Rolls-Royce Confirms 2025 Projections: Tariff Impact Manageable

Table of Contents

Rolls-Royce's 2025 Projections: A Detailed Look

Key Financial Targets

Rolls-Royce has set several ambitious financial targets for 2025, reflecting their confidence in their future performance. These targets represent a significant step forward in their long-term strategy, focusing on enhanced profitability and sustainable growth.

- Projected 15% revenue increase: This ambitious target signifies expected growth across their diverse product portfolio.

- Target profit margin of 10%: This indicates a focus on operational efficiency and cost optimization.

- Significant reduction in net debt: This demonstrates a commitment to fiscal responsibility and long-term financial stability.

These targets are crucial for Rolls-Royce's long-term strategy, aiming to establish a stronger financial footing and drive future investments in research and development, ensuring continued innovation and market leadership. Their achievement will solidify Rolls-Royce's position as a leading player in its key sectors. Successful achievement hinges on strong financial performance, robust revenue growth, and effective management of profitability.

Underlying Growth Drivers

Rolls-Royce's positive outlook is underpinned by several key growth drivers:

- New product launches: The introduction of cutting-edge engines and power systems across aerospace and power generation sectors will drive significant demand.

- Market expansion into new geographical regions: Rolls-Royce is actively pursuing growth opportunities in emerging markets.

- Increased demand for sustainable aviation technologies: The growing focus on environmental sustainability is fueling demand for Rolls-Royce's more environmentally friendly engine technologies.

- Strong order backlog: A healthy order book ensures a steady stream of revenue and work for the foreseeable future.

These factors, coupled with effective market trends analysis and product innovation, contribute significantly to the positive outlook for 2025. The company is effectively leveraging demand growth in key sectors to propel its financial objectives.

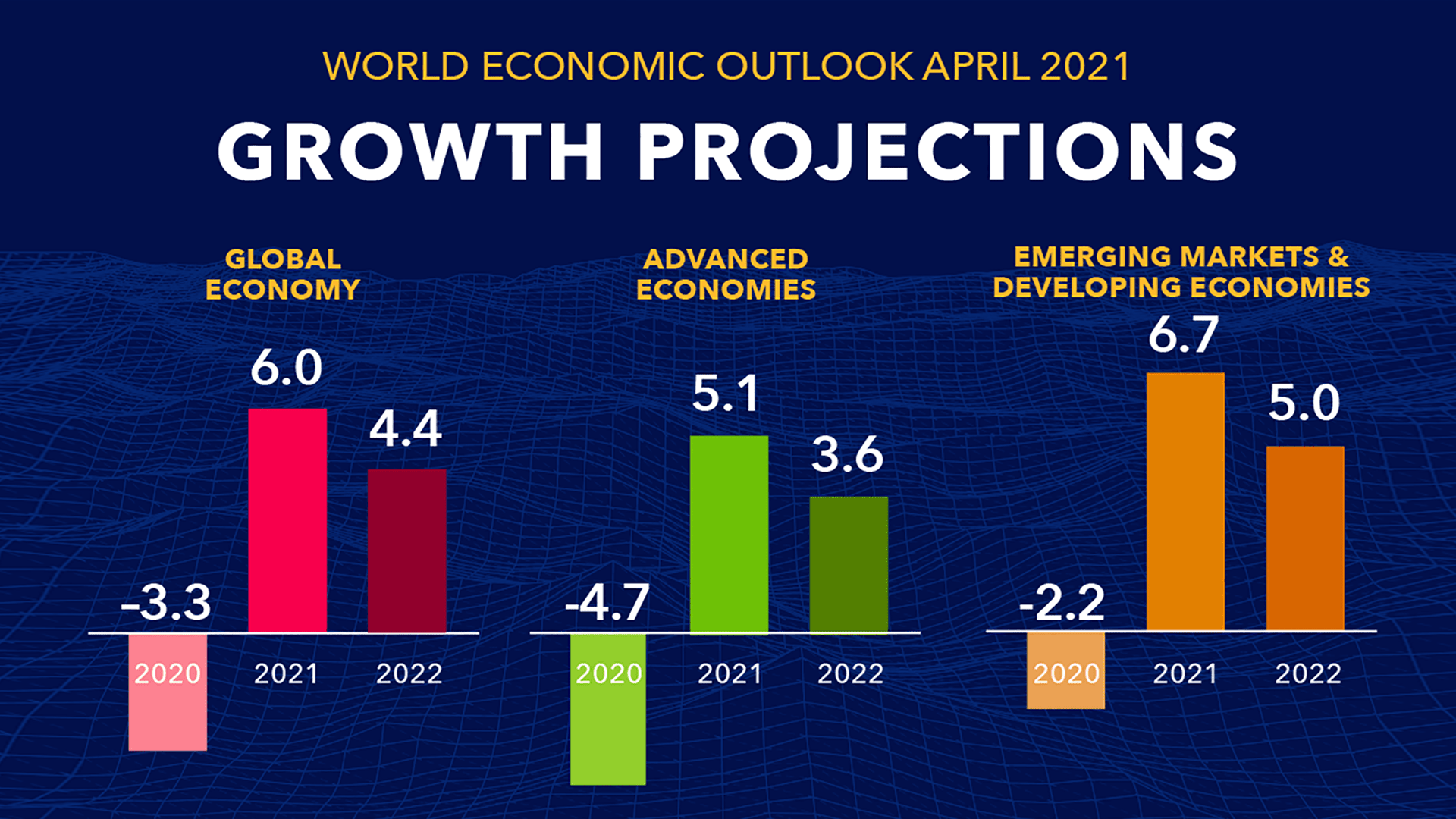

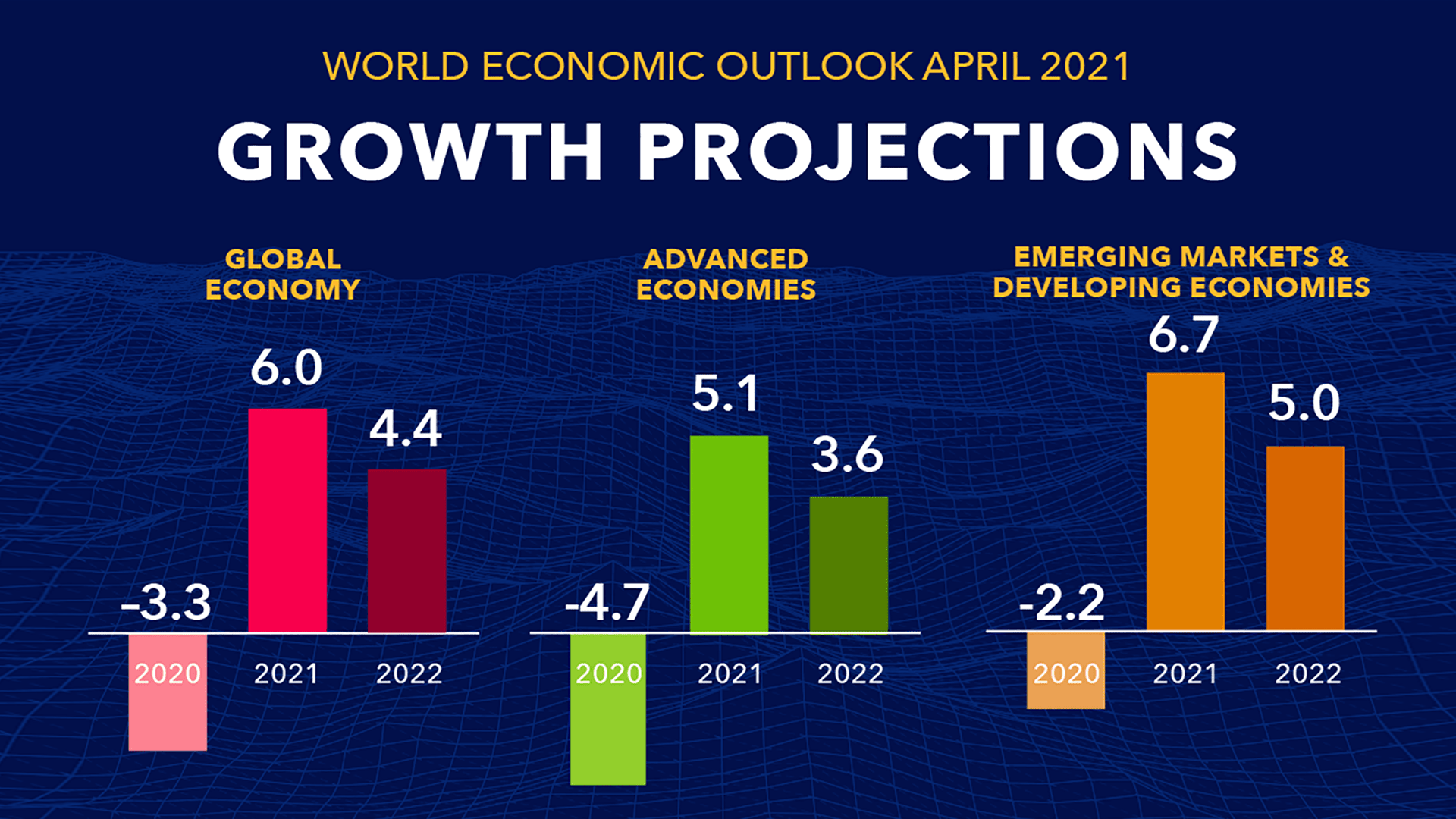

Addressing Global Economic Uncertainty

Rolls-Royce acknowledges the challenges posed by global economic uncertainty, including inflation and potential supply chain disruptions. However, the company has implemented robust risk management strategies to mitigate these risks:

- Diversification of supply chains: Minimizing reliance on single suppliers ensures resilience against disruptions.

- Strategic partnerships: Collaborations with key suppliers and technology partners bolster resilience and innovation.

- Effective cost control measures: Efficiency improvements and streamlined operations minimize the impact of inflation.

By proactively addressing economic uncertainty, Rolls-Royce aims to maintain operational stability and achieve its projected financial goals.

The Impact of Tariffs on Rolls-Royce's Projections

Assessing Tariff-Related Challenges

Rolls-Royce acknowledges that global trade policies and tariffs, particularly import/export regulations, could pose some challenges. These tariffs could impact:

- Import costs of raw materials: Increased import costs could affect production costs and profitability.

- Export competitiveness: Tariffs on Rolls-Royce products in certain markets could reduce competitiveness.

- Supply chain complexity: Navigating tariff regulations adds complexity and administrative burden to global supply chains.

Mitigation Strategies

To manage the impact of tariffs, Rolls-Royce has implemented several mitigation strategies:

- Supply chain diversification: Reducing reliance on specific regions minimizes tariff vulnerability.

- Pricing strategies: Adjusting pricing models to account for tariff increases while maintaining market competitiveness.

- Strategic lobbying efforts: Engaging with relevant regulatory bodies to advocate for favorable trade policies.

- Hedging strategies: Utilizing financial instruments to mitigate potential losses from fluctuating currency exchange rates and tariffs.

These risk mitigation techniques demonstrate a proactive approach to managing tariff-related challenges.

Maintaining Confidence Despite Tariff Headwinds

Despite tariff headwinds, Rolls-Royce remains confident in its 2025 projections. The company's resilience and adaptability, honed through years of navigating complex global markets, are key to overcoming these challenges. Their strategic planning and proactive risk management highlight their commitment to delivering on their ambitious targets.

Analyst Reactions and Market Response to the Announcement

Positive Outlook from Analysts

The announcement of Rolls-Royce's reaffirmed 2025 projections has been met with largely positive responses from financial analysts. Many analysts highlighted the company's robust long-term strategy and its ability to navigate economic uncertainty. Several analysts have maintained a "buy" or "hold" rating on Rolls-Royce stock, reflecting a positive market sentiment.

Stock Market Performance

Following the announcement, Rolls-Royce's stock price experienced a modest increase, indicating positive investor confidence in the company's future prospects. This demonstrates the market's faith in Rolls-Royce's ability to deliver on its ambitious goals, despite the potential challenges presented by tariffs and broader economic uncertainty.

Conclusion: Rolls-Royce 2025 Projections Remain Strong Despite Tariff Challenges

Rolls-Royce has demonstrated strong financial performance and strategic planning by maintaining confidence in its 2025 projections despite potential tariff impacts. Their proactive approach to risk management, coupled with a commitment to innovation and market expansion, highlights their resilience and adaptability in a dynamic global market. The key takeaway is Rolls-Royce's ability to navigate economic uncertainty and deliver on its long-term strategic goals. To stay updated on Rolls-Royce's financial performance and follow Rolls-Royce's 2025 projections, continue to follow industry news and official company announcements.

Featured Posts

-

The China Factor Analyzing Automotive Market Challenges For Brands Like Bmw And Porsche

May 03, 2025

The China Factor Analyzing Automotive Market Challenges For Brands Like Bmw And Porsche

May 03, 2025 -

Souness On Rashford Aston Villas Transfer Pursuit Analyzed

May 03, 2025

Souness On Rashford Aston Villas Transfer Pursuit Analyzed

May 03, 2025 -

Sulm Me Thike Ne Qendren Tregtare Te Cekise Dy Te Vdekur

May 03, 2025

Sulm Me Thike Ne Qendren Tregtare Te Cekise Dy Te Vdekur

May 03, 2025 -

Christina Aguileras Transformation Fans React To Her Youthful New Look

May 03, 2025

Christina Aguileras Transformation Fans React To Her Youthful New Look

May 03, 2025 -

Great Yarmouth Rupert Lowes Renewed Focus After Political Fallout

May 03, 2025

Great Yarmouth Rupert Lowes Renewed Focus After Political Fallout

May 03, 2025