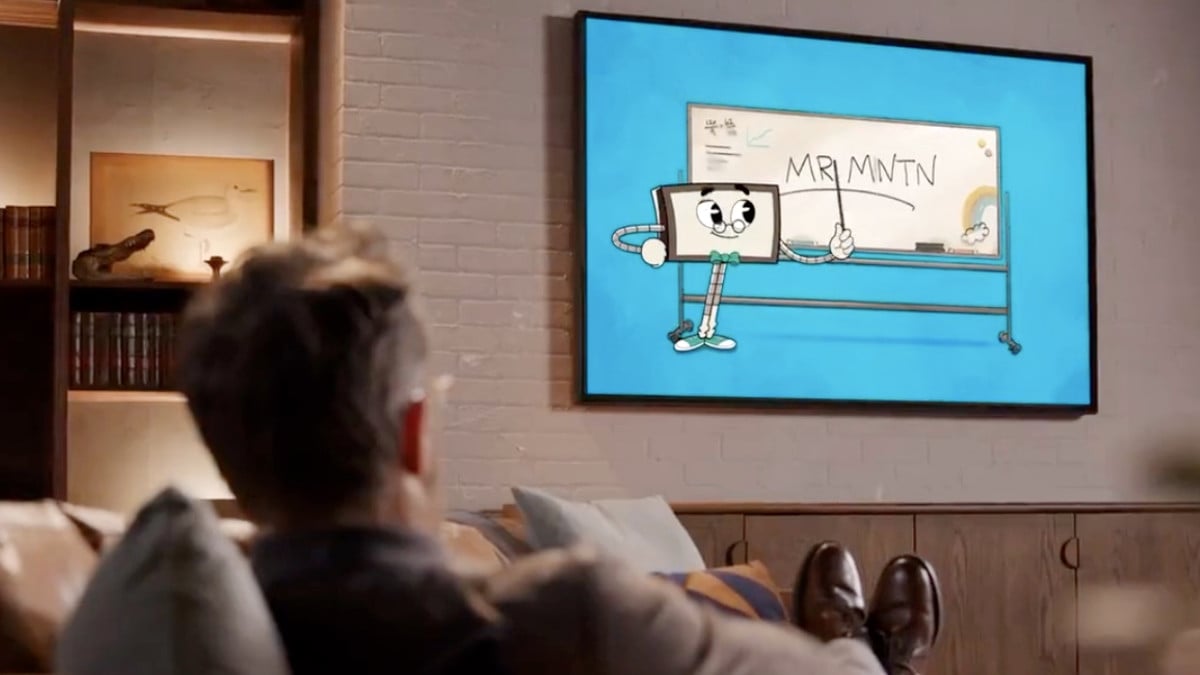

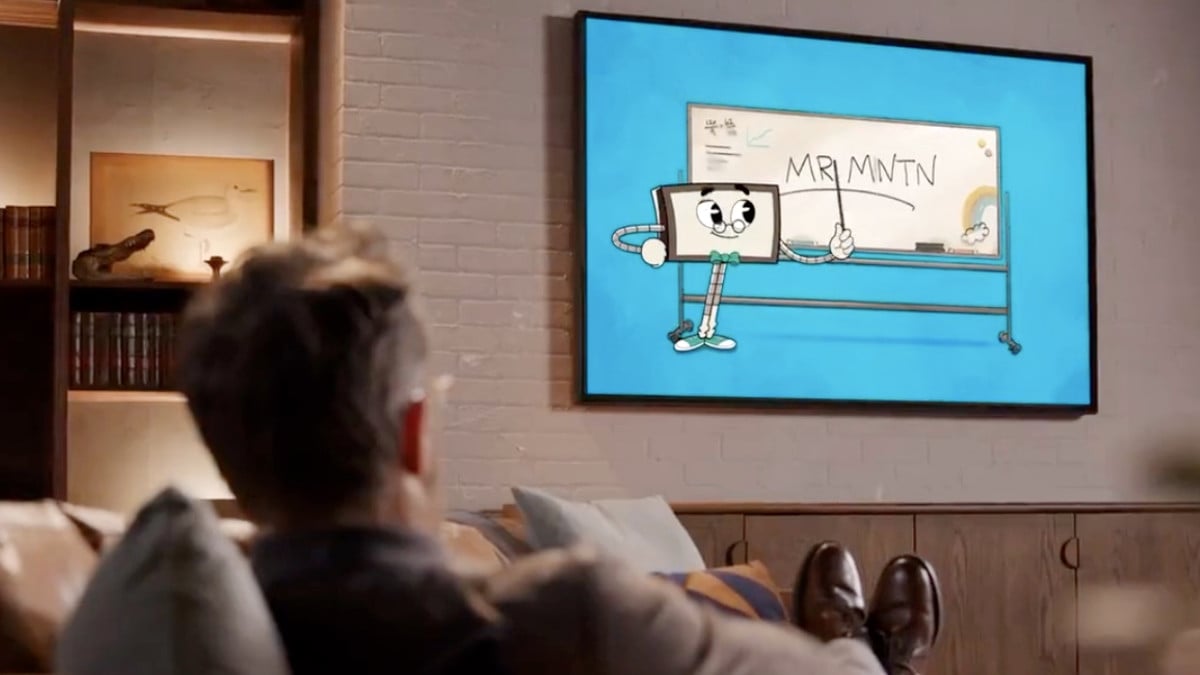

Ryan Reynolds' MNTN IPO: Launch Expected Next Week

Table of Contents

MNTN's Business Model and Brand Portfolio

MNTN employs a unique approach to brand building and acquisition, focusing on premium alcohol brands with strong growth potential. They don't just acquire; they cultivate. This involves significant investment in marketing, branding, and innovative direct-to-consumer strategies. This differentiates them from traditional beverage alcohol companies.

- Focus on acquisition and development of premium alcohol brands: MNTN actively seeks out brands with established reputations or significant market potential, then leverages its resources to enhance their reach and appeal.

- Celebrity endorsements and marketing strategies: While Ryan Reynolds' involvement is a major draw, MNTN uses a multi-pronged marketing approach, employing strategic partnerships and digital marketing to reach their target demographic.

- Key brands under the MNTN umbrella: While Aviation Gin is the flagship brand, MNTN's portfolio likely includes other premium alcohol brands, though specifics may not be publicly available until closer to the IPO. The expansion beyond a single brand diversifies their risk and appeal to investors.

- Innovative approach to direct-to-consumer sales and marketing: MNTN bypasses traditional distribution channels to some extent, utilizing online sales and targeted advertising campaigns to reach consumers directly. This approach enhances their profit margins and allows for precise data-driven marketing.

- Target market and market share: MNTN's target market is the premium alcohol consumer, typically a millennial or Gen Z demographic with a strong appreciation for high-quality products and unique branding. Their market share is likely to expand significantly post-IPO.

The IPO Details (as much as publicly available)

While precise details surrounding the Ryan Reynolds MNTN IPO are still emerging, certain aspects are generally expected.

- Expected IPO valuation: The anticipated valuation is subject to market conditions and investor demand. Various financial news sources will offer projected figures closer to the launch date.

- Number of shares to be offered: The number of shares will be disclosed in the official IPO prospectus, providing clarity on the overall size of the offering.

- Expected price range: A price range per share will be announced in the lead-up to the IPO, providing a benchmark for investors to consider.

- Underwriters involved: Leading investment banks will typically manage the IPO, facilitating the sale of shares and managing investor relations. These details will be revealed as the IPO approaches.

- Use of proceeds from the IPO: The funds raised are likely to be used for brand expansion, marketing initiatives, potential acquisitions, and general corporate purposes.

- Potential risks associated with the investment: All IPOs carry inherent risks, including market volatility, competitive pressures, and the potential for the company to underperform expectations. Investors should thoroughly review the prospectus to understand these risks.

Ryan Reynolds' Influence and Brand Appeal

Ryan Reynolds' involvement is arguably the most significant factor contributing to MNTN's success and brand recognition. His entrepreneurial spirit and marketing savvy have proven invaluable.

- Marketing expertise and social media influence: Reynolds’ significant social media following and established brand-building capabilities provide significant marketing leverage.

- Role in brand building and innovation: His involvement extends beyond mere celebrity endorsement; he actively participates in shaping the brand’s strategy and direction.

- Potential impact of his celebrity status on investor confidence: Reynolds' positive public image and business acumen create investor confidence in MNTN's potential for growth.

- Contribution to MNTN's brand equity: Reynolds’ personal brand is inextricably linked to MNTN's success, significantly bolstering the company’s overall brand equity.

Potential Investors and Market Outlook

The Ryan Reynolds MNTN IPO is likely to appeal to a broad range of investors.

- Appeal to individual investors versus institutional investors: The celebrity factor and relatively accessible entry point may attract individual investors, while institutional investors will be drawn by the company's growth potential and market position.

- Competitive landscape and potential market growth: The premium alcohol market is highly competitive, but MNTN’s unique branding and direct-to-consumer approach offer a competitive edge. The market’s growth potential is strong.

- Overall market conditions affecting the IPO's success: Broader economic conditions and investor sentiment will significantly influence the success of the IPO.

- Long-term growth prospects of the company: MNTN's potential for long-term growth hinges on its ability to expand its brand portfolio, enhance its marketing reach, and effectively manage its operations.

Conclusion

The upcoming Ryan Reynolds MNTN IPO presents a unique investment opportunity within the premium beverage alcohol sector. The company's innovative business model, coupled with the strong brand appeal driven by Ryan Reynolds' involvement, creates a compelling narrative for potential investors. However, careful consideration of the risks involved and thorough due diligence are crucial before making any investment decisions.

Call to Action: Stay informed about the latest developments surrounding the Ryan Reynolds MNTN IPO. Monitor financial news outlets and official company announcements for updates as the launch date approaches. Understanding the details surrounding this high-profile IPO will empower you to make informed decisions regarding this potentially exciting investment opportunity. Learn more about the Ryan Reynolds MNTN IPO and its potential.

Featured Posts

-

Mask Singer 2025 Chantal Ladesou A T Elle Devoile L Autruche Nos Predictions

May 11, 2025

Mask Singer 2025 Chantal Ladesou A T Elle Devoile L Autruche Nos Predictions

May 11, 2025 -

Palou Secures Another P1 Start Andretti Struggles At Indy

May 11, 2025

Palou Secures Another P1 Start Andretti Struggles At Indy

May 11, 2025 -

The Next Pope Examining Potential Candidates For The Papacy

May 11, 2025

The Next Pope Examining Potential Candidates For The Papacy

May 11, 2025 -

Hollywood Shutdown Writers And Actors Strike Impacts Film And Television Production

May 11, 2025

Hollywood Shutdown Writers And Actors Strike Impacts Film And Television Production

May 11, 2025 -

Celtics Guards Choice No Campaign For Nba Award

May 11, 2025

Celtics Guards Choice No Campaign For Nba Award

May 11, 2025