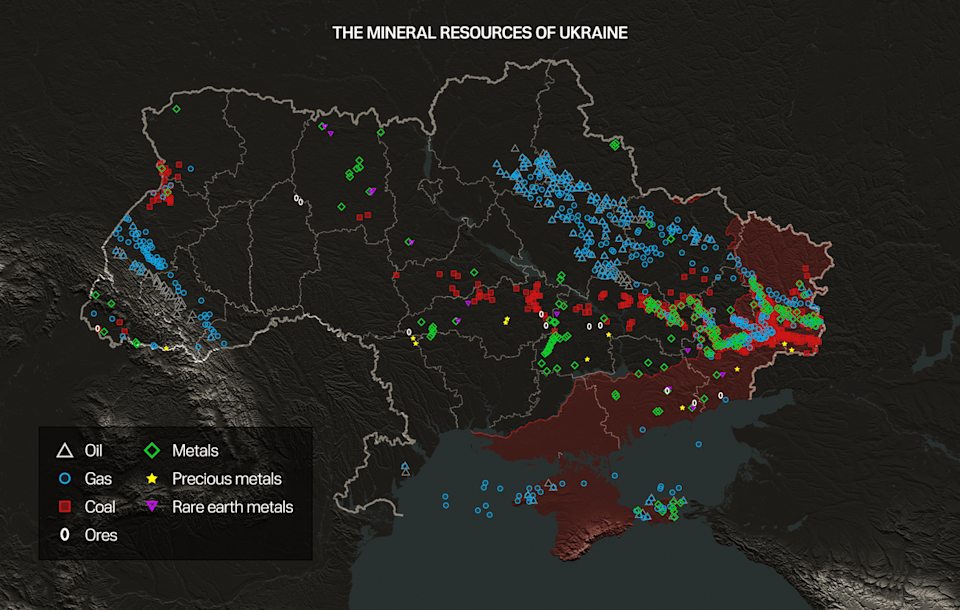

Ukraine Us Rare Earth Mineral Deal A Strategic Economic Partnership

May 03, 2025

Ukraine Us Rare Earth Mineral Deal A Strategic Economic Partnership

May 03, 2025 -

Macau Casinos Outperform Expectations Ahead Of Golden Week

May 03, 2025

Macau Casinos Outperform Expectations Ahead Of Golden Week

May 03, 2025 -

Christina Aguileras New Video A Jaw Dropping Transformation That Defies Age

May 03, 2025

Christina Aguileras New Video A Jaw Dropping Transformation That Defies Age

May 03, 2025