Ryanair Faces Tariff War Headwinds, Launches Share Buyback Program

Table of Contents

The Impact of Tariff Wars on Ryanair's Operations

The airline industry is highly sensitive to global economic shifts, and Ryanair is no exception. Current tariff wars, characterized by increased trade barriers and escalating fuel surcharges, are significantly impacting operational costs. These trade disputes, often involving fuel import regulations and aircraft manufacturing components, directly affect Ryanair’s bottom line.

The direct impact on Ryanair's operations is multifaceted:

- Increased fuel costs and their effect on profitability: Fluctuations in fuel prices, exacerbated by tariffs and trade disputes, represent a major expense for any airline. Higher fuel costs directly eat into profit margins, forcing airlines to make difficult decisions.

- Potential route adjustments or cancellations due to trade restrictions: Tariffs can make certain routes economically unviable. Restrictions on access to specific airports or airspace due to geopolitical factors can further complicate operations, potentially leading to route cancellations.

- Impact on ticket prices and passenger numbers: To offset increased costs, Ryanair may be forced to increase ticket prices, potentially impacting passenger numbers, particularly among price-sensitive travelers. This can lead to reduced revenue and decreased market share.

- Competitive disadvantages compared to airlines less affected by tariffs: Airlines based in regions less impacted by the current trade disputes may have a competitive advantage, putting pressure on Ryanair's market position.

Ryanair's Share Buyback Program: A Strategic Response

In response to these challenges, Ryanair announced a significant share buyback program. While the specific details – the exact amount, timeline, and mechanics – may vary, the program aims to demonstrate confidence in the company's future prospects and enhance shareholder value.

The rationale behind the buyback is multifaceted:

- Demonstrates confidence: The buyback signals Ryanair's belief in its long-term growth potential, even in the face of headwinds. It suggests the company believes its stock is undervalued.

- Improves shareholder value: By reducing the number of outstanding shares, the buyback increases earnings per share (EPS), potentially boosting the stock price and providing a return for shareholders.

The potential benefits for Ryanair include:

- Reduced number of outstanding shares: This makes each remaining share more valuable.

- Increased earnings per share (EPS): This enhances the company's profitability metrics.

- Improved stock price: A higher EPS often leads to a higher stock price, attracting investors.

- Signal to investors about the company’s financial health: The buyback acts as a positive signal, reassuring investors about the company’s financial strength and future prospects.

Analyzing the Effectiveness of the Share Buyback in Mitigating Tariff Impacts

The effectiveness of Ryanair's share buyback program in mitigating the negative impacts of tariff wars is a complex issue. While it boosts shareholder value and signals confidence, it doesn't directly address the underlying cost pressures caused by tariffs.

- Comparison of the cost of the buyback to the potential losses from tariffs: A key question is whether the financial resources allocated to the buyback could be more effectively used to offset tariff-related losses.

- Potential alternative strategies Ryanair could employ: Ryanair might explore hedging strategies to mitigate fuel price risks, negotiate better deals with fuel suppliers, or adjust its route network to minimize exposure to tariff-affected regions.

- Analysis of market reaction to the announcement of the share buyback: The market's positive or negative reaction to the buyback announcement is crucial in assessing its overall effectiveness.

- Long-term implications for Ryanair’s financial stability: The long-term impact of the buyback on Ryanair’s financial stability depends on various factors, including the persistence of tariff wars and the overall performance of the airline industry.

Investor Sentiment and Market Reaction

Initial investor reaction to both the tariff headwinds and the share buyback announcement has been mixed. While some analysts express concern about the ongoing impact of tariffs on Ryanair’s profitability, others view the buyback as a positive signal, highlighting the company's long-term outlook. Stock price fluctuations will continue to reflect the market's evolving assessment of these competing factors. Further analysis of financial news and expert commentary is needed to fully grasp the market sentiment.

Conclusion: Ryanair Navigates Tariff Wars with Share Buyback Program

Ryanair's strategic response to the challenges posed by tariff wars includes a significant share buyback program. While this program demonstrates confidence and improves shareholder value, its effectiveness in directly offsetting the negative impacts of tariffs remains to be seen. The buyback is one piece of a larger strategy; the long-term success will depend on navigating the complexities of the global trade landscape. The market's response will be crucial in judging the effectiveness of this strategy. Stay updated on Ryanair's response to tariff wars, follow the progress of Ryanair's share buyback program, and learn more about the impact of global trade on the airline industry to gain a comprehensive understanding of this complex situation.

Featured Posts

-

Federal Investigation Uncovers Massive Office365 Data Breach Millions Lost

May 21, 2025

Federal Investigation Uncovers Massive Office365 Data Breach Millions Lost

May 21, 2025 -

Reddit Post To Become Feature Film Sydney Sweeney Lands Lead Role Warner Bros

May 21, 2025

Reddit Post To Become Feature Film Sydney Sweeney Lands Lead Role Warner Bros

May 21, 2025 -

Little Britains Future Matt Lucas Addresses Revival Speculation

May 21, 2025

Little Britains Future Matt Lucas Addresses Revival Speculation

May 21, 2025 -

Promena Imena Vanje Mijatovic Razlozi I Posledice

May 21, 2025

Promena Imena Vanje Mijatovic Razlozi I Posledice

May 21, 2025 -

How Winter Weather Impacts School Decisions Delays And Closures Explained

May 21, 2025

How Winter Weather Impacts School Decisions Delays And Closures Explained

May 21, 2025

Latest Posts

-

Nadiem Amiri His Rise To Prominence In German Football

May 21, 2025

Nadiem Amiri His Rise To Prominence In German Football

May 21, 2025 -

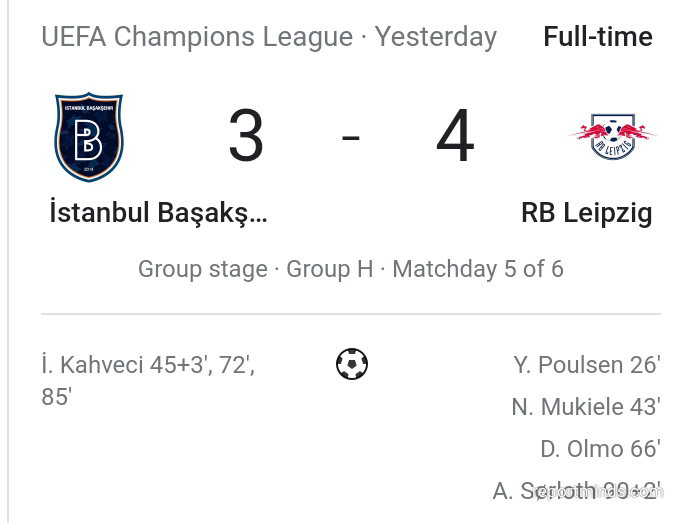

Rb Leipzig Defeated Mainzs Winning Comeback With Burkardt And Amiri

May 21, 2025

Rb Leipzig Defeated Mainzs Winning Comeback With Burkardt And Amiri

May 21, 2025 -

Mainzs Dramatic Turnaround Burkardt And Amiris Impact Against Leipzig

May 21, 2025

Mainzs Dramatic Turnaround Burkardt And Amiris Impact Against Leipzig

May 21, 2025 -

Who Is Nadiem Amiri The Mainz 05 And Germany Player

May 21, 2025

Who Is Nadiem Amiri The Mainz 05 And Germany Player

May 21, 2025 -

Gladbach Defeat Mainz Strengthens Top Four Bid

May 21, 2025

Gladbach Defeat Mainz Strengthens Top Four Bid

May 21, 2025