RTL Group Streaming Revenue: Key Performance Indicators And Future Outlook

Table of Contents

Key Performance Indicators (KPIs) for RTL Group's Streaming Success

RTL Group's success in the streaming market hinges on several key performance indicators. Analyzing these metrics provides a clear picture of its current standing and potential for future growth. Consistent monitoring of these KPIs is vital for informed strategic decision-making.

Subscriber Growth

The trajectory of RTL Group's streaming subscriber base is a fundamental indicator of its success. This involves examining not just the raw number of subscribers but also the rate of subscriber growth, acquisition costs, churn rate, and the effectiveness of marketing campaigns.

- Comparing subscriber growth against competitors: Benchmarking against rivals like Netflix, Disney+, and Amazon Prime Video is essential to gauge RTL Group's market share and competitive positioning.

- Impact of bundled offerings and pricing strategies: Offering bundled packages or tiered subscription models can significantly influence subscriber acquisition and retention. Analyzing the effectiveness of different pricing strategies is crucial.

- Geographical variations in subscriber growth: Growth patterns may vary across different regions due to factors like market saturation, cultural preferences, and competitive intensity. Identifying high-growth areas allows for targeted marketing and expansion strategies.

Average Revenue Per User (ARPU)

Average Revenue Per User (ARPU) reflects the average revenue generated per subscriber. A high ARPU indicates effective monetization strategies and a strong value proposition for subscribers.

- Comparing ARPU to industry benchmarks: Comparing RTL Group's ARPU to industry averages provides valuable context and reveals areas for improvement.

- Impact of different monetization strategies: Factors like advertising revenue, subscription tiers (with varying levels of ad-supported content), and the introduction of premium features significantly impact ARPU.

- Potential for ARPU growth through premium content and features: Offering exclusive content, ad-free experiences, or interactive features can justify higher subscription fees and boost ARPU.

Content Engagement Metrics

Measuring user engagement with RTL Group's streaming content is critical. This involves analyzing metrics such as average viewing time, completion rates, and user retention.

- Performance of different content genres: Analyzing which genres resonate most with audiences informs future content acquisition and production strategies.

- Impact of personalized recommendations: Effective recommendation algorithms significantly enhance user experience and engagement, leading to increased viewing time.

- Role of data analytics in improving content engagement: Analyzing viewing data allows for data-driven decisions, improving content recommendations, and optimizing programming schedules.

Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) represents the cost of acquiring a new subscriber. A low CAC signifies efficient marketing and user acquisition strategies.

- Effectiveness of different marketing channels: Analyzing the ROI of different marketing channels (e.g., social media, paid advertising, influencer marketing) is crucial for optimizing marketing spend.

- Impact of customer lifetime value (CLTV): The relationship between CAC and CLTV (the total revenue generated by a customer throughout their subscription) is paramount; a high CLTV justifies a higher CAC.

- Cost-effectiveness of various acquisition strategies: Continuous evaluation and optimization of acquisition strategies are essential to maintain a healthy CAC.

Competitive Landscape and Market Challenges

RTL Group operates in a highly competitive streaming market, facing challenges from both established players and emerging competitors.

Competition from Global Streaming Giants

The presence of global giants like Netflix, Disney+, and Amazon Prime Video creates significant competitive pressure.

- RTL Group's competitive advantage: Identifying and leveraging RTL Group's unique strengths—be it local content, specific genre expertise, or a strong brand reputation—is key to differentiation.

- Impact of pricing strategies on market share: Pricing strategies must be carefully calibrated to balance affordability and profitability while remaining competitive.

- Success of RTL Group's original content: Investing in and promoting high-quality original programming is vital to attracting and retaining subscribers.

Technological Advancements and Innovation

Technological advancements are constantly reshaping the streaming landscape.

- Role of 4K streaming and other advancements: Adopting and offering advanced streaming technologies, such as 4K resolution, HDR, and immersive audio, enhances the viewing experience and attracts subscribers.

- Investments in technology and infrastructure: Continuous investment in technology and infrastructure is essential to ensure reliable and high-quality streaming services.

- Impact of evolving viewing habits: Adapting to changing viewing habits, such as the rise of mobile streaming and binge-watching, is crucial to remain competitive.

Regulatory Environment and Content Licensing

Navigating the regulatory landscape and securing content licensing agreements is crucial for RTL Group's streaming business.

- Impact of regional regulations: Regulations vary across different regions, impacting content availability and operations.

- Role of content partnerships and licensing deals: Strategic partnerships and licensing deals are essential for securing a diverse and attractive content library.

- Impact of copyright laws and content rights: Understanding and adhering to copyright laws and content rights is vital to avoid legal issues.

Future Outlook and Growth Strategies for RTL Group Streaming Revenue

RTL Group's future success in streaming depends on its ability to adapt and innovate.

Expansion into New Markets and Geographic Reach

Expanding into new markets offers significant growth opportunities.

- Potential expansion strategies: Identifying new markets with high growth potential and adapting strategies to suit local preferences is key.

- Opportunities and challenges in new markets: Entering new markets presents both opportunities and challenges, including regulatory hurdles, competition, and cultural nuances.

- Potential impact on streaming revenue: Successful expansion into new markets can significantly boost RTL Group's streaming revenue.

Investment in Original Content and Programming

Investment in high-quality original programming is vital for subscriber acquisition and retention.

- Importance of high-quality original content: Original content provides a key differentiator in the crowded streaming market.

- Investment in different content genres: Diversifying content offerings to cater to a broader audience is crucial.

- Potential for return on investment: Strategic content investments can generate significant returns through increased subscriptions and engagement.

Strategic Partnerships and Collaborations

Strategic partnerships can expand RTL Group's streaming reach and content offerings.

- Benefits of strategic partnerships: Partnerships can provide access to new content, technologies, and markets.

- Impact on content diversity and audience reach: Collaborations can expand the diversity of content and broaden the audience base.

- Potential for future collaborations: Continuously seeking and forging strategic partnerships is key to long-term growth.

Conclusion

RTL Group's streaming revenue is a key indicator of its success in the evolving digital media landscape. By carefully analyzing KPIs such as subscriber growth, ARPU, content engagement, and CAC, we can understand the drivers of its current performance and predict future growth. The competitive landscape presents significant challenges, but strategic investments in original content, expansion into new markets, and strategic partnerships are crucial to achieving long-term success. Further research into RTL Group's specific strategies and financial reporting will provide a deeper understanding of their RTL Group streaming revenue and its future prospects. Stay informed about the latest developments in RTL Group streaming revenue to stay ahead of the curve in the dynamic streaming market.

Featured Posts

-

Canada Posts Future Report Recommends Eliminating Daily Home Mail Delivery

May 20, 2025

Canada Posts Future Report Recommends Eliminating Daily Home Mail Delivery

May 20, 2025 -

Nyt Mini Crossword Solutions March 18

May 20, 2025

Nyt Mini Crossword Solutions March 18

May 20, 2025 -

Us Typhon Missile System In Philippines A Counter To Chinese Aggression

May 20, 2025

Us Typhon Missile System In Philippines A Counter To Chinese Aggression

May 20, 2025 -

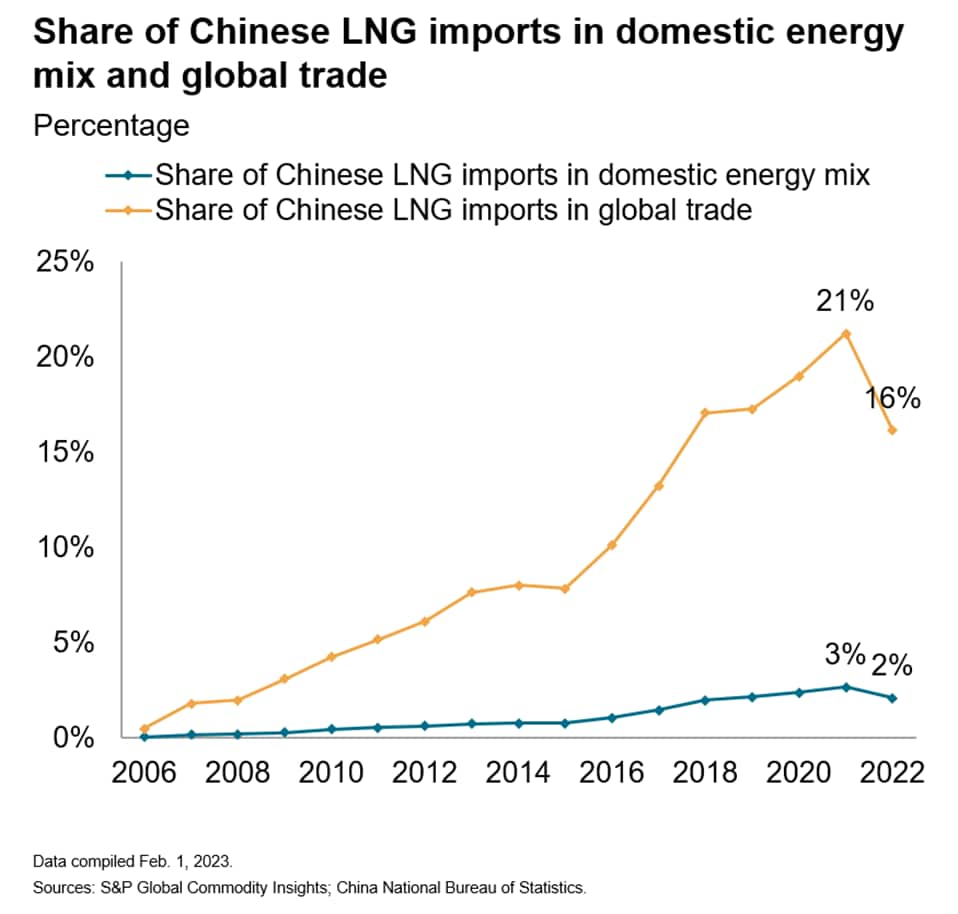

Increased Lng Demand In Taiwan The Post Nuclear Reality

May 20, 2025

Increased Lng Demand In Taiwan The Post Nuclear Reality

May 20, 2025 -

Jalkapallo Jacob Friisin Yllaetysratkaisu Kamara Ja Pukki Vaihdossa

May 20, 2025

Jalkapallo Jacob Friisin Yllaetysratkaisu Kamara Ja Pukki Vaihdossa

May 20, 2025

Latest Posts

-

Home Office Alebo Kancelaria Rozhodovanie Na Zaklade Potrieb Zamestnancov A Manazerov

May 20, 2025

Home Office Alebo Kancelaria Rozhodovanie Na Zaklade Potrieb Zamestnancov A Manazerov

May 20, 2025 -

Vyber Idealneho Pracovneho Prostriedku Home Office Vs Kancelaria

May 20, 2025

Vyber Idealneho Pracovneho Prostriedku Home Office Vs Kancelaria

May 20, 2025 -

How To Build A Billionaire Boys Empire Strategies For Young Entrepreneurs

May 20, 2025

How To Build A Billionaire Boys Empire Strategies For Young Entrepreneurs

May 20, 2025 -

Preco 79 Manazerov Preferuje Osobny Kontakt Home Office Vs Klasicka Kancelaria

May 20, 2025

Preco 79 Manazerov Preferuje Osobny Kontakt Home Office Vs Klasicka Kancelaria

May 20, 2025 -

Understanding The Billionaire Boy Phenomenon Wealth Influence And Legacy

May 20, 2025

Understanding The Billionaire Boy Phenomenon Wealth Influence And Legacy

May 20, 2025