Riot Platforms (RIOT) Stock: A Deep Dive Into Recent Performance

Table of Contents

Recent Financial Performance of Riot Platforms (RIOT)

Revenue and Profitability

Analyzing Riot Platforms' financial results is essential to understanding its current standing. We need to examine key metrics such as revenue growth, Bitcoin mining profitability, and operating expenses. Let's look at some recent data:

- Q[Insert Quarter] [Insert Year] Results: Riot Platforms reported [Insert Revenue Figure] in revenue, a [Insert Percentage]% increase/decrease compared to the previous quarter. This was driven largely by [Insert Reason, e.g., increased Bitcoin production, higher Bitcoin price].

- Profitability: The company's mining profitability was impacted by [Insert Factors, e.g., Bitcoin price fluctuations, energy costs]. Operating expenses totaled [Insert Figure], representing a [Insert Percentage]% change from the previous period. This change is attributed to [Insert Reasons, e.g., expansion of mining facilities, increased energy costs].

- Year-over-year comparison: Comparing to the same quarter last year, RIOT Platforms revenue shows a [Insert Percentage]% change, indicating [Insert Trend, e.g., positive growth, contraction]. This trend reflects [Insert contributing factors]. This analysis of RIOT financial results helps gauge the overall health of the company.

Bitcoin Production and Mining Efficiency

Riot Platforms' Bitcoin production and mining efficiency are directly linked to its profitability and stock price. Key metrics to consider include the company's hash rate and energy consumption.

- Bitcoin Production: In [Insert Period], Riot Platforms mined approximately [Insert Number] Bitcoins, representing a [Insert Percentage]% increase/decrease compared to the previous period. This change is a result of [Insert Reasons, e.g., increased mining capacity, improved hash rate]. This data on RIOT Bitcoin production showcases the company's mining prowess.

- Hash Rate: Riot Platforms' hash rate has increased to [Insert Hash Rate] TH/s, showing [Insert Percentage]% growth. This signifies [Insert Implications, e.g., enhanced mining capabilities, increased Bitcoin mining capacity]. The improvement in Riot Platforms hash rate is key to the company's success.

- Mining Efficiency Improvements: The company is constantly working on improving its mining efficiency through [Insert Initiatives, e.g., upgrades to its mining equipment, strategic partnerships]. This focus on mining efficiency improvements is vital for long-term profitability.

Debt and Liquidity

Evaluating Riot Platforms' financial health requires analyzing its debt levels, cash flow, and liquidity position. These metrics provide insights into the company's ability to meet its financial obligations.

- Debt-to-Equity Ratio: Riot Platforms' debt-to-equity ratio stands at [Insert Ratio], suggesting [Insert Interpretation, e.g., a healthy financial position, potential risk]. This data on RIOT financial health requires careful consideration.

- Cash on Hand: The company currently has [Insert Amount] in cash and cash equivalents, providing [Insert Interpretation, e.g., a strong buffer against market fluctuations, potential liquidity issues]. This indicator is important for assessing Riot Platforms' debt and liquidity.

- Cash Flow: Riot Platforms’ cash flow from operations was [Insert Figure] for the latest reporting period. This is indicative of [Insert Interpretation, e.g., strong operational performance, financial strain].

Market Factors Affecting RIOT Stock Price

Bitcoin Price Fluctuations

The price of Bitcoin is a major driver of Riot Platforms' stock price. A strong correlation exists between the two:

- Historical Data: Historically, when the Bitcoin price rises, RIOT's stock price generally follows suit, and vice versa. This is because Bitcoin is Riot Platforms' primary revenue source. The Bitcoin price impact on RIOT is undeniable.

- Market Sentiment: Positive market sentiment towards Bitcoin usually translates to increased investor interest in RIOT stock. Conversely, negative sentiment can lead to price drops. Understanding cryptocurrency market volatility is paramount.

Regulatory Landscape

The regulatory landscape surrounding cryptocurrency mining significantly influences Riot Platforms' operations and stock price.

- Regulatory Changes: New regulations or proposed legislation in [Insert Regions] could impact Riot Platforms' operations, potentially creating both opportunities and challenges.

- Compliance Costs: Increased regulatory scrutiny may lead to higher compliance costs for RIOT, affecting profitability. This information about RIOT regulatory risks is important to investors.

Competition and Industry Trends

The Bitcoin mining industry is competitive. Riot Platforms faces competition from other large-scale miners.

- Major Competitors: Key competitors include [Insert Competitors], each with its own strengths and weaknesses. Understanding Bitcoin mining competition is essential.

- Industry Trends: Advancements in mining technology and the increasing adoption of Bitcoin are key industry trends impacting Riot Platforms and its competitors. Following industry trends in Bitcoin mining is crucial.

Future Outlook and Investment Considerations for RIOT Stock

Growth Potential

Riot Platforms' future growth hinges on several factors, including expansion plans and technological advancements.

- Expansion Plans: The company's plans to [Insert Plans, e.g., expand mining operations, acquire new assets] could significantly drive future growth.

- Technological Advancements: Investing in more energy-efficient mining equipment and exploring new technologies will be critical to maintaining a competitive edge. The future outlook for RIOT is contingent on its ability to adapt and innovate.

Investment Risks

Investing in RIOT stock involves several risks:

- Bitcoin Price Volatility: Fluctuations in the Bitcoin price present a major risk to Riot Platforms' profitability and stock price.

- Regulatory Uncertainty: Changes in regulations could significantly impact the company's operations.

- Operational Challenges: Unexpected equipment failures or other operational challenges could disrupt mining activities. Considering RIOT investment risks is essential before making any investment decisions.

Conclusion: Making Informed Decisions about Riot Platforms (RIOT) Stock

This analysis of Riot Platforms (RIOT) stock reveals a complex interplay of financial performance, market factors, and future prospects. Understanding RIOT's financial results, the impact of Bitcoin price fluctuations, and the competitive landscape is crucial for making informed investment decisions. Key takeaways include the significant influence of Bitcoin's price on RIOT’s stock, the importance of regulatory developments, and the inherent risks associated with investing in cryptocurrency mining companies. Learn more about Riot Platforms (RIOT) stock, analyze RIOT’s performance thoroughly, and assess the risks of investing in RIOT before making any investment choices. Remember to conduct your own thorough research and consider your personal risk tolerance before investing.

Featured Posts

-

Manchester United Mourns 10 Year Old Poppy Atkinson After Tragic Car Accident

May 03, 2025

Manchester United Mourns 10 Year Old Poppy Atkinson After Tragic Car Accident

May 03, 2025 -

The Urgent Need For Mental Health Reform In Ghana Addressing The Psychiatrist Shortage

May 03, 2025

The Urgent Need For Mental Health Reform In Ghana Addressing The Psychiatrist Shortage

May 03, 2025 -

Riot Fest 2025 The Unmissable Lineup Featuring Green Day Blink 182 And Weird Al Yankovic

May 03, 2025

Riot Fest 2025 The Unmissable Lineup Featuring Green Day Blink 182 And Weird Al Yankovic

May 03, 2025 -

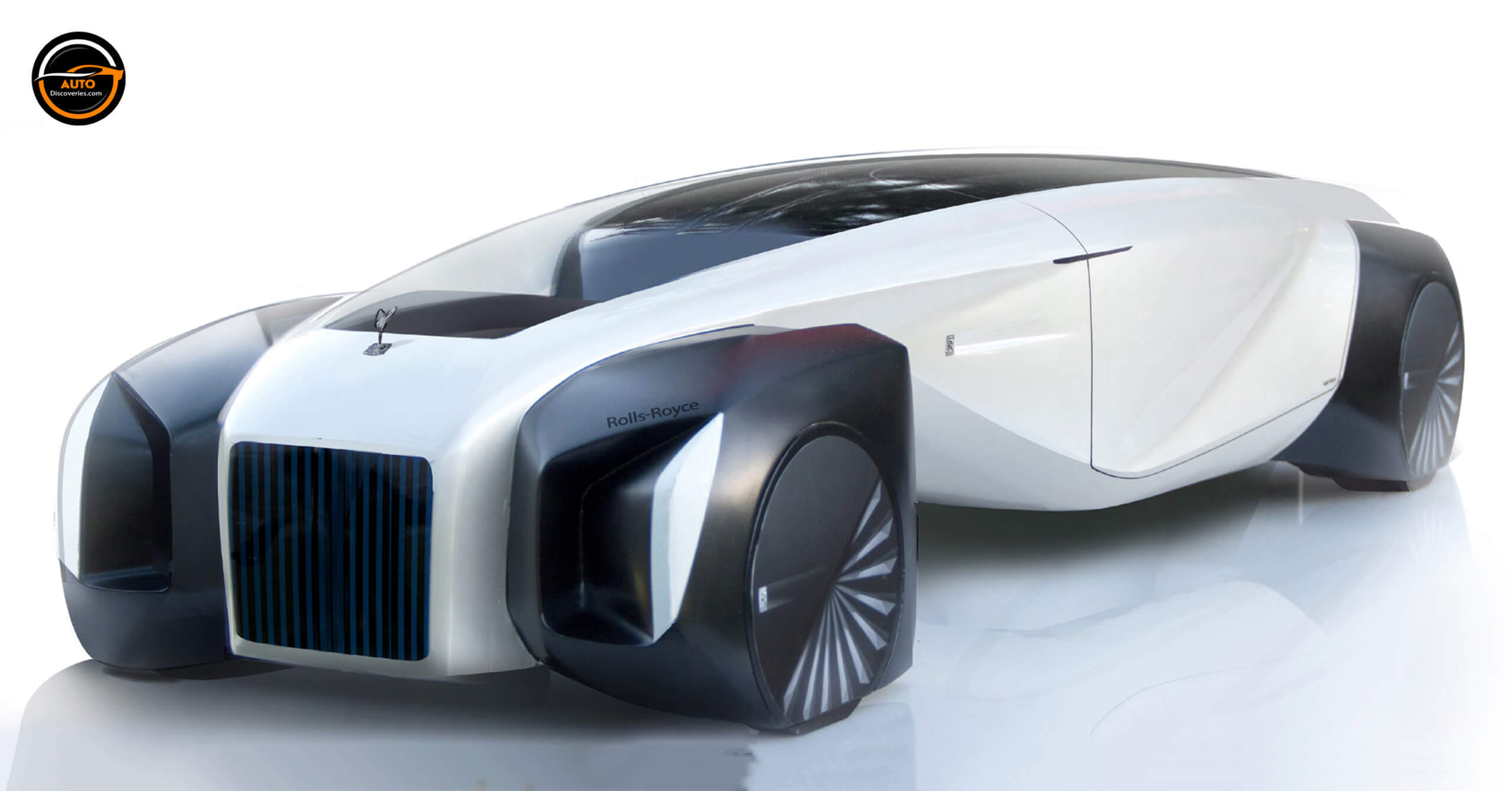

Rolls Royce Maintains 2025 Outlook Despite Tariff Challenges

May 03, 2025

Rolls Royce Maintains 2025 Outlook Despite Tariff Challenges

May 03, 2025 -

Negative Reaction To Fortnites Latest Item Shop Update

May 03, 2025

Negative Reaction To Fortnites Latest Item Shop Update

May 03, 2025