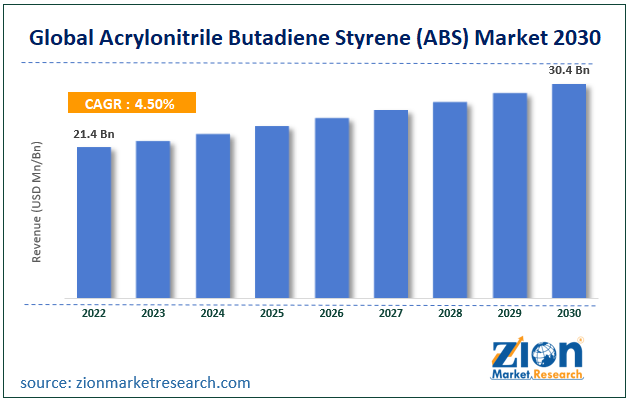

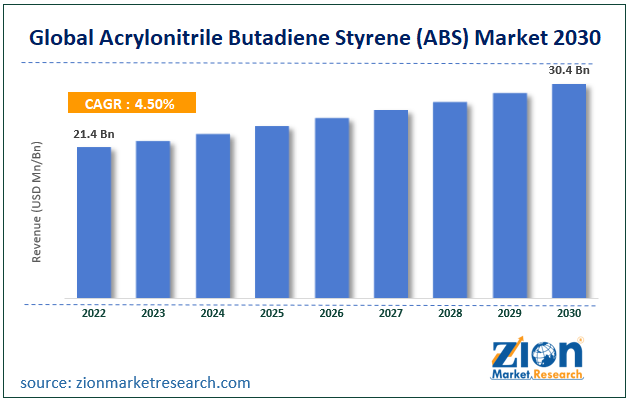

Saudi ABS Market Transformation: A Rule Change With Far-Reaching Impact

Table of Contents

The New Regulations: A Deep Dive

The newly implemented regulations governing the Saudi ABS market represent a comprehensive overhaul designed to enhance transparency, strengthen investor protection, and foster greater market efficiency. These changes aim to address previous limitations that hindered the growth of the ABS market in Saudi Arabia. The core objectives are to increase market depth and liquidity, attract more international investors, and facilitate broader access to credit for businesses and individuals.

The specific changes introduced include:

- Changes to Issuance Requirements: Streamlined processes and reduced bureaucratic hurdles have made it easier and faster to issue ABS in Saudi Arabia. This includes easing requirements for documentation and collateral verification.

- New Disclosure Standards: More stringent disclosure requirements mandate greater transparency in the underlying assets and the performance of the ABS. This increased transparency aims to attract more sophisticated investors.

- Impact on Credit Rating Agencies: The new regulations have strengthened the role and oversight of credit rating agencies, leading to more robust and reliable credit assessments.

- Amendments to Investor Protection Mechanisms: Enhanced investor protection measures aim to safeguard the interests of investors in the Saudi ABS market, minimizing risk and boosting confidence. This includes clearer guidelines on investor rights and dispute resolution.

The rationale behind these changes is clear: to create a more robust, transparent, and attractive ABS market that can better serve the needs of the Saudi economy and its investors. The ultimate goal is to foster economic growth and development by promoting greater access to capital.

Impact on Market Players: Opportunities and Challenges

The Saudi ABS market transformation presents both significant opportunities and challenges for various market participants.

Opportunities:

- Issuers: Easier access to capital at potentially lower costs, leading to improved business expansion and development.

- Investors: A wider range of investment opportunities with potentially higher returns, accompanied by increased transparency and investor protection.

- Underwriters: Increased deal flow and potentially higher fees, driven by the growth of the ABS market.

- Rating Agencies: Greater demand for their services, resulting in increased business volume and revenue.

Challenges:

- Increased Compliance Costs: Meeting the more stringent regulatory requirements might lead to increased compliance costs for issuers, underwriters, and other market participants.

- Adapting to New Regulations: Market players will need time and resources to adapt their processes and systems to comply with the new regulations.

- Potential for Short-Term Market Volatility: The initial period following the regulatory changes might see some short-term market volatility as participants adjust to the new landscape.

Economic Implications: Growth and Development

The transformation of the Saudi ABS market holds profound implications for the Saudi economy. Increased access to credit facilitated by the expanded ABS market can catalyze growth in various sectors.

- Real Estate: ABS can provide much-needed financing for real estate development projects, fueling economic growth and creating jobs.

- Infrastructure: The development of crucial infrastructure projects can benefit significantly from ABS financing, boosting long-term economic development.

- Foreign Investment: A more transparent and efficient ABS market will attract increased foreign investment, injecting much-needed capital into the Saudi economy.

- Capital Market Sophistication: The development of a more sophisticated and liquid ABS market strengthens the overall Saudi capital market, enhancing its global competitiveness.

Future Outlook: Predictions and Trends

The long-term effects of these new regulations are promising. We anticipate a significant expansion of the Saudi ABS market, attracting both domestic and international investors. Future trends could include:

- Increased securitization of various asset classes: Beyond traditional assets, we expect to see an increase in securitization of more diverse asset classes.

- Greater participation of international investors: The improved transparency and investor protection will draw significant interest from global investors.

- Development of specialized ABS products: We anticipate the creation of more sophisticated and tailored ABS products to meet the diverse needs of the market.

However, challenges remain, including the need for ongoing monitoring of market behavior and potential adjustments to the regulatory framework as the market evolves. Further regulatory changes focusing on specific aspects of the ABS market might be introduced to ensure its continued growth and stability.

Navigating the Saudi ABS Market Transformation

The Saudi ABS market transformation presents a unique opportunity for growth and investment. This comprehensive overhaul of regulations aims to create a more efficient, transparent, and attractive market. While challenges remain, the potential rewards for those who adapt and understand the new landscape are considerable. To capitalize on these opportunities, it is crucial to stay informed about the latest developments and adjust strategies accordingly. For a more in-depth analysis of the changes and their potential impact, consult [link to relevant resources/reports]. Understanding the dynamics of this evolving market is key to successful navigation within the transformed Saudi ABS market.

Featured Posts

-

Is The Eco Flow Wave 3 The Best Portable Climate Control Solution A Review

May 03, 2025

Is The Eco Flow Wave 3 The Best Portable Climate Control Solution A Review

May 03, 2025 -

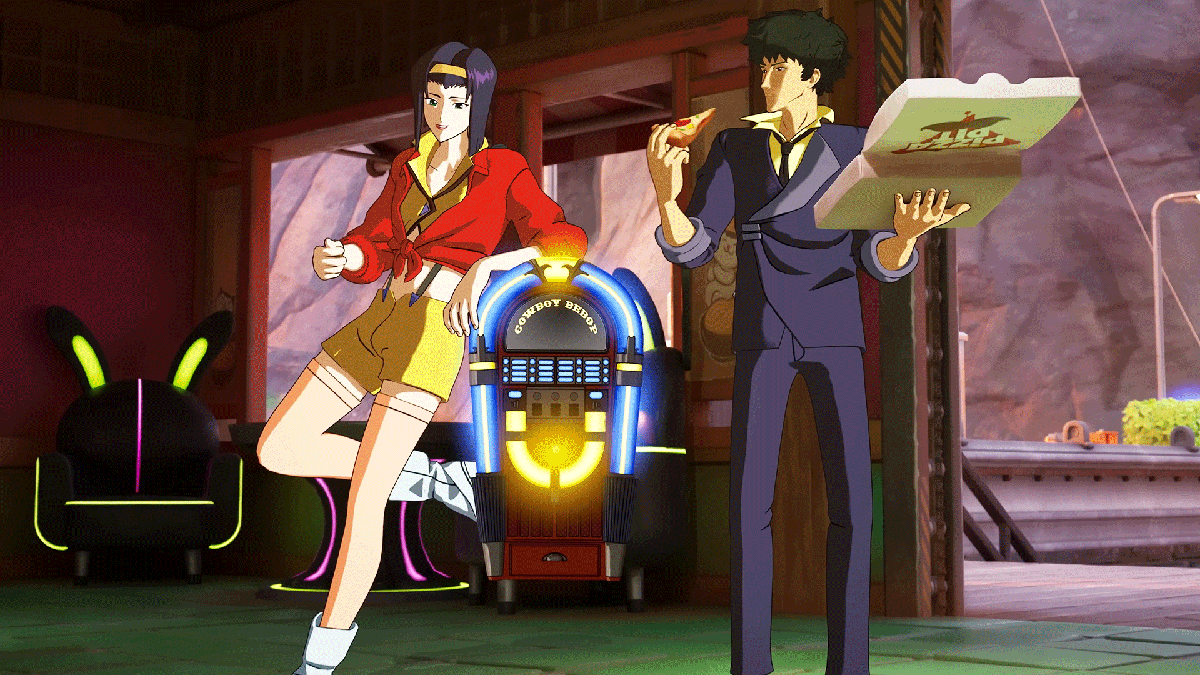

Claim Your Free Cowboy Bebop Loot In Fortnite Act Fast

May 03, 2025

Claim Your Free Cowboy Bebop Loot In Fortnite Act Fast

May 03, 2025 -

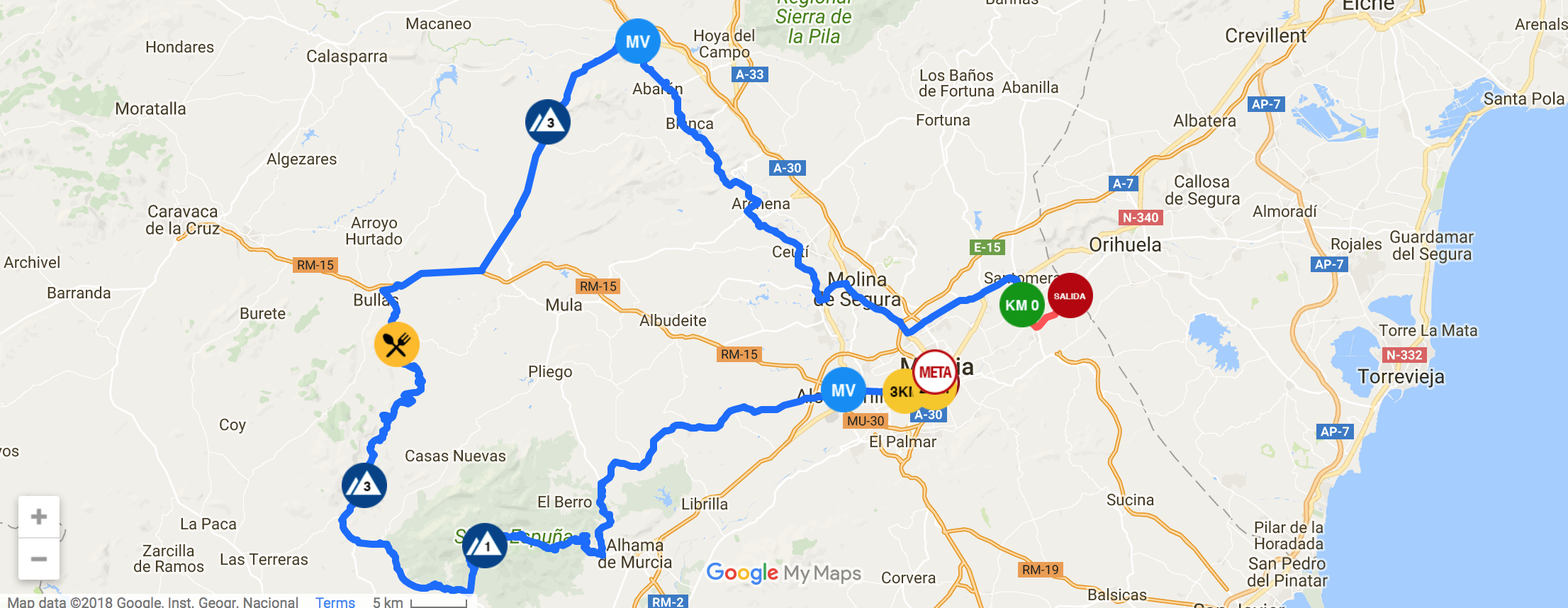

45 Vuelta Ciclista A Murcia El Suizo Christen Se Lleva La Victoria

May 03, 2025

45 Vuelta Ciclista A Murcia El Suizo Christen Se Lleva La Victoria

May 03, 2025 -

Dari Sampah Menjadi Harta Petunjuk Lengkap Mengolah Cangkang Telur Untuk Tanaman Dan Hewan

May 03, 2025

Dari Sampah Menjadi Harta Petunjuk Lengkap Mengolah Cangkang Telur Untuk Tanaman Dan Hewan

May 03, 2025 -

Mittwoch Lotto 6aus49 9 4 2025 Alle Gewinnzahlen Im Ueberblick

May 03, 2025

Mittwoch Lotto 6aus49 9 4 2025 Alle Gewinnzahlen Im Ueberblick

May 03, 2025