Refinancing Federal Student Loans: Private Lender Options And Considerations

Table of Contents

Understanding the Federal Student Loan Refinancing Process

What is Federal Student Loan Refinancing?

Refinancing federal student loans involves replacing your existing federal loans with a new private loan from a private lender. This process consolidates your multiple loans into a single, new loan, often with a lower interest rate. However, it's crucial to understand the key differences between federal and private student loans. Federal loans often come with borrower protections, such as income-driven repayment plans and deferment options in times of financial hardship. Refinancing your federal loans with a private lender means you lose these crucial federal benefits. You'll be subject to the terms and conditions set by the private lender.

Eligibility Requirements for Refinancing

Qualifying for private student loan refinancing depends on several factors:

- Credit Score: Lenders typically require a good credit score (generally 670 or higher) to offer favorable interest rates. A lower credit score may result in higher interest rates or even loan denial.

- Debt-to-Income Ratio: Your debt-to-income ratio (DTI) – the percentage of your gross monthly income that goes towards debt payments – plays a significant role. A lower DTI improves your chances of approval.

- Income Verification: Lenders will verify your income through documentation such as pay stubs, tax returns, or bank statements. Stable income is essential for approval.

- Eligible Loan Types: Most lenders accept various federal loan types, including Direct Subsidized Loans, Direct Unsubsidized Loans, and Grad PLUS Loans. However, it's essential to check each lender's specific eligibility criteria.

Exploring Private Lender Options for Refinancing

Comparing Different Private Lenders

Choosing the right private lender is critical. Compare lenders based on these key factors:

- Interest Rates: Shop around for the lowest interest rate possible. Rates vary based on your creditworthiness and the market conditions.

- Fees: Be aware of any origination fees, prepayment penalties, or other charges.

- Repayment Terms: Consider different repayment terms (loan lengths) to find a balance between lower monthly payments and total interest paid.

- Customer Service: Research the lender's reputation and customer service. Read online reviews and check with the Better Business Bureau.

Examples of reputable private student loan refinancing lenders include (but are not limited to) SoFi, Earnest, and Splash Financial. Remember to compare multiple lenders before making a decision.

Types of Refinancing Options Available

Private lenders offer various refinancing options:

- Fixed vs. Variable Interest Rates: Fixed-rate loans offer predictable monthly payments, while variable-rate loans have fluctuating interest rates that can change over time.

- Repayment Plans: Choose a repayment plan that aligns with your budget and financial goals. Options might include standard repayment, graduated repayment, or extended repayment.

- Loan Consolidation: Refinancing often allows you to consolidate multiple federal loans into a single, streamlined loan, simplifying your repayment process.

Crucial Considerations Before Refinancing Federal Student Loans

Potential Downsides of Refinancing

Before you refinance, carefully consider the potential drawbacks:

- Loss of Federal Protections: You lose access to federal benefits like income-driven repayment plans, deferment, and forbearance options.

- Higher Interest Rates: If your credit score is poor, you might end up with a higher interest rate than your federal loans.

- Impact on Credit Score: The application process can temporarily affect your credit score, although this effect is usually short-lived.

Factors to Evaluate Before You Decide

Make an informed decision by carefully evaluating:

- Current Interest Rates: Compare the interest rates on your federal loans to the rates offered by private lenders. Refinancing only makes sense if you can secure a significantly lower rate.

- Financial Situation: Assess your current financial health, including your credit score, debt-to-income ratio, and income stability.

- Long-Term Financial Goals: Consider how refinancing will impact your long-term financial plans, such as saving for a home or retirement.

- Tax Implications: You may lose the ability to deduct student loan interest from your taxes if you refinance your federal loans.

Gathering Necessary Documents and Information

Prepare the necessary documents for a smooth application process:

- Credit Report: Obtain a copy of your credit report to understand your credit score and any potential issues.

- Tax Returns: Lenders will review your tax returns to verify your income.

- Proof of Income: Provide pay stubs or other documentation to prove your income stability.

Accurate and complete information is essential for a successful application.

Making Informed Decisions About Refinancing Federal Student Loans

Refinancing federal student loans can offer significant benefits, such as lower monthly payments and faster repayment. However, it's crucial to understand the process, explore available private lender options, and carefully weigh the potential advantages and disadvantages before making a decision. Losing valuable federal protections is a serious consideration. Don't rush into refinancing your federal student loans. Use this guide to weigh your options and find the best private lender for your unique financial situation. Conduct thorough research and compare offers from multiple lenders before committing to a refinancing plan. Remember to prioritize your financial well-being and choose a plan that aligns with your long-term goals.

Featured Posts

-

Play At The Best No Kyc Casinos Top No Id Verification Gambling Sites For 2025

May 17, 2025

Play At The Best No Kyc Casinos Top No Id Verification Gambling Sites For 2025

May 17, 2025 -

Former Springfield Councilman Joins Missouri State Board Of Education

May 17, 2025

Former Springfield Councilman Joins Missouri State Board Of Education

May 17, 2025 -

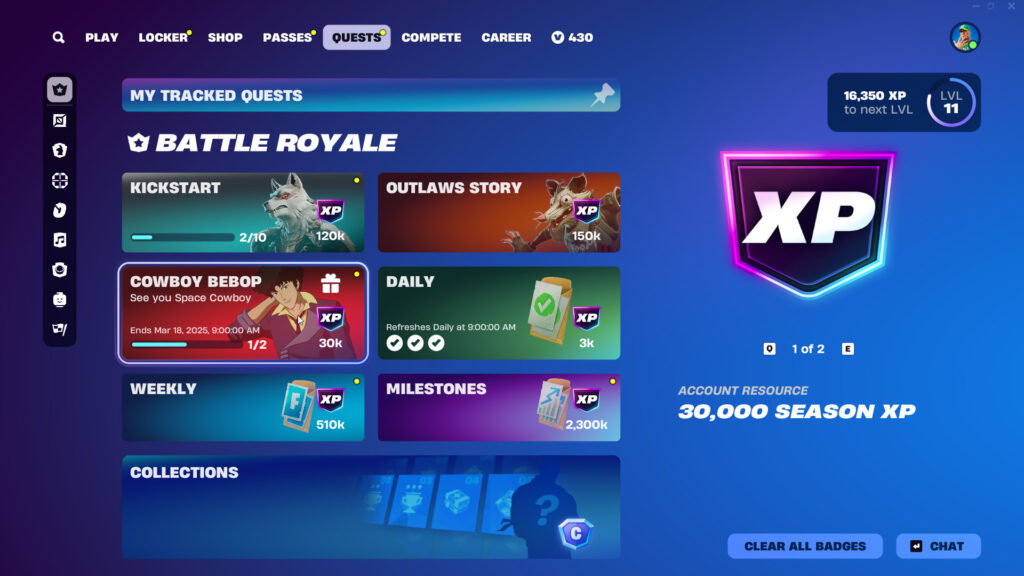

Fortnite Cowboy Bebop Collaboration Free Items Available For A Short Time

May 17, 2025

Fortnite Cowboy Bebop Collaboration Free Items Available For A Short Time

May 17, 2025 -

Appeal Filed Ftc Challenges Judges Decision On Microsoft Activision Blizzard Acquisition

May 17, 2025

Appeal Filed Ftc Challenges Judges Decision On Microsoft Activision Blizzard Acquisition

May 17, 2025 -

Fortnites Controversial Music Change Player Reaction

May 17, 2025

Fortnites Controversial Music Change Player Reaction

May 17, 2025

Latest Posts

-

De Volta Aos Gramados Ex Vasco Conquista Camisa 10 E Mira Copa 2026 Nos Emirados Arabes

May 17, 2025

De Volta Aos Gramados Ex Vasco Conquista Camisa 10 E Mira Copa 2026 Nos Emirados Arabes

May 17, 2025 -

Camisa 10 Nos Emirados Arabes Ex Jogador Do Vasco Sonha Com A Copa De 2026

May 17, 2025

Camisa 10 Nos Emirados Arabes Ex Jogador Do Vasco Sonha Com A Copa De 2026

May 17, 2025 -

Nos Emirados Arabes Ex Jogador Do Vasco Conquista Camisa 10 E Almeja Copa 2026

May 17, 2025

Nos Emirados Arabes Ex Jogador Do Vasco Conquista Camisa 10 E Almeja Copa 2026

May 17, 2025 -

Brasilien Und Die Emirate Chancen Und Risiken Von Investitionen In Favelas

May 17, 2025

Brasilien Und Die Emirate Chancen Und Risiken Von Investitionen In Favelas

May 17, 2025 -

Favelas Als Investitionsobjekt Die Strategie Der Emirate In Brasilien

May 17, 2025

Favelas Als Investitionsobjekt Die Strategie Der Emirate In Brasilien

May 17, 2025