Reliance Earnings Surprise: Positive Impact On Indian Large-Cap Stocks?

Table of Contents

Reliance Industries' Q[Insert Quarter, e.g., 2] Earnings: A Detailed Analysis

Key Highlights of the Earnings Report:

Reliance Industries' Q[Insert Quarter, e.g., 2] results showcased impressive growth across multiple segments. Here are some key highlights:

- Revenue Growth: A significant surge in revenue, exceeding [Insert Percentage]% year-on-year, driven by strong performance across its key business verticals.

- Profit Margin Expansion: Improved profit margins, reaching [Insert Percentage]%, demonstrating enhanced operational efficiency and cost management.

- Jio's Stellar Performance: Reliance Jio, the telecom arm, continued its impressive growth trajectory, adding [Insert Number] million subscribers and significantly increasing its ARPU (Average Revenue Per User).

- Retail Segment Growth: The retail segment also experienced robust growth, driven by both online and offline sales, with revenue exceeding [Insert Figures].

These positive results clearly surpassed market expectations, leading to the "earnings surprise."

Factors Contributing to the Earnings Surprise:

Several factors contributed to Reliance's outstanding Q[Insert Quarter, e.g., 2] performance:

- Increased Market Share: Aggressive strategies in the telecom and retail sectors have resulted in significant market share gains for Reliance.

- Operational Efficiency Improvements: Reliance has implemented various initiatives to enhance operational efficiency and reduce costs, leading to improved profit margins.

- Favorable Market Conditions: The overall economic climate and positive consumer sentiment have also contributed to the company's strong performance.

- Successful New Initiatives: The success of new initiatives and product launches within Jio and the retail segment has played a vital role.

Impact on Indian Large-Cap Stocks:

Ripple Effect on the Broader Market:

Reliance's strong earnings are likely to have a positive ripple effect on the broader Indian stock market. This robust performance can significantly boost investor confidence and improve overall market sentiment. The positive news could trigger a chain reaction, leading to increased investment in other large-cap companies, particularly those in related sectors. This increased investor confidence could lead to improved index performance, reflecting a more optimistic outlook on the Indian economy.

Specific Stocks Likely to Benefit:

While the entire market could experience a positive uplift, certain large-cap stocks stand to benefit more directly from Reliance's success. Companies with significant business interactions or operating in similar sectors might experience positive spillover effects. For example, companies involved in technology, telecom infrastructure, and consumer goods may see increased investor interest. Specific examples could include companies like Tata Consultancy Services (TCS), benefiting from increased digital adoption spurred by Jio's growth, or HDFC Bank, potentially seeing increased lending opportunities due to the positive economic outlook fueled by Reliance's performance. Further research is needed to fully assess these potential linkages and impacts.

Analyzing the Long-Term Implications:

Sustainable Growth or Short-Term Phenomenon?:

The crucial question is whether Reliance's exceptional performance represents sustainable long-term growth or a short-term phenomenon. While the current results are undeniably impressive, several factors could impact future earnings. These include potential regulatory changes, intensifying competition, and global economic uncertainties. A thorough risk assessment is essential to accurately predict the long-term trajectory of Reliance Industries' performance.

Expert Opinions and Market Forecasts:

Financial analysts and market experts have offered diverse perspectives on Reliance's future prospects. [Insert quote from a reputable financial analyst regarding Reliance's future]. These varying opinions highlight the complexity of predicting long-term performance and the importance of considering multiple factors when assessing investment opportunities.

Conclusion:

Reliance Industries' Q[Insert Quarter, e.g., 2] earnings surprise showcases remarkable growth and operational efficiency across various segments. This positive performance has the potential to significantly boost investor confidence and positively impact the broader Indian large-cap stock market. While the sustainability of this growth remains a key consideration, the current results certainly point towards a positive outlook for Reliance and potentially several other large-cap companies. Specific stocks, particularly those in related sectors, may experience increased investor interest. However, careful analysis of potential risks and future market conditions is crucial for informed investment decisions. Stay tuned for further updates on Reliance Industries' performance and its continued impact on Indian large-cap stocks.

Featured Posts

-

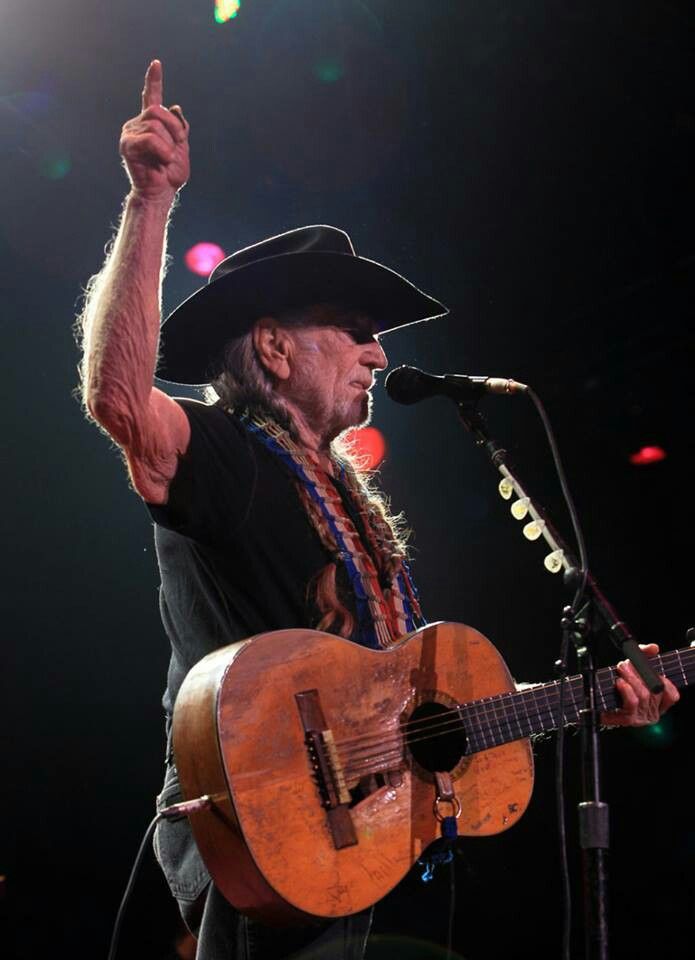

Key Facts About Willie Nelsons Life And Music

Apr 29, 2025

Key Facts About Willie Nelsons Life And Music

Apr 29, 2025 -

Get Your Capital Summertime Ball 2025 Tickets Today

Apr 29, 2025

Get Your Capital Summertime Ball 2025 Tickets Today

Apr 29, 2025 -

Johnny Damon Supports Trumps Stance On Pete Roses Hall Of Fame Eligibility

Apr 29, 2025

Johnny Damon Supports Trumps Stance On Pete Roses Hall Of Fame Eligibility

Apr 29, 2025 -

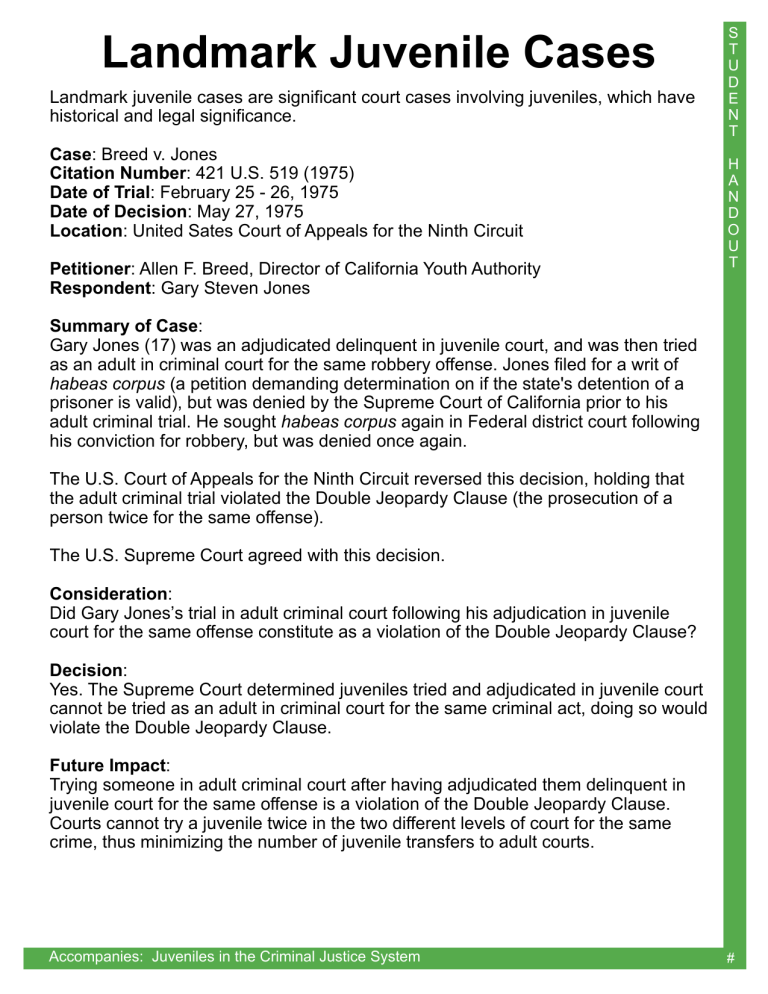

Lgbt Legal History A Timeline Of Landmark Cases And Figures

Apr 29, 2025

Lgbt Legal History A Timeline Of Landmark Cases And Figures

Apr 29, 2025 -

Jeff Goldblums Transformative Performance In The Fly An Oscar Worthy Achievement

Apr 29, 2025

Jeff Goldblums Transformative Performance In The Fly An Oscar Worthy Achievement

Apr 29, 2025