Ride-Sharing's Future: Investing In Uber's Autonomous Technology Via ETFs

Table of Contents

Understanding the Potential of Autonomous Vehicles in Ride-Sharing

Self-driving cars are set to transform the ride-sharing industry fundamentally. Uber, a pioneer in ride-sharing, has heavily invested in autonomous vehicle technology, recognizing its immense potential. The impact extends beyond mere convenience; it promises increased efficiency, lower costs, and enhanced safety.

- Increased Efficiency and Convenience: A driverless fleet will lead to shorter wait times for riders, optimizing vehicle allocation and reducing idle time. This translates to a more efficient and responsive service.

- Reduced Operational Costs: Automation promises to significantly lower operational costs, eliminating driver salaries and associated expenses. This increased profitability could drive further innovation and expansion.

- Enhanced Safety: Autonomous vehicles have the potential to drastically reduce accidents caused by human error, a major concern in the ride-sharing industry. Advanced safety features and data-driven analysis can contribute to safer roads.

- Market Expansion: Autonomous ride-sharing services can expand into underserved areas and new markets, offering transportation solutions where traditional ride-sharing might be impractical or unprofitable.

Exploring Exchange-Traded Funds (ETFs) for Autonomous Vehicle Investment

Exchange-Traded Funds (ETFs) are investment vehicles that track a specific index or sector, offering diversified exposure to multiple companies within that sector. Investing in ETFs provides several advantages over buying individual stocks:

- Diversification: ETFs spread your investment across numerous companies, mitigating the risk associated with a single stock's performance. This approach reduces overall portfolio volatility.

- Cost-Effectiveness: ETFs typically have lower expense ratios than actively managed mutual funds, making them a more cost-effective investment option.

- Accessibility: ETFs provide access to a wide range of companies involved in autonomous vehicle technology, including those with significant holdings in Uber's initiatives.

- Growth Potential: The autonomous vehicle sector is rapidly expanding, presenting a significant opportunity for high growth and substantial returns for investors.

Analyzing the Risks and Rewards of Investing in Uber's Autonomous Tech via ETFs

While the potential rewards of investing in Uber's autonomous technology via ETFs are considerable, it’s crucial to acknowledge the risks:

- Regulatory Uncertainty: The regulatory landscape surrounding autonomous vehicles is still evolving, presenting potential delays and hurdles to widespread adoption.

- Technological Challenges: Developing fully autonomous vehicles presents significant technological challenges, and unforeseen issues could impact timelines and profitability.

- Market Volatility: The technology sector, in general, is known for its volatility. Investment in this sector requires a higher risk tolerance.

- High-Reward Potential: Despite these risks, the potential payoff is significant. Successful implementation of autonomous technology could lead to exponential growth and high returns for investors. Thorough research and an understanding of your own risk tolerance are paramount.

Finding the Right ETFs for Investing in Autonomous Vehicle Technology

Several ETFs offer exposure to companies involved in autonomous vehicle technology, including those with significant holdings in Uber (e.g., consider researching ETFs that hold shares of companies like Uber or those focused on the broader technology sector). Remember to always check the ETF's holdings and expense ratios before investing.

- Consider ETF holdings: Carefully examine the specific companies held within each ETF to ensure alignment with your investment goals.

- Expense Ratio Comparison: Compare the expense ratios of different ETFs to minimize investment costs.

- Due Diligence: Thorough research is essential before committing your funds. Understand the ETF's investment strategy and the risks involved.

- Seek Professional Advice: Before making any investment decisions, consult with a qualified financial advisor to create a personalized investment strategy aligned with your risk tolerance and financial objectives.

Conclusion: Ride-Sharing's Future: Investing in Uber's Autonomous Technology Via ETFs

Investing in Uber's autonomous technology through ETFs offers a compelling opportunity to participate in the growth of a transformative sector. While risks exist, the potential for substantial returns is undeniable. By carefully researching available ETFs, understanding your risk tolerance, and seeking professional advice, you can make informed decisions. Start your journey into the future of ride-sharing by exploring ETFs related to Uber's autonomous technology today! Learn more about investing in the future of autonomous ride-sharing with ETFs – start your research now!

Featured Posts

-

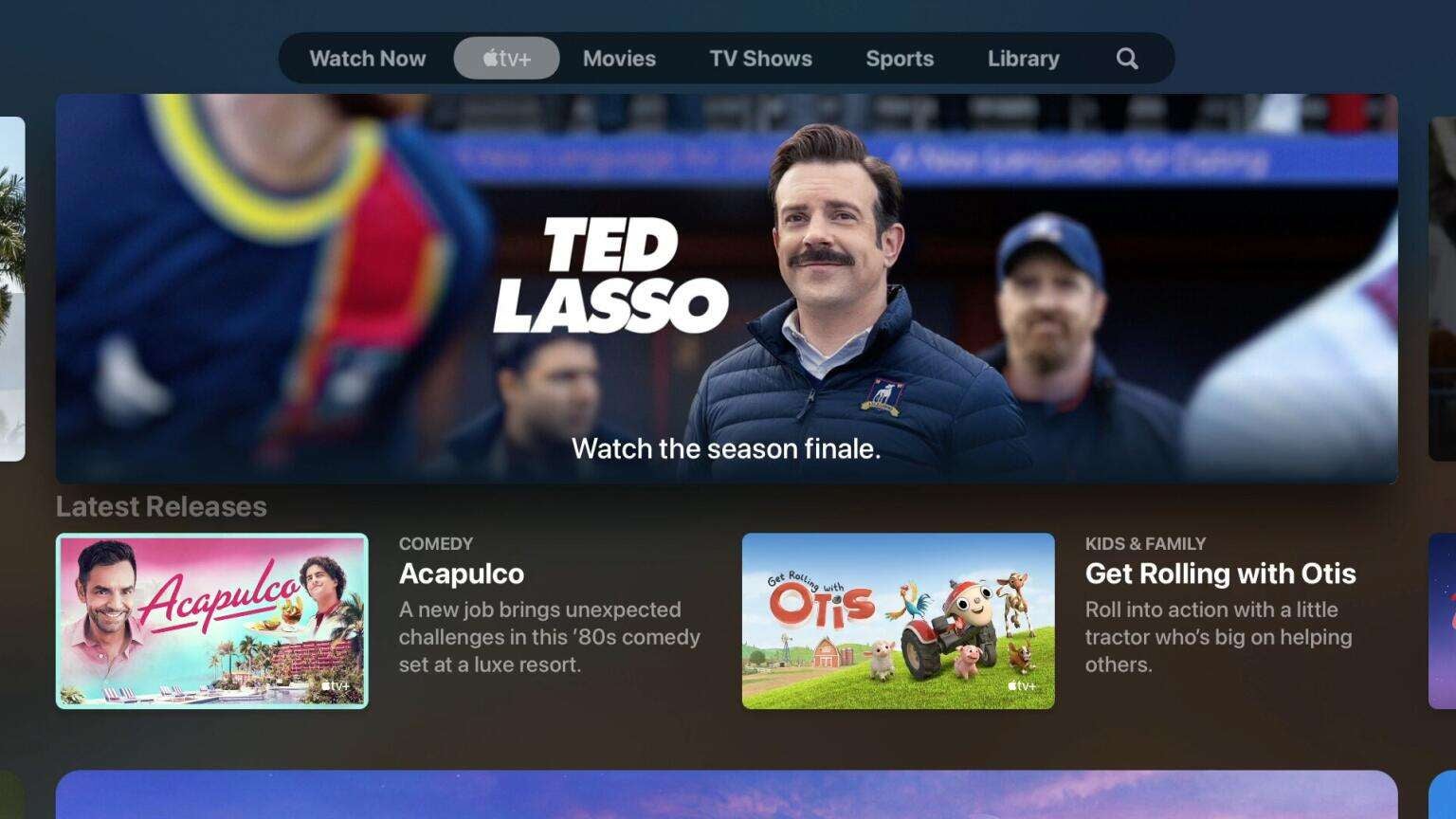

Apple Tv Deal 3 Months For 3 Final Days

May 17, 2025

Apple Tv Deal 3 Months For 3 Final Days

May 17, 2025 -

Lynas Breaking Chinas Hold On Heavy Rare Earths Production

May 17, 2025

Lynas Breaking Chinas Hold On Heavy Rare Earths Production

May 17, 2025 -

Severance Ben Stiller Compares Lumon Industries To Apple

May 17, 2025

Severance Ben Stiller Compares Lumon Industries To Apple

May 17, 2025 -

Fortnite Brings Back Beloved Skins After 1000 Days Item Shop Update

May 17, 2025

Fortnite Brings Back Beloved Skins After 1000 Days Item Shop Update

May 17, 2025 -

The Impact Of Josh Cavallos Coming Out On The World Of Football

May 17, 2025

The Impact Of Josh Cavallos Coming Out On The World Of Football

May 17, 2025

Latest Posts

-

Cade Cunninghams Impact How The Knicks Can Avoid A First Round Upset

May 17, 2025

Cade Cunninghams Impact How The Knicks Can Avoid A First Round Upset

May 17, 2025 -

Nba Prediction Knicks Vs Pistons Who Will Win At Madison Square Garden

May 17, 2025

Nba Prediction Knicks Vs Pistons Who Will Win At Madison Square Garden

May 17, 2025 -

Knicks Playoff Push Why Avoiding The Pistons Is Crucial

May 17, 2025

Knicks Playoff Push Why Avoiding The Pistons Is Crucial

May 17, 2025 -

Pistons At Knicks Game Prediction Betting Analysis And Odds

May 17, 2025

Pistons At Knicks Game Prediction Betting Analysis And Odds

May 17, 2025 -

Knicks Vs Pistons Avoiding A Cade Cunningham Led Disaster

May 17, 2025

Knicks Vs Pistons Avoiding A Cade Cunningham Led Disaster

May 17, 2025