Retail Sales Growth Impacts Bank Of Canada Interest Rate Decision

Table of Contents

How Strong Retail Sales Influence Inflation

Strong retail sales are a significant indicator of economic health, but they also have a direct impact on inflation. The Bank of Canada closely monitors these figures to gauge the overall health of the economy and potential inflationary pressures.

Consumer Spending as a Key Inflation Driver

Increased consumer spending, reflected in robust retail sales, is a primary driver of demand-pull inflation. When consumers spend more, businesses respond by increasing production, potentially leading to higher prices if supply cannot keep pace with demand.

- Automotive sales: A surge in new car purchases can significantly contribute to inflation, especially if chip shortages or other supply chain issues constrain production.

- Durable goods: Increased spending on furniture, appliances, and electronics can also fuel inflation, particularly if global supply chains are disrupted.

- Wage growth: Rising wages, providing consumers with more disposable income, can further stimulate demand and exacerbate inflationary pressures. This creates a cycle where higher wages lead to higher spending, leading to higher prices, and potentially leading to demands for even higher wages.

Measuring Inflation Through Retail Sales Data

Statistics Canada's monthly retail sales data provides valuable insights into consumer spending habits, a key component of the Bank of Canada's inflation assessment. This data, combined with other economic indicators, helps the Bank to understand the underlying dynamics of price changes.

- Consumer Price Index (CPI): The CPI measures the average change in prices paid by urban consumers for a basket of goods and services.

- Core inflation: This metric excludes volatile components like food and energy prices, providing a clearer picture of underlying inflationary pressures.

- Unexpected surges: Significant and unexpected jumps in retail sales can signal potential inflationary pressures, prompting the Bank of Canada to take action.

The Bank of Canada's Inflation Target

The Bank of Canada's primary mandate is to maintain price stability, typically aiming for an inflation rate of around 2%. Deviations from this target, whether significantly above or below, influence the Bank's interest rate decisions. If retail sales data suggests inflation is rising above the target, the Bank may respond by raising interest rates.

The Bank of Canada's Response to Strong Retail Sales Data

When retail sales figures indicate strong consumer spending and rising inflationary pressures, the Bank of Canada often responds by adjusting its monetary policy.

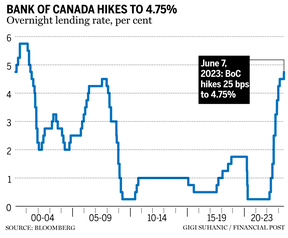

Interest Rate Hikes to Combat Inflation

To cool down an overheated economy characterized by robust retail sales and rising inflation, the Bank of Canada typically raises interest rates. This makes borrowing more expensive, discouraging consumer spending and business investment, thus dampening demand and easing inflationary pressures.

- Higher borrowing costs: Increased interest rates lead to higher mortgage payments, making it more expensive to buy a home. This can reduce demand in the housing market, which is a major component of the Canadian economy.

- Reduced consumer spending: Higher interest rates on credit cards and loans discourage discretionary spending, leading to a slowdown in retail sales.

- Impact on investment: Higher borrowing costs also discourage business investment, potentially slowing economic growth.

Balancing Economic Growth and Inflation Control

The Bank of Canada faces the challenging task of balancing economic growth with inflation control. Raising interest rates too aggressively can stifle economic growth and potentially trigger a recession. Conversely, failing to address rising inflation can lead to more severe economic consequences in the long term. The search for a "soft landing"—slowing economic growth without causing a recession—is a delicate act of balancing these competing forces.

Factors Beyond Retail Sales

While retail sales are a crucial indicator, the Bank of Canada considers numerous other factors when making interest rate decisions. These include:

- Global economic conditions

- Commodity prices (especially oil)

- The Canadian dollar exchange rate

- Labor market conditions (unemployment rate, wage growth)

Analyzing Recent Retail Sales Figures and Their Impact

Understanding the current economic climate and recent retail sales data is essential for anticipating future interest rate adjustments.

Current Economic Climate

[Insert current economic climate description here, including relevant data and statistics from Statistics Canada. For example: "As of October 2023, the Canadian economy shows [signs of strength/weakness]... Statistics Canada reported retail sales growth of [X]% in September, [mention specific sectors performing well or poorly]. This suggests [interpretation of the data's impact on inflation]."]

Market Predictions and Expert Opinions

[Insert summaries of predictions from reputable economists and financial analysts regarding future interest rate changes, citing sources with links. For example: "Economists at [Financial Institution] predict a [X]% chance of another interest rate hike in [Month], citing [reasoning based on retail sales and other factors]."]

Conclusion: Retail Sales Data's Crucial Role in Interest Rate Decisions

Strong retail sales growth is a key indicator of economic strength, but it also contributes to inflation. This necessitates a response from the Bank of Canada, often in the form of interest rate adjustments to maintain price stability. The Bank carefully considers retail sales data alongside other economic indicators to strike a balance between fostering economic growth and controlling inflation. Monitoring retail sales figures and the Bank of Canada's monetary policy announcements is crucial for understanding their impact on the Canadian economy and making informed financial decisions. Staying informed about how retail sales growth influences the Bank of Canada's decisions, and the impact of retail sales on Bank of Canada interest rates, will allow you to navigate the economic landscape more effectively.

Featured Posts

-

Real Madrid De Sok Doert Yildiza Sorusturma Acildi

May 25, 2025

Real Madrid De Sok Doert Yildiza Sorusturma Acildi

May 25, 2025 -

Amsterdam Stock Exchange 7 Plunge At Open Reflects Growing Trade War Anxiety

May 25, 2025

Amsterdam Stock Exchange 7 Plunge At Open Reflects Growing Trade War Anxiety

May 25, 2025 -

Vozachi Na Mertsedes Kazneti Pred Gran Pri Na Bakhrein

May 25, 2025

Vozachi Na Mertsedes Kazneti Pred Gran Pri Na Bakhrein

May 25, 2025 -

Urgent Flood Advisory Miami Valley Residents Urged To Take Precautions

May 25, 2025

Urgent Flood Advisory Miami Valley Residents Urged To Take Precautions

May 25, 2025 -

The Truth About Lauryn Goodmans Move To Italy After Kyle Walkers Ac Milan Transfer

May 25, 2025

The Truth About Lauryn Goodmans Move To Italy After Kyle Walkers Ac Milan Transfer

May 25, 2025

Latest Posts

-

Gauff Advances To Italian Open Third Round Alongside Sabalenka

May 25, 2025

Gauff Advances To Italian Open Third Round Alongside Sabalenka

May 25, 2025 -

Gauffs Grit Reaching The Italian Open Third Round

May 25, 2025

Gauffs Grit Reaching The Italian Open Third Round

May 25, 2025 -

Swiateks Winning Streak Continues Madrid Open Victory Over Keys De Minaurs Loss

May 25, 2025

Swiateks Winning Streak Continues Madrid Open Victory Over Keys De Minaurs Loss

May 25, 2025 -

Madrid Open Results De Minaurs Early Exit And Swiateks Dominant Win

May 25, 2025

Madrid Open Results De Minaurs Early Exit And Swiateks Dominant Win

May 25, 2025 -

Iga Swiatek Triumphs In Madrid Keys Defeated In Straight Sets

May 25, 2025

Iga Swiatek Triumphs In Madrid Keys Defeated In Straight Sets

May 25, 2025