Rosenberg Critiques Bank Of Canada's Cautious Approach

Table of Contents

Rosenberg's Concerns Regarding Inflation and the Bank of Canada's Response

Rosenberg argues that the Bank of Canada is significantly underestimating the persistence and severity of current inflationary pressures. He believes the current inflation rate, while showing signs of easing, is still far above the Bank of Canada's target and risks becoming entrenched. The Bank of Canada, on the other hand, maintains a more cautious stance, citing concerns about potential economic slowdown and the impact of global uncertainties. This discrepancy forms the core of Rosenberg's critique.

- Specific Criticisms: Rosenberg contends that the Bank of Canada has been too slow to raise interest rates, implementing hikes that are insufficient to curb inflation effectively. He advocates for a more aggressive approach, arguing that the current policy risks allowing inflation to become entrenched, leading to long-term economic damage.

- Supporting Data: Rosenberg's arguments are often supported by pointing to persistent upward pressure on key inflation indicators such as core inflation, and highlighting the strength of the Canadian labor market despite rising interest rates. He uses data to demonstrate that the economy remains robust enough to handle a more aggressive monetary policy response.

- Potential Risks: Rosenberg warns of the significant risks associated with the Bank of Canada’s approach. He points to the possibility of a wage-price spiral, where rising prices lead to higher wages, fueling further inflation, as well as the potential for prolonged inflation to erode consumer purchasing power and damage long-term economic growth.

Analysis of the Bank of Canada's Risk Assessment

The Bank of Canada justifies its cautious approach by emphasizing the risks of triggering a recession. They argue that aggressive interest rate hikes could stifle economic growth and lead to job losses, particularly given the uncertain global economic outlook. Rosenberg counters this argument, suggesting that the Bank of Canada's risk assessment is overly pessimistic and that the potential costs of inaction—allowing inflation to persist—outweigh the risks of a more aggressive policy.

- Economic Models and Forecasts: A key difference lies in the economic models and forecasts used by both sides. Rosenberg often criticizes the Bank of Canada's reliance on specific leading indicators, suggesting that these might not adequately capture the current dynamics of the economy.

- Underlying Assumptions and Biases: Rosenberg suggests that the Bank of Canada's approach may be influenced by biases towards maintaining stability and avoiding dramatic policy shifts, even if it means accepting higher inflation in the short term.

- Alternative Monetary Policy Strategies: Rosenberg may advocate for alternative strategies such as quantitative tightening or more targeted interventions to address specific inflationary pressures, rather than relying solely on interest rate adjustments.

The Implications of Rosenberg's Critique for Investors and the Canadian Economy

Rosenberg's critique has significant implications for investors and the Canadian economy. His more hawkish stance suggests a potential for higher interest rates and a stronger Canadian dollar in the long run. However, this could also dampen economic growth and negatively impact sectors sensitive to interest rate changes, such as housing.

- Investor Advice: Based on Rosenberg's perspective, investors might consider strategies that protect against inflation, such as investing in assets that tend to appreciate during inflationary periods (e.g., real estate, commodities).

- Economic Scenarios: The differing approaches could lead to significantly different economic outcomes. Rosenberg's scenario might involve a sharper but shorter recession, followed by a period of lower inflation and stronger economic growth. Conversely, the Bank of Canada’s approach might lead to a shallower but more prolonged period of slower growth and persistent inflation.

- Long-Term Implications: The long-term implications for Canadian economic growth and stability depend heavily on which approach proves more effective in managing inflation and fostering sustainable economic growth.

Conclusion: Navigating the Debate on the Bank of Canada's Approach

David Rosenberg's critique of the Bank of Canada's cautious approach highlights the complex and multifaceted nature of managing monetary policy in a volatile economic environment. While the Bank of Canada emphasizes the risks of triggering a recession through aggressive rate hikes, Rosenberg argues that the risks of prolonged inflation are far greater. The debate underscores the inherent uncertainties and challenges involved in forecasting economic trends and choosing the optimal policy response. It is crucial for investors and citizens alike to stay informed about developments in Canadian monetary policy and the ongoing debate. For further insights, follow developments in Rosenberg's economic predictions and stay updated on Canadian monetary policy updates. Understanding the nuances of this discussion is key to navigating the complexities of the current economic climate and making informed financial decisions. Continue researching Bank of Canada analysis to form your own informed opinion on this critical issue.

Featured Posts

-

Mlb To Review Petition Could Pete Rose Return

Apr 29, 2025

Mlb To Review Petition Could Pete Rose Return

Apr 29, 2025 -

Shedeur Sanders Prank Call Son Of Falcons Defensive Coordinator Offers Apology

Apr 29, 2025

Shedeur Sanders Prank Call Son Of Falcons Defensive Coordinator Offers Apology

Apr 29, 2025 -

Mesa Welcomes Shen Yuns Return

Apr 29, 2025

Mesa Welcomes Shen Yuns Return

Apr 29, 2025 -

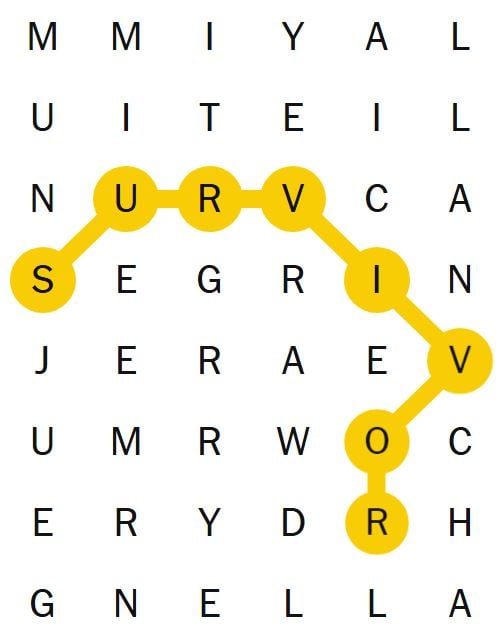

Nyt Spelling Bee Puzzle 360 Feb 26th Complete Guide With Answers And Hints

Apr 29, 2025

Nyt Spelling Bee Puzzle 360 Feb 26th Complete Guide With Answers And Hints

Apr 29, 2025 -

Capital Summertime Ball 2025 Tickets A Buyers Guide

Apr 29, 2025

Capital Summertime Ball 2025 Tickets A Buyers Guide

Apr 29, 2025