Sasol's 2023 Strategy Update: What Investors Need To Know

Table of Contents

Financial Performance and Outlook

Sasol's recent financial results reveal a complex picture. Analyzing Sasol's financial performance requires examining key metrics such as revenue, profit margins, and debt levels. While specific numbers will vary depending on the released financial statements, investors should focus on trends. For example, did Sasol revenue show growth in specific sectors, or were there declines in certain areas due to market fluctuations or operational challenges? Understanding the drivers behind these trends is crucial for assessing Sasol's earnings and profitability.

Sasol's projected financial outlook for the coming year is equally important. The company's growth expectations and the potential challenges they face will directly impact the Sasol stock price and shareholder returns. Factors like global energy prices, geopolitical instability, and the ongoing energy transition all play a role. A thorough understanding of these factors is vital for a complete Sasol investment analysis. Furthermore, the company's dividend policy is a key factor for many investors. Changes to Sasol's dividend payouts will significantly influence the attractiveness of Sasol as an investment.

- Revenue growth of X% (replace X with actual data)

- Profit margin increase of Y% (replace Y with actual data)

- Debt reduction target of Z% (replace Z with actual data)

Energy Transition and Sustainability Initiatives

Sasol's commitment to sustainability and its strategy for navigating the energy transition are pivotal for long-term success and investor confidence. The company's approach to decarbonization and the reduction of greenhouse gas emissions are closely scrutinized by ESG (environmental, social, and governance) investors. Sasol's investments in renewable energy sources, low-carbon fuels, and related technologies are key aspects of its transition strategy. Analyzing the progress made towards Sasol's sustainability targets, such as reducing emissions by a specific percentage by a given year, will provide insights into the company's commitment to a sustainable future.

The success of Sasol's energy transition will significantly influence investor sentiment. Investors are increasingly prioritizing ESG factors, and Sasol's performance in this area will directly impact the perception of the company's long-term viability and its ability to attract future investments. Further examination into Sasol's specific renewable energy projects and partnerships will provide a clearer picture of its long-term strategy.

- Target to reduce emissions by X% by 2030 (replace X with actual data)

- Investment in Y renewable energy project (replace Y with actual data)

Operational Efficiency and Strategic Priorities

Sasol's operational efficiency and cost-reduction strategies are crucial for maintaining profitability in a competitive market. Analyzing improvements in production processes, supply chain management, and resource utilization will reveal the company's success in optimizing operations. The company's strategic priorities, including growth plans and market expansion initiatives, offer insights into Sasol's future direction. Investors should examine the effectiveness of Sasol's innovation efforts and their potential to drive future growth. Finally, understanding Sasol's risk management strategies and their effectiveness in mitigating potential challenges is essential for a comprehensive assessment.

- Optimization of production processes leading to X% increase in efficiency (replace X with actual data)

- Launch of new product line targeting Y market (replace Y with actual data)

Impact on Investors and Investment Opportunities

Sasol's 2023 strategy update has significant implications for investors. The analysis of the potential impact on the Sasol share price and overall valuation is a critical aspect of any investment decision. The updated strategy provides a framework for assessing the long-term growth potential of Sasol and the associated investment opportunities. However, investors must also carefully consider the risks and uncertainties associated with investing in Sasol, including market volatility and the challenges inherent in the energy transition. Based on the updated strategy, investors can make informed decisions, potentially capitalizing on attractive investment opportunities while mitigating potential risks.

- Potential for share price appreciation based on X factor (replace X with actual data)

- Risks associated with Y market conditions (replace Y with actual data)

Conclusion

Sasol's 2023 strategy update presents a complex picture for investors. Careful consideration of the financial outlook, energy transition plans, and operational improvements is necessary for making informed investment decisions. The company's success in navigating the energy transition and improving operational efficiency will be key drivers of future performance. For a deeper understanding of Sasol's strategy and its implications, investors should consult Sasol's investor relations materials and stay updated on future Sasol strategy updates to make the most informed decisions regarding your Sasol investments.

Featured Posts

-

Its A Girl Peppa Pigs Family Grows

May 21, 2025

Its A Girl Peppa Pigs Family Grows

May 21, 2025 -

Trans Australia Run Challenging The Existing World Record

May 21, 2025

Trans Australia Run Challenging The Existing World Record

May 21, 2025 -

Solve The Nyt Mini Crossword Answers For March 18 2025

May 21, 2025

Solve The Nyt Mini Crossword Answers For March 18 2025

May 21, 2025 -

Dexter New Blood Sequel Trailer Release Date Hints

May 21, 2025

Dexter New Blood Sequel Trailer Release Date Hints

May 21, 2025 -

The New Mexico Gop Arson Attack A Look At Abc Cbs And Nbcs Reporting

May 21, 2025

The New Mexico Gop Arson Attack A Look At Abc Cbs And Nbcs Reporting

May 21, 2025

Latest Posts

-

Winter Weather Advisory Planning For School Cancellations And Delays

May 21, 2025

Winter Weather Advisory Planning For School Cancellations And Delays

May 21, 2025 -

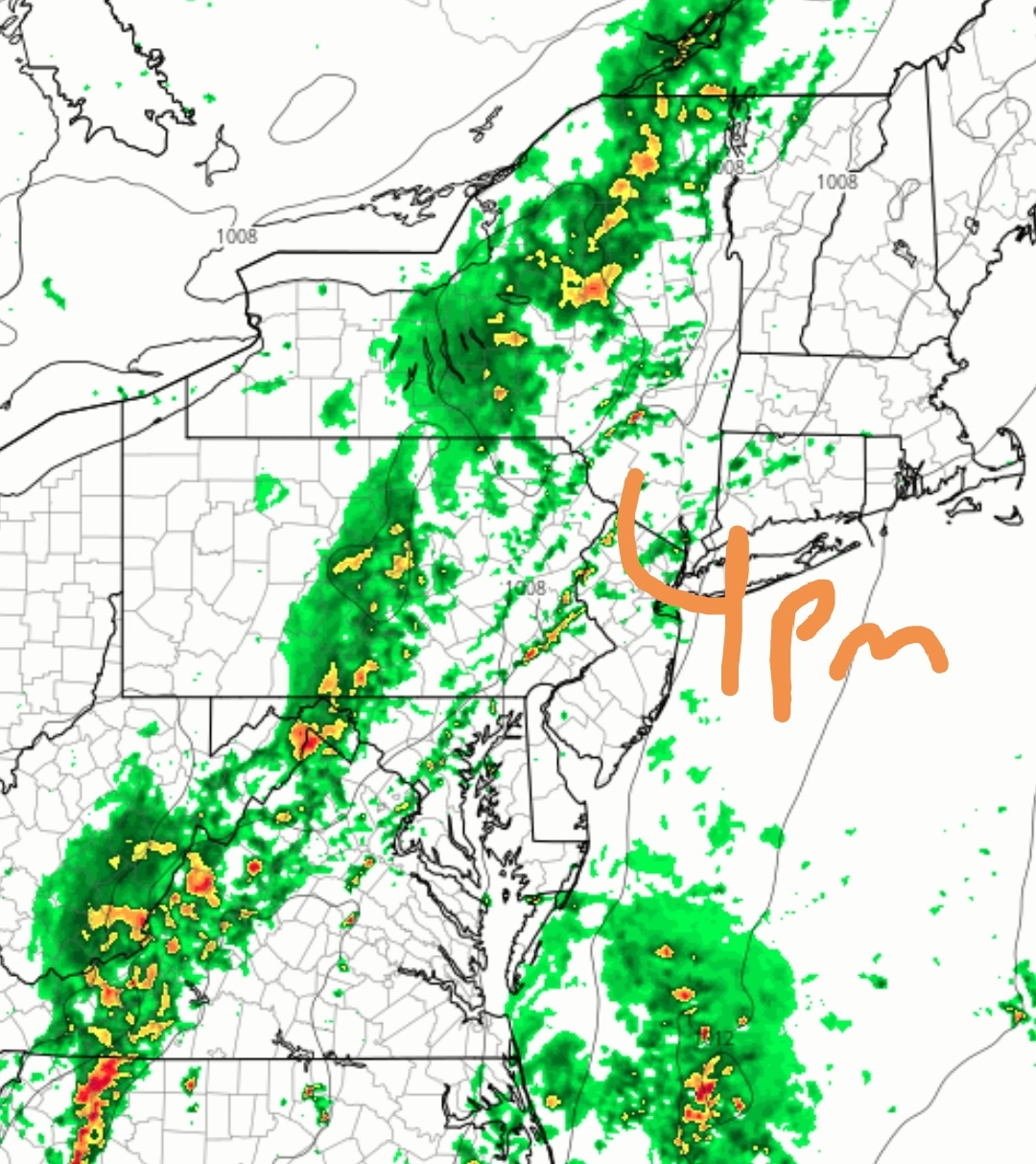

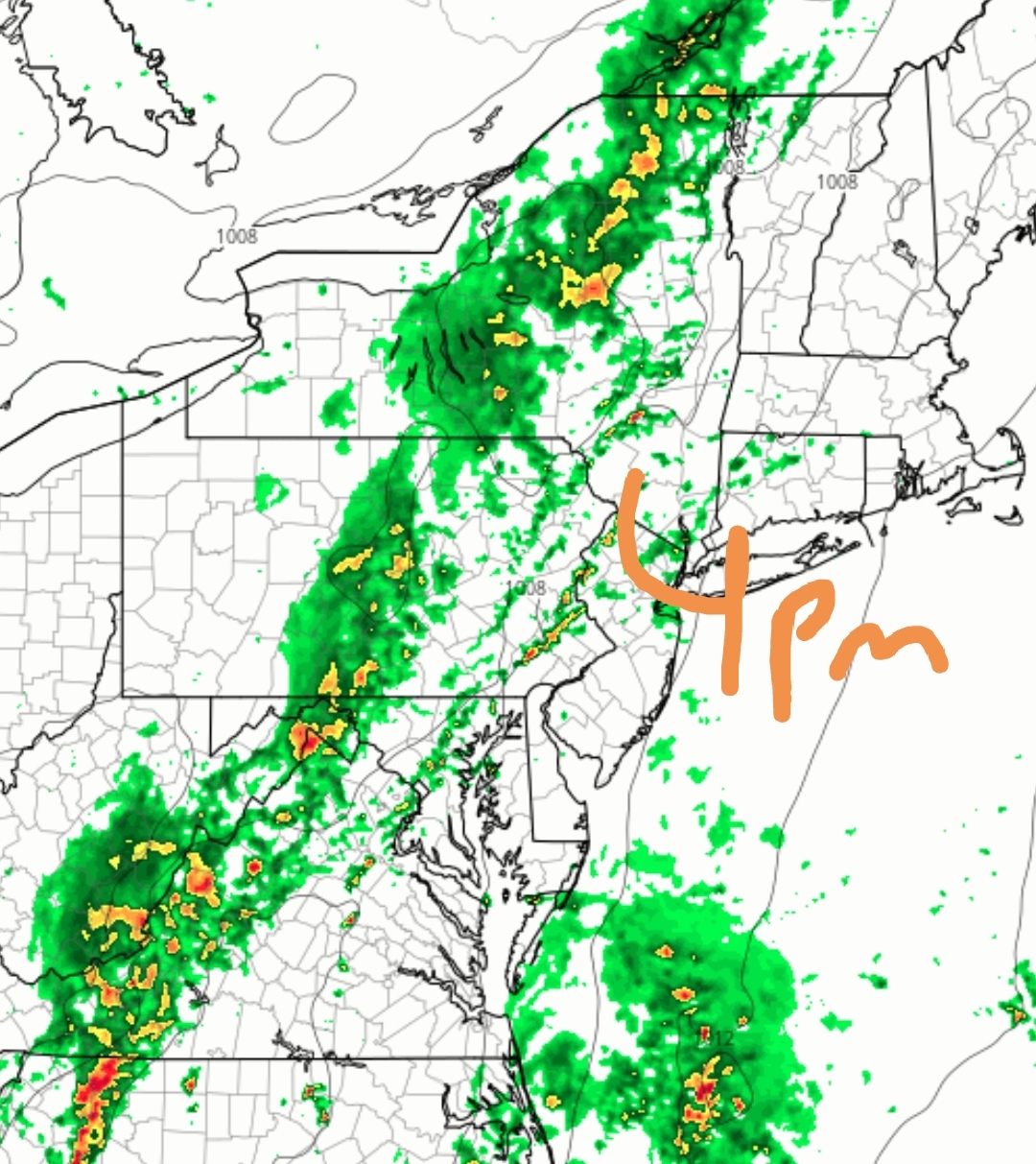

Updated Rain Forecast Precise Timing Of Showers

May 21, 2025

Updated Rain Forecast Precise Timing Of Showers

May 21, 2025 -

How Winter Weather Impacts School Decisions Delays And Closures Explained

May 21, 2025

How Winter Weather Impacts School Decisions Delays And Closures Explained

May 21, 2025 -

The 12 Most Popular Ai Stocks On Reddit A Guide For Investors

May 21, 2025

The 12 Most Popular Ai Stocks On Reddit A Guide For Investors

May 21, 2025 -

Precise Rain Predictions Updated Forecasts For On Off Showers

May 21, 2025

Precise Rain Predictions Updated Forecasts For On Off Showers

May 21, 2025