Saudi Arabia: SABIC Eyes Initial Public Offering For Gas Operations

Table of Contents

Strategic Rationale Behind the SABIC IPO

The decision to pursue a SABIC IPO for its gas operations aligns perfectly with Saudi Arabia's ambitious Vision 2030. This national transformation program aims to diversify the Kingdom's economy, reducing its dependence on oil revenue and fostering sustainable long-term growth. The SABIC IPO is a key component of this strategy.

By opening its gas operations to public investment, Saudi Arabia seeks to attract significant foreign direct investment (FDI). This influx of capital can be channeled into further developing the energy sector and other key industries, stimulating economic diversification. The IPO also offers several other strategic advantages:

- Increased transparency and accountability: A public listing enhances corporate governance and transparency, building confidence among investors.

- Access to capital markets for future investments: The proceeds from the SABIC IPO can fuel future growth and expansion within the company.

- Enhanced corporate governance: The requirements for public listing will strengthen SABIC's corporate governance structures.

- Attracting international expertise: The IPO will attract a wider range of investors, including those with valuable international expertise in the energy sector.

Details of the Planned SABIC Gas Operations IPO

While precise details are still emerging, the planned SABIC gas operations IPO is expected to be substantial. The size and valuation will depend on several factors, including market conditions and investor appetite. Speculation suggests a significant percentage of shares will be offered to the public, although the exact figure remains undisclosed. A targeted timeline for the IPO launch is yet to be officially confirmed.

Key aspects of the planned SABIC IPO include:

- Expected listing venue: The Tadawul, Saudi Arabia's stock exchange, is the most likely primary listing venue, although a dual listing on an international exchange is also a possibility.

- Potential underwriters and advisors: Several prominent investment banks are expected to be involved as underwriters and advisors for the IPO. Their selection will be crucial in ensuring a successful offering.

- Regulatory approvals required: The IPO will require approval from the Capital Market Authority (CMA) of Saudi Arabia and other relevant regulatory bodies.

- Expected proceeds from the IPO and their intended use: The proceeds will likely be used to fund further expansion and development within SABIC's gas operations, and potentially to support broader diversification initiatives within the Kingdom.

Impact and Implications of the SABIC IPO on the Saudi Arabian Economy

The SABIC IPO is poised to have a significant positive impact on the Saudi Arabian economy. It will likely boost the market capitalization of the Tadawul, attracting more domestic and international investors. Increased trading activity could strengthen the Saudi Riyal and contribute to greater financial market depth and liquidity.

The broader economic implications include:

- Increased market capitalization of the Tadawul: The inclusion of SABIC's gas operations will significantly boost the size and attractiveness of the Tadawul.

- Strengthening of the Saudi Riyal: Increased foreign investment flows associated with the IPO could support the Saudi Riyal's exchange rate.

- Potential for spin-off effects on related industries: The success of the SABIC IPO could stimulate growth and investment in related industries within the Saudi Arabian economy.

- Long-term implications for energy security: The IPO contributes to a more diversified and resilient energy sector, improving long-term energy security for the Kingdom.

Global Market Response and Competitive Landscape

The SABIC IPO is expected to attract considerable interest from global investors seeking exposure to a major player in the energy sector. SABIC's substantial gas assets, coupled with the growth potential of the Saudi Arabian market, make this IPO an attractive proposition. However, the competitive landscape post-IPO will require careful analysis.

Several factors will influence the global market response:

- Attractiveness of SABIC's gas assets to international investors: The size, quality, and profitability of SABIC's gas assets are key determinants of investor interest.

- Comparison with similar IPOs in the energy sector: The success of the SABIC IPO will be benchmarked against other significant energy sector IPOs.

- Analysis of potential risks and challenges: Investors will carefully assess the potential risks and challenges associated with the investment, including geopolitical factors and regulatory changes.

- Opportunities for strategic partnerships: The IPO may also facilitate the formation of strategic partnerships between SABIC and other global energy players.

Conclusion

The SABIC IPO represents a pivotal moment for both Saudi Arabia and the global energy market. By strategically offering shares in its gas operations, the Kingdom aims to achieve its Vision 2030 goals, attract significant foreign investment, and further diversify its economy away from its reliance on oil. The success of this SABIC IPO will have wide-ranging implications for investors, the Saudi Arabian economy, and the global energy landscape. To stay updated on the latest news and analysis regarding the SABIC IPO and its impact on the global energy market, continue to follow reputable financial news sources and monitor the progress of this landmark event. Understanding the intricacies of this SABIC IPO will be key for investors seeking opportunities in the evolving global energy landscape.

Featured Posts

-

Libyas Prime Minister Addresses Growing Militia Threat Following Tripoli Protests

May 19, 2025

Libyas Prime Minister Addresses Growing Militia Threat Following Tripoli Protests

May 19, 2025 -

Legendary Singer Johnny Mathis Announces Retirement From Touring

May 19, 2025

Legendary Singer Johnny Mathis Announces Retirement From Touring

May 19, 2025 -

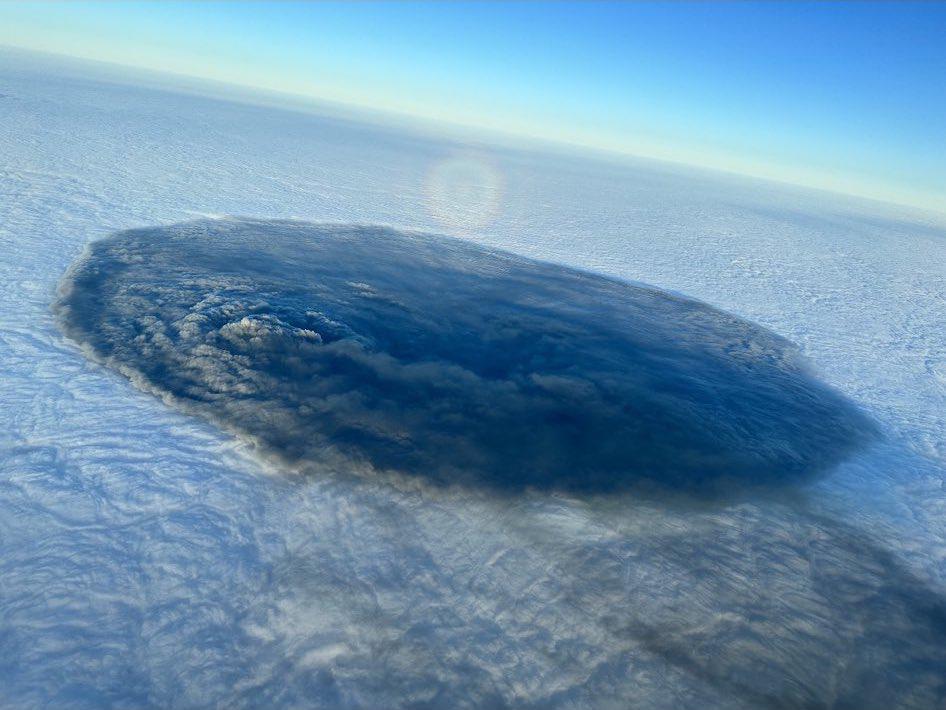

The Lingering Threat Toxic Chemical Contamination From The Ohio Train Derailment

May 19, 2025

The Lingering Threat Toxic Chemical Contamination From The Ohio Train Derailment

May 19, 2025 -

Mohawk Council Faces 220 Million Lawsuit From Kahnawake Casino

May 19, 2025

Mohawk Council Faces 220 Million Lawsuit From Kahnawake Casino

May 19, 2025 -

Analyse Financiere Credit Mutuel Am Saison Des Resultats Q4 2024

May 19, 2025

Analyse Financiere Credit Mutuel Am Saison Des Resultats Q4 2024

May 19, 2025