Ripple Vs SEC: XRP Gains Momentum – What It Means For Investors

Understanding the Ripple vs SEC Lawsuit

The SEC's lawsuit against Ripple Labs, filed in December 2020, alleges that Ripple conducted an unregistered securities offering through the sale of XRP. The SEC argues that XRP is a security, subject to registration requirements under federal securities laws. Ripple vehemently denies this, asserting that XRP is a digital asset, a currency, and not a security. This core disagreement forms the crux of the legal battle.

The legal arguments hinge on the Howey Test, a Supreme Court precedent used to determine whether an investment constitutes a security. The SEC contends XRP meets the criteria of the Howey Test, implying a reasonable expectation of profit derived from the efforts of others (Ripple). Ripple, conversely, argues that XRP is decentralized, widely traded on exchanges, and lacks the centralized control necessary to qualify as a security under the Howey Test.

- SEC's Claims: XRP sales constitute an unregistered securities offering, violating federal securities laws. They claim Ripple profited from selling XRP without proper registration.

- Ripple's Counterarguments: XRP is a decentralized digital asset, functioning as a currency and not a security. They highlight its widespread adoption and use outside of Ripple's control.

- Key Legal Precedents: The Howey Test, various court decisions on digital assets and securities laws, are central to the arguments presented by both sides.

Recent Developments and Their Impact on XRP

Recent court rulings and expert opinions have significantly impacted XRP's trajectory. The "fair notice" defense, a key argument of Ripple’s, has gained traction. Furthermore, the judge's consideration of various amicus briefs from industry experts has influenced the perception of the case's outcome. These positive developments have fueled increased trading volume and a notable price surge for XRP.

- Positive Developments for Ripple: Favorable court rulings on specific motions, expert testimonies supporting Ripple's arguments, and growing industry support have boosted investor confidence.

- XRP Price Fluctuations: XRP's price has shown a strong correlation with positive news related to the case, indicating market sensitivity to legal developments. Price increases have been followed by periods of consolidation, showing investor caution.

- Expert Opinions: Many cryptocurrency analysts predict a positive outcome for Ripple, which is reflected in their outlook on XRP’s long-term potential.

XRP's Market Position and Future Prospects

XRP currently holds a significant market capitalization and ranking among cryptocurrencies, despite the ongoing legal uncertainty. A favorable ruling could significantly boost its adoption and usage, especially within the RippleNet network and beyond. However, an unfavorable outcome could negatively affect XRP's price and market standing.

- XRP's Technology and Utility: XRP’s technology facilitates fast and low-cost cross-border payments, extending beyond the RippleNet network. Its use cases extend to various applications within the blockchain and fintech industries.

- Potential Partnerships and Collaborations: A positive resolution could open doors for new partnerships and collaborations, accelerating XRP's adoption across diverse sectors.

- Long-Term Outlook: The long-term price and market share of XRP heavily depend on the outcome of the Ripple vs SEC lawsuit, broader regulatory clarity in the cryptocurrency space, and its continued adoption and innovation.

Investment Strategies Considering the Ripple vs SEC Uncertainty

Investing in XRP during this legal uncertainty requires a cautious approach. Thorough due diligence is paramount. Investors should understand the risks and consider strategies like dollar-cost averaging to mitigate potential losses.

- Risk Assessment: XRP investments carry significant risk due to the ongoing legal battle. The outcome could drastically affect its price.

- Diversification Strategies: Diversifying your cryptocurrency portfolio across multiple assets helps reduce overall risk. Don't put all your eggs in one basket.

- Importance of Financial Advice: Always seek guidance from a qualified financial advisor before making any investment decisions, particularly in volatile markets like cryptocurrencies.

Conclusion: Ripple vs SEC: Making Informed Investment Decisions about XRP

The Ripple vs SEC lawsuit significantly impacts XRP's price and market position. A favorable ruling could propel XRP to new heights, while an unfavorable one could lead to significant losses. Understanding the legal complexities and inherent risks is critical for investors. The uncertainty surrounding the outcome necessitates a careful, informed approach. Stay informed about the ongoing Ripple vs SEC developments and make well-informed investment decisions regarding XRP. Consult with financial advisors and conduct thorough research before investing in XRP or any other cryptocurrency.

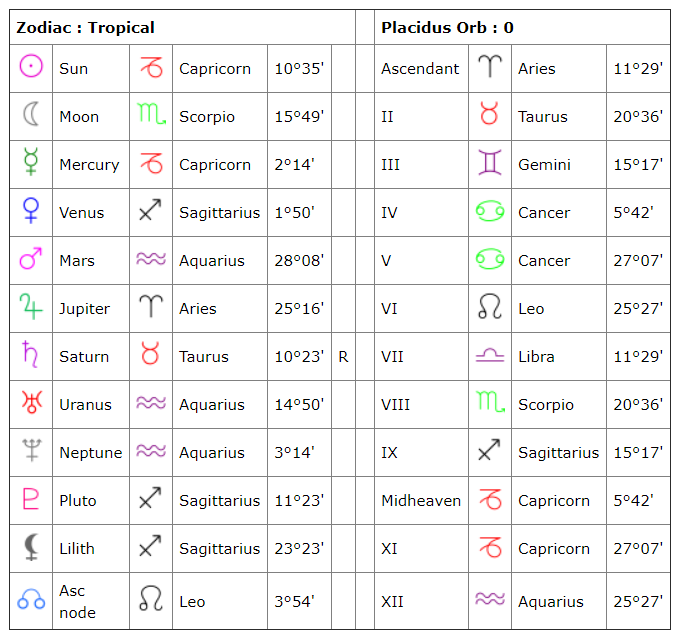

Daily Horoscope April 17 2025 Astrological Readings By Zodiac Sign

Daily Horoscope April 17 2025 Astrological Readings By Zodiac Sign

Guardians Series Victory Over Yankees Analysis And Insights

Guardians Series Victory Over Yankees Analysis And Insights

Tbs Safety And Nebofleet Automating Workboat Safety

Tbs Safety And Nebofleet Automating Workboat Safety

The Merrie Monarch Festivals Hoike A Celebration Of Pacific Island Dance And Music

The Merrie Monarch Festivals Hoike A Celebration Of Pacific Island Dance And Music

Beware Of Fake Steven Bartlett Protecting Your Finances From Online Fraud

Beware Of Fake Steven Bartlett Protecting Your Finances From Online Fraud