Riot Platforms Stock: What's Happening With RIOT And The Crypto Market?

Table of Contents

Riot Platforms' Business Model and Bitcoin Mining Operations

Riot Platforms' core business revolves around Bitcoin mining. Their operations involve deploying substantial computing power (hash rate) to solve complex cryptographic puzzles, earning Bitcoin as a reward. The efficiency and scale of their mining operations are crucial to their profitability. Several key factors define their business model:

-

Mining Infrastructure: Riot Platforms boasts a significant network of mining facilities, strategically located to optimize energy costs and operational efficiency. The sheer number of mining rigs they operate directly influences their Bitcoin mining capacity and, consequently, their potential earnings.

-

Mining Hardware and Technological Advancements: The company continually invests in the latest generation of ASIC (Application-Specific Integrated Circuit) miners. These advancements in mining hardware are crucial for maintaining a competitive edge in the increasingly complex Bitcoin mining landscape. Upgrades allow for increased hash rate and improved energy efficiency.

-

Energy Sourcing and Environmental Impact: Energy costs constitute a significant expense in Bitcoin mining. Riot Platforms’ strategies for sourcing energy, including exploring renewable sources, directly impact their operational profitability and their environmental footprint. Transparency regarding their energy mix is vital for attracting environmentally conscious investors.

-

Recent Expansions and Upgrades: Growth in mining capacity is achieved through expansions to existing facilities and the addition of new mining sites. These expansions directly influence their potential Bitcoin production and, therefore, their overall revenue.

The Impact of Bitcoin's Price on RIOT Stock

The price of Bitcoin is inextricably linked to the performance of RIOT stock. This correlation stems from the simple fact that Riot Platforms' primary revenue source is Bitcoin. When Bitcoin's price rises, the value of their mined Bitcoin increases, boosting their profitability and positively influencing RIOT's stock price. Conversely, a drop in Bitcoin's price negatively impacts their revenue and exerts downward pressure on the RIOT stock price.

-

Historical Data Correlation: Analyzing past performance clearly demonstrates a strong positive correlation between Bitcoin's price and RIOT's stock price. Periods of Bitcoin price appreciation have generally coincided with increases in RIOT stock value, and vice-versa.

-

Market Sentiment and its Influence: Broader market sentiment toward Bitcoin significantly affects both the cryptocurrency's price and RIOT's stock. Positive news and investor confidence tend to drive up both, while negative news or regulatory uncertainty can cause sharp declines.

-

Future Price Movement Scenarios: Predicting future price movements is inherently speculative, but analyzing Bitcoin's price trajectory, along with macroeconomic factors and regulatory developments, provides clues about potential scenarios for both Bitcoin and RIOT stock.

Regulatory Landscape and its Effect on Riot Platforms

The regulatory environment surrounding cryptocurrency mining significantly influences Riot Platforms' operations. Changes in regulations can impact their profitability and even the legality of their activities. Therefore, understanding the evolving regulatory landscape is crucial for evaluating the long-term viability of RIOT as an investment.

-

US and International Regulations: Regulations vary across jurisdictions. Staying abreast of regulatory changes in the US and other countries where Riot operates is vital. Stricter regulations could increase operational costs or even restrict mining activities.

-

Impact of Future Regulatory Changes: Future regulatory changes could range from stricter environmental regulations impacting energy consumption to tax policies affecting the profitability of Bitcoin mining. These changes could significantly alter the risk profile of investing in RIOT stock.

-

Current Legal and Compliance Issues: Analyzing any ongoing legal or compliance issues facing Riot Platforms is crucial for assessing the risks associated with the investment.

Analyzing RIOT Stock: Investment Considerations and Risks

Investing in RIOT stock offers potential rewards but entails considerable risk. The cryptocurrency market's inherent volatility is a major factor to consider. Before investing, a thorough analysis of the company’s financial performance and long-term prospects is essential.

-

Financial Health and Growth Prospects: Analyzing Riot Platforms' financial statements, including revenue, profitability, and debt levels, is crucial for assessing its financial health and long-term growth potential.

-

Volatility of the Cryptocurrency Market: The cryptocurrency market's volatility presents a significant risk. Sharp price swings in Bitcoin can lead to substantial gains or losses in RIOT stock within short periods.

-

Disclaimer on Speculative Nature: Investing in crypto-related stocks is inherently speculative. Potential investors must be prepared for the possibility of significant losses.

Conclusion

Riot Platforms stock (RIOT) is deeply intertwined with the performance of Bitcoin and the broader cryptocurrency market. Its profitability is directly affected by Bitcoin's price, regulatory developments, and the efficiency of its mining operations. While the potential for substantial returns exists, investors must acknowledge the significant risks associated with this volatile sector. Before investing in RIOT stock, thorough research into the company's financials, the regulatory landscape, and the overall health of the cryptocurrency market is crucial. Learn more about Riot Platforms stock, stay updated on RIOT’s performance, and analyze the current trends in the crypto market and RIOT’s position within it to make informed investment decisions. Remember, responsible investment strategies are paramount when dealing with RIOT stock and the volatile nature of the cryptocurrency market.

Featured Posts

-

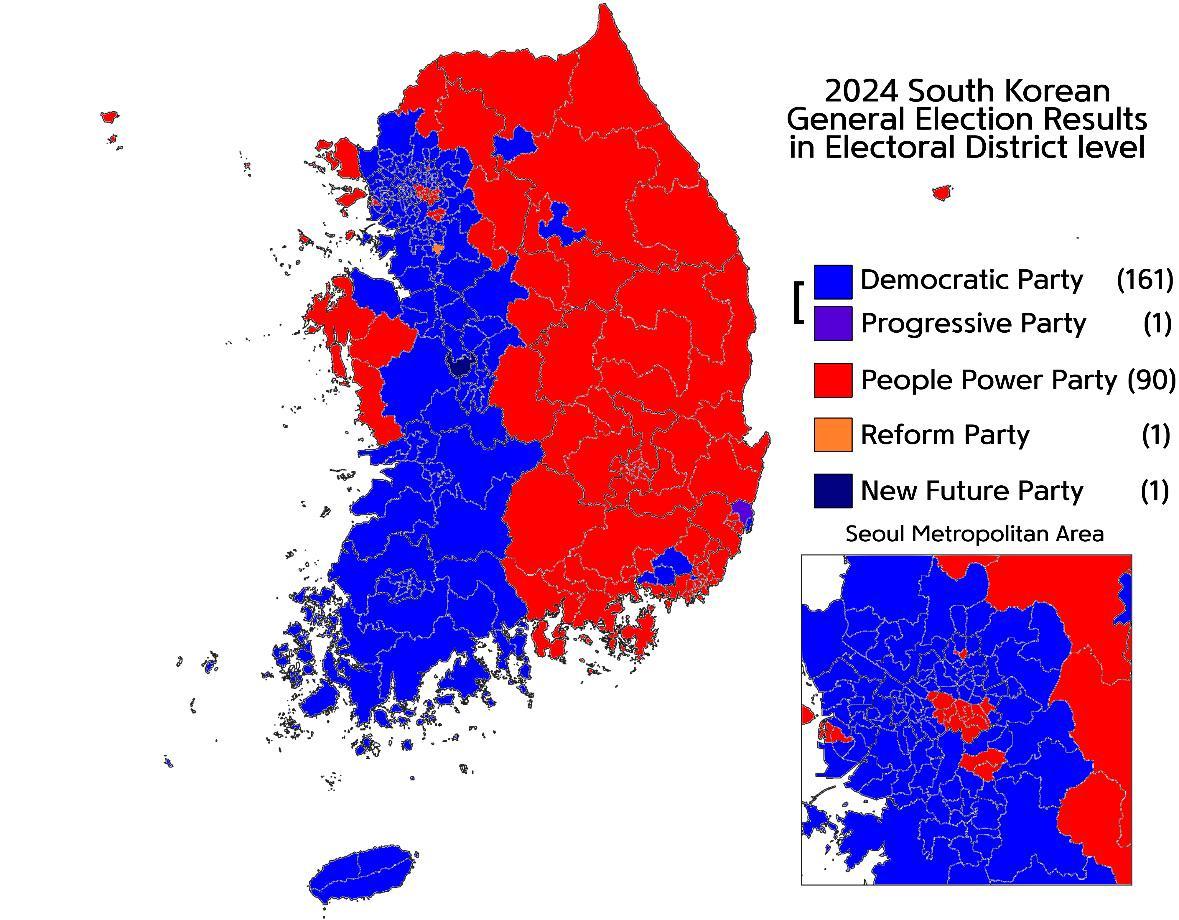

Analysis Hans Resignation And The Upcoming South Korean Election

May 02, 2025

Analysis Hans Resignation And The Upcoming South Korean Election

May 02, 2025 -

Play Station Portal And Cloud Streaming Access To A Wider Range Of Classic Games

May 02, 2025

Play Station Portal And Cloud Streaming Access To A Wider Range Of Classic Games

May 02, 2025 -

Tbs Klinieken Overvol Wachttijden Langer Dan Een Jaar

May 02, 2025

Tbs Klinieken Overvol Wachttijden Langer Dan Een Jaar

May 02, 2025 -

Endonezya Ve Tuerkiye Ortak Gelecege Dogru Imzalar

May 02, 2025

Endonezya Ve Tuerkiye Ortak Gelecege Dogru Imzalar

May 02, 2025 -

Leading Healthcare Experience Management Nrc Healths Klas Award

May 02, 2025

Leading Healthcare Experience Management Nrc Healths Klas Award

May 02, 2025