Ripple's $1 Trillion Market Cap Potential: A Realistic Investment?

Table of Contents

1. Introduction

Ripple, a prominent player in the cryptocurrency space, utilizes its proprietary technology, RippleNet, and its native cryptocurrency, XRP, to facilitate fast and cost-effective cross-border payments. While XRP has seen phenomenal price swings, its potential for growth remains a topic of much debate. This article will explore the factors contributing to, and hindering, Ripple reaching a $1 trillion market capitalization.

2. Main Points

H2: Ripple's Current Market Position and Growth Trajectory

H3: Market Capitalization and Trading Volume

As of [Insert Date], Ripple (XRP) holds a market capitalization of approximately [Insert Current Market Cap] and a 24-hour trading volume of [Insert Current Trading Volume]. This places it [Insert Current Ranking] among cryptocurrencies. [Insert a chart or graph visualizing the market cap and trading volume over time]. The historical data reveals periods of significant growth, interspersed with periods of correction, highlighting the inherent volatility of the cryptocurrency market.

H3: Adoption by Financial Institutions

RippleNet's adoption by financial institutions is a key driver of XRP's value. Major banks like [List Examples of Banks Using RippleNet] are utilizing RippleNet for cross-border transactions, significantly impacting the volume processed through the network.

- Number of banks using RippleNet: [Insert Approximate Number]

- Transaction volume processed through RippleNet: [Insert Approximate Volume, possibly in USD or other relevant unit]

- Geographic spread of RippleNet adoption: [Describe the geographic reach, mentioning key regions]

- Analysis of growth rate and future projections: [Insert analysis and projections based on available data, include sources]

H2: Factors Contributing to a Potential $1 Trillion Market Cap

H3: Technological Advantages of XRP

XRP's potential stems from its technological advantages. Its speed, scalability, and low transaction costs make it a compelling alternative to traditional payment systems.

- Comparison of XRP's transaction speed to other cryptocurrencies: [Include comparative data with sources]

- Explanation of RippleNet's role in reducing transaction fees: [Detail how RippleNet contributes to cost reduction]

H3: Growing Demand for Cross-border Payments

The global demand for efficient and cost-effective cross-border payment solutions is steadily increasing. Ripple, with its RippleNet, is well-positioned to capitalize on this growing demand.

H3: Regulatory Landscape and Legal Battles

Ripple's ongoing legal battle with the SEC significantly impacts its price and market potential. A positive outcome could unlock substantial growth, while a negative outcome could severely hamper its progress. [Discuss various potential outcomes and their implications on the market cap].

- Discussion of potential regulatory changes that could benefit XRP: [Analyze potential future regulations and their effect]

- Assessment of the risk associated with the ongoing legal case: [Provide a balanced perspective on the risks involved]

H2: Challenges and Risks to Achieving a $1 Trillion Market Cap

H3: Competition from Other Cryptocurrencies

Ripple faces stiff competition from other cryptocurrencies and blockchain-based payment solutions such as [List Key Competitors]. These competitors offer alternative solutions, impacting Ripple's market share.

H3: Market Volatility and Investor Sentiment

The cryptocurrency market is notoriously volatile. Investor sentiment plays a crucial role in XRP's price fluctuations, making it susceptible to market-wide trends and news events.

- Analyze historical price fluctuations of XRP: [Provide data on historical price volatility]

H3: Scalability and Technological Limitations

While XRP offers advantages, scalability and technological limitations remain potential challenges. [Discuss potential limitations and ongoing development efforts to address them].

H2: Is a $1 Trillion Market Cap Realistic? A Balanced Perspective

Reaching a $1 trillion market cap for Ripple would require sustained adoption, positive regulatory developments, and overcoming significant competition. While the technology and growing demand are positive indicators, the legal uncertainties and market volatility introduce considerable risk. Given the current market conditions and the ongoing legal challenges, achieving a $1 trillion market cap appears unlikely in the near future, though not entirely impossible in the long term.

3. Conclusion

Ripple (XRP) presents a compelling investment opportunity, driven by its technology and the growing need for efficient cross-border payments. However, the legal battle, market volatility, and intense competition present considerable risks. A $1 trillion market cap is a long-shot scenario but not entirely outside the realm of possibility.

Key Takeaways:

- Ripple's technology offers advantages in speed and cost-effectiveness.

- The legal battle with the SEC is a major uncertainty.

- Market volatility is inherent in the cryptocurrency space.

- Competition is intense.

Call to Action: Is a Ripple investment right for you? Assess the potential of Ripple (XRP) carefully, considering your risk tolerance and investment goals. Conduct thorough research and consult with a financial advisor before making any investment decisions. Learn more about Ripple's $1 trillion market cap potential by exploring reputable sources and staying updated on the latest developments.

Eurovision 2025 Analyzing The Leading Candidates Weeks Before The Contest

Eurovision 2025 Analyzing The Leading Candidates Weeks Before The Contest

Sheinbaum Y Julio Cesar Patrocinadores De La Clase Nacional De Boxeo 2025 If Applicable

Sheinbaum Y Julio Cesar Patrocinadores De La Clase Nacional De Boxeo 2025 If Applicable

Remembering Priscilla Pointer A Century On Stage And Screen

Remembering Priscilla Pointer A Century On Stage And Screen

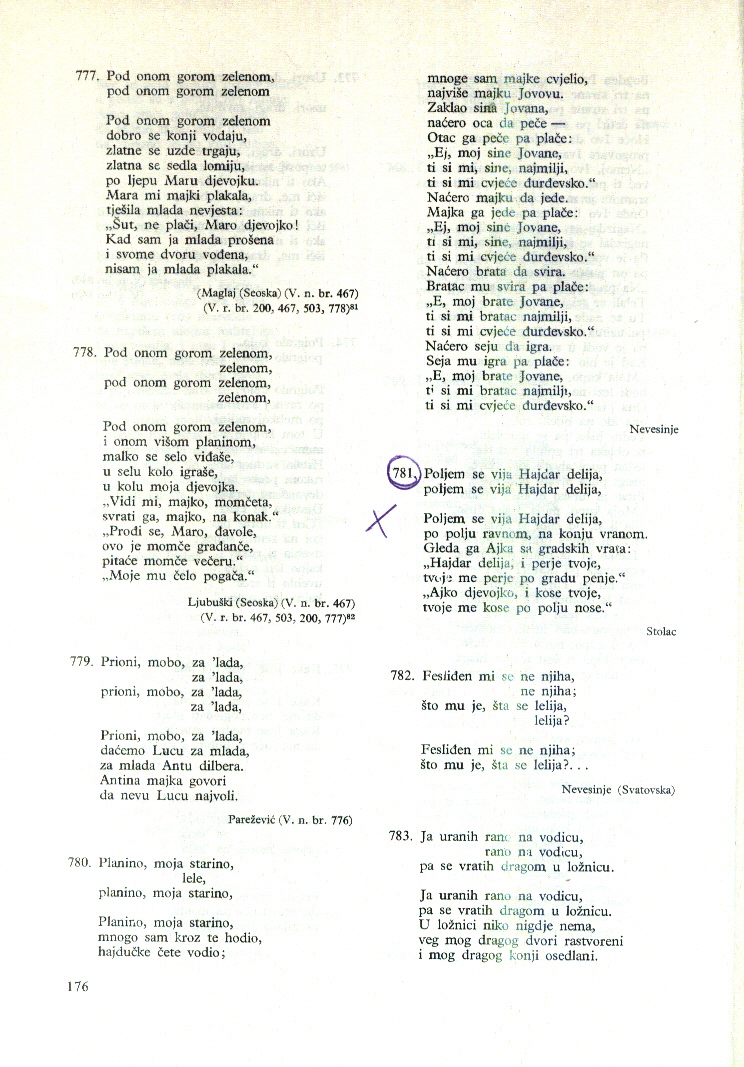

Zdravkove Prve Ljubavi Prica O Pjesmi Kad Sam Se Vratio

Zdravkove Prve Ljubavi Prica O Pjesmi Kad Sam Se Vratio

Nrc Halts Warri Itakpe Rail Services Following Train Engine Malfunction

Nrc Halts Warri Itakpe Rail Services Following Train Engine Malfunction