Saudi ABS Market: A Post-Regulation Analysis

Table of Contents

Regulatory Changes and Their Impact on the Saudi ABS Market

The introduction of new regulations has fundamentally reshaped the Saudi ABS market. These changes aim to enhance transparency, mitigate risks, and foster a more robust and attractive investment environment.

New Regulations and Their Objectives

The Saudi Arabian Monetary Authority (SAMA) has implemented several key regulations aimed at modernizing the ABS market. These objectives include:

- Increased Transparency: Improving the disclosure of information to investors.

- Risk Mitigation: Strengthening risk management practices for issuers.

- Investor Protection: Enhancing the safeguards for investors participating in the market.

Key regulations introduced include:

- Amendments to the Capital Market Law: These amendments address issues related to issuance, disclosure, and trading of ABS.

- New SAMA Circulars: These circulars provide detailed guidelines on various aspects of ABS transactions, including due diligence and reporting requirements.

- Enhanced Rating Requirements: Stricter rating criteria are now in place to ensure the creditworthiness of issued ABS.

These regulations aim to create a more standardized and regulated environment for Saudi ABS, attracting both domestic and international investors.

Impact on Market Liquidity and Transaction Volumes

The impact of these regulations on market liquidity and transaction volumes is a key area of analysis. While initial data may show a temporary slowdown, the long-term effects are expected to be positive.

- Pre-Regulation: Transaction volumes were relatively low, hindered by a lack of transparency and standardized practices.

- Post-Regulation: While precise figures require further time to compile, early indicators suggest an increase in transaction volume and improved market liquidity.

The regulatory changes have fostered greater confidence among investors, both domestic and international, leading to increased participation in the Saudi ABS market. This increased participation is further expected to boost liquidity in the long term.

Enhanced Transparency and Disclosure Requirements

The new regulations have significantly improved transparency and disclosure standards within the Saudi ABS market.

- Standardized Reporting: Issuers are now required to adhere to standardized reporting formats, making it easier to compare and analyze different ABS offerings.

- Improved Data Accessibility: Enhanced data accessibility through centralized platforms improves investor access to crucial information.

- Clearer Disclosure Guidelines: More detailed guidelines on required disclosures ensure investors are better informed about the risks associated with ABS investments.

These improvements have increased investor confidence, enabling better risk assessment and informed decision-making, ultimately contributing to a healthier and more efficient Saudi ABS market.

Investor Sentiment and Market Participation Post-Regulation

The regulatory changes have influenced investor sentiment and participation in the Saudi ABS market in several ways.

Changes in Investor Base

The regulatory reforms are attracting a broader range of investors.

- Increased Institutional Participation: Institutional investors, including banks and insurance companies, are increasingly participating due to improved transparency and risk mitigation.

- Growing International Interest: International investors are showing increased interest in the Saudi ABS market, attracted by the improved regulatory framework and the Kingdom's economic growth potential.

- Shifting Investment Strategies: Investors are adopting longer-term investment strategies due to the increased stability and transparency in the market.

Impact on Investment Strategies

Investor strategies have adapted to the new regulatory environment.

- Risk Appetite: Investors are exhibiting a more calculated risk appetite, focusing on due diligence and thorough risk assessments.

- Investment Horizons: Longer-term investment strategies are becoming more prevalent due to the enhanced stability provided by the regulations.

- Diversification: The Saudi ABS market is increasingly seen as a tool for portfolio diversification, offering attractive returns while mitigating risks.

Increased Investor Confidence

The new regulations have noticeably boosted investor confidence in the Saudi ABS market.

- Improved Credit Ratings: Improved credit ratings of ABS issuers reflect the positive impact of the regulations on risk management.

- Higher Investment Flows: Increased investment flows indicate growing investor trust and confidence in the market's stability and growth potential.

- Positive Market Sentiment: A more positive market sentiment is evidenced by increased trading activity and overall market stability.

Future Outlook and Growth Potential of the Saudi ABS Market

The Saudi ABS market presents significant growth opportunities and potential for future expansion.

Opportunities for Growth

Several factors contribute to the market's potential for growth.

- Infrastructure Development: Large-scale infrastructure projects create a significant demand for ABS financing.

- Economic Diversification: The Kingdom's economic diversification initiatives provide ample opportunities for ABS issuance across various sectors.

- Financial Innovation: The development of new ABS products and structures will further drive market growth.

Challenges and Risks

Despite its potential, the Saudi ABS market still faces certain challenges.

- Economic Volatility: Global economic conditions can influence investor sentiment and market stability.

- Geopolitical Factors: Geopolitical events can impact investor confidence and market activity.

- Competition: Competition from other asset classes and regional markets remains a challenge.

Effective risk management and proactive adaptation to changing market dynamics are crucial for sustaining growth.

Role of Technology and Innovation

Technology is playing an increasingly important role in the Saudi ABS market.

- Blockchain Technology: Blockchain can enhance transparency and efficiency in ABS transactions.

- Artificial Intelligence: AI can improve risk assessment and credit scoring.

- Data Analytics: Data analytics can improve investment decision-making and market forecasting.

The adoption of these technologies will drive efficiency, transparency, and accessibility within the Saudi ABS market.

Conclusion

This post-regulation analysis of the Saudi ABS market highlights the significant positive changes brought about by new regulations. While challenges remain, the improvements in transparency, investor confidence, and the potential for growth offer a positive outlook for the future. The Saudi ABS market presents exciting opportunities for investors and issuers alike, with potential for considerable expansion and contribution to the Kingdom’s economic diversification strategy. To stay informed about the latest developments and opportunities within the dynamic Saudi ABS market, continue to follow our research and analysis.

Featured Posts

-

Play Station Network Outage Sony Offers Free Credit To Affected Users

May 02, 2025

Play Station Network Outage Sony Offers Free Credit To Affected Users

May 02, 2025 -

Daily Lotto Results Thursday 17th April 2025

May 02, 2025

Daily Lotto Results Thursday 17th April 2025

May 02, 2025 -

Bbc Two Hd Programme Guide Newsround

May 02, 2025

Bbc Two Hd Programme Guide Newsround

May 02, 2025 -

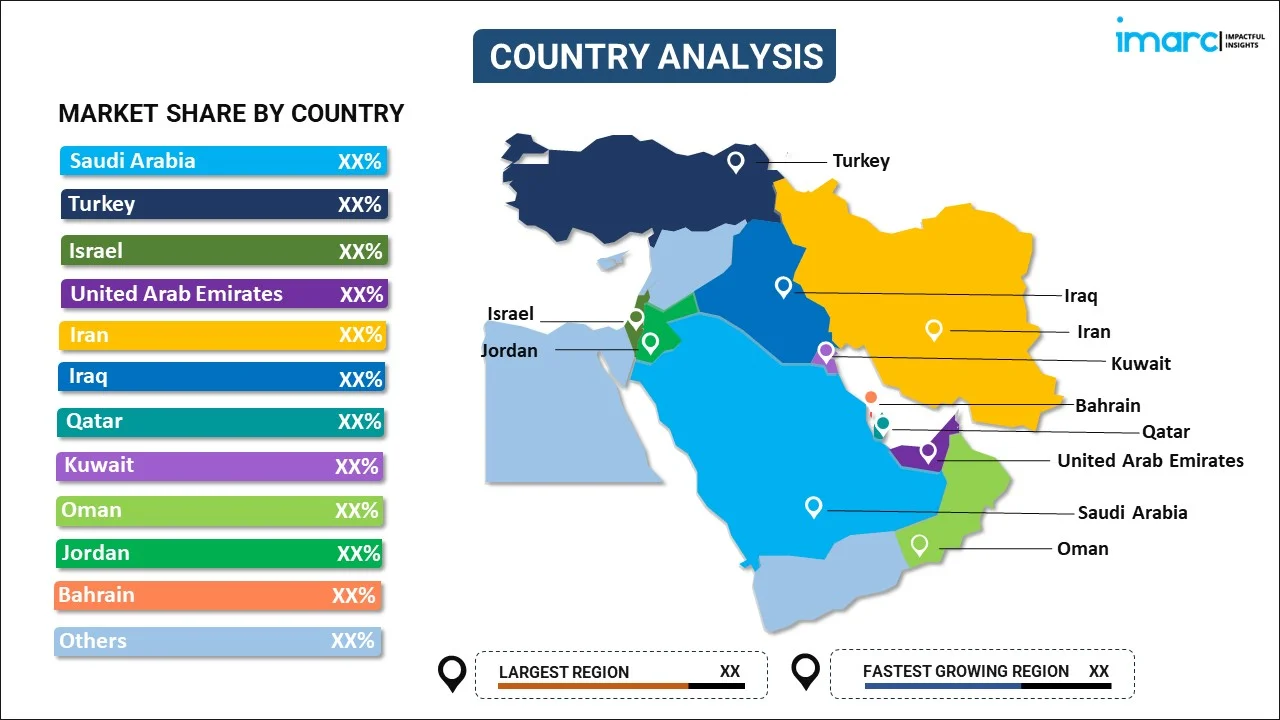

Middle East Luxury Resort Development Balsillie Golf Venture And Saudi Partner

May 02, 2025

Middle East Luxury Resort Development Balsillie Golf Venture And Saudi Partner

May 02, 2025 -

Remembering Priscilla Pointer A Career Retrospective Following Her Death

May 02, 2025

Remembering Priscilla Pointer A Career Retrospective Following Her Death

May 02, 2025