Rough Patch For Condos: Shifting Investment Sentiment In Canada

Table of Contents

Rising Interest Rates and Their Impact on Condo Investment

Higher interest rates are significantly impacting the Canadian condo investment landscape. The Bank of Canada's efforts to combat inflation have resulted in increased borrowing costs, making condo purchases less affordable and reducing the profitability of condo investments. This affects both new and existing investors.

- Increased mortgage payments reduce potential rental income profitability: Higher mortgage payments eat into the potential rental income, shrinking profit margins for condo investors. This is especially true for those who leveraged significant debt to finance their purchases. Careful cash flow projections are more critical than ever before.

- Higher rates discourage new investors entering the market: The increased cost of borrowing makes it less attractive for new investors to enter the market, reducing demand and potentially impacting prices. First-time buyers, in particular, are feeling the pinch.

- Existing investors may face refinancing challenges: As interest rates rise, existing investors may face challenges when it comes time to refinance their mortgages, potentially increasing their monthly payments significantly. This can impact their ability to maintain their investment.

- Impact on condo prices – potential for price corrections: Reduced demand coupled with increased borrowing costs can lead to price corrections in the condo market, particularly in areas with an oversupply of units. This presents both challenges and opportunities for savvy investors.

Over-Saturation of the Condo Market in Certain Cities

Increased condo construction in several major Canadian cities has led to a noticeable oversupply of units in some markets. This oversaturation is creating a more competitive rental market and impacting investor returns.

- Specific cities experiencing oversupply: Toronto and Vancouver, for example, have seen a significant surge in condo construction in recent years, leading to increased competition and lower occupancy rates in some areas. Other cities are also starting to show signs of oversupply.

- Effect on rental yields and occupancy rates: The abundance of available condo units is driving down rental yields and occupancy rates, making it harder for investors to achieve positive cash flow. Vacancy periods can significantly impact profitability.

- Competition among landlords: The increased supply of rental condos translates into greater competition among landlords, often leading to downward pressure on rental rates to attract tenants. This directly impacts investor income.

- Potential for price stagnation or decline: In markets with significant oversupply, condo prices may stagnate or even decline, potentially resulting in losses for investors who purchased at higher prices. Careful market research is crucial before committing to a purchase.

Economic Uncertainty and its Effect on Investor Confidence

Broader economic factors, including inflation and recessionary fears, are also impacting investor confidence in the Canadian condo market. Uncertainty about the future can significantly influence investment decisions.

- Decreased investor demand: Economic uncertainty often leads to decreased investor demand, as individuals become more cautious about making large financial commitments. Risk aversion increases.

- Shift to other asset classes: Investors may shift their focus to other asset classes perceived as less risky during periods of economic uncertainty, further impacting condo demand. This can include government bonds or blue-chip stocks.

- Impact of potential job losses on rental demand: Economic downturns often result in job losses, which can lead to reduced rental demand and increased vacancy rates, hurting condo investors' rental income.

- Correlation between economic downturns and condo market performance: Historically, there's a strong correlation between economic downturns and a slowdown or decline in the condo market. Understanding this historical context is vital for informed decision-making.

Navigating the Rough Patch: Strategies for Condo Investors

Despite the current challenges, savvy investors can still navigate the rough patch and potentially find opportunities. Adopting proactive strategies can mitigate risks and improve investment outcomes.

- Diversification of investment portfolio: Don't put all your eggs in one basket. Diversifying investments across different asset classes and geographic locations can reduce overall risk.

- Thorough due diligence before purchasing: Conduct comprehensive market research, focusing on factors such as rental demand, vacancy rates, and potential for price appreciation in the chosen location.

- Focus on high-demand locations and desirable amenities: Target areas with strong rental demand and properties with desirable amenities that can command higher rental rates.

- Consider long-term investment strategies: Condo investing is a long-term game. Focus on building long-term equity rather than chasing short-term gains.

- Seek professional financial advice: Consult with a financial advisor to develop an investment strategy tailored to your specific circumstances and risk tolerance.

Conclusion

The Canadian condo market is currently facing a period of adjustment, influenced by rising interest rates, market oversaturation in certain areas, and broader economic uncertainties. These factors are creating a "rough patch" for many condo investors. While the current climate presents challenges, understanding these factors is crucial for navigating the market successfully. By carefully considering the implications of rising interest rates, market saturation, and economic trends, investors can make informed decisions and potentially still find opportunities within the evolving Canadian condo investment landscape. Stay informed about market trends and continue your research on the Canadian condo market to make well-informed investment decisions.

Featured Posts

-

Wwii Photo Unearths Two Remarkable Jewish Stories

Apr 25, 2025

Wwii Photo Unearths Two Remarkable Jewish Stories

Apr 25, 2025 -

Challenges To Elon Musks Robotaxi Timeline

Apr 25, 2025

Challenges To Elon Musks Robotaxi Timeline

Apr 25, 2025 -

Rethinking Middle Management Their Contribution To Organizational Success

Apr 25, 2025

Rethinking Middle Management Their Contribution To Organizational Success

Apr 25, 2025 -

Ankara Emniyet Mueduerluegue Nuen Yeni Binasi Kapsamli Bilgiler Ve Fotograflar

Apr 25, 2025

Ankara Emniyet Mueduerluegue Nuen Yeni Binasi Kapsamli Bilgiler Ve Fotograflar

Apr 25, 2025 -

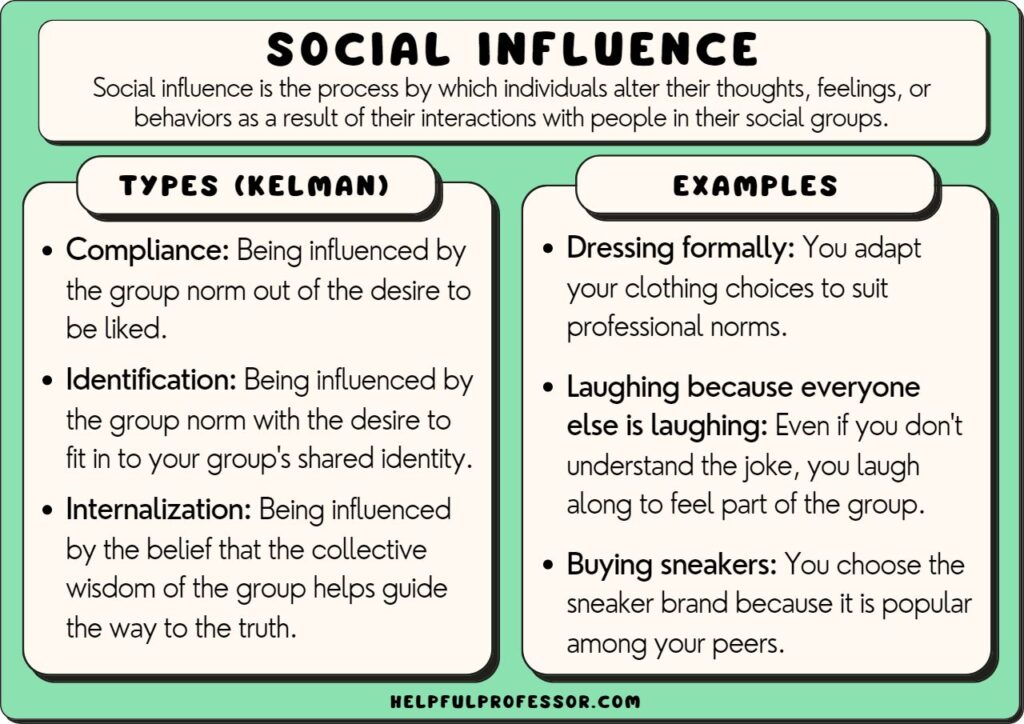

Understanding You Tubes Influence A Comprehensive Guide

Apr 25, 2025

Understanding You Tubes Influence A Comprehensive Guide

Apr 25, 2025

Latest Posts

-

Wynne Evans Fights Back Fresh Evidence In Strictly Controversy

May 10, 2025

Wynne Evans Fights Back Fresh Evidence In Strictly Controversy

May 10, 2025 -

Wynne Evans New Evidence To Clear Name After Strictly Scandal

May 10, 2025

Wynne Evans New Evidence To Clear Name After Strictly Scandal

May 10, 2025 -

Wynne Evans Receives Backing Following Claims Of Misconduct

May 10, 2025

Wynne Evans Receives Backing Following Claims Of Misconduct

May 10, 2025 -

Wynne Evans Health Scare Update On His Condition And Return To Stage

May 10, 2025

Wynne Evans Health Scare Update On His Condition And Return To Stage

May 10, 2025 -

Wynne Evans Road To Recovery Illness Details And Future Plans

May 10, 2025

Wynne Evans Road To Recovery Illness Details And Future Plans

May 10, 2025