Ripple's XRP: Navigating The SEC Case And The Potential For ETF Listing

Table of Contents

The SEC Lawsuit Against Ripple: A Comprehensive Overview

The SEC's lawsuit against Ripple Labs, filed in December 2020, alleges that Ripple sold XRP as an unregistered security, violating federal securities laws. This legal battle has significantly impacted XRP's price and overall market perception. The core of the SEC's argument hinges on the Howey Test, a legal framework used to determine whether an investment contract qualifies as a security.

-

The SEC's Allegations: The SEC claims Ripple conducted an unregistered securities offering, raising billions of dollars through the sale of XRP. They argue that XRP investors reasonably expected profits based on Ripple's efforts, fulfilling the criteria of the Howey Test.

-

Ripple's Defense: Ripple counters that XRP is a decentralized digital asset, functioning more like Bitcoin or Ether, and therefore not a security. They emphasize XRP's utility as a payment facilitator on their network and highlight its independent market dynamics.

-

The Howey Test and its Implications: The Howey Test examines whether an investment involves an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others. The application of this test to XRP is central to the lawsuit's outcome. The judge's interpretation of this test will be critical in determining the final ruling.

-

Significant Court Rulings and Price Impact: The case has seen several significant rulings, each causing considerable volatility in XRP's price. Favorable rulings for Ripple have generally led to price increases, while rulings favoring the SEC have resulted in price drops. Tracking these rulings and their market impact is vital for understanding XRP's price fluctuations.

-

Potential Outcomes: The potential outcomes of the case range from a complete victory for Ripple, dismissing the SEC's claims, to a settlement where Ripple might agree to certain conditions, to a complete SEC victory, which could have severe implications for XRP's future and broader cryptocurrency regulation.

Analyzing Market Sentiment and XRP Price Volatility

The SEC lawsuit has profoundly impacted XRP's price, creating considerable volatility. Understanding market sentiment and its influence on trading volume is crucial for navigating the XRP market.

-

Impact of the Lawsuit on XRP Price: The ongoing legal battle has led to significant price swings, with periods of both sharp increases and decreases. Investor confidence plays a crucial role in these fluctuations.

-

Market Sentiment and Trading Volume: Positive news regarding the lawsuit often leads to increased trading volume and price surges, while negative news typically results in decreased volume and price drops. Monitoring social media sentiment and news coverage can provide insights into market sentiment.

-

Technical and Fundamental Analysis: Technical analysis, examining charts and patterns, and fundamental analysis, considering factors like Ripple's technology and adoption, can help investors understand XRP's price movements. However, the unusual circumstances surrounding the SEC lawsuit add a layer of complexity to traditional analysis.

-

Correlation with the Overall Crypto Market: While XRP’s price is influenced by its specific circumstances, it’s also correlated with the broader cryptocurrency market. Positive trends in the overall crypto market can positively affect XRP, even during periods of legal uncertainty.

-

Price Charts and Graphs: Visualizing XRP's price movements over time helps illustrate the impact of news events and overall market sentiment. Many reputable cryptocurrency exchanges and analysis websites provide historical price data and charts.

The Potential for an XRP ETF Listing: Opportunities and Challenges

The possibility of an XRP ETF (Exchange-Traded Fund) listing presents both opportunities and significant challenges. An XRP ETF could increase market accessibility and liquidity, but significant regulatory hurdles remain.

-

Benefits of an XRP ETF: An ETF would make XRP more accessible to institutional and retail investors, potentially boosting liquidity and driving price appreciation. Diversification benefits would also attract a broader range of investors.

-

Regulatory Hurdles: SEC approval is paramount. The SEC's concerns about XRP's classification as a security pose a significant barrier to ETF approval. The outcome of the ongoing lawsuit will heavily influence the SEC's decision.

-

SEC Evaluation Criteria: The SEC would likely consider several factors, including XRP's regulatory status, market manipulation risks, and the ETF's compliance with securities laws. Meeting these criteria is crucial for approval.

-

Impact of ETF Approval: ETF approval would likely increase XRP's legitimacy and market adoption, leading to significant price increases and enhanced liquidity. It would signal a greater acceptance of cryptocurrencies within traditional financial markets.

-

Challenges to ETF Approval: Lingering SEC concerns about XRP's security status and the broader regulatory uncertainty surrounding cryptocurrencies could prevent ETF approval, at least for the foreseeable future.

Conclusion

The SEC lawsuit against Ripple and the potential for an XRP ETF listing are pivotal events shaping the future of XRP. The outcome of the lawsuit will significantly influence the regulatory landscape for cryptocurrencies, and a potential ETF listing could boost XRP's mainstream adoption and liquidity. While uncertainty remains, understanding the legal battle and market dynamics surrounding XRP is crucial for informed investment decisions.

Call to Action: Stay informed on the latest developments in the Ripple vs. SEC case and the potential for an XRP ETF listing. Continue researching XRP and its potential, but remember to conduct thorough due diligence before investing in any cryptocurrency, including XRP. Learn more about navigating the complexities of the XRP market and make informed investment choices.

Featured Posts

-

Analyzing Home Court Advantage In The Warriors Rockets Playoffs

May 07, 2025

Analyzing Home Court Advantage In The Warriors Rockets Playoffs

May 07, 2025 -

The Karate Kids Impact On Pop Culture And Martial Arts Training

May 07, 2025

The Karate Kids Impact On Pop Culture And Martial Arts Training

May 07, 2025 -

May 4th 2025 Daily Lotto Results

May 07, 2025

May 4th 2025 Daily Lotto Results

May 07, 2025 -

Analyzing The Karate Kid Part Ii Plot Characters And Themes

May 07, 2025

Analyzing The Karate Kid Part Ii Plot Characters And Themes

May 07, 2025 -

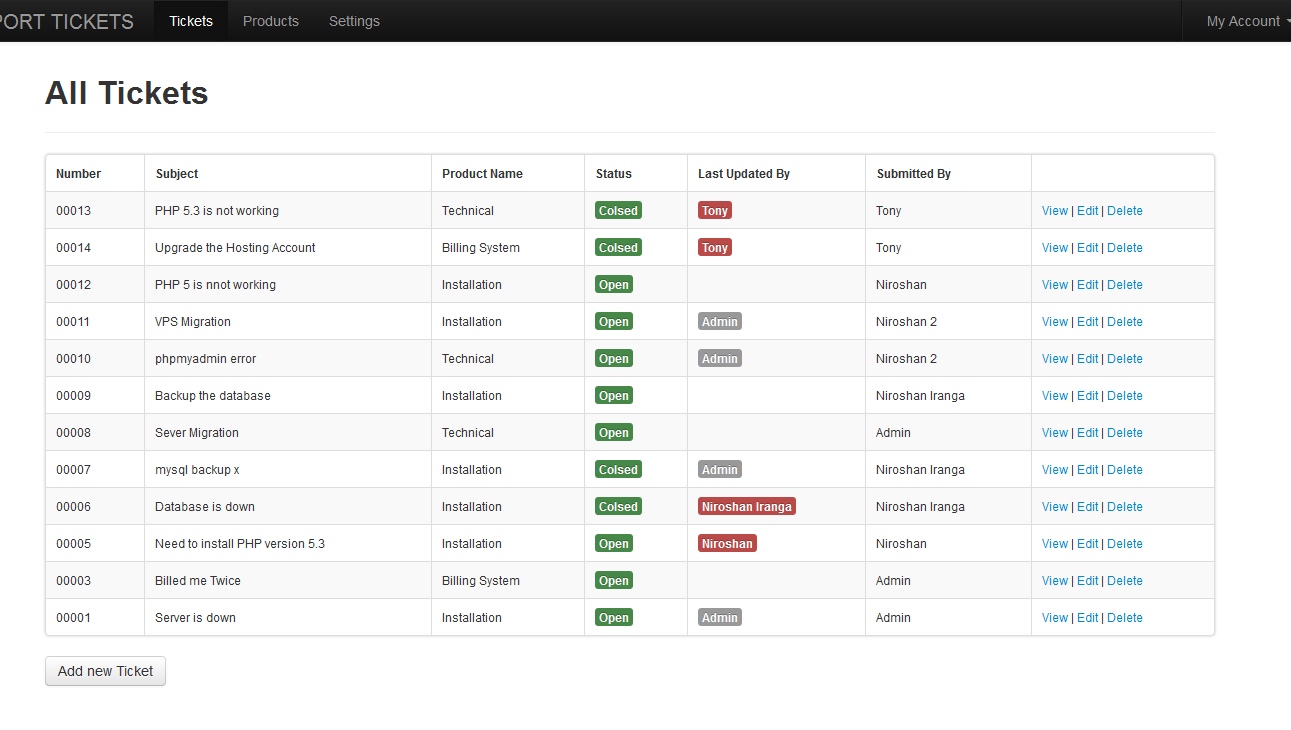

Support The Cavs And Donate Your Tickets New Online System

May 07, 2025

Support The Cavs And Donate Your Tickets New Online System

May 07, 2025

Latest Posts

-

La Temporada Historica Del Betis Datos Y Analisis

May 08, 2025

La Temporada Historica Del Betis Datos Y Analisis

May 08, 2025 -

Este Betis Historico El Legado De Un Equipo Inolvidable

May 08, 2025

Este Betis Historico El Legado De Un Equipo Inolvidable

May 08, 2025 -

Former Okc Thunders Record Breaking Double Performances An Analysis

May 08, 2025

Former Okc Thunders Record Breaking Double Performances An Analysis

May 08, 2025 -

Por Que Este Betis Es Ya Historico Un Repaso A Sus Logros

May 08, 2025

Por Que Este Betis Es Ya Historico Un Repaso A Sus Logros

May 08, 2025 -

Exploring The Unique Double Performance Records Of The Former Okc Thunder

May 08, 2025

Exploring The Unique Double Performance Records Of The Former Okc Thunder

May 08, 2025