Ripple XRP Price Surge: Brazil ETF Approval And Trump's Endorsement

Table of Contents

Brazil ETF Approval: A Game Changer for XRP Adoption?

The approval of a Brazil-based XRP ETF marks a pivotal moment for Ripple and the broader cryptocurrency market. This regulatory green light signifies a significant step towards mainstream adoption, legitimizing XRP in the eyes of institutional investors and potentially opening floodgates for new investment.

-

Details on the approved Brazilian XRP ETF: While specific details may vary depending on the final ETF structure, the approval itself signals a willingness from Brazilian regulators to embrace cryptocurrencies, potentially setting a precedent for other Latin American countries. The issuing company and the precise regulatory body involved will be crucial factors in determining the ETF's long-term success.

-

Impact on XRP's legitimacy and institutional adoption: The approval of an ETF provides a regulated and accessible entry point for institutional investors, who previously may have hesitated due to regulatory uncertainty surrounding cryptocurrencies. This influx of institutional capital could significantly bolster XRP's price and market capitalization.

-

Opening the XRP market to new investors in Brazil and Latin America: This ETF represents a significant opportunity for investors in Brazil and across Latin America to gain exposure to XRP through a regulated financial product, bypassing some of the complexities and risks associated with direct cryptocurrency exchanges.

-

Comparison with other crypto ETF approvals globally: The success of this Brazilian XRP ETF will undoubtedly be compared to other crypto ETF approvals globally. Analyzing the impact of similar approvals on other cryptocurrencies’ prices can provide valuable insights into the potential trajectory of XRP. This comparative analysis will help determine if Brazil's move is an isolated event or a trend signaling broader global acceptance of XRP.

-

Potential future implications for other emerging markets: The approval in Brazil could inspire other emerging markets to consider similar regulatory frameworks for XRP and other cryptocurrencies, potentially leading to a wave of new ETF approvals and accelerating the global adoption of digital assets.

Trump's Endorsement: Unexpected Boost to XRP Sentiment

Former President Donald Trump's comments on cryptocurrencies, even if not explicitly endorsing XRP, have undeniably influenced market sentiment. The sheer impact of his words on social media and financial news outlets cannot be underestimated.

-

Details on Trump's statement: While the exact nature of Trump's statements regarding cryptocurrencies needs careful analysis, their impact on the XRP market is undeniable. Any positive sentiment expressed towards digital assets, even indirectly, can translate into increased investor interest and buying pressure.

-

Impact on XRP's market sentiment and price: Trump's comments, regardless of their specificity, injected a dose of positive sentiment into the market, triggering a wave of buying activity and subsequently pushing up the XRP price. This demonstrates the power of celebrity endorsements and the influence of high-profile figures on market psychology.

-

Role of celebrity endorsements in influencing cryptocurrency markets: The cryptocurrency market is susceptible to the influence of celebrity endorsements, a phenomenon also observed with other digital assets. The reach and influence of these figures can sway public opinion and investor behavior, causing significant price fluctuations.

-

Short-term and long-term implications of Trump's endorsement: While the short-term impact of Trump’s comments is evident in the XRP price surge, the long-term implications remain uncertain. Sustained growth will depend on fundamental factors like technological advancements, regulatory clarity, and overall market conditions.

-

Comparison with other instances of celebrity endorsements in the crypto space: Analyzing past instances of celebrity endorsements in the cryptocurrency space, their short-term impact and their long-term effects, helps put Trump's influence in perspective and predict future trends.

Technical Analysis: XRP Price Charts and Future Predictions

Analyzing XRP's price charts using technical indicators is crucial for understanding its recent surge and potential future trajectory.

-

Analysis of XRP's recent price movements: Technical analysis, incorporating indicators like moving averages, RSI, and MACD, helps identify trends and predict potential price reversals.

-

Identification of key support and resistance levels: Chart patterns reveal crucial support and resistance levels, providing insight into potential price fluctuations.

-

Discussion on trading volume and its implications: High trading volume accompanying the price surge confirms strong market interest, but sustained volume is crucial for validating the upward trend.

-

Presentation of different price predictions: Various prediction models, based on technical analysis and fundamental factors, offer different potential scenarios, highlighting both upside potential and inherent risks.

-

Cautionary notes about the inherent volatility of cryptocurrency markets: Investors must remain aware of the inherently volatile nature of the cryptocurrency market and the unpredictable nature of price movements.

Risks and Considerations for XRP Investors

While the recent price surge is encouraging, it's vital to acknowledge the risks associated with investing in XRP.

-

Potential risks: Market volatility remains a significant risk. Regulatory uncertainty surrounding cryptocurrencies globally also poses a potential challenge. The Ripple Labs lawsuit also carries implications for XRP's long-term viability.

-

Importance of due diligence: Thorough research and due diligence are critical before any investment decision. Understanding the technology, market dynamics, and potential risks is paramount.

-

Diversification of investment portfolios: Diversifying investments across various asset classes mitigates overall portfolio risk and protects against potential losses in any single asset.

-

Understanding your risk tolerance: Investors should carefully evaluate their own risk tolerance before investing in XRP or any other volatile cryptocurrency.

Conclusion

The recent Ripple XRP price surge, fueled by the approval of a Brazil-based ETF and a surprising endorsement from Donald Trump, highlights the dynamic nature of the cryptocurrency market. While these events have generated significant positive sentiment, investors should approach this with caution. The combination of increased institutional interest and positive media attention presents both substantial opportunities and considerable challenges. Understanding the factors driving the Ripple XRP price surge is crucial for informed investment decisions. Stay informed on the latest developments in the XRP market and continue your research into the potential of Ripple and its cryptocurrency to navigate this dynamic landscape effectively.

Featured Posts

-

Xrp Price Prediction Will Xrp Hold 2 Support Reversal Or Fakeout

May 08, 2025

Xrp Price Prediction Will Xrp Hold 2 Support Reversal Or Fakeout

May 08, 2025 -

Ptt 2025 Personel Alimi Basvuru Tarihleri Ve Sartlari

May 08, 2025

Ptt 2025 Personel Alimi Basvuru Tarihleri Ve Sartlari

May 08, 2025 -

Saturday April 12 2025 Lotto Draw Results

May 08, 2025

Saturday April 12 2025 Lotto Draw Results

May 08, 2025 -

Carney Calls Trump Transformational In D C Meeting

May 08, 2025

Carney Calls Trump Transformational In D C Meeting

May 08, 2025 -

Grizzlies Thunder Showdown A Preview Of A Critical Game

May 08, 2025

Grizzlies Thunder Showdown A Preview Of A Critical Game

May 08, 2025

Latest Posts

-

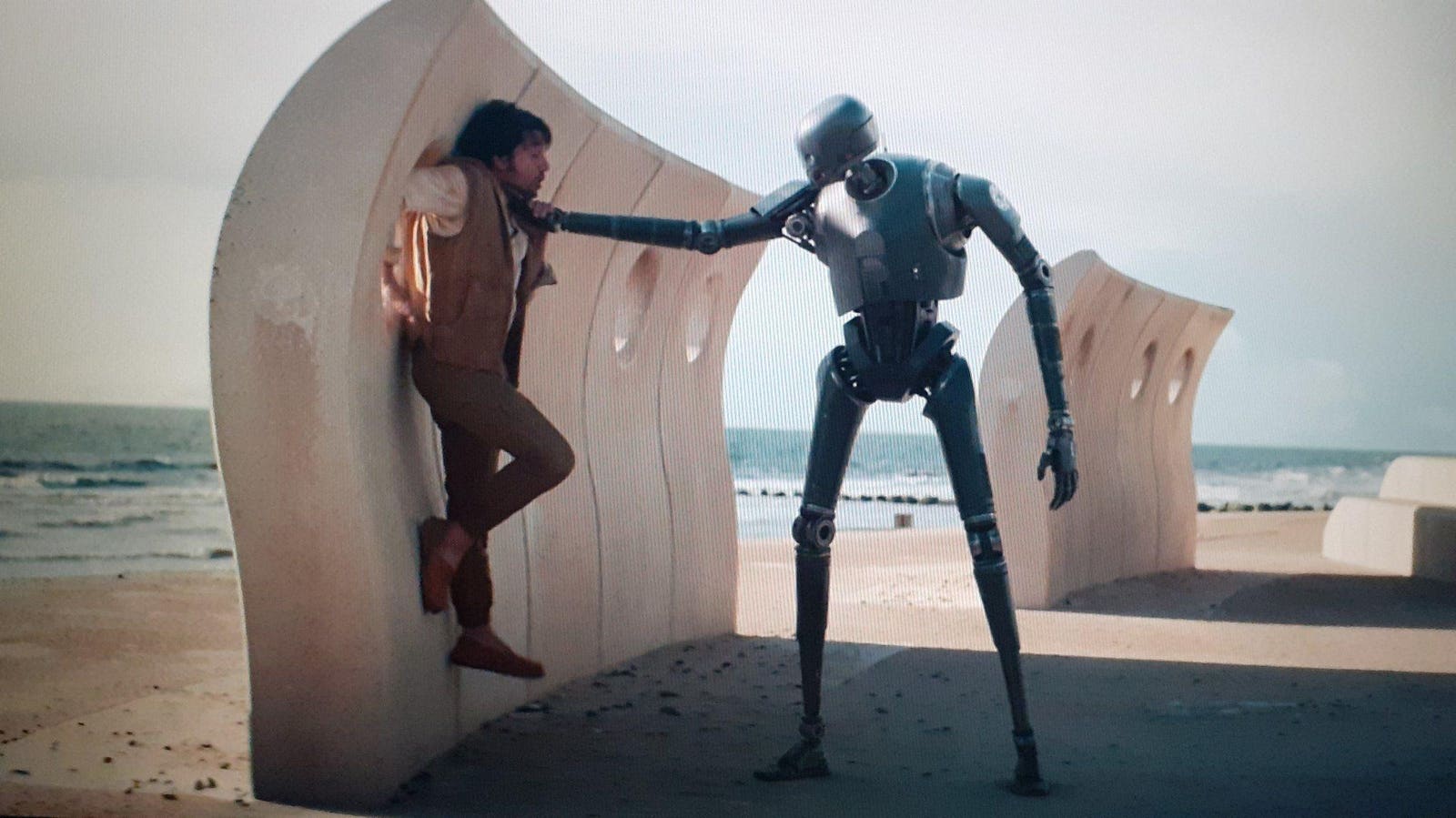

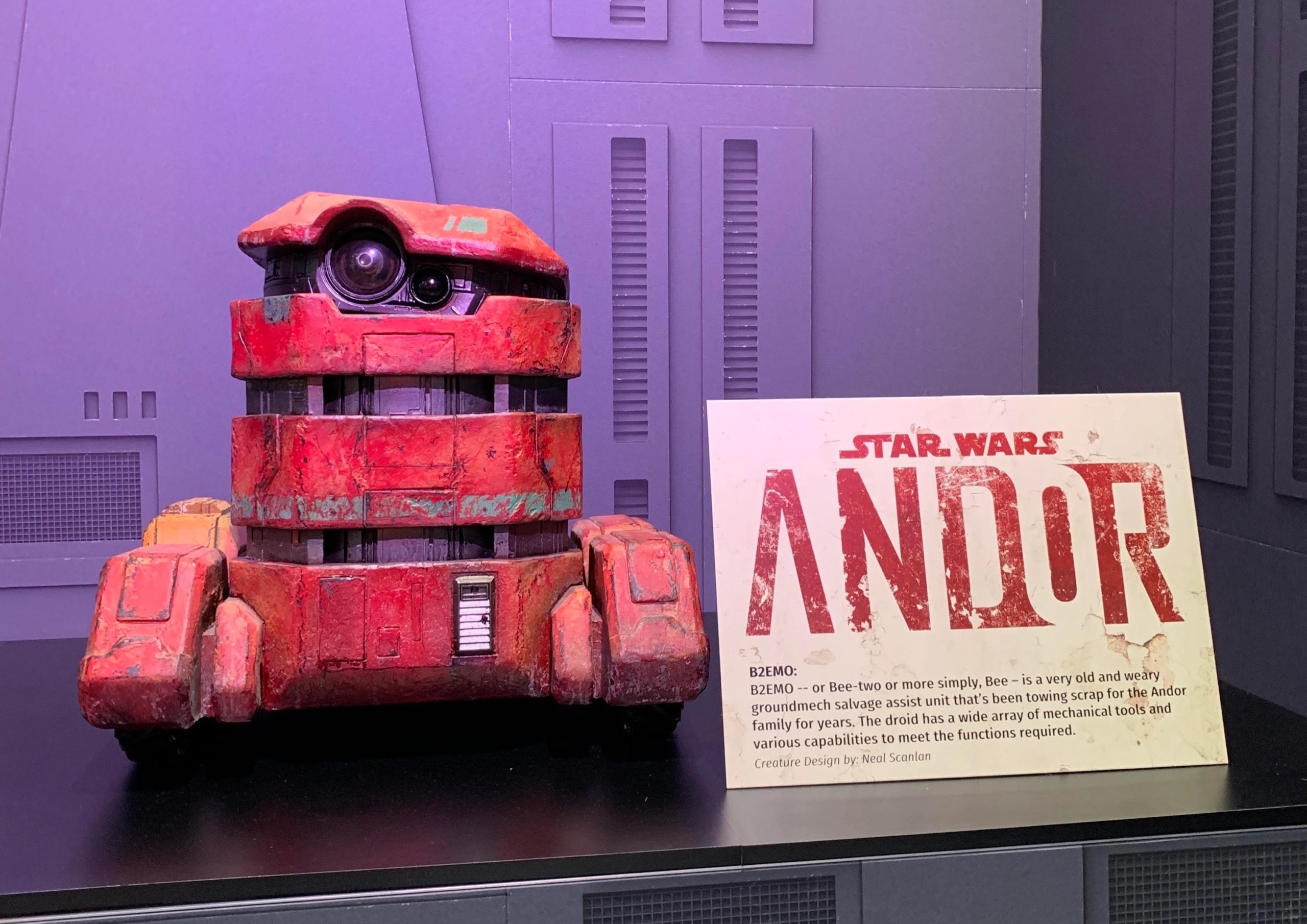

Watch 3 Free Star Wars Andor Episodes On You Tube Now

May 08, 2025

Watch 3 Free Star Wars Andor Episodes On You Tube Now

May 08, 2025 -

Yavin 4s Return A Star Wars Legacy Explained

May 08, 2025

Yavin 4s Return A Star Wars Legacy Explained

May 08, 2025 -

Andor Season 2 The Trailers Absence Sparks Intense Fan Debate

May 08, 2025

Andor Season 2 The Trailers Absence Sparks Intense Fan Debate

May 08, 2025 -

Fan Anxiety Mounts As Andor Season 2 Trailer Release Remains Unscheduled

May 08, 2025

Fan Anxiety Mounts As Andor Season 2 Trailer Release Remains Unscheduled

May 08, 2025 -

First Look At Andor The Star Wars Event 31 Years In The Making

May 08, 2025

First Look At Andor The Star Wars Event 31 Years In The Making

May 08, 2025