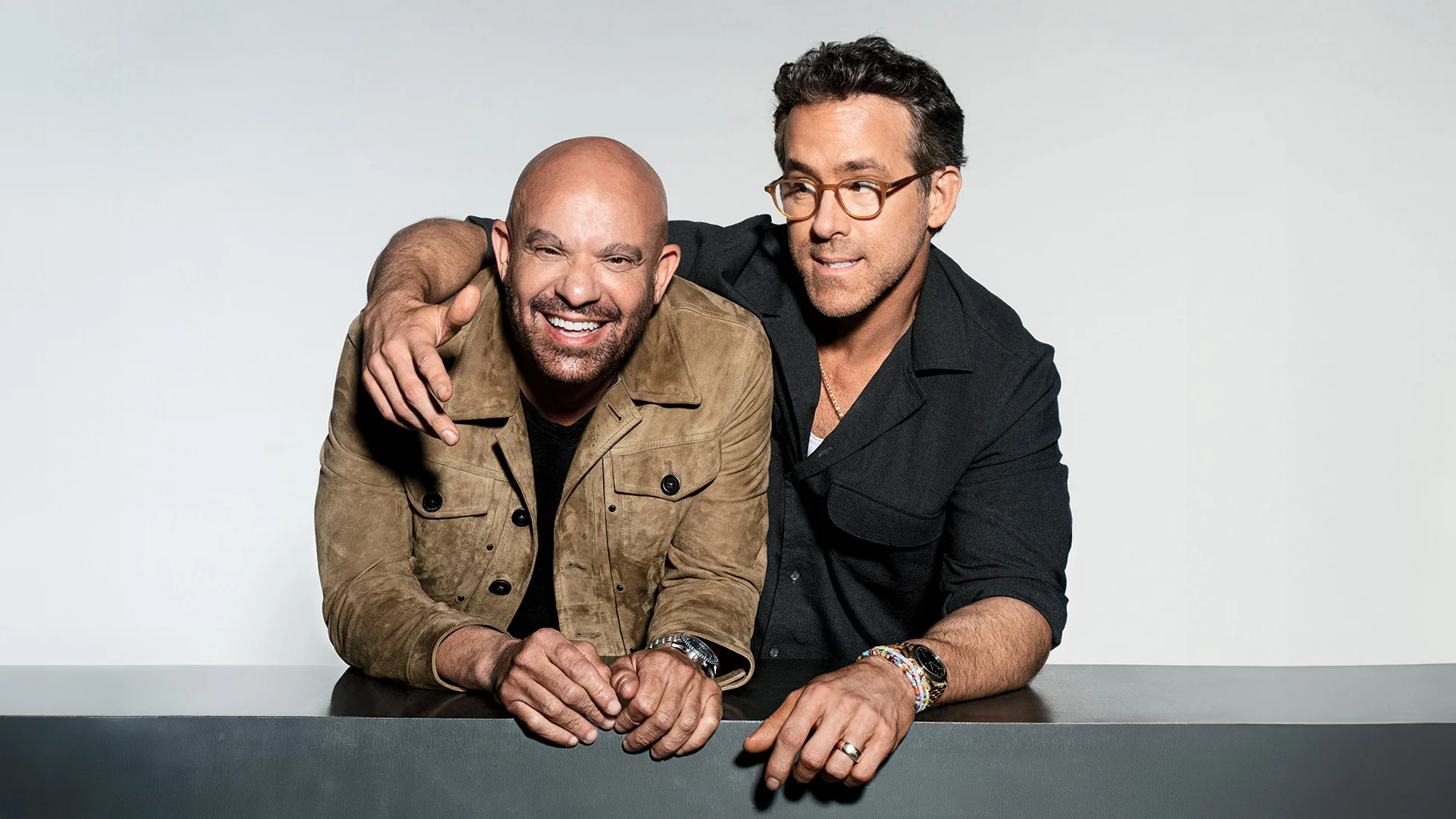

Ryan Reynolds' MNTN IPO: Could A Launch Happen Next Week?

Table of Contents

The MNTN IPO Speculation: What We Know (and Don't Know)

The internet is buzzing with rumors about a potential MNTN IPO launch next week. However, concrete information remains scarce. While several financial news outlets have hinted at a possible launch, there haven't been any official announcements from MNTN or Ryan Reynolds himself. The source of the speculation seems to be a combination of industry whispers, social media chatter, and perhaps some strategic leaks designed to generate excitement.

- Specific dates mentioned in rumors (if any): While no specific date has been officially confirmed, several online forums mention next week as a potential launch window.

- Mention any related financial news articles or analyst predictions: Several financial blogs and news sites have published articles speculating on the MNTN IPO, with some analysts predicting a strong market debut based on the brand's appeal and Reynolds' business acumen.

- Highlight the lack of confirmed information: It's crucial to remember that until an official announcement is made, all information regarding the MNTN IPO should be considered speculation.

MNTN's Potential Market Performance: A Look at the Fitness Sector

Analyzing MNTN's potential market performance requires examining the broader fitness equipment and technology market. This sector is fiercely competitive, with established players like Peloton and Nautilus. However, MNTN possesses several potential competitive advantages.

- Key competitors in the fitness market: Peloton, Nautilus, Bowflex, and other established brands represent significant competition.

- MNTN's unique selling points (USP): MNTN's focus on premium, high-quality equipment, combined with a potentially strong brand identity, could differentiate it from competitors. The perceived exclusivity of the brand might also attract a premium customer base.

- Projected market growth for fitness equipment: The fitness equipment market is experiencing robust growth, driven by increasing health consciousness and the convenience of at-home workouts.

- Risk factors associated with investing in MNTN: Competition, economic downturns, and the inherent volatility of the stock market all pose risks to investors. The relatively new nature of MNTN also presents a degree of uncertainty.

The Role of Celebrity Influence in the IPO

Ryan Reynolds' involvement is undoubtedly a key factor influencing the potential success of the MNTN IPO. His celebrity status, coupled with the proven success of his other ventures like Aviation Gin and Mint Mobile, could significantly boost investor interest and the company's valuation.

- Examples of successful and unsuccessful celebrity-backed businesses: The track record of celebrity endorsements is mixed. While some ventures thrive, others falter. Careful consideration of these examples provides valuable insight.

- Analysis of Ryan Reynolds’ brand image and its relevance to the MNTN brand: Reynolds' brand aligns with MNTN's target audience, a demographic that values quality, innovation, and a touch of playful irreverence.

- How celebrity influence can impact investor confidence and market valuation: Reynolds' involvement may attract investors seeking exposure to a high-profile brand, potentially driving up the initial valuation. However, relying solely on celebrity endorsement presents risks.

What the Next Week Holds: Predictions and Possibilities

Based on current information, the likelihood of an MNTN IPO launch next week remains uncertain. While the speculation is intense, the lack of official confirmation leaves room for various scenarios.

- Optimistic, realistic, and pessimistic scenarios for the MNTN IPO: An optimistic scenario sees a successful launch with strong initial investor interest. A realistic scenario might involve a successful launch but with less dramatic initial gains. A pessimistic scenario could include delays or even cancellation.

- Factors that could influence the timing of the launch: Regulatory approvals, market conditions, and internal company decisions could all influence the timing.

- Potential impact on stock prices if the IPO proceeds as planned: The initial stock price will depend on various factors, including investor demand, market conditions, and the overall perception of the company's potential.

Conclusion: The MNTN IPO - A Speculative but Potentially Lucrative Opportunity

The potential MNTN IPO is a highly anticipated event, fueled by speculation and Ryan Reynolds' significant influence. While a launch next week remains unconfirmed, the potential market impact is undeniable. Careful analysis of the fitness equipment market and the risks involved is crucial for prospective investors. The success of the IPO hinges not only on Reynolds' star power but also on MNTN's ability to deliver on its promises and compete effectively in a challenging market.

Call to Action: Stay tuned for updates on the Ryan Reynolds' MNTN IPO. Keep an eye on financial news sources for the latest developments concerning this exciting investment opportunity. Understanding the nuances of the MNTN IPO is key to making informed investment decisions.

Featured Posts

-

Was Marvel Right To Cancel The Potential Henry Cavill Series Exploring The Implications

May 12, 2025

Was Marvel Right To Cancel The Potential Henry Cavill Series Exploring The Implications

May 12, 2025 -

Why Apple Might Be Helping Google Survive

May 12, 2025

Why Apple Might Be Helping Google Survive

May 12, 2025 -

Brewers Vs Yankees Injury Updates For The Series March 27 30

May 12, 2025

Brewers Vs Yankees Injury Updates For The Series March 27 30

May 12, 2025 -

Belal Muhammad Vs Jack Della Maddalena At Ufc 315 Montreal Complete Event Details

May 12, 2025

Belal Muhammad Vs Jack Della Maddalena At Ufc 315 Montreal Complete Event Details

May 12, 2025 -

62 Salh Tam Krwz Awr 36 Salh Adakarh Kya Yh Mhbt Sch He

May 12, 2025

62 Salh Tam Krwz Awr 36 Salh Adakarh Kya Yh Mhbt Sch He

May 12, 2025

Latest Posts

-

Nba Picks Cavaliers Vs Knicks Odds And Prediction For February 21st

May 12, 2025

Nba Picks Cavaliers Vs Knicks Odds And Prediction For February 21st

May 12, 2025 -

Cavaliers Vs Knicks February 21st Game Analysis Predictions And Betting Odds

May 12, 2025

Cavaliers Vs Knicks February 21st Game Analysis Predictions And Betting Odds

May 12, 2025 -

Ufc 315 Previewing Tonights Must See Fights

May 12, 2025

Ufc 315 Previewing Tonights Must See Fights

May 12, 2025 -

Nba Betting Cavaliers Vs Knicks February 21st Game Preview And Predictions

May 12, 2025

Nba Betting Cavaliers Vs Knicks February 21st Game Preview And Predictions

May 12, 2025 -

Combat Ufc 315 Montreal Zahabi Et Aldo Plus Long Que 13 Secondes

May 12, 2025

Combat Ufc 315 Montreal Zahabi Et Aldo Plus Long Que 13 Secondes

May 12, 2025