Reps Vow To Recover $1.231 Billion From Oil Firms

Table of Contents

The Allegations Against Oil Firms

The accusations leveled against these oil firms are serious, involving a range of alleged fraudulent activities and financial misconduct. These allegations paint a picture of systematic attempts to avoid paying their fair share of taxes, exploiting loopholes, and misrepresenting expenses to inflate deductions. This alleged behavior not only deprives the government of vital revenue but also undermines the principles of fair taxation that underpin a just society.

- Specific examples of alleged tax evasion schemes: Reports suggest the use of complex offshore accounts to hide profits, the manipulation of transfer pricing between subsidiaries, and the deliberate misclassification of expenses to reduce taxable income.

- Details on the types of improper deductions claimed: Allegations include inflating expenses related to exploration and extraction, claiming deductions for non-deductible items, and improperly deducting capital expenditures as operating expenses.

- Mention of any prior regulatory actions or warnings against the involved companies: Several of the implicated firms have faced previous regulatory scrutiny for minor violations, raising concerns about a pattern of disregard for tax laws and regulations.

The Representatives' Plan of Action

Government representatives are taking a multi-pronged approach to recover the $1.231 billion. This strategy involves a combination of legislative action, rigorous legal proceedings, strengthened regulatory oversight, and thorough financial audits. The aim is to ensure full accountability and to deter similar actions by other corporations in the future.

- Outline specific legislative proposals: Proposed legislation includes stricter penalties for corporate tax evasion, increased transparency requirements for oil company financial reporting, and enhanced auditing powers for regulatory bodies.

- Describe planned legal challenges or investigations: Legal actions encompass civil lawsuits to recover the unpaid taxes and potential criminal investigations into alleged fraudulent activities.

- Mention any collaborations with regulatory bodies: Representatives are collaborating closely with relevant regulatory agencies to coordinate investigations, share information, and ensure a unified approach to enforcement.

- Explain the timeline for expected recovery: While a precise timeline is difficult to predict due to the complexities of legal proceedings, representatives aim to expedite the process as much as possible to maximize the recovery for taxpayers.

Potential Impact and Implications

The successful recovery of the $1.231 billion would have significant ramifications, impacting both taxpayers and the oil industry. Beyond the direct financial benefits to taxpayers, the outcome of this case will shape future corporate behavior and regulatory practices.

- Explain the potential financial benefit to taxpayers: The recovered funds could be used to fund essential public services, reduce the national debt, or provide tax relief.

- Discuss the potential impact on the oil industry's reputation and profitability: The outcome could significantly damage the reputation of the oil industry and potentially lead to increased scrutiny and stricter regulations.

- Analyze potential changes in oil industry regulations as a result: This case could serve as a catalyst for stricter regulations, greater transparency, and more robust enforcement mechanisms within the oil industry.

- Mention any related political considerations: The case is likely to become a focal point in political discourse, influencing future debates on corporate taxation and regulatory reform.

Public Response and Media Coverage

Public reaction to the representatives' vow and the allegations against the oil firms has been mixed. The media has extensively covered the case, with a range of opinions expressed across various platforms.

- Highlight key public opinions for and against the representatives' actions: While many support the efforts to recover the funds and hold oil companies accountable, some raise concerns about potential impacts on the economy and job security.

- Mention relevant media articles or statements: Numerous news outlets have published articles and editorials expressing various perspectives on the case, providing diverse viewpoints on the issue.

- Include quotes from experts or public figures: Experts and public figures have weighed in, offering valuable insights into the legal and ethical dimensions of the case.

Conclusion

The representatives' vow to recover $1.231 billion from oil firms represents a significant effort to ensure accountability within the oil industry and protect taxpayer interests. The allegations of tax evasion and financial misconduct are serious, highlighting the need for stricter regulations and greater transparency. The potential impact on taxpayers, the oil industry, and future regulatory practices is substantial. Follow the developments in this crucial fight to recover $1.231 billion from oil firms and stay tuned for updates on this important case of oil industry accountability. Contact your representatives to express your support for these crucial recovery efforts.

Featured Posts

-

The Typhon Missile System And The Shifting Geopolitical Landscape In The South China Sea

May 20, 2025

The Typhon Missile System And The Shifting Geopolitical Landscape In The South China Sea

May 20, 2025 -

Rtl Groups Streaming Strategy Path To Profitability

May 20, 2025

Rtl Groups Streaming Strategy Path To Profitability

May 20, 2025 -

Us Army Deploys Second Typhon Missile Battery To The Pacific

May 20, 2025

Us Army Deploys Second Typhon Missile Battery To The Pacific

May 20, 2025 -

Le Passage De Marc Lievremont A Millau Un Recit Poignant

May 20, 2025

Le Passage De Marc Lievremont A Millau Un Recit Poignant

May 20, 2025 -

Paulina Gretzky In Leopard Print A Sopranos Style Fashion Moment

May 20, 2025

Paulina Gretzky In Leopard Print A Sopranos Style Fashion Moment

May 20, 2025

Latest Posts

-

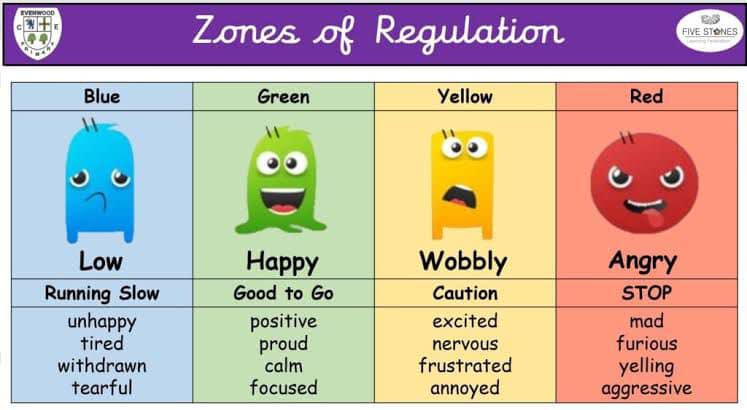

The Love Monster A Tool For Teaching Children About Emotions

May 21, 2025

The Love Monster A Tool For Teaching Children About Emotions

May 21, 2025 -

Macron Urges Eu To Prioritize European Goods Over American Imports

May 21, 2025

Macron Urges Eu To Prioritize European Goods Over American Imports

May 21, 2025 -

Review Of The Love Monster A Parents Perspective

May 21, 2025

Review Of The Love Monster A Parents Perspective

May 21, 2025 -

Experience The Funbox Mesas Premier Indoor Bounce Park

May 21, 2025

Experience The Funbox Mesas Premier Indoor Bounce Park

May 21, 2025 -

Love Monster A Guide To Understanding The Book And Its Themes

May 21, 2025

Love Monster A Guide To Understanding The Book And Its Themes

May 21, 2025