Sasol (SOL) Strategy Update: Investors Demand Answers

Table of Contents

Profitability Concerns and the Impact on Sasol (SOL) Stock Price

The recent Sasol (SOL) strategy update has highlighted significant profitability concerns. The company's financial performance has deviated from projected targets, leading to decreased profitability in several key sectors. This underperformance has directly impacted the SOL stock price, causing considerable volatility and negatively affecting investor sentiment.

- Decreased profitability in key sectors: The decline in profitability is not uniform across all sectors, with some experiencing steeper drops than others. A detailed breakdown of performance across different segments is crucial for investors to understand the extent of the challenges.

- Rising operational costs and their contribution to lower margins: Increased operational costs, driven by factors like inflation and supply chain disruptions, have significantly compressed profit margins. Understanding the specific cost drivers is vital for assessing the sustainability of these pressures.

- Comparison of Sasol's performance with competitors: A comparative analysis against industry peers is needed to determine whether Sasol's underperformance is unique or a reflection of broader market trends. Benchmarking against competitors can provide valuable insights.

- Analysis of stock price fluctuations post-strategy update: The immediate and subsequent reactions of the SOL stock price to the strategy update reveal the market's perception of the company's prospects. Analyzing price movements helps gauge investor confidence. The Sasol (SOL) profitability directly affects the SOL stock price and investor sentiment.

Sustainability Initiatives and ESG (Environmental, Social, and Governance) Concerns

Sasol's commitment to sustainability and its alignment with investor ESG expectations are under intense scrutiny. While the company has announced ambitious carbon emission reduction targets, concerns remain about the effectiveness of its current strategies and their impact on long-term value creation.

- Discussion of Sasol's carbon emission reduction targets: The ambitious nature of these targets needs to be carefully examined against the backdrop of the company's current operations and future plans.

- Analysis of their progress in meeting these targets: A transparent assessment of Sasol's progress towards its sustainability goals is vital for investors to gauge the company's commitment to ESG principles.

- Investor concerns regarding the company's environmental impact: The environmental impact of Sasol's operations remains a primary concern for many ESG investors, particularly regarding its carbon footprint and potential environmental liabilities.

- Comparison to industry best practices in ESG performance: Comparing Sasol's ESG performance to industry leaders and best practices helps provide context and identify areas for improvement. The Sasol sustainability strategy and its ESG performance are key factors influencing investor decisions.

Long-Term Growth Strategy and Investor Confidence

The long-term growth strategy presented in the recent Sasol (SOL) strategy update is crucial for regaining investor confidence. The feasibility and potential success of this strategy are key determinants of future performance.

- Analysis of Sasol's diversification plans: A thorough evaluation of Sasol's diversification plans is essential to determine their potential to mitigate risks and drive future growth.

- Assessment of the potential risks and opportunities: Identifying and assessing potential risks and opportunities associated with the strategy is critical for understanding the potential for success.

- Investor confidence levels following the strategy update: Measuring investor confidence post-update is crucial to gauging the market's reaction to the proposed changes and their belief in Sasol's long-term vision.

- Comparison to competitor strategies and market trends: Comparing Sasol's strategy to competitors' strategies within the context of broader market trends helps assess the competitiveness and potential viability of its plans. The Sasol growth strategy and the SOL long-term outlook are paramount for investor confidence.

Key Questions Investors Need Answered

Investors require clarity on several crucial aspects of the Sasol (SOL) strategy update to make informed decisions. These key questions need immediate and transparent answers:

- Clarity on the path to improved profitability: Investors need a detailed roadmap demonstrating how Sasol intends to improve profitability in the short and long term.

- Detailed roadmap for achieving sustainability goals: A clear and specific roadmap for achieving the announced sustainability goals is crucial to address investor concerns about environmental impact.

- Concrete evidence supporting the long-term growth projections: Investors require concrete evidence supporting the company's long-term growth projections, including detailed financial models and market analyses.

- Transparency regarding risk management and mitigation strategies: Transparent communication about risk management and mitigation strategies is essential for building investor trust and confidence. Improved Sasol investor relations and SOL transparency are critical.

Conclusion

The Sasol (SOL) strategy update has left many investors with unanswered questions regarding profitability, sustainability, and long-term growth. Addressing these concerns is crucial to regaining investor confidence and ensuring the company's continued success. To stay informed on the evolving situation and the company's response, continue to follow updates on the Sasol (SOL) strategy and engage with financial news sources for analysis and commentary. Understanding the complexities of the Sasol (SOL) strategy update is vital for informed investment decisions. Stay informed about future developments concerning the Sasol (SOL) strategy to make sound investment choices.

Featured Posts

-

Kaellmanin Nousu Kenttien Ulkopuolella Ja Niillae

May 20, 2025

Kaellmanin Nousu Kenttien Ulkopuolella Ja Niillae

May 20, 2025 -

Amazons Spring 2025 Sale Deep Discounts On Hugo Boss Perfumes

May 20, 2025

Amazons Spring 2025 Sale Deep Discounts On Hugo Boss Perfumes

May 20, 2025 -

16 Million Penalty For T Mobile Three Year Data Breach Investigation Concludes

May 20, 2025

16 Million Penalty For T Mobile Three Year Data Breach Investigation Concludes

May 20, 2025 -

Sostoyanie Zdorovya Shumakhera Drug Rasskazal O Tyazheloy Situatsii

May 20, 2025

Sostoyanie Zdorovya Shumakhera Drug Rasskazal O Tyazheloy Situatsii

May 20, 2025 -

Nigerias Pragmatic Choices A Kite Runner Analysis

May 20, 2025

Nigerias Pragmatic Choices A Kite Runner Analysis

May 20, 2025

Latest Posts

-

I Los Antzeles Thelei Ton Giakoymaki

May 20, 2025

I Los Antzeles Thelei Ton Giakoymaki

May 20, 2025 -

I Periptosi Giakoymaki Mia Analysi Tis Ypotimisis Tis Anthropinis Aksias

May 20, 2025

I Periptosi Giakoymaki Mia Analysi Tis Ypotimisis Tis Anthropinis Aksias

May 20, 2025 -

Baggelis Giakoymakis I Katarrakosi Tis Aksias Toy Alloy

May 20, 2025

Baggelis Giakoymakis I Katarrakosi Tis Aksias Toy Alloy

May 20, 2025 -

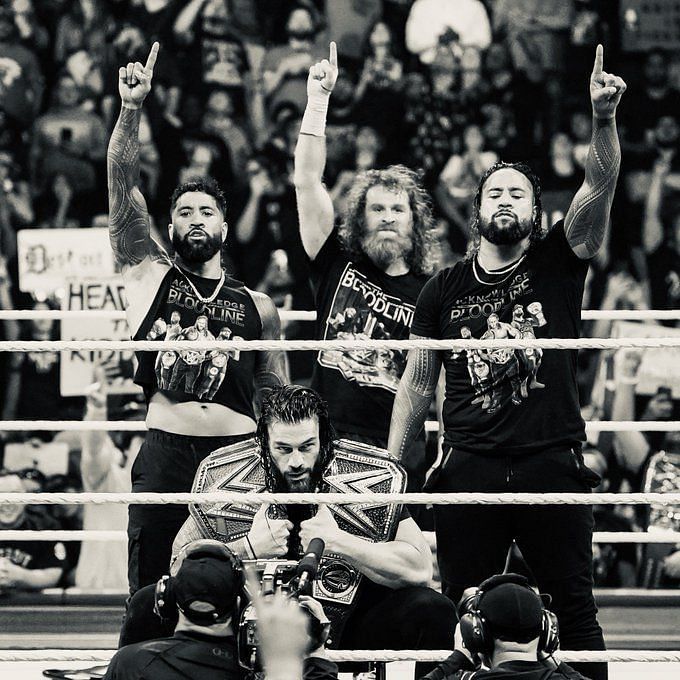

Wwe Raw Sami Zayn Faces Rollins And Breakkers Aggression

May 20, 2025

Wwe Raw Sami Zayn Faces Rollins And Breakkers Aggression

May 20, 2025 -

The Sami Zayn Seth Rollins Bron Breakker Confrontation On Wwe Raw

May 20, 2025

The Sami Zayn Seth Rollins Bron Breakker Confrontation On Wwe Raw

May 20, 2025