Rent Freeze: Housing Corporations Warn Of €3 Billion Deficit

Table of Contents

The Impact of the Rent Freeze on Housing Corporations

The rent freeze, while seemingly beneficial for tenants in the short-term, has created a significant financial strain on housing corporations across the Netherlands. This section details the severe consequences this policy is having on the organizations responsible for providing affordable housing.

Reduced Revenue Streams

The most immediate effect of a rent freeze is a dramatic reduction in income for housing corporations. This directly impacts their capacity to fulfill their core responsibilities:

- Funding essential maintenance and repairs: Deferred maintenance leads to a deterioration of housing stock, potentially resulting in unsafe living conditions for tenants.

- Investing in energy efficiency upgrades: With less revenue, crucial upgrades to improve energy efficiency and reduce energy bills for tenants are likely to be delayed or cancelled entirely. This impacts both tenant affordability and environmental sustainability goals.

- Constructing new social housing units: The lack of funds severely hampers the development of new affordable housing, exacerbating the existing housing shortage. New construction projects are likely to be delayed or abandoned altogether.

- Covering operational costs: Basic operational costs, including staff salaries, administrative expenses, and insurance, are all affected. This can lead to staff reductions and a diminished ability to effectively manage properties.

Difficulty in Securing Loans and Investments

The reduced revenue significantly impacts the ability of housing corporations to secure loans and attract investors for future projects. Lenders are hesitant to finance organizations facing substantial financial deficits, creating a vicious cycle that further limits their capacity to invest in maintenance, repairs, and new construction. This lack of access to capital directly translates to a decline in the quality and quantity of available social housing.

Increased Pressure on Existing Resources

The financial constraints imposed by the rent freeze place immense pressure on the limited resources available to housing corporations. This can lead to difficult choices, potentially prioritizing urgent repairs over preventative maintenance, further impacting the long-term condition of the housing stock. Difficult decisions regarding staffing levels and service provision also become unavoidable.

The Potential Consequences for Tenants

While intended to help tenants, the rent freeze paradoxically creates several negative consequences that ultimately harm the very people it aims to protect.

Deteriorating Housing Conditions

The lack of investment in maintenance and repairs, a direct result of the reduced revenue streams, leads to a decline in the quality of housing provided. This can manifest in several ways:

- Delayed repairs and maintenance: Essential repairs, from leaky roofs to faulty plumbing, may be delayed indefinitely, leading to unsafe and uncomfortable living conditions.

- Increased pest infestation: Lack of preventative maintenance and timely repairs can create breeding grounds for pests, compromising tenant health and safety.

- Unsafe living conditions: Delayed repairs can escalate into serious safety hazards, putting tenants at risk.

Limited New Housing Construction

The financial strain on housing corporations directly translates to a significant reduction in new social housing construction. This exacerbates the already critical housing shortage, increasing competition for the limited affordable units available and lengthening waiting lists.

Increased Waiting Lists

The combination of deteriorating existing housing and a significant reduction in new construction inevitably leads to dramatically longer waiting lists for social housing. This leaves vulnerable individuals and families without adequate shelter, further deepening the housing crisis.

Government Response and Potential Solutions

Addressing the €3 billion deficit and its repercussions requires a comprehensive and immediate response from the government.

Government Subsidies and Financial Aid

The government needs to significantly increase subsidies and financial aid to housing corporations to mitigate the financial losses caused by the rent freeze. This direct financial assistance is crucial to ensure the continued operation and maintenance of existing properties and the development of new social housing.

Revisiting the Rent Freeze Policy

A thorough review of the current rent freeze policy is essential. The government needs to assess its effectiveness and consider the long-term consequences for both tenants and housing corporations. Exploring alternative solutions, such as targeted rent subsidies for vulnerable tenants, could provide more effective and sustainable support without crippling the financial stability of housing organizations.

Long-Term Sustainable Housing Strategies

Developing long-term, sustainable strategies for affordable housing is crucial. Short-term solutions like rent freezes often mask underlying problems. The government needs to encourage private sector participation in social housing development through incentives and collaborations to ensure a sustainable and resilient affordable housing sector for the future. This should include exploring innovative financing models and partnerships.

Conclusion

The current rent freeze, while well-intentioned, is creating a severe €3 billion deficit for housing corporations, jeopardizing the quality and availability of affordable housing in the Netherlands. This is leading to deteriorating housing conditions, longer waiting lists, and a halt in new construction. Addressing this crisis requires a multifaceted approach, including increased government subsidies, a critical review of the rent freeze policy, and the development of robust, long-term sustainable housing strategies. Finding a balance between tenant protection and the financial viability of housing corporations is crucial to prevent a worsening housing crisis. The future of affordable housing hinges on finding a sustainable solution to the challenges posed by the current rent freeze. We urge the government to take decisive action to address this urgent issue.

Featured Posts

-

Affordable Rent Protections Potential Rollback And Market Impact

May 28, 2025

Affordable Rent Protections Potential Rollback And Market Impact

May 28, 2025 -

Nl West Showdown Dodgers And Padres Start Strong

May 28, 2025

Nl West Showdown Dodgers And Padres Start Strong

May 28, 2025 -

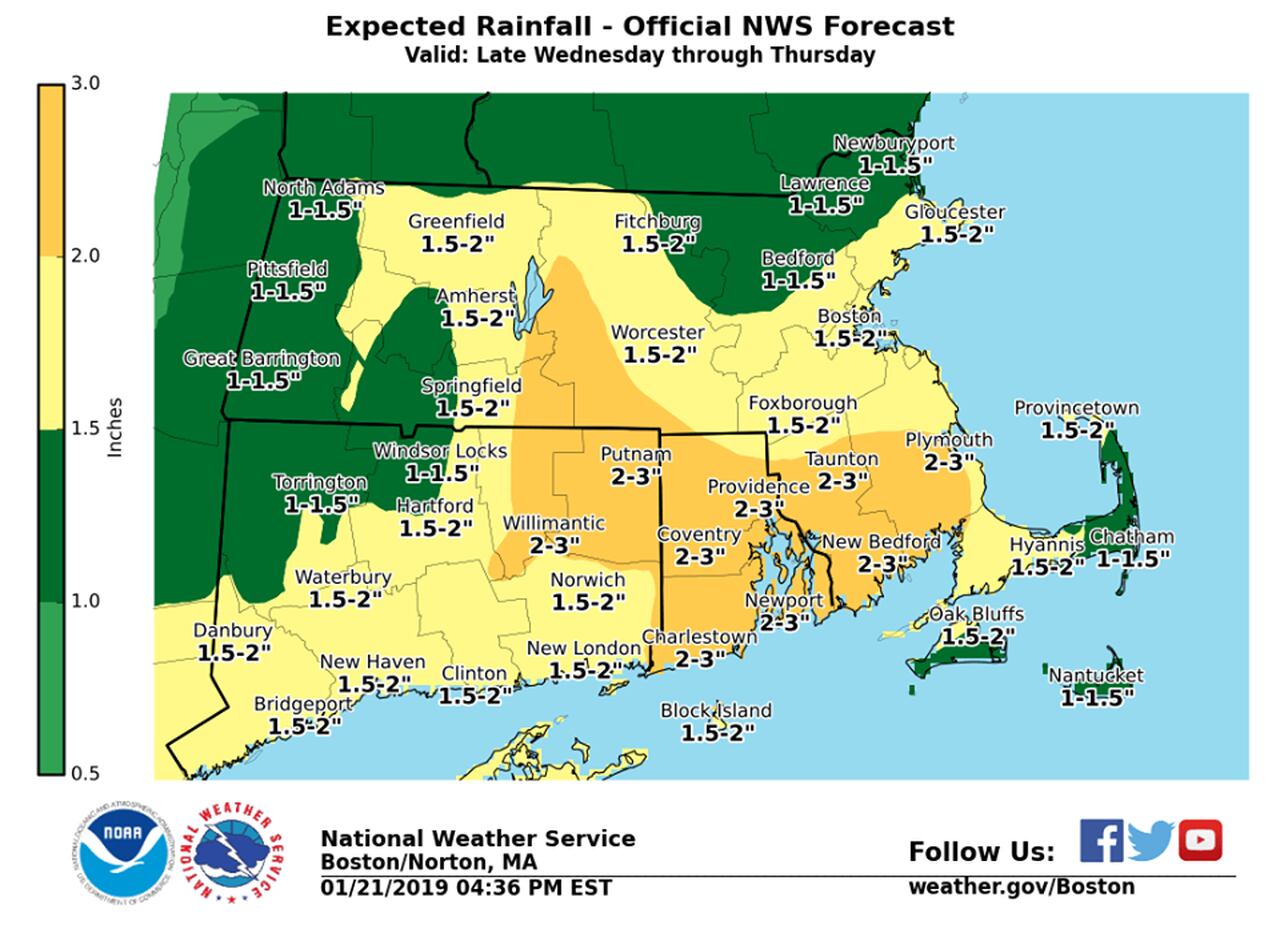

The Effect Of Climate Change On Rainfall In Western Massachusetts

May 28, 2025

The Effect Of Climate Change On Rainfall In Western Massachusetts

May 28, 2025 -

Kanye West And Bianca Censori Examining Power Dynamics And Control

May 28, 2025

Kanye West And Bianca Censori Examining Power Dynamics And Control

May 28, 2025 -

Dodgers Vs Diamondbacks Predicting The Upcoming Series

May 28, 2025

Dodgers Vs Diamondbacks Predicting The Upcoming Series

May 28, 2025

Latest Posts

-

Governments Commitment To A Strongest G7 Economy King Charles Iiis Perspective

May 29, 2025

Governments Commitment To A Strongest G7 Economy King Charles Iiis Perspective

May 29, 2025 -

Strengthening The Uk Economy King Charles Iiis Backing Of Governments G7 Aim

May 29, 2025

Strengthening The Uk Economy King Charles Iiis Backing Of Governments G7 Aim

May 29, 2025 -

At And T Challenges Broadcoms Extreme Price Increase On V Mware

May 29, 2025

At And T Challenges Broadcoms Extreme Price Increase On V Mware

May 29, 2025 -

G7 Economic Leadership King Charles Iiis Support For Governments Strategy

May 29, 2025

G7 Economic Leadership King Charles Iiis Support For Governments Strategy

May 29, 2025 -

Broadcoms V Mware Acquisition At And T Highlights Extreme Cost Increase

May 29, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Cost Increase

May 29, 2025